IG Review 2025

Awards

- Best Customer Service 2022 - Online Money Awards

- Best Spread Betting Provider 2022 - Online Money Awards

- Best Platform for the Active Trader 2022 - ADVFN International Financial Awards

- Best Multi Platform Provider 2022 - ADVFN International Financial Awards

- Best Finance App 2022 - ADVFN International Financial Awards

Pros

- The ProRealTime advanced charting platform is free as long as certain modest monthly trading activity requirements are met.

- IG offers an extensive collection of professional and engaging educational resources, including webinars, articles, and analysis.

- IG is amongst the best in terms of its range of instruments, which includes stocks, forex, indices, commodities, and cryptocurrencies, plus recently added US-listed futures and options as well as an AI Index, providing diversification opportunities.

Cons

- IG has discontinued its swap-free account, reducing its appeal to Islamic traders.

- Beginners might find IG’s fee structure complex, with various fees for different types of trades or services, potentially leading to confusion or unexpected charges.

- IG applies an inactivity fee of $12 per month after 2 years, deterring casual investors.

IG Review

In this review, I evaluate the merits and drawbacks of trading with IG. I provide ratings in every important area, drawing from my personal experience trading on the platform over a number of years. Additionally, I compare IG to alternatives, highlighting areas where the broker could improve.

Check out DayTrading.com’s IG video review for a tour of the broker’s platforms and best bits.

Regulation & Trust

4.9 / 5IG stands out as one of the most trusted brokers earning a score of 4.9/5.

IG is part of IG Group Holdings Plc, a publicly traded company on the London Stock Exchange (LSE), ensuring a high degree of financial transparency.

With 50 years in the industry, the brokerage has built an excellent reputation, earning numerous awards for its trading platforms and technological innovations. The company’s analysts are also frequently cited in the news as trusted sources for market analysis.

IG holds authorization from multiple tier-one regulators, including:

- US Commodity Futures Trading Commission (CFTC)

- UK Financial Conduct Authority (FCA)

- Australian Securities & Investments Commission (ASIC)

- Japanese Financial Services Authority (JFSA)

- Monetary Authority of Singapore (MAS)

- Swiss Financial Market Supervisory Authority (FINMA)

- New Zealand Financial Markets Authority (FMA)

The broker is also regulated within the European Union through the MiFID passporting system.

Clients in the UK benefit from investor protection up to £85,000 in case of broker insolvency; EU clients are covered up to €20,000, Swiss clients up to CHF 100,000, and other clients receive similar protections.

It’s also reassuring to see IG employ security measures like 256-bit SSL encryption and offer two-factor authentication during login, creating a secure trading environment.

Accounts & Banking

4 / 5IG earns a score of 4/5 for its wide range of accounts that serve different traders and flexible payment methods that ensure convenient deposits and withdrawals.

Live Accounts

IG offers different retail trading accounts depending on the markets you wish to trade, with each account granting complete access to trading platforms, complimentary market data, and educational materials.

- CFD trading account

- Share dealing account

- Spread betting account

- IG Smart Portfolio account

- Stocks and shares ISA account

- IG Smart ISA Portfolio account

- US-listed futures and options account

There also exists a professional account offering higher leverage but with reduced regulatory safeguards. To qualify for this premium account, you must have executed 40 significantly leveraged trades per quarter for the past four quarters, maintain a portfolio exceeding £50,000, plus have at least 2 years of professional derivatives trading experience.

Considering the negatives, there is no Electronic Communication Network (ECN) account, which often appeals to experienced day traders looking for raw spreads. Pepperstone is a good alternative here.

There is also no longer a swap-free account for Muslim traders wishing to adhere to Islamic Finance principles. If this is important to you, consider our top-rated halal broker – AvaTrade.

Deposits & Withdrawals

IG accommodates numerous payment methods, subject to variations based on your country of residence and the corresponding IG entity governing your account.

These options include bank wire transfers, debit cards, and third-party payment providers like PayPal and Wise. Some traders may be disappointed to find there is no support for crypto deposits or withdrawals, but this is common practice at established brokers.

Card and PayPal payments are processed immediately while bank wire transfers can take up to three days.

The minimum deposit requirement differs based on the chosen IG entity for your trading account and your country of residence, but starts from just $0, making the broker accessible to beginners.

