IC Markets Review 2025

Awards

- Best MT4/MT5 Broker 2025 - DayTrading.com

- Best MT4/MT5 Broker 2023 - DayTrading.com

- Best Forex Broker 2022 - DayTrading.com

- Best Overall Broker 2020 - DayTrading.com

- Best Trading App 2020 - DayTrading.com

Pros

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

Cons

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

IC Markets Review

IC Markets aims to narrow the divide between retail clients and institutional investors by providing trading solutions previously exclusive to investment banks and high-net-worth individuals. In this review, we’ll see if it succeeds, drawing on our own experience trading at IC Markets over several years.

Regulation & Trust

4.6 / 5IC Markets is highly trusted. It’s authorized by two top-tier regulators (ASIC and CySEC) and one low-tier regulator (FSA):

- International Capital Markets Pty obtained authorization from the Australian Securities & Investments Commission (ASIC) in 2009, requiring it to adhere to strict procedures like segregating client funds and offering negative balance protection to safeguard Aussie traders from losing more than their deposits while trading with leverage.

- IC Markets (EU) obtained authorization from the Cyprus Securities & Exchange Commission (CySEC) in 2018, another first-rate regulator which requires similar safeguards for retail traders in Europe.

- IC Markets (SC) is registered with the Financial Services Authority (FSA) in the Seychelles, providing global traders with features like higher leverage (up to 1:500) in return for fewer legal protections.

One drawback is that the company is not listed on a stock exchange and it does not publicly disclose financial information, unlike Plus500 or IG, which are listed on the London Stock Exchange, ensuring a higher level of financial transparency.

Also, 2024 saw IC Markets hit with a lawsuit that alleged it failed to sufficiently assess clients’ goals and circumstances before allowing them to trade CFDs. However, the company has strongly denied these claims and we’ve observed other leading brokers, notably CMC Markets and Plus500, face similar lawsuits with a trend emerging in the Australian legal arena.

Overall, IC Markets has proven its reliability through strong regulatory oversight and our team’s many years of real-money trading at the broker with no concerns about scams.

| IC Markets | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | ASIC, CySEC, FSA, CMA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

4 / 5Trading Accounts

IC Markets offers two distinct account types tailored to suit the particular needs of your trading style: Standard and Raw Spread (MetaTrader or cTrader/TradingView).

While each account has its unique features, they essentially provide the same functionalities. The Raw Spread account boasts slightly lower spreads best suited to scalpers, although spreads are very competitive across both account types.

You can also hone your skills with IC Markets’ demo account, allowing you to practice trading with virtual funds in a real market environment for 30 days.

Importantly, opening an account is a snap and the fully-digital process can be done within a few minutes, ensuring a hassle-free sign-up process. The only delay is waiting for approval, which can take up to 24 hours due to time zones.

IC Markets also enhanced its offering for high-volume traders in 2023 with the introduction of Raw Trader Plus. This provides excellent rebates on commissions as well as perks like VPS hosting and priority support.

Deposits & Withdrawals

IC Markets continues to excel with its fast, convenient and low-cost account funding.

The broker offers a diverse range of deposit options across 10 different currencies (depending on your account jurisdiction), including AUD, USD and EUR. This far surpasses most brokers, such as eToro, which only offers a USD base currency.

The major benefit of opening an account using your preferred base currency is that you won’t incur a conversion fee if you fund your trading account in the same currency as your bank account, or if you trade assets in the same currency as your trading account’s base currency.

Deposit options are also flexible (depending on your account jurisdiction) and encompass debit cards, bank wire transfers, broker-to-broker transfers, branch cash deposits, and a huge range of digital wallets, notably PayPal, Skrill, Klarna, and BPay Deposits (AUD only).

Every time I’ve made a deposit to IC Markets over the years, my deposits have been near instantaneous – even using different currencies and payment methods.

As with other brokers, things slow down when it comes to withdrawals. You can only withdraw money to accounts in your name, and you have to use the same methods as deposits until you have withdrawn more than your initial deposit.

From my experience, debit card and e-wallet withdrawals are typically processed within the same business day, are free of charge, and take up to 3-5 business days. Bank transfers are a little slower and can incur a $20 charge, which is why I avoid them wherever possible.

| IC Markets | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | BPAY, Credit Card, Klarna, Mastercard, Neteller, PayPal, POLi, Rapid Transfer, SafeCharge, Skrill, Swift, UnionPay, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer |

| Minimum Deposit | $200 | $0 | $100 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

3.5 / 5IC Markets specializes in forex and CFDs, making it excellent for short-term traders. However, it does mean that some popular asset classes like real stocks, real ETFs, or options, aren’t offered, deterring longer-term investors.

