Best Broker Payment Methods

Choosing the right payment method is essential for smooth and efficient transfers with brokers – especially for day traders making frequent transactions.

Explore our growing list of the best broker payment methods, featuring bank cards, wire transfers, e-wallets, and increasingly popular crypto solutions.

Top Broker Payment Methods For 2026

- 1ForYou Brokers 2026

- ACH Transfer Brokers 2026

- Airtel Brokers 2026

- Airtm Brokers 2026

- Alipay Brokers 2026

- American Express Brokers 2026

- Apple Pay Brokers 2026

- AstroPay Brokers 2026

- Automated Customer Account Transfer Service Brokers 2026

- B2BinPay Brokers 2026

- Banxa Brokers 2026

- Bitcoin Payments Brokers 2026

- Bitwallet Brokers 2026

- Boleto Brokers 2026

- BPAY Brokers 2026

- Cashu Brokers 2026

- Cheque Brokers 2026

- Credit Card Brokers 2026

- Debit Card Brokers 2026

- Diners Club Brokers 2026

- Doku Wallet Brokers 2026

- Dragonpay Brokers 2026

- ecoPayz Brokers 2026

- Etana Brokers 2026

- Ethereum Payments Brokers 2026

- FasaPay Brokers 2026

- Finrax Brokers 2026

- Flutterwave Brokers 2026

- Giropay Brokers 2026

- GlobePay Brokers 2026

- Google Pay Brokers 2026

- iDeal Brokers 2026

- Interac Brokers 2026

- JCB Card Brokers 2026

- JetonCash Brokers 2026

- Klarna Brokers 2026

- M-Pesa Brokers 2026

- Maestro Brokers 2026

- Mastercard Brokers 2026

- Mobile Money Brokers 2026

- MoneyGram Brokers 2026

- Netbanx Asia Brokers 2026

- Neteller Brokers 2026

- Ozow Brokers 2026

- Paybis Brokers 2026

- PayID Brokers 2026

- PayNow Brokers 2026

- Payoneer Brokers 2026

- PayPal Brokers 2026

- PayRedeem Brokers 2026

- Paysafecard Brokers 2026

- Paytrust Brokers 2026

- Perfect Money Brokers 2026

- PIX Payment Brokers 2026

- POLi Brokers 2026

- Przelewy24 Brokers 2026

- QIWI Brokers 2026

- Rapid Transfer Brokers 2026

- RBK Money Brokers 2026

- SafeCharge Brokers 2026

- Simplex Brokers 2026

- Skrill Brokers 2026

- Sofort Brokers 2026

- Sticpay Brokers 2026

- Swift Brokers 2026

- TransferWise Brokers 2026

- Trustly Brokers 2026

- UnionPay Brokers 2026

- Venmo Brokers 2026

- Vietcombank Transfer Brokers 2026

- Visa Brokers 2026

- Volet Brokers 2026

- WebMoney Brokers 2026

- WeChat Pay Brokers 2026

- Western Union Brokers 2026

- Wire Transfer Brokers 2026

- WorldPay Brokers 2026

- Yandex Money Brokers 2026

What Should I Consider When Choosing A Payment Method?

There are five key factors to weigh up when selecting a transfer option at a broker:

Transaction Speed

How long will it take for the funds to reach or leave your trading account?

E-wallets like PayPal, as well as debit cards and credit cards, tend to be near-instant, while international bank transfers can take up to five days with lots of brokers.

Transfer Fees

How much will you have to pay per deposit and withdrawal?

Many brokers we’ve evaluated don’t charge internal fees, but card and e-wallet providers sometimes charge 1-3%, while wire transfers to overseas brokers may incur a $10 to $50 charge.

Security

Can you trust that your funds will be transferred safely?

Bank transfers remain among the most secure payment methods, and have been used by traders since the very first online brokers.

However, Bitcoin payments are increasingly available at brokers we test and the nature of blockchain technology makes transactions difficult to tamper with.

