Peter Lynch Strategy

Peter Lynch, a renowned investor, took the helm of Fidelity’s Magellan Fund in 1977 and transformed it into one of history’s most successful mutual funds.

During his tenure from 1977 to 1990, the fund boasted an impressive average return of 29.2% per year.

Lynch’s investing strategy, which has proven effective over time, can provide valuable insights for investors at any level.

Key Takeaways – Peter Lynch Strategy

- Peter Lynch advises investors to purchase stocks in companies they are familiar with and understand. By focusing on industries and businesses within one’s area of expertise, investors can make better-informed decisions and identify opportunities that others may overlook.

- Lynch encourages investors to seek out lesser-known, undervalued companies with the potential to deliver outsized returns, or “multi-baggers.” These hidden gems may not be widely recognized but could offer significant growth opportunities for those willing to put in the research.

- Diversification is key to mitigating risk in any investment portfolio. Lynch advises investors to spread their investments across a variety of industries and sectors to reduce the impact of any single underperforming stock or sector.

- Moreover, Lynch emphasizes the importance of considering stocks as long-term investments, benefiting from compounding and the growth potential of quality stocks.

Let’s take a look at some of them:

Peter Lynch Strategy & Principles

Buy What You Know

Peter Lynch advises investors to purchase stocks in companies they are familiar with and understand.

By focusing on industries and businesses within one’s area of expertise, investors can make better-informed decisions and identify opportunities that others may overlook.

Hidden Gems with Multi-Bagger Potential

Lynch encourages investors to seek out lesser-known, undervalued companies with the potential to deliver outsized returns, or “multi-baggers.”

These hidden gems may not be widely recognized but could offer significant growth opportunities for those willing to put in the research.

Diversify

Diversification is key to mitigating risk in any investment portfolio.

Lynch advises investors to spread their investments across a variety of industries and sectors to reduce the impact of any single underperforming stock or sector.

Long-Term Investing

According to Lynch, stocks should be considered long-term investments, not short-term gambles.

For the average investor, attempting to time the market or make short-term trades can result in diminished returns.

Instead, a long-term perspective allows investors to benefit from compounding and the growth potential of quality stocks.

Research

Thorough research is a cornerstone of Lynch’s investment philosophy.

Investors should understand a company’s fundamentals, competitive position, and growth prospects before making any investment decisions.

Reinvesting Dividends

Reinvesting dividends (often called a DRIP plan as set up through your broker) can significantly boost long-term returns.

Lynch suggests using dividend payments to purchase additional shares of a company, thereby accelerating the compounding effect.

Value Investing

Value investing involves seeking out undervalued stocks with strong fundamentals, offering potential for price appreciation.

Lynch’s approach emphasizes finding companies with a low price-to-earnings (P/E) ratio and strong earnings growth.

Margin of Safety

A margin of safety is the difference between a stock’s intrinsic value and its current market price.

Lynch recommends purchasing stocks with a significant margin of safety to protect against potential market downturns and reduce downside risk.

Bottom-Up Approach to Investing

Lynch’s bottom-up investing approach focuses on individual companies rather than broader market trends.

By analyzing companies on a case-by-case basis, investors can identify strong performers regardless of the overall market environment.

Tax-Loss Harvesting

Tax-loss harvesting involves selling underperforming stocks to offset capital gains tax liabilities.

Lynch advocates for this strategy as a way to reduce tax burdens and improve overall investment returns.

Compounding

Compounding is the process of earning returns on both the initial investment and any accumulated returns.

Over time, compounding can lead to exponential growth, which is why Lynch emphasizes the importance of long-term investing.

Peter Lynch Quotes

In addition to his investment strategies, Peter Lynch is known for his memorable quotes, which offer succinct wisdom for investors.

Some examples include:

- “In the long run, it’s not just how much money you make that will determine your future prosperity. It’s how much of that money you put to work by saving it and investing it.”

- “The real key to making money in stocks is not to get scared out of them.”

- “Behind every stock is a company. Find out what it’s doing.”

- “Know what you own, and know why you own it.”

- “You get recessions, you have stock market declines. If you don’t understand that’s going to happen, then you’re not ready, you won’t do well in the markets.”

- “Go for a business that any idiot can run – because sooner or later, any idiot probably is going to run it.”

- “If you spend more than 13 minutes analyzing economic and market forecasts, you’ve wasted 10 minutes.”

- “Time is on your side when you own shares of superior companies.”

- “Absence of a recession is not the same as the presence of prosperity.”

- “Investing without research is like playing stud poker and never looking at the cards.”

- “I’ve found that when the market’s going down and you buy funds wisely, at some point in the future, you will be happy. You won’t get there by reading ‘Now is the time to buy.'”

- “Everyone has the brainpower to follow the stock market. If you made it through fifth-grade math, you can do it.”

- “I think you have to learn that there’s a company behind every stock, and that there’s only one real reason why stocks go up. Companies go from doing poorly to doing well or small companies grow to large companies.”

Basically, these quotes boil down to Peter Lynch’s emphasis on understanding the businesses behind the stocks, the importance of research, and the long-term nature of investing.

By keeping these principles in mind, investors can develop a stronger foundation for their investment decisions and ultimately achieve greater success in the stock market.

“Outperform 99% Of Investors With This Simple Strategy…” – Peter Lynch

FAQs – Peter Lynch Strategy

How do I start implementing the Peter Lynch strategy in my investments?