With over 2,250 instruments available, including currency pairs (75), CFDs on indices (25), stocks (2,100), commodities (28), ETFs (4), bonds (9) and popular cryptocurrencies (13), the brokerage offers ample trading opportunities.

Lot sizes start from just 0.01, catering to beginner traders, while the maximum lot size is 100.

High leverage up to 1:500 is available, providing significant purchasing power for experienced traders, although it’s capped at 1:30 in Europe and Australia in line with regulatory requirements.

| IC Markets | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:50 | 1:200 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

4.6 / 5Year after year IC Markets shines as one of the best brokers for tight spreads and low trading fees.

The spread for major currency pairs like EUR/USD can start from as low as 0.0 pips in the Raw Spread account, with an associated commission of $3.50 per standard lot traded. Average spreads, which are a more reliable cost indicator, are also exceptionally low, such as 0.1 pips for EUR/USD, which can significantly impact day trading profitability.

IC Markets also delivers excellent pricing across stocks, indices and commodities. We’ve recorded spreads on a range of instruments and compared them with alternatives, and as you can see from the analysis below, IC Markets matches or beats most brokers.

Overnight fees are also low and there is no monthly inactivity fee penalizing casual traders.

| IC Markets | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.02 | 0.08-0.20 bps x trade value | 0.1 |

| FTSE Spread | 1.0 | 0.005% (£1 Min) | 100 |

| Oil Spread | 0.03 | 0.25-0.85 | 0.1 |

| Stock Spread | 0.02 | 0.003 | 0.1 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Looking at the negatives, IC Markets doesn’t offer interest payments on cash balances, unlike eToro or Interactive Brokers, which allow idle funds to generate returns.

Also, while the broker doesn’t typically charge deposit fees, withdrawal fees can vary depending on the method used. Bank wire withdrawals, for example, can incur a steep fee of $20 per transaction.

Platforms & Tools

4 / 5The biggest barrier to entry for beginner traders using IC Markets is the absence of its own trading platform to help simplify the trading experience. Fortunately, it makes up for this limitation by supporting four of the best third-party trading platforms: MetaTrader 4, MetaTrader 5, cTrader and TradingView.

