Hankotrade Review 2024

Pros

- Demo account

- MT4 integration

- Low minimum deposit

Cons

- Few payment methods

- No copy trading

- No regulatory oversight

Hankotrade Review

Hankotrade is a multi-asset broker with cryptocurrency deposits and withdrawals. Day traders can invest in 80+ instruments via the MT4 and MT5 platforms. This Hankotrade.com review will assess minimum deposits and withdrawals, account types, spreads, leverage, and bonuses. Our experts also cover Hankotrade’s regulation status and safety rating.

Key Takeaways

- 1:500 leverage

- ECN/STP broker

- 100% welcome deposit bonus

- Spreads from 0.0 pips with a $2 commission per $100k

- Unregulated status raises safety concerns

- Limited educational content

- Crypto deposits only

Company Details

Hankotrade is an online brokerage, founded in 2019. The brand has a registered headquarters address in Saint Vincent and the Grenadines, plus a location in Dubai.

Hankotrade is a no-dealing desk (NDD) broker meaning all orders are sent directly to liquidity providers. There are no restrictions on trading strategies, including arbitrage, scalping, and EAs.

Importantly, Hankotrade is not regulated by a trusted financial authority. There is also limited information on the company’s management team and background, which is a concern compared to alternatives.

Trading Platforms

Hankotrade scores well in terms of trading software. The firm offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. Both solutions can be downloaded to desktop devices, accessed through web browsers, or installed on Apple and Android (APK) devices.

The industry-leading terminals offer sophisticated analysis tools, a simple user experience, plus access to an extensive global trading community. Instant and pending orders are available, plus automated trading bots with backtesting functionality. The MetaTrader marketplace is also home to thousands of downloadable indicators, signals and additional trading tools.

MetaTrader 4 is the best pick for forex traders and beginners while MetaTrader 5 will suit more experienced traders with additional indicators, order types, charting timeframes, and analysis capabilities.

MT4 Features

- 9 timeframes

- 3 chart types

- One-click trading

- 24 analytical objects

- 4 pending order types

- Market, stop and limit orders

- 30+ pre-downloaded indicators

MT5 Features

- 21 timeframes

- 3 chart types

- 44 analytical objects

- Strategy backtesting

- 6 pending order types

- Level 2 market depth data

- MQL5 programming language

- 38+ in-built technical indicators

How To Place A Trade

- Click the ‘Trading Terminals’ logo when you sign in to the client portal

- Download and/or open your chosen platform

- Choose an asset from the ‘Market Watch’ widget

- Select the ‘New Order’ icon from the toolbar along the top of the screen

- Input the order details into the pop-out window

- Choose any stop loss or take profit levels

- Select ‘Buy’ or ‘Sell’ to confirm the order

Note, the window along the bottom can be used to track open orders and view trading history.

Assets & Markets

Hanktotrade offers a modest range of assets, including fiat and digital currencies, metals and energies, plus indices. Supported instruments:

- Indices – Invest in six major indices including the FTSE100, US30 and NAS100

- Cryptocurrencies – Trade three popular cryptocurrency and fiat pairs, LTC/USD, BTC/USD, and ETH/USD

- Forex – Speculate on the price of 62 major, minor, and exotic currency pairs such as EUR/USD, GBP/JPY, and USD/CAD

- Commodities – Trade eight precious metals and energies including XAG/USD, XAU/EUR, and USO/USD

On the downside, stocks are not offered. Also, the list of global instruments is limited versus leading competitors which offer thousands of global assets.

Hankotrade Fees

Hankotrade offers low fees which vary by account type.

The STP profile is the only commission-free account, with minimum spreads from 0.7 pips. The Hankotrade ECN account has a $4 per round lot turn commission with raw spreads from 0 pips. This is more expensive than the ECN Plus account with a commission of $2 per round lot turn, also with raw spreads from 0 pips.

When we used Hankotrade, we were offered spreads of 0.7 pips on the GBP/USD and 0.8 pips on the USD/EUR. There are also swap fees for positions held overnight, though these are waived on the Islamic account.