Importantly, I find withdrawing funds as straightforward as depositing them, but depending on your account’s currency denomination, minimum thresholds may apply for withdrawing funds via debit or credit cards.

Demo Account

A complimentary demo account lets you explore the various platforms and markets in a simulated environment with $10,000 in virtual funds.

This enables you to test trading strategies including hedging, comprehend financial statements, identify lucrative equity options, utilize a tiered margin system, manage positions, and grasp the mechanics of FTSE dividend payments, among other functionalities.

The bonus is that there is no time limit, an advantage over alternatives like XTB, allowing you to continue using the demo account alongside a real-money account.

Assets & Markets

4.5 / 5IG scores 4.5/5 for its huge range of markets and choice of trading vehicles. Only a select few brokers, such as Blackbull Markets (26,000+) and Saxo (71,000+), surpass IG’s investment offering.

Alongside an extensive selection of over 17,000 CFDs, IG provides access to exchange-traded securities (non-CFDs) for residents in the UK, Germany, and Australia, facilitating international stock exchange participation.

The platform also includes offerings like forex options, exchange-traded turbo warrants through Spectrum (its Multilateral Trading Facility in Europe), and listed derivatives via tastytrade. Additionally, eligible clients can explore options through IG Bank in Switzerland.

In terms of cryptocurrency, IG offers crypto trading via CFDs but doesn’t support direct trading of the underlying asset (e.g., purchasing Bitcoin). Additionally, crypto derivatives are not available to retail traders in the UK.

There’s also support for bonds, futures and interest rates. IG is also one of a limited pool of brokers to facilitate pre and post market trading on over 70 US stocks, plus weekend trading on major indices like the DAX and FTSE, catering to traders looking for additional opportunities or a way to hedge weekday positions.

Finally, IG Smart Portfolios provide managed portfolios, offering a balanced blend of income, growth, and risk, curated through diverse asset allocations. These portfolios may appeal if you have limited time for extensive research and trade execution.

Fees & Costs

3.5 / 5Although it doesn’t fit the profile of a discount broker, IG scores 3.5/5 thanks to its competitive pricing for active traders, notably through its Forex Direct solution, allowing for efficient execution of substantial orders.

Trading Fees

Spreads are close to industry averages, with the average spread on EUR/USD being 0.98 for standard accounts during testing. That said, it trails brokers like CMC Markets which came in at 0.7 pips on the same currency pair.

On major indices, such as the FTSE 100, spreads start at 1 point, and on spot gold, spreads from 0.3 pips are available.

It’s important to mention that, similar to many other forex brokers, IG’s spreads might elevate during periods of low liquidity compared to regular market conditions.

As customary in the FX industry, you may incur swap fees, calculated using tom-next rates, for positions held overnight, potentially subject to currency conversion charges for trading in a currency different from the account’s base currency.

Non-Trading Fees

IG scores slightly lower for its non-trading fees.

There’s a $15 charge for wire withdrawals.

There is also an inactivity fee of $12 per month if there has been no trading activity for 24 months. This may frustrate casual investors, though with such a long period, this isn’t a major drawback.

Platforms & Tools

4.9 / 5IG scores 4.9/5 for its exceptional array of trading platforms and tools designed to cater to traders of varying experience levels.