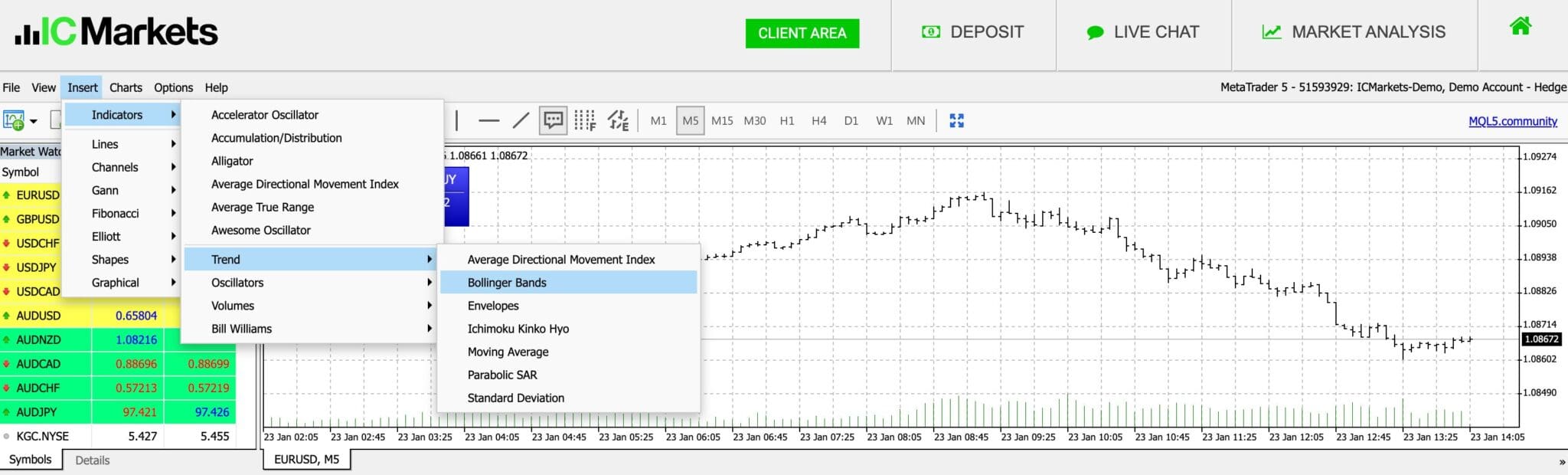

MetaTrader is probably the most popular choice among traders, even if its interface is outdated and unintuitive in my opinion. It offers extensive customizations for market depth analysis, a wide range of technical indicators, advanced charting tools, Expert Advisors, and extensive back-testing options.

The charting capabilities of cTrader are equally impressive and it’s my personal go-to platform of choice due to its slick interface that makes trading quick and easy.

MetaTrader and cTrader both feature a wide range of default indicators and additional algorithmic plugins. cTrader further adds copy trading features if you’d like to replicate the trades of more experienced traders.

IC Markets recently elevated its offering by adding support for trading directly within TradingView, the market-leading charting platform. TradingView distinguishes itself with its intuitive design, providing a customizable interface that allows for effortless adjustments to layouts, color themes, and technical indicators.

Its advanced charting features offer a diverse array of user-friendly tools and indicators suitable for traders of all experience levels, from beginners to seasoned professionals.

TradingView is also renowned for its vibrant social community, which enables traders to connect globally. You can share market insights, educational content, and video ideas, while also following peers to exchange strategies.

What sets IC Market apart from other brokers, is their attention to the core function of executing trades and providing excellent service to traders. They deliver across a range of platforms, and all of them put the trader first.

You can access MetaTrader, cTrader and TradingView platforms via their own independent mobile apps for Android and Apple devices, as well as through their web-based platforms on any desktop.

| IC Markets | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

4 / 5IC Markets has some great research tools, providing trading ideas grounded in technical analysis, news updates, and effective charting tools, but its research offerings still lag behind those of category leaders like IG.

The broker publishes several articles daily on its blog, covering technical and fundamental forecasts. While the quality of this content is good, it doesn’t quite match the depth offered by industry leaders, which helps aspiring traders discover opportunities and provide a more complete user experience.