Our experts were pleased to see no charges for deposits or withdrawals.

Leverage

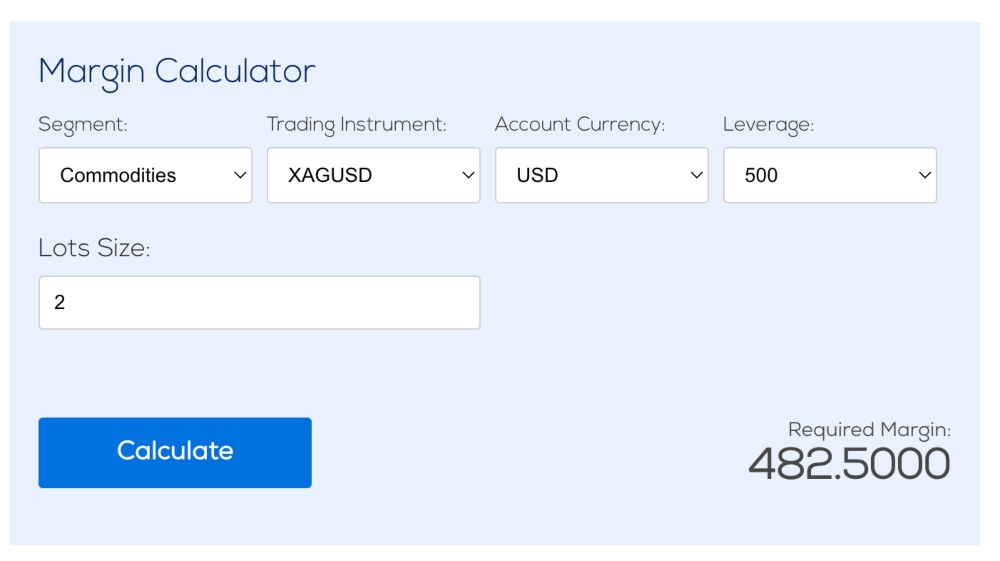

Hankotrade offers high leverage up to 1:500. A margin call of 70% applies with a stop-out level of 50%. But whilst trading with high leverage may amplify profits, losses may also significantly rise.

The broker can offer attractive leverage due to its unregulated status, but this also means fewer safety measures to protect retail traders.

Mobile App

Hanktotrade clients can access the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) mobile apps to trade on the go. Both applications are available for free download to iOS and Android devices.

When we used Hankotrade, we found the mobile apps easy to use, with push alerts and notifications, trading from charts, plus signals and graphs optimised for tablets and mobiles. Overall, they will meet the needs of most active traders.