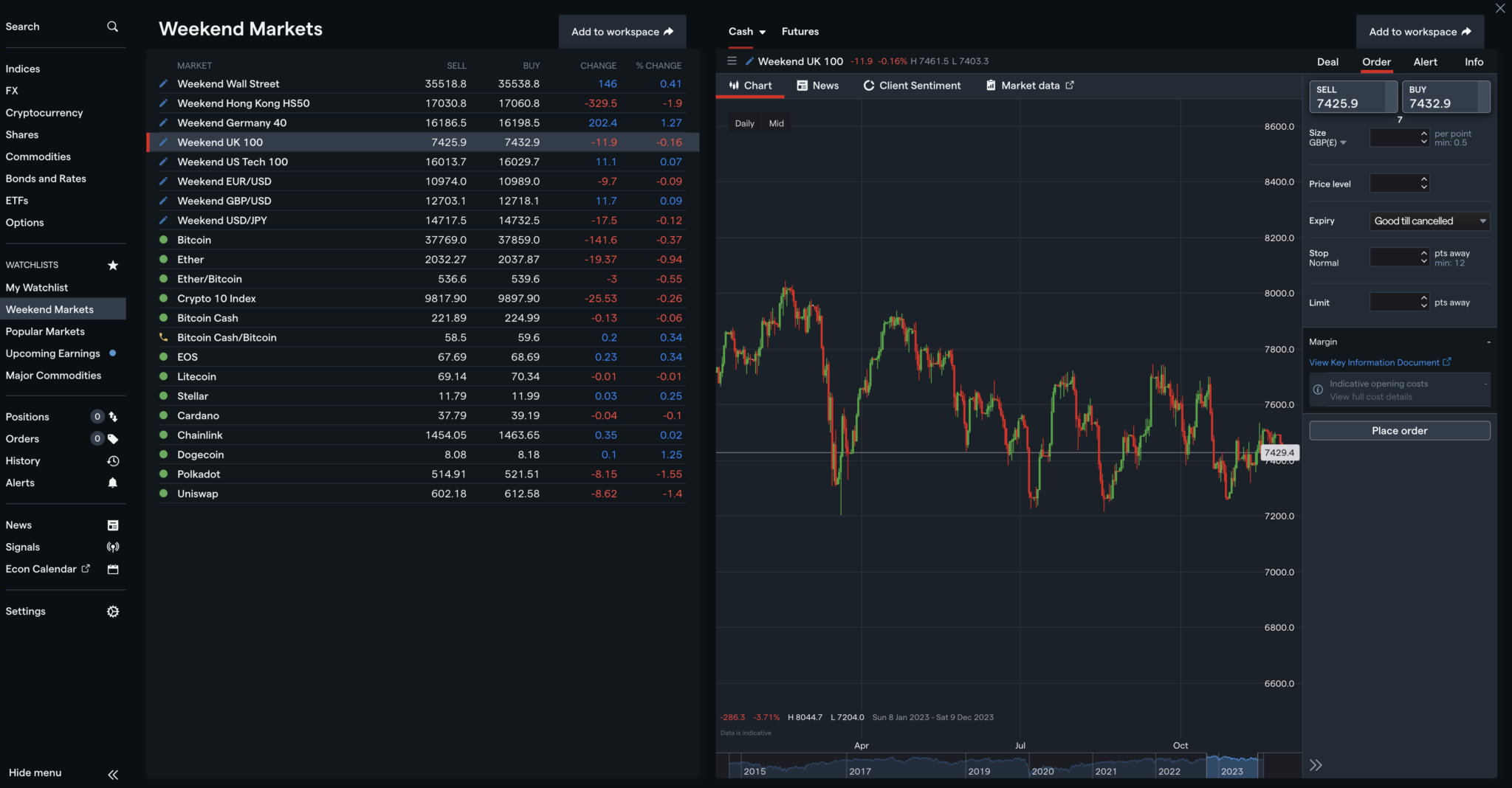

MetaTrader 4 (MT4) is available, along with the L2 Dealer DMA platform, the ProRealTime charting software and now TradingView (for Aussie clients). However, after testing the various options on offer over several years, I always favor IG’s flagship Web platform due to its easy of use and speed.

Although setting up the layout may require a few minutes as the default view is relatively sparse, multiple custom layouts (workspaces) can be saved.

The default charts within IG’s Web platform offer advanced features, such as the ability to add up to four alerts to any of its 11 supported indicators. Alongside five chart types, a tick chart is available, but there’s no Renko chart.

Zooming, resizing the view across time frames, and trading directly from the chart is fast and smooth. Additionally, the platform showcases risk/reward ratios and enables precise dragging of stops/limits.

While MT4 may have limitations in its product range, L2 Dealer is a direct market access (DMA) share trading platform. The software has useful monitoring tools, including watchlists and price alerts.

It also facilitates direct chart investing and comes with price-improvement technology. Note, the broker does not currently have OCO orders, but it offers limit orders.

Advanced tools for IG Markets Java and Python tech-savvy investors also include REST and web API.

ProRealTime is a powerful third-party platform exclusive to IG in the UK and offers powerful charting with nearly 100 indicators and automated strategy support, making it a good option for advanced day traders.