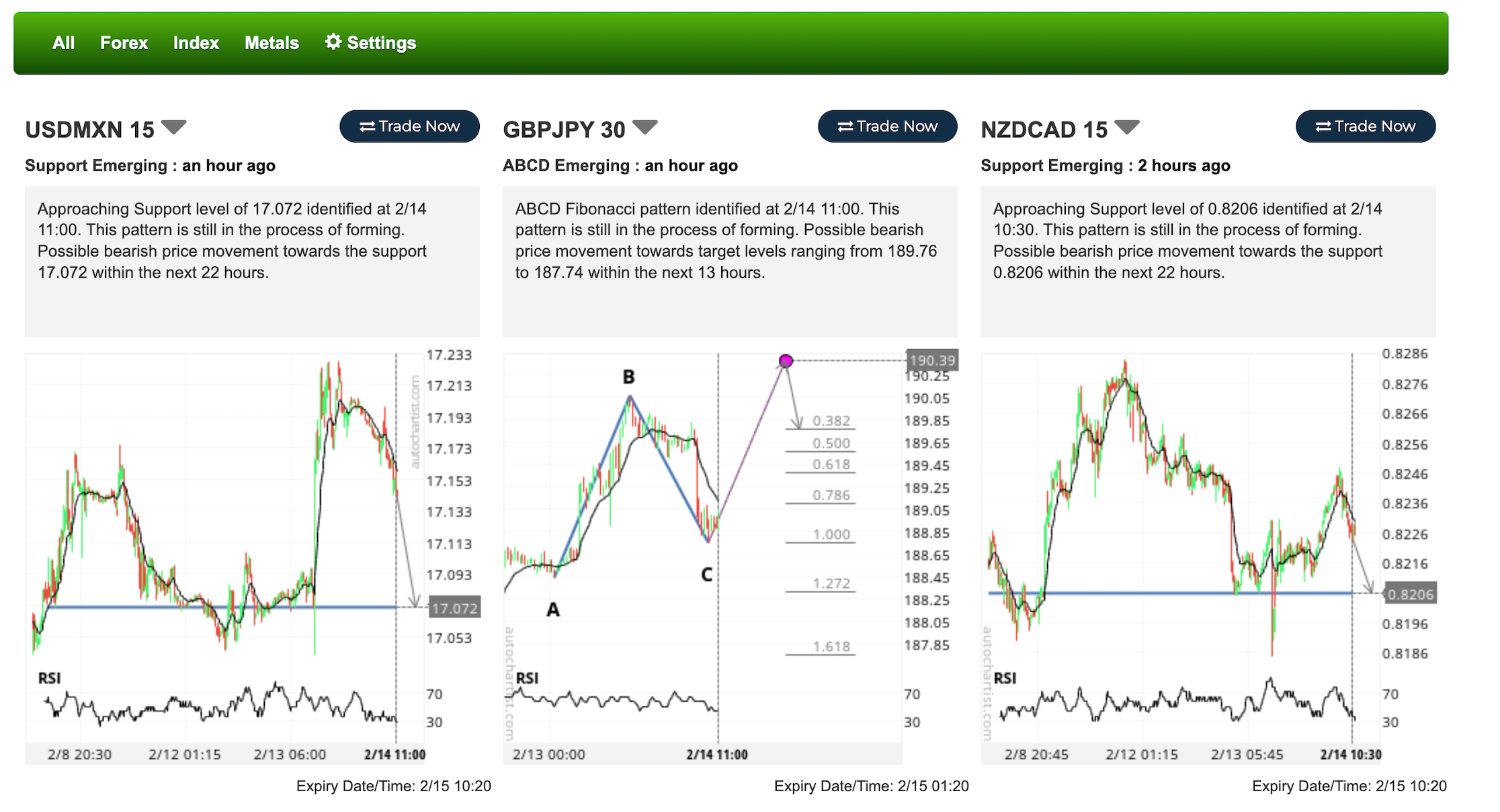

The most valuable addition based on my countless hours using IC Markets is the technical analysis and trading ideas from third-party providers Autochartist and Trading Central. Accessed from your account page or from within a supported charting tool such as cTrader, you can view trade setups and even make trades based on automated setups with just a few clicks (take profit and stop loss included).