Availability

Is the payment option available where you’re trading from?

Some transfer solutions like Sofort are primarily available to traders in the EU, while ACH transfers mainly exist in the US, and deposit options like M-Pesa are generally only available in certain African countries.

Convenience

Is it quick and seamless to deposit and withdraw?

With the rising class of mobile traders, brokers have been quick to facilitate trading payments in solutions like Apple Pay and Google Pay.

Many digital wallets also offer a smooth experience that takes just a few clicks.

How Do I Deposit To My Trading Account?

If you’re a beginner wondering how to make your first deposit to a trading account, let me walk you through the steps…

1. Activate Your Account

Before you can load your account, you need to make sure your account is live and you’ve provided copies of any documents requested to comply with know your customer (KYC) and anti-money laundering (AML) requirements.

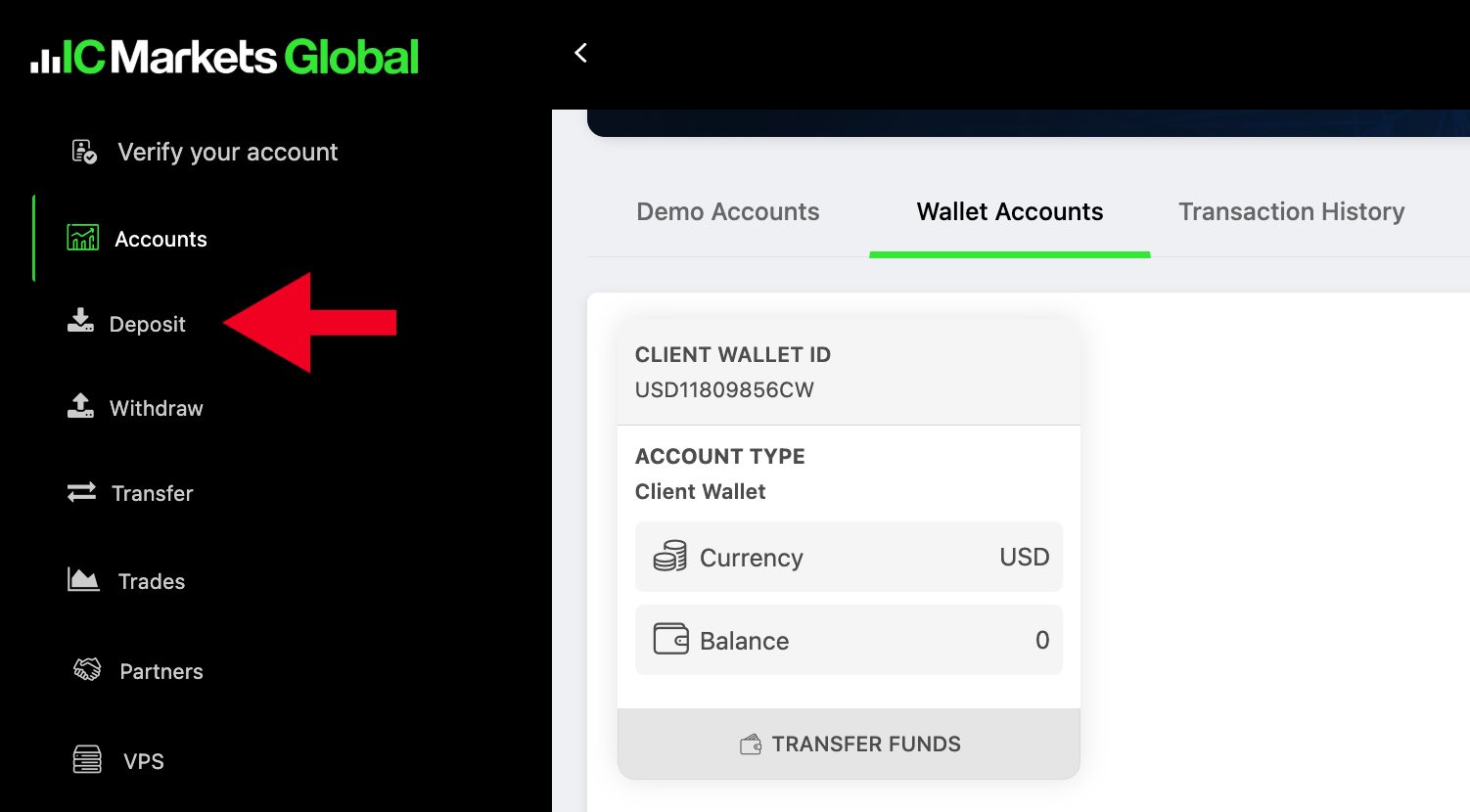

2. Go To Your Broker’s Cashier

Navigate to your broker’s cashier portal. This is usually available within the client area.

As an example, below you can see ‘Deposit’ on the left-hand side of the IC Markets personal area.

