Day Trading in Indonesia

Indonesia is Southeast Asia’s largest economy and a member of the G20. With a GDP of around $1.3 trillion, it offers a dynamic landscape for day traders, supported by a growing middle class and rapid digitalization.

The Indonesian Stock Exchange (IDX) has also seen a steady increase in retail investor participation, with over 11 million investors, a significant rise from previous years.

Are you ready to start day trading in Indonesia? This guide will get you started.

Quick Introduction

- Online trading in Indonesia is regulated by the Financial Services Authority (or OJK). The OJK oversees the capital markets, including the IDX. The Commodity Futures Trading Regulatory Agency (or Bappebti) oversees futures trading, commodities, and forex.

- The IDX, known as Bursa Efek Indonesia (BEI), is the main securities exchange in Indonesia. It is where stocks, bonds, and other financial instruments are traded. It was formed in 2007 through a merger of the Jakarta Stock Exchange (JSX) and Surabaya Stock Exchange (SSX).

- In Indonesia, profits from short-term trading are taxable. You will typically pay progressive income tax on profits, with rates ranging from 5% to 35% based on your income.

Top 4 Brokers In Indonesia

After exhaustive testing, these 4 platforms emerge as the best for day traders in Indonesia:

Day Trading Platforms in Indonesia

What Is Day Trading?

Day trading involves purchasing and selling financial instruments such as stocks, commodities, indices, and derivatives within a single trading day. Forex trading in Indonesia is particularly popular.

Traders focus on profiting from short-term price fluctuations, employing real-time data, technical analysis, and strategies such as scalping and momentum trading.

Unlike long-term investors who hold positions for extended periods, day traders close all positions before the market closes.

Leverage, a standard tool among active traders, can magnify gains and losses. While it allows you to control larger positions with less capital, it also increases the risk of significant losses.

Day trading in Indonesia, though highly speculative and carrying substantial risks, offers the potential for significant returns when executed effectively.

Is Day Trading Legal In Indonesia?

Yes, day trading is legal in Indonesia.

The country’s financial markets, including the IDX and futures markets, are regulated by the Financial Services Authority (Otoritas Jasa Keuangan or OJK) and the Commodity Futures Trading Regulatory Agency (Badan Pengawas Perdagangan Berjangka Komoditi or Bappebti).

CFD trading in Indonesia is also permitted, but subject to oversight by the Bappebti.

These regulatory bodies ensure that trading activities, including day trading, are conducted transparently and fairly, protecting you and the overall market.

You must comply with the rules set by these regulators, which include registering with licensed brokers, following margin requirements, and adhering to tax obligations.

How Is Day Trading Taxed In Indonesia?

Under Indonesian tax law, income earned from trading activities, such as stocks, futures, or forex, is generally considered taxable.

For individual traders, these profits are normally subject to the progressive income tax rates applicable to personal income, which range from 5% to 35%, depending on your total income level.

Additionally, there is a final tax of 0.1% on the gross proceeds from stock transactions conducted on the IDX.

Getting Started

Ready to embark on your Indonesian day trading journey? Here’s a simple three-step guide:

- Choose a top day trading broker in Indonesia. When choosing a broker in Indonesia, it’s essential to evaluate factors such as low fees, access to the markets you’re interested in like Indonesian stocks and currency pairs containing IDR (though they aren’t widely supported), a feature-rich platform, robust regulatory compliance, excellent support, educational resources, competitive margin requirements, and reasonable account minimums, especially for newer traders.

- Set up your account. To commence trading in Indonesia, complete an online application and provide your personal and financial information. Submit required documents, such as a government-issued ID (known locally as Kartu Tanda Penduduk (KTP)) and proof of address, to verify your identity. Finally, agree to the broker’s terms and conditions to initiate trading.

- Deposit funds. Once your trading account is approved, fund it using your preferred payment method, such as a debit card, bank wire transfer, or digital wallet. Consider using your local currency for your trading account to minimize costs and streamline your trading experience and tax reporting. That said, brokers with Indonesian Rupiah (IDR) accounts are rare based on our evaluations, although Exness is one leading option.