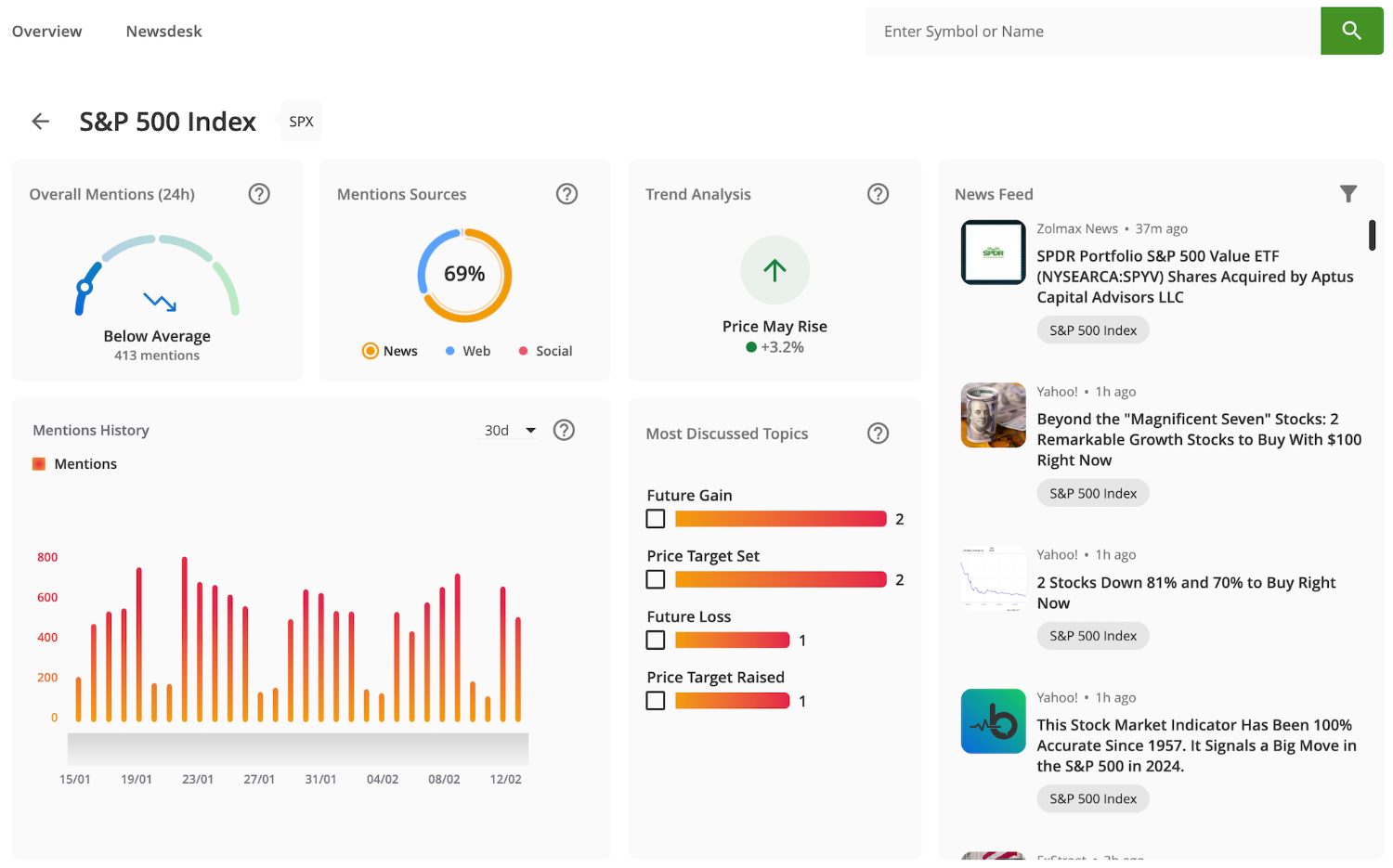

The news feed, ‘Market Buzz’, is another useful feature that provides analytics and sentiment indicators from Trading Central. Entering an individual symbol or name into the search box lets you isolate news for that specific asset, which is really useful if you are tracking an index or currency pair, for example.

| IC Markets | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

3.5 / 5IC Markets provides a decent range of trading tutorials, webinars, and other educational resources aimed at helping beginner traders understand the basics of trading, risk management, and market analysis.

But the variety and presentation of the materials just isn’t up to scratch compared to other major brokers, notably CMC Markets and XTB.

Another disappointment is that these resources are inconveniently accessed from IC Markets’ blog rather than your account page, so many traders probably won’t even know they exist.

Ultimately, IC Markets has room for improvement in its educational resources. I would like to see it enrich its offerings by introducing courses with progress tracking, quizzes, and the option to filter content based on your experience level. And making all this content accessible from a trader’s own account page would also be more intuitive.

| IC Markets | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

4.5 / 5IC Markets stands out for its robust customer support that helps create a dependable trading environment. It provides multilingual assistance 24/5 through live chat, email, and a global telephone support hotline.

Over the years of trading at IC Markets, I’ve found its support to be reliable and efficient, especially when it comes to accounts and banking issues. In fact, I’ve found its customer service to be one of the best of all the brokers I have used.

Any minor issues I’ve encountered were promptly addressed by helpful live chat staff almost instantaneously, or within a couple of hours by e-mail support for more technical issues. I’ve never had the need to phone the company.

The only issue I have found is that the technical knowledge of live chat agents is fairly limited, often requiring a follow-up email to be sent to technical support. But just knowing there is a human contact to chat to while the markets are open helps to enforce confidence in the broker.

| IC Markets | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Customer Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Trade With IC Markets?

IC Markets continues to be my go-to forex broker. The tight spreads, quick execution, and hassle-free banking options are hard to beat.

If you are an experienced trader seeking a cost-effective and regulated forex/CFD broker that lets you use your own favorite charting tools and trading algorithms, Australia-based IC Markets is one of the best choices.

FAQ

Is IC Markets Legit Or A Scam?

IC Markets is a legitimate and reputable online trading broker and I’ve traded with the company for over four years with no problems whatsoever.

Additionally, IC Markets has a track record of providing transparent services to its clients, backed by strong regulatory oversight and adherence to industry standards, making it a trustworthy option for forex and CFD traders.

Is IC Markets A Regulated Broker?

IC Markets is regulated by multiple regulatory authorities, including the Australian Securities & Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the Financial Services Authority (FSA) in the Seychelles.