Priced at £30 per month, unless a minimum of four trades are conducted in each calendar period, the platform’s highly customizable layout could benefit from modern upgrades.

Despite this, its charts provide a detailed workspace, aided by automatic coloring of studies, enhancing the visibility of multiple indicators.

IG’s integration of ProRealTime charts continues to enhances desktop-based technical analysis capabilities, while the mobile app’s intuitive design allows trading on the go.

How To Trade On IG

It’s quick and easy to enter a trade on the IG platform:

- Select a market/asset to launch the deal ticket. This will display current buy and sell prices, along with the spread and minimum trade size

- Input your trade parameters, including currency and closing conditions. You can also view your margin levels.

- Head to ‘settings’ to enter force open plus price and fill requirements

- To set a position to open navigate to ‘order’

- To set a price alert head to the ‘alert’ tab

Research

4.9 / 5IG scores 4.9/5 for its impressive market screening, technical analysis, and social/community research, which continue to elevate the trading experience for beginner, intermediate and advanced traders.

Its standard quote pages encompass various research segments, including company news, client sentiment, trading activity, news and analysis, share price data, broker ratings, fundamentals, financials, and events, among others.

In social analysis, IG offers unique and valuable data, revealing the percentage of customers buying or selling specific shares within the week. Clients can also view other positions held by clients and the percentage of bullish or bearish IG client accounts on the underlying stock.

