Inflation and Impact on Asset Classes

Inflation generally causes the Fed to tighten monetary policy. This impacts asset classes by removing liquidity from the financial system.

Namely, the process of raising interest rates and/or slowing the pace of central bank asset purchases slows money and credit creation.

This is the point at which you often see the classic moves that mark a turning point:

- A flattening of the yield curve

- Increase in the value of the domestic currency

- Drop in the stock market

- Risk premiums rise

Speaking in terms of generalities, it has the following impact on asset classes:

- Stocks: Down

- Bonds: Down (Yields higher)

- Commodities: Depends (Sometimes higher commodity prices cause inflation)

- Domestic currency: Up (Tightening policy help to increase its yield and relative attraction)

Owning the dollar can be a portfolio diversifier against risk assets

Speaking from the perspective of US markets, a lower dollar is typically associated with rising stock markets and often rising bond markets.

The periods of biggest growth for the stock market are when the central bank is trying to get the economy going again even when the real economy is still weak.

The financial economy leads the real economy.

2009 and 2020 (after March 24) are good examples.

Tightening cycles take this away

And tightening cycles usually commence when the real economy is strong, when inflation is high and/or rising and nominal GDP growth is around its highest in the cycle.

This is a period where traders, investors, and the public are generally most confident of putting money into the stock market. The labor market is strong.

Many people are starting to build savings, which they can put into the stock market. And naturally they were more cautious and/or weren’t in the same financial position earlier in the cycle when stocks were materially cheaper.

Tightening threatens to topple things over

Tightening, however, is unsettling for markets.

It’s especially so when the central bank is behind the curve on inflation (e.g., 2021-22). That means the Fed is so far behind it needs to get interest rates up almost no matter what new data say about growth or inflation.

When the US is at maximum employment, this puts upward pressure on inflation (demand for labor exceeds the supply). This is normally where the Fed wants the economy to be when it finishes tightening, not when it starts.

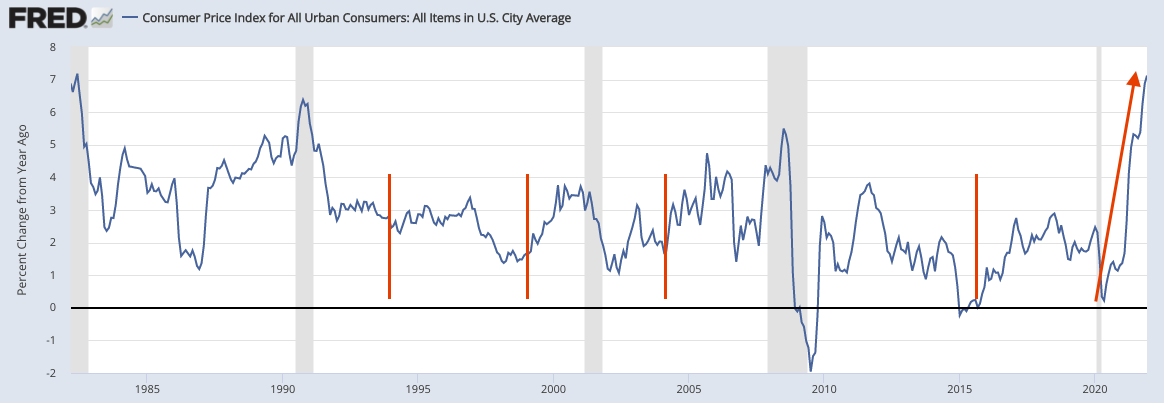

When the Fed began raising interest rates in 1994, 1999, 2004, and 2015, inflation was near or below its desired level (which is now formally 2 percent).

The tightening was therefore preemptive. In other words, it was intended to keep inflation from going up rather than to push it down. That gave the Fed substantial wiggle room about how fast to raise interest rates and how to respond to new data.

In the 2021-22 situation, it’s at much higher levels.

1994, 1999, 2004, 2015 Tightening & 2021-22’s Situation

(Source: US Bureau of Labor Statistics)

Moreover, the Fed won’t hold the market’s hand by committing to a particular path of rate increases. That induces more market volatility.

It’s been a long time since markets had to deal with:

a) a Fed behind the curve on inflation and

b) unwilling to commit to an interest-rate path because the range of outcomes is wider with inflation well above its two percent target.

It’s a recipe for more unpleasant moves in financial markets, more volatility in financial assets, and a combination of higher bond yields and/or lower stock market valuations.