Is IC Markets Suitable For Beginners?

IC Markets may not be the most suitable option for complete beginners due to the fact it doesn’t provide its own trading platform, nor does it provide much in the way of education. It’s catered more towards experienced traders who want low trading costs and support for their favorite third-party charting tools.

Complete beginners would be better off with Plus500 or eToro.

Does IC Markets Offer Low Fees?

IC Markets offers very competitive fees for forex and CFD trading. The broker typically charges low spreads, averaging near 0.1 pips on some major currency pairs, making it amongst the lowest in the industry.

IC Markets also provides commission-based pricing options, allowing you to choose the fee structure that best suits your trading preferences. Overall, it’s an excellent choice for cost-conscious traders.

Is IC Markets A Good Broker For Day Trading?

IC Markets is an excellent broker for day trading due to its competitive pricing, fast execution speeds, and wide range of tradable instruments. The broker offers low spreads, which is vital if you are looking to capitalize on small price movements.

Furthermore, IC Markets provides access to advanced trading platforms including MT4/MT5, cTrader and TradingView, which offer robust charting tools, technical indicators, and order types suitable for day trading strategies.

Does IC Markets Have A Mobile App?

IC Markets doesn’t offer its own proprietary trading platform, so you’ll have to use the mobile versions of one of the supported third-party charting tools: MT4/MT5, cTrader or TradingView.

It does, however, have a standalone copy trading app called IC Social (Powered by Pelican Trading), that lets you replicate the trades of other traders automatically.

It’s also worth noting that ZuluTrade is supported for copy trading in certain jurisdictions, which also has its own mobile app.

Top 3 Alternatives to IC Markets

Compare IC Markets with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

IC Markets Comparison Table

| IC Markets | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| Rating | 4.8 | 4.3 | 3.6 | 4.4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, Stock CFDs, Futures, Futures Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $200 | $0 | $100 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | ASIC, CySEC, FSA, CMA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | NFA, CFTC |

| Bonus | – | – | 10% Equity Bonus | VIP status with up to 10k+ in rebates – T&Cs apply. |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | WebTrader, Mobile, MT4, MT5, TradingView |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:50 | 1:200 | 1:50 |

| Payment Methods | 14 | 6 | 11 | 8 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by IC Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| IC Markets | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | No |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | Yes | No | No | No |

| Crypto | Yes | Yes | Yes | No |

| Futures | Yes | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | Yes | Yes | Yes | No |

| Bonds | Yes | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | Yes | No | Yes | No |

IC Markets vs Other Brokers

Compare IC Markets with any other broker by selecting the other broker below.

The most popular IC Markets comparisons:

- IC Markets vs FBS

- XM vs IC Markets

- IC Markets vs Oanda

- Dukascopy vs IC Markets

- IC Markets vs NinjaTrader

- IC Markets vs Eightcap

- IC Markets vs CMC Markets

- ActivTrades vs IC Markets

- FP Markets vs IC Markets

- IC Markets vs Exness

- IC Markets vs Avatrade

- Switch Markets vs IC Markets

- IC Markets vs Admiral Markets

- IC Markets vs ThinkMarkets

- IC Markets vs IG

- IC Markets vs Fusion Markets

- IC Markets vs Interactive Brokers

- IC Markets vs Binance

- IC Markets vs Fortrade

- IC Markets vs FxPro

Customer Reviews

4.3 / 5This average customer rating is based on 3 IC Markets customer reviews submitted by our visitors.

If you have traded with IC Markets we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of IC Markets

Article Sources

- IC Markets Website

- International Capital Markets Pty - ASIC License

- IC Markets (EU) - CySEC License

- IC Markets (SC) - FSA License

- Piper Alderman - 2024 Lawsuit in Australia

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Yup, IC Markets is the best broker I’ve used for intraday trading. I haven’t found a firm that can match it when it comes to fast and dependable execution during volatile market conditions. The cTrader integration is excellent and even better since they added cTrader Copy. There’s some hit and miss stuff in the Autochartist forecasts but a han dy resource nontheless.

This is one of the better day trading brokers I’ve used. The MetaTrader package is fast and reliable with excellent charting tools. I did try IC Social though and thought it wasn’t as good as eToro’s app.

IC Markets is great for day traders. I’ve been impressed with the fast and reliable execution, plus the ECN pricing with really low spreads. Market research could be better but it’s not a dealbreaker for me.