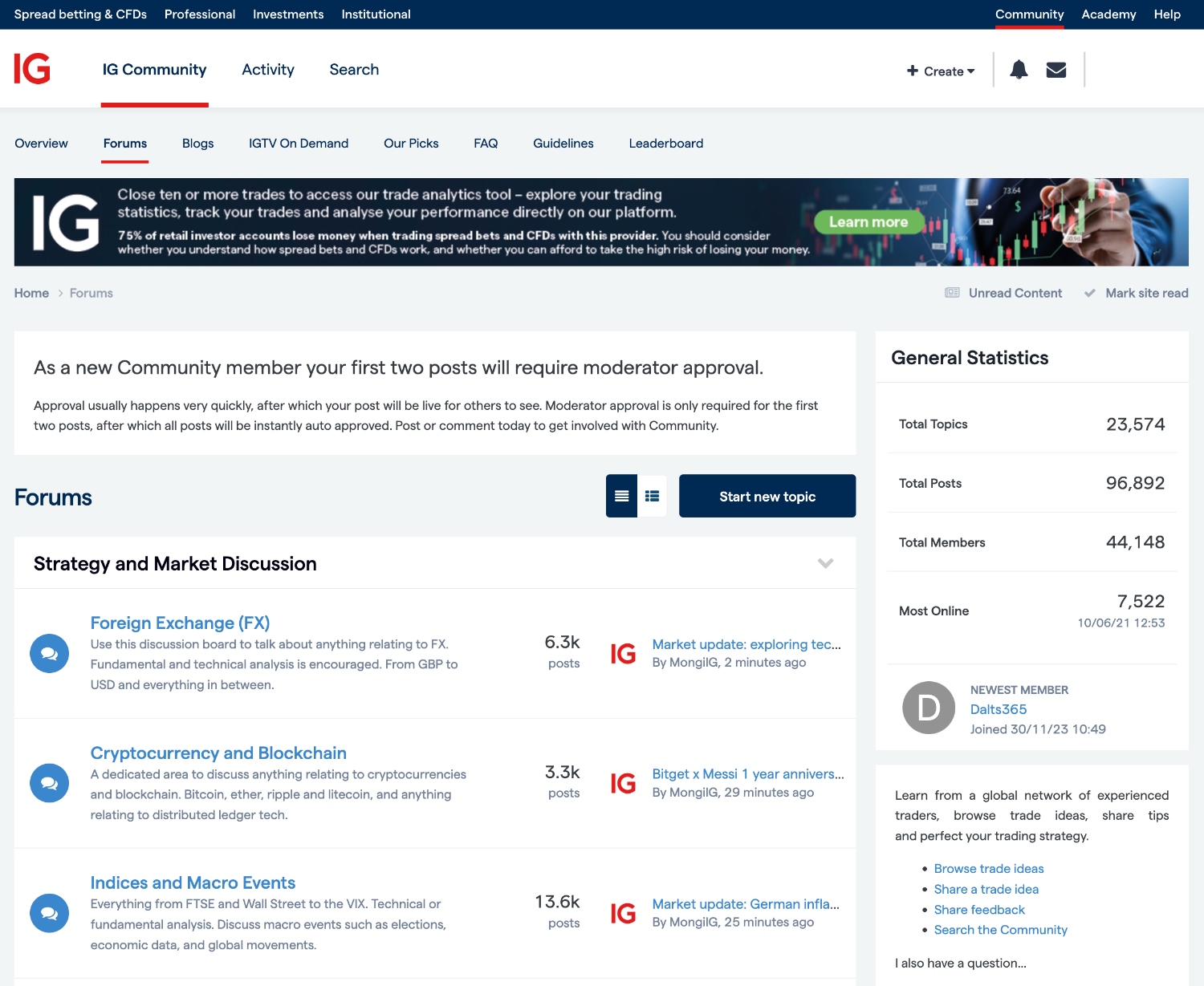

The IG Community is a forum that enables live account holders to engage in discussions about trading and markets through blog posts and forums.

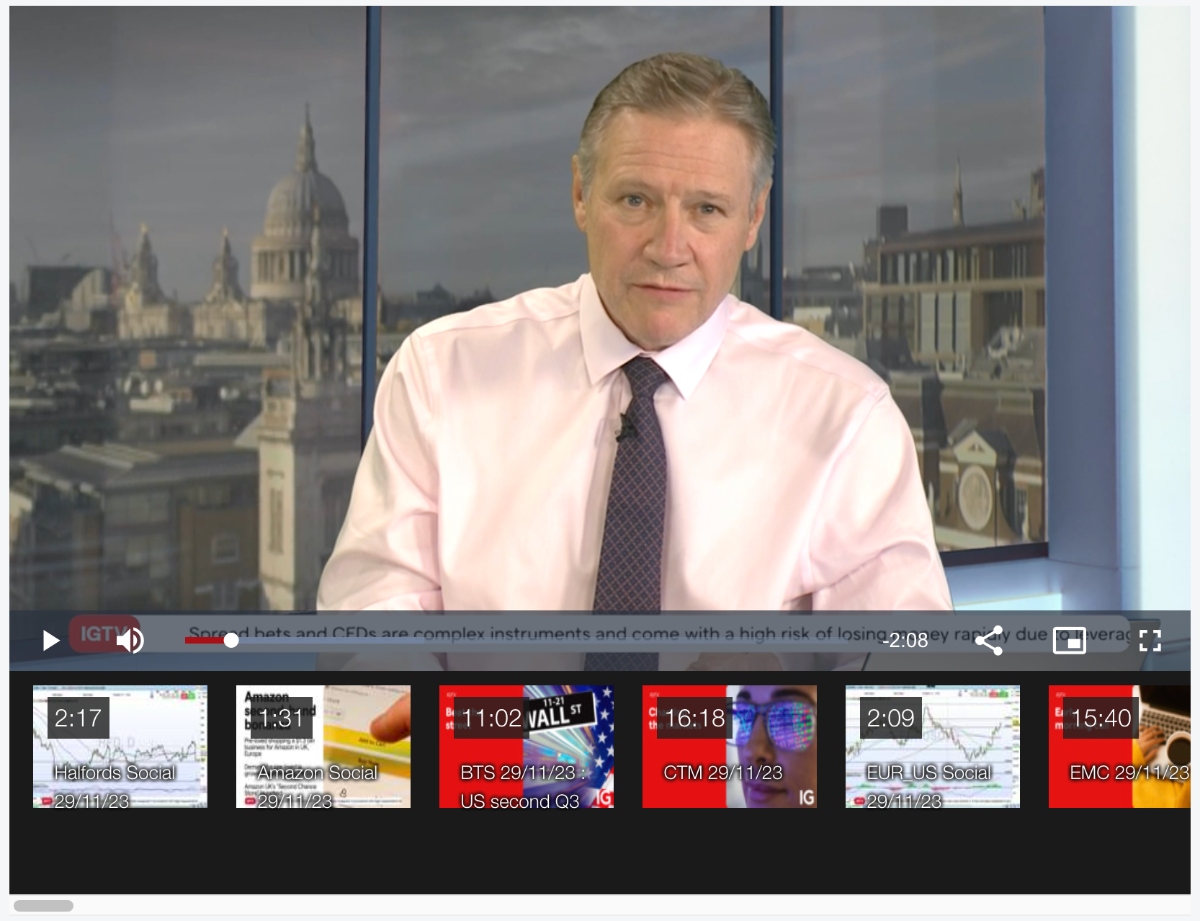

IGTV is a really interesting video channel that presents IG Live videos three times a day and features pre-open bulletins, live charting analysis, and forward-looking insights. The content covers CEO interviews, market insights, technical analysis, and educational content, and is available in an extensive on-demand video library.