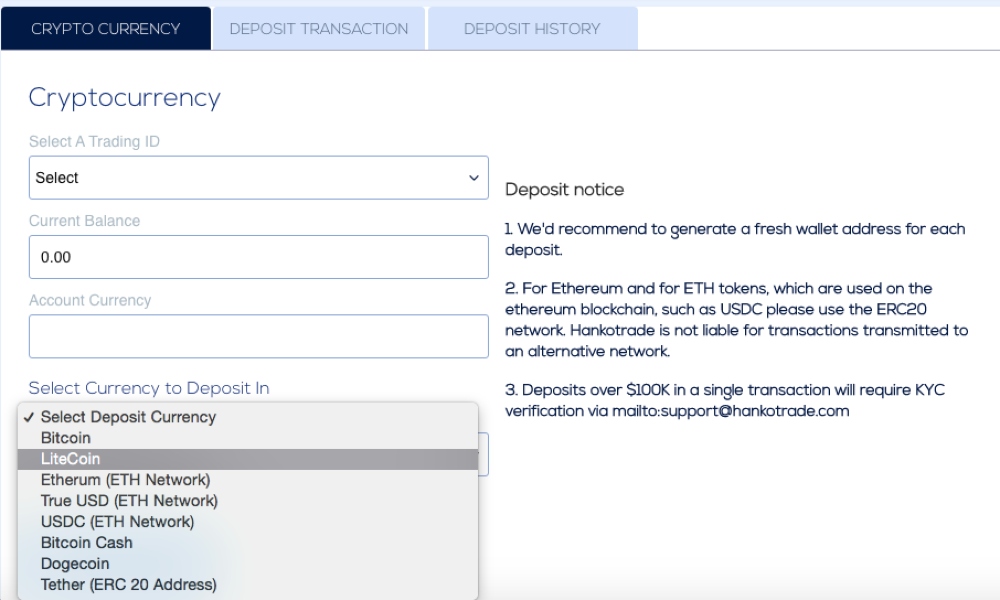

Payment Methods

Hankotrade only accepts cryptocurrency deposit and withdrawal options. Accepted digital currencies include Bitcoin, Litecoin, Ethereum, and Dogecoin. This is restrictive, particularly vs major brokers like Exness, IC Markets, and Oanda which offer bank wire transfers and credit/debit cards, among others.

The minimum deposit requirement varies by account, the lowest being $10 for STP account holders, making it the best pick for beginners. The deposit processing time is blockchain-dependent.

Note, any payment requests over $100,000 will require KYC verification.

How To Make A Deposit On Hankotrade

- Sign in to the client portal

- Once logged in, click ‘Deposit’ in the side menu

- Select ‘Cryptocurrency’ in the deposit menu

- Complete the payment request with your trading account ID and the cryptocurrency to deposit

- Click ‘Proceed’

- Crypto wallet details should be displayed on the next screen

- Use the QR code or information on the screen to complete the transaction

- You can view deposit history and transaction status within the ‘Deposit’ screen of the client dashboard

You can follow the same process for withdrawals by selecting the ‘Withdrawal’ icon in the side menu of the client portal.

Withdrawals should be made back to the original payment method. Hankotrade aims to process all withdrawal requests within one working day, though the time taken for funds to clear will be blockchain-dependent.

Unfortunately, Hankotrade does not provide any information regarding minimum withdrawal amounts.

Demo Account

The broker offers a free demo account. Traders can access real-time price conditions, flexible leverage up to 1:500, and unlimited virtual funds. Hankotrade also allows users to hold a demo profile and live account at the same time.

Our experts recommend using a demo account to learn the features of the MT4 and MT5 platforms. A paper trading account is also a good place to start when the firm is unregulated.

Regulation & License

Hankotrade is registered to an address in Saint Vincent and the Grenadines, however, there are no regulatory credentials.

This is a serious drawback vs top-rated brokers which hold a license with trusted financial agencies like the CySEC, SEC, FCA or ASIC. You may not have access to compensation schemes in the case of misconduct, and your funds could be at risk.

Bonuses & Promotions

Hankotrade offers a 100% deposit bonus. The financial incentive is available to users depositing a minimum of $100 to a live trading account, and the funds will be matched and credited by the broker.

Importantly, withdrawals are only permitted once the minimum trade volume has been achieved; bonus value / 2 = number of lots to trade.

Additional Features

Hankotrade falls short in terms of educational materials. There are no guides or tutorials for beginners, nor popular tools like TradingView.

With that said, there is an FX calculator which can be used to determine commissions, a pip calculator, a margin calculator, and a swap fee calculator for positions held overnight. Additionally, an economic calendar is hosted on the broker’s website.

Clients can also make use of a Virtual Private Server (VPS) for ultra-low latency trading. However, Hankotrade is not transparent about usage fees or minimum trading conditions.

Finally, PAMM/MAM-funded accounts are available. Retail traders can deposit funds into managed profiles for a hands-off investing experience.

Account Types

Hankotrade offers four live trading accounts; STP, ECN, ECN Plus, and Islamic.

Conditions vary between profiles though all are available in USD, EUR, and CAD base currencies, offer leverage up to 1:500, and have a minimum trade size of 0.01 lots. All customers have access to the same client portal, regardless of account type.