Begin by understanding your circle of competence, focusing on industries and businesses you’re familiar with. For example, Warren Buffett famously avoided tech companies because he didn’t understand them.

Perform thorough research on companies within these areas, considering their fundamentals, competitive advantages, and growth prospects.

Prioritize diversification across various sectors, long-term investing, and value investing to build a resilient and profitable portfolio.

What are some resources I can use to research companies like Peter Lynch recommends?

To conduct comprehensive research, utilize resources such as company annual reports (10-K filings), quarterly reports (10-Q filings), investor presentations, and earnings call transcripts.

In addition, consider reading industry reports, financial news, and reputable investment websites to gain a better understanding of the company’s performance and industry trends.

How can I identify multi-bagger stocks with potential for significant growth?

Look for companies with a competitive advantage or unique product offering, strong financials, and a history of earnings growth.

Consider factors such as a low price-to-earnings (P/E) ratio, high return on equity (ROE), and a scalable business model.

Identifying multi-baggers requires extensive research and patience, as these investments may take time to realize their full potential.

How many stocks should I own to achieve proper diversification?

The ideal number of stocks for diversification varies depending on your investment goals, risk tolerance, and portfolio size.

Generally, owning 15-30 stocks across various sectors and industries can provide adequate diversification.

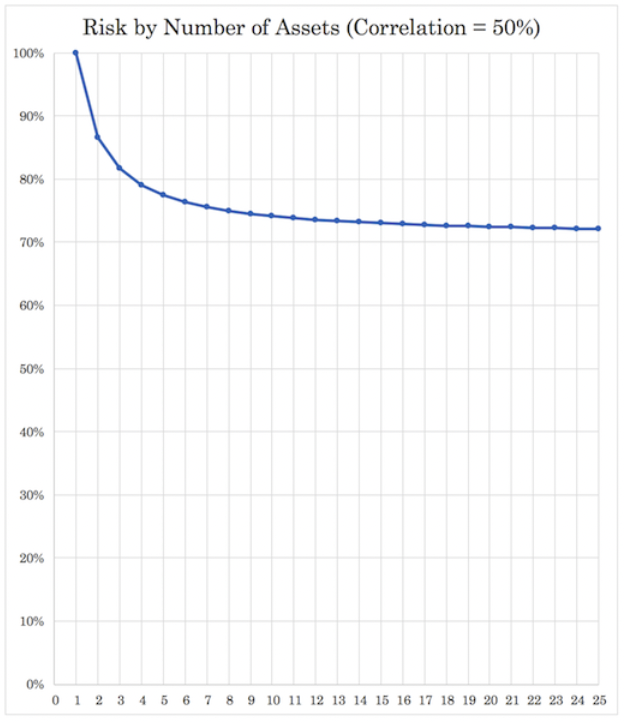

Individual stocks tend to generally be fairly tightly correlated together, so the more you add, the more marginal the benefits become.

As you can see based on this diagram, if individual stocks are 50% correlated, for example, the benefits start to thin out going past 10-15.

However, it is essential to strike a balance between diversification and maintaining a manageable portfolio that you can effectively research and monitor.

How do I calculate the margin of safety for a stock?

To determine a stock’s margin of safety, first estimate its intrinsic value using methods like discounted cash flow (DCF) analysis, earnings multiple analysis, or dividend discount models.

Then, compare the intrinsic value to the stock’s current market price.

The margin of safety is the difference between these values, expressed as a percentage of the intrinsic value.

A higher margin of safety indicates a more attractive investment opportunity with lower downside risk.

What is the difference between top-down and bottom-up investing approaches?

A top-down approach starts with macroeconomic factors, such as GDP growth, interest rates, and market trends, and then identifies industries and individual companies expected to benefit from these factors.

In contrast, a bottom-up approach focuses on analyzing individual companies’ fundamentals, regardless of macroeconomic conditions or industry trends.

Peter Lynch’s strategy emphasizes the bottom-up approach, as it allows investors to find strong performers even in challenging market environments.

How does tax-loss harvesting work, and when should I consider using this strategy?

Tax-loss harvesting involves selling underperforming stocks in your portfolio to offset capital gains tax liabilities from other investments.

This strategy can be useful when you have realized capital gains during a tax year and want to minimize your tax burden.

However, ensure that you don’t compromise your overall investment strategy solely for tax purposes.

Consult a tax advisor or financial planner to determine whether tax-loss harvesting is appropriate for your specific situation.

Conclusion – Peter Lynch Strategy

Peter Lynch’s investment philosophy has stood the test of time and remains a powerful guide for investors looking to achieve long-term success in the stock market.

By adhering to principles such as buying what you know, diversifying, researching, reinvesting dividends, and focusing on the long-term, investors can increase their odds of success and build lasting wealth.

Emphasizing value investing and maintaining a margin of safety can help investors identify undervalued stocks with strong fundamentals, while a bottom-up approach to investing keeps the focus on individual companies rather than macroeconomic factors.

Tax-loss harvesting and understanding the power of compounding further enhance investment returns and preserve wealth over time.

Peter Lynch’s quotes serve as a reminder of the simple yet effective principles that underpin his strategy.

By internalizing these lessons and applying them consistently, investors can navigate the often uncertain and tumultuous world of investing with greater confidence and achieve their financial goals.