After rolling out Trade live with IG, it’s also one of the only brokers we’ve seen to run a morning show every weekday to break down market events and share practical tips in an engaging, casual format.

Additionally, sections like Trade of the Week, the Week Ahead, and Morning Call are accessible via regular email alerts.

IG also manages the DailyFX website, serving as a hub for comprehensive news, research, and education. The platform offers in-house analyst insights on numerous market topics, encompassing intermediate technical and fundamental analyses. Real-time news coverage is provided in-house, focusing on major currency pairs.

Additionally, the website hosts live webinars aiming to enhance trading skills, spotlight pivotal events, and pinpoint influential news catalysts.

A dedicated Trading Strategies section furnishes short-term buy and sell signals, analyst selections, pivot points, and an array of technical data.

Education

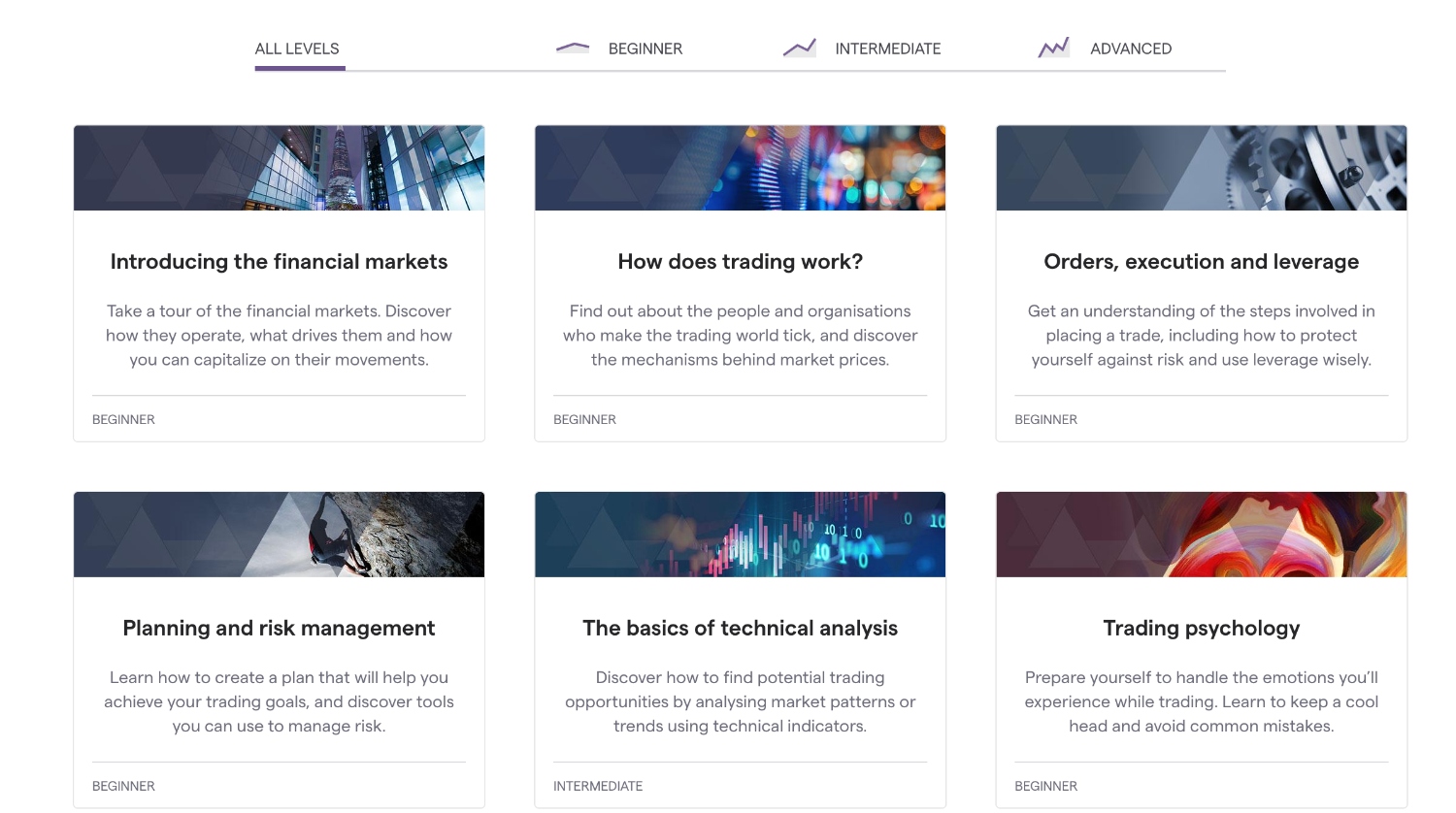

5 / 5IG scores 5/5 thanks to its best-in-class educational platform, the IG Academy, further solidifying its position in the trading arena.

IG Academy is accessible through the IG website or a standalone IG Academy mobile app. Currently offering 18 course categories, each category culminates in a quiz, enabling progress tracking and making for an enjoyable learning environment.

The online trading courses cater to all skill levels and typically take between 30 to 90 minutes to complete. Furthermore, live sessions are available every weekday, including weekly webinars covering diverse topics.

In addition to the IG Academy, an extensive library of articles delves into various subjects like tax-efficient investing, trading strategies, and macroeconomic data, benefiting traders across all proficiency levels.

IG’s educational resources are a real standout for me, surpassing those of other brokers. They will swiftly acquaint beginners with the basics of online trading while offering seasoned practitioners valuable insights through advanced strategy articles.

Customer Support

4.5 / 5While not available 24/7, IG scores 4.5/5 for its responsive and mostly reliable support.

The customer service team is available 8am to 10pm (GMT), Monday to Friday. Help is available in multiple languages via:

- Email address – newaccountenquiries.uk@ig.com

- Telephone contact number – 0800 195 3100

- Twitter – @IGClientHelp

There is also excellent peer support accessible via the Community portal where you will find forums, blogs, tutorial videos, and webinars.