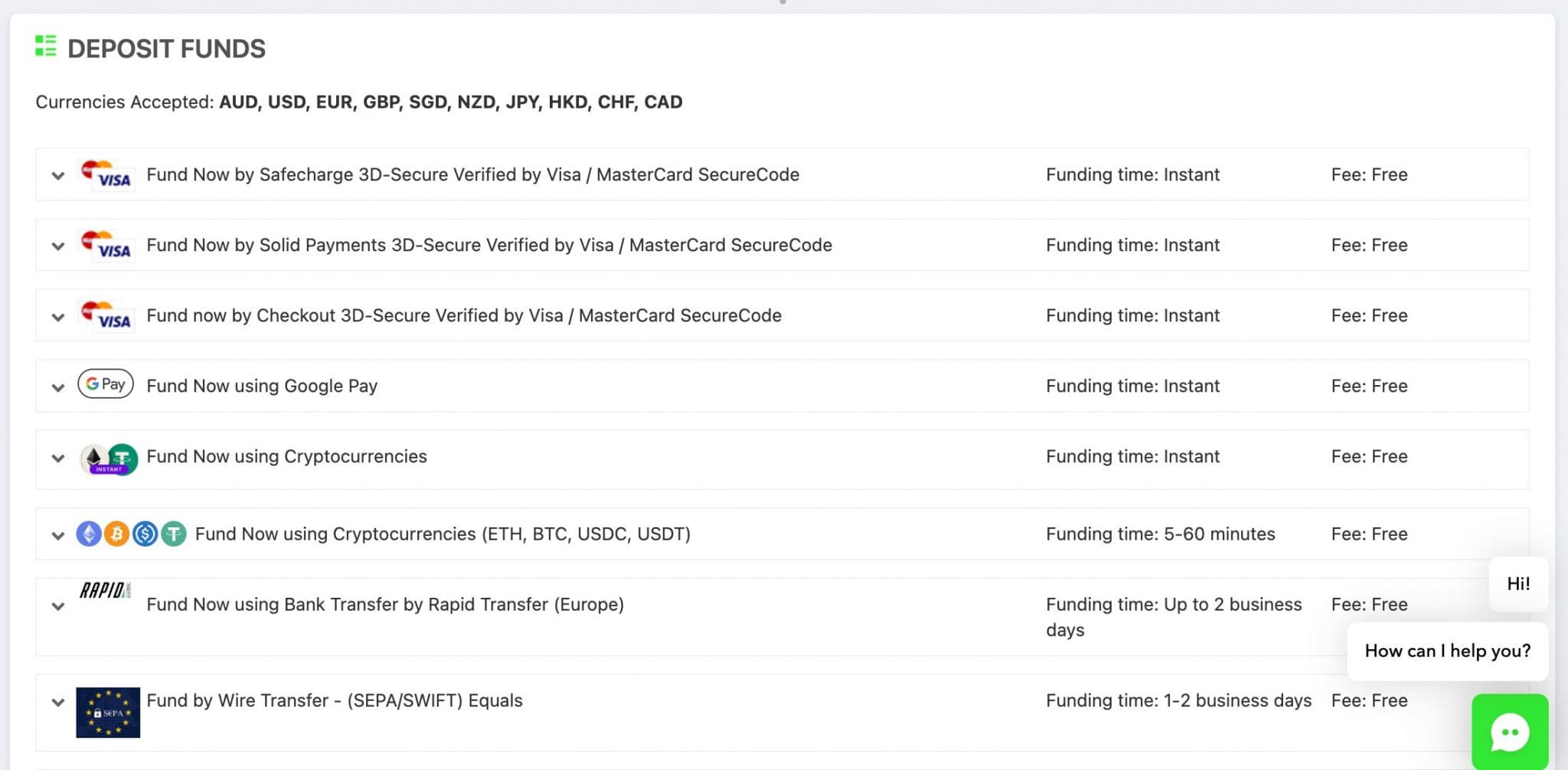

3. Choose A Payment Method

Once you’ve navigated to the deposit area, you’ll normally be presented with a list of available payment options.

For example, below you can see the selection of funding solutions I can use at IC Markets.

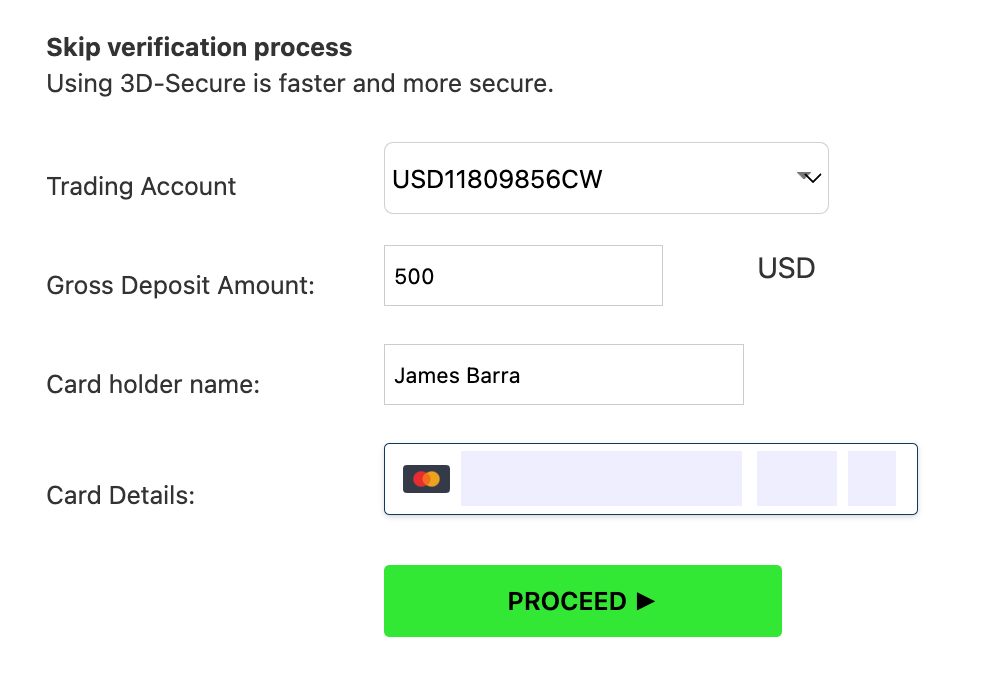

4. Complete The Transfer

Once you’ve selected the right payment method for your trading needs, click on it and follow the on-screen instructions to complete the transfer.

As you can see below, I opted for a debit card transaction because I wanted my funds to be available immediately, allowing me to start trading without delay.

Bottom Line

Whether you’re a trader looking for fast deposits, low transfer fees, or complete security, finding the best broker payment methods can make the difference.

See our evolving selection of payment methods for online trading to find the right solution for you.