A Day Trade In Action

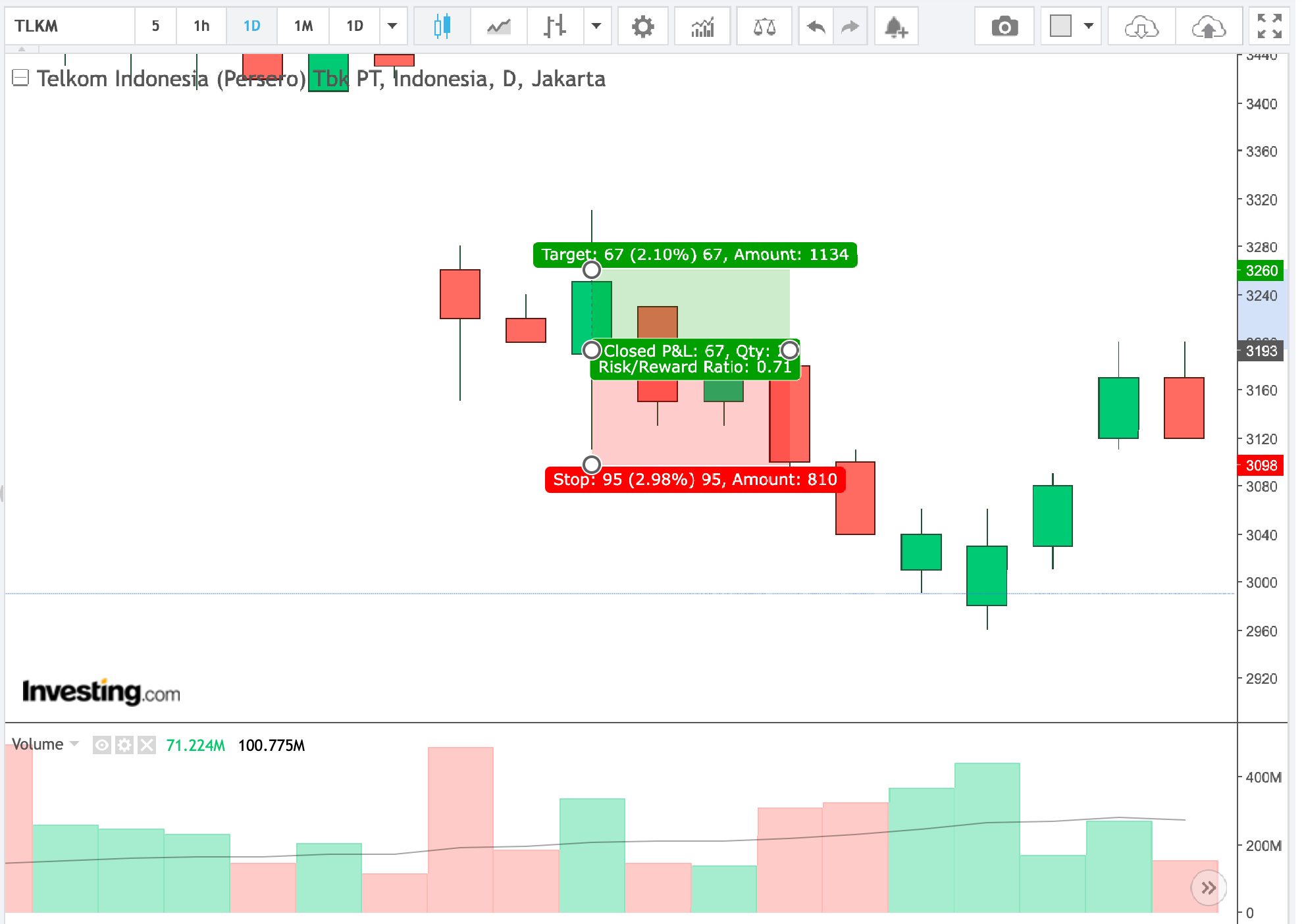

Let’s explore a hypothetical scenario where I day trade Telkom Indonesia, a prominent Indonesian telecommunications company listed on the IDX.

As a provider of information and communication technology (ICT) services and telecommunications networks, Telkom Indonesia offers a potential trading opportunity within the Indonesian market.

Event Background

Telkom Indonesia released a highly positive earnings report, which caught my attention. The report highlighted a significant revenue and net income increase, surpassing analysts’ expectations.

I noticed that Telkom Indonesia’s digital services division had grown remarkably, which indicated strong future potential.

The trading volume had also spiked after the report, showing increased market interest.

The overall sentiment was positive, so I believed a short-term bullish trend was likely to follow.

Trade Entry & Exit

Armed with this information, I entered a day trade early in the morning, just as the market opened.

The stock opened slightly lower than the previous day, contradicting my expectation of a positive reaction.

However, I believed in my analysis and placed a buy order at IDR 3,193 per share, aiming to capitalize on the short-term momentum. I also set a stop loss order at IDR 3,098 (-2.98% loss) to minimize the loss in case my analysis was wrong.

As the day progressed, the stock climbed steadily, driven by strong buying interest. I monitored key resistance levels and noticed the stock approaching IDR 3,260, where it had faced resistance two days prior.

Anticipating a possible pullback, I sold my shares for a 2.10% gain.

Trade Analysis

My day trade on Telkom Indonesia was successful due to thorough data analysis and precise execution.

The positive earnings report provided a strong catalyst, and the stock’s reaction allowed me to enter and exit the trade profitably.

By identifying key price levels and monitoring market sentiment, I captured a significant gain within a single trading session, reaffirming the importance of strategic planning in day trading.

Bottom Line

Indonesia’s day trading market is well-regulated and increasingly attractive. The Financial Services Authority and the Commodity Futures Trading Regulatory Agency oversee the industry, ensuring compliance with established standards.

Remember that day trading profits may be subject to income tax from the Indonesian Directorate General of Taxes, so adhering to financial and tax regulations in this dynamic and expanding market is essential.

To get started, use DayTrading.com’s selection of the best brokers for day trading in Indonesia.

Recommended Reading

Article Sources

- Commodity Futures Trading Regulatory Agency (Badan Pengawas Perdagangan Berjangka Komoditi or Bappebti)

- Financial Services Authority (Otoritas Jasa Keuangan or OJK)

- Indonesian Directorate General of Taxes (Direktorat Jenderal Pajak or DJP)

- Indonesian Stock Exchange (IDX)

- Indonesia GDP - Trading Economics

- Indonesian Taxes on Personal Income - PWC

- Indonesia Stock Exchange Witnesses Surge in Individual Investors - Jakarta Globe

- Taxation On Equities Investment - IDX

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com