IG’s online trading community is among the most extensive I have seen, with help available on a whole host of issues, including if the website is down or if charts are not working/experience an outage. Information on how to close an account and key terms and conditions are explained too. There is also a clear complaints process to ensure users can get issues resolved properly.

Most important perhaps, is the provision of live chat support, though I find the automated chatbot frustrating to use and connecting to agent sometimes time-consuming.

Should You Trade With IG?

We tested IG with actual money and it impresses with its user-friendly web platform, diverse investment offering, and top-notch research resources.

On top of that, its regulatory compliance and educational content make it a secure and informative choice – particularly for those looking to trade US stocks using CFDs.

In summary, IG maintains its position as an industry leader in nearly every category we consider important for traders.

FAQ

Is IG Legit Or A Scam?

IG is a legitimate online trading platform regulated by reputable financial authorities such as the CFTC, FCA and ASIC, ensuring adherence to stringent industry standards and the protection of users’ funds and interests.

Can I Trust IG?

IG’s long-standing presence in the industry, combined with a large and diverse client base exceeding 300,000 traders, speaks to its reliability and trusted reputation.

While no platform is without occasional issues, IG’s commitment to security measures, transparent practices, and regulatory compliance instills confidence, make it a solid choice if you’re seeking a trustworthy and dependable platform.

Is IG A Regulated Broker?

IG is a heavily regulated broker under the supervision of various regulatory bodies across different regions. It operates under licenses from financial authorities such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, and other regulatory bodies in different countries where it provides services.

Is IG Suitable For Beginners?

IG is suitable for beginners due to its extensive educational resources, but its web-based platform can initially be daunting. However, once you’ve spent a little time familiarizing yourself, you’ll appreciate the intuitive interface and the market data on offer.

Does IG Offer Low Fees?

Our tests show that IG generally offers competitive fees compared to most brokers, particularly regarding spreads. However, the fee structure varies based on the specific asset being traded, account type, and market conditions.

While it provides transparency in its fee schedules, you might might find certain fees, such as overnight financing charges or inactivity fees, relatively higher compared to other brokers.

Is IG A Good Broker For Day Trading?

IG is an excellent broker for day trading due to its clean platform design, diverse range of tradable assets, and competitive spreads. Its web platform offers advanced charting tools, real-time data, and quick execution speeds, which are essential for day trading.

Does IG Have A Mobile App?

IG offers a mobile app for both iOS and Android devices, providing on-the-go access to your trading accounts and the financial markets. The mobile app lets you execute trades, access real-time market data, monitor your portfolios, use charting tools, and stay updated with news and analysis. Its terrific user experience and range of features also helped it secure one of our awards.

Top 3 Alternatives to IG

Compare IG with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

IG Comparison Table

| IG | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| Rating | 4.7 | 4.3 | 3.6 | 4.4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, Stock CFDs, Futures, Futures Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $100 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | NFA, CFTC |

| Bonus | – | – | 10% Equity Bonus | VIP status with up to 10k+ in rebates – T&Cs apply. |

| Education | Yes | Yes | Yes | Yes |

| Platforms | Web, ProRealTime, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | WebTrader, Mobile, MT4, MT5, TradingView |

| Leverage | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:200 | 1:50 |

| Payment Methods | 6 | 6 | 11 | 8 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by IG and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| IG | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | No |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | No |

| Futures | Yes | Yes | No | Yes |

| Options | Yes | Yes | No | Yes |

| ETFs | Yes | Yes | Yes | No |

| Bonds | Yes | Yes | Yes | No |

| Warrants | Yes | Yes | No | No |

| Spreadbetting | Yes | No | No | No |

| Volatility Index | Yes | No | Yes | No |

IG vs Other Brokers

Compare IG with any other broker by selecting the other broker below.

The most popular IG comparisons:

- FP Markets vs IG

- IG Group vs Interactive Brokers

- Exness vs IG

- IG vs Alpari

- CommSec vs IG

- Saxo Bank vs IG Group

- IC Markets vs IG

- IG vs FOREX.com

- IG vs OANDA

- IG Group vs Binance

- CMC Markets vs IG

Customer Reviews

4.3 / 5This average customer rating is based on 3 IG customer reviews submitted by our visitors.

If you have traded with IG we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of IG

Article Sources

- IG Website

- IG Group Holdings Plc - London Stock Exchange

- IG Markets Limited - FCA License #1

- IG Index Limited - FCA License #2

- IG Trading and Investments Limited - FCA License #3

- IG PTY Ltd - ASIC License

- IG - NFA License

- IG Limited - DFSA License

- IG Europe GmbH - BaFin License

- IG Asia PTE LTD - MAS License

- IG International Limited - BMA License

- IG Markets South Africa Limited - FSCA License

- IG Securities Ltd - JFSA License

- IG Bank SA - FINMA License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

For me, IG is hands down the best broker for day traders. I’ve had an account for many months now and they get it right in all the key areas. 1. Charting. I’ve never had any problems running TA – you’ve got tick charts and up, can run 4 charts at same time, and indicators and drawing tools you can add and customise in a few clicks. 2. Data. Client sentiment, TipRanks, fundamentals. it’s all there in the platform at a click and you don’t get ‘no data found’ or ‘not enough data’ like I’ve seen on other softwares. 3. Fees are good if not the best I’ve seen but still spreads you can trade on and have some confidence they’re not going to widen to klingdom come when the market heats up a smidge. 4. Service. Spoken to the lads at IG countless times on account stuff, withdrawal questions, tooling, not had any issues. And they’re big, regulated and well -known – not one of these rogue operators nobodfy has ever heard of. Don’t understand for the life of me why someone would you use one of those over IG. Not if you’re serious about trading anyway.

I’ve used IG for many years and will continue to do so. The online platform took a little while to get used to but now that I’ve customized my workspace, I’ve got access to all the research and analysis functions I need in a user-friendly view. The $15 fee for bank transfer withdrawals is annoying but I can live with it.

I’m a big fan of IG. The product portfolio is almost unrivalled and the web platform is top-tier with excellent charting tools and news from Reuters. I’d like to see a copy trading app for more opportunities though.