STP Account

- EAs allowed

- Commission-free

- NDD market execution

- Floating spreads from 0.7 pips

- Hedging and scalping permitted

- $10 minimum deposit requirement

ECN Account

- EAs allowed

- NDD market execution

- Floating spreads from 0.0 pips

- Hedging and scalping permitted

- $100 minimum deposit requirement

- $4 commission fee per round lot turn

ECN Plus Account

- EAs allowed

- NDD market execution

- Floating spreads from 0.0 pips

- Hedging and scalping permitted

- $1000 minimum deposit requirement

- $2 commission fee per round lot turn

Islamic Account

The swap-free Islamic account is available for day traders looking to adhere to Sharia law.

Overnight rollover charges are not applicable, however, admin costs do apply when a position is held for more than two days. Cryptocurrency positions, for example, will be liable for a 0.25-point admin charge, and indices a 2-point fee.

Traders must contact the broker’s customer service team to open an Islamic profile or to switch from an existing account.

How To Register For A Hankotrade Account

It is relatively quick and easy to open a Hankotrade account. Basic personal details including an email address and contact number are required. A six-digit one-time investor password will then be sent to the registered email address, and can be inputted into the login page.

Once you have access to the client dashboard, select either ‘Add Live Account’ or ‘Add Demo Account’. Follow the on-screen instructions to choose the account type, base currency, and leverage.

When we opened a Hankotrade account, there were no KYC or AML ID checks, usually required by regulated brokers.

Trading Hours

Hankotrade is available to traders 24 hours a day Monday to Thursday and Fridays until 12 pm. On the downside, our experts found the broker does not offer weekend trading.

Note, the server time zone is GMT +2 during winter months and GMT +3 during the summer months.

Customer Support

Day traders can access 24/5 customer service. Contact methods include email, live chat, phone, and an online inquiry form. While using Hankotrade, we received a response on live chat within a few minutes.

Contact details:

- Telephone Number – +97143325768

- Live Chat – Bottom right of all webpages

- Email Address – contactus@hankotrade.com

- Online Enquiry Form – Via the ‘contact us’ webpage

- Postal Address – Hankotrade LLC First Floor, First St Vincent Bank Ltd Build, James Street, Kingstown, St Vincent and the Grenadines

The website also provides a list of FAQs with queries such as how to withdraw money from and fund a Hankotrade account, plus how to delete an account or change leverage.

Security & Safety

There is limited information regarding the security measures used by Hankotrade.

However, when our traders signed in to the client portal, they were able to enable/disable two-factor authentication (2FA). Additionally, all new customers are required to provide information on their previous trading experience and knowledge of forex.

The MetaTrader brand is renowned for its secure trading terminals, operating with data encryption, hidden IP addresses, and RSA digital signatures.

Hankotrade Verdict

Hankotrade is a no-frills broker providing access to 80+ assets on the MT4 and MT5 platforms. Yet despite ECN and STP accounts, a welcome bonus and high leverage, the firm does not have strong regulatory credentials and the limited public information about the company raises concerns. The broker also only accepts crypto deposits and has negative user reviews regarding slippage.

Overall, alternative brokers are a better pick for most beginners and experienced traders.

FAQ

Is Hankotrade A Regulated Broker?

Hankotrade is not regulated by a reputable financial authority. This is a significant disadvantage compared to legit competitors and raises scam concerns.

Is Hankotrade A Good Broker?

Hankotrade offers all the basic trading services that you would expect, including a demo profile, a choice of live accounts, MT4/MT5 webtrader access, and 24/5 customer support. However, the company’s unregulated status and limited safeguarding measures are drawbacks. Also, only crypto deposits are accepted and the range of assets is narrow.

Is Hankotrade Suitable For Day Trading?

Hankotrade’s ECN Plus account is the best option for day traders. It offers spreads from 0.0 pips with a $2 commission per $100k lot traded, plus 1:500 leverage. However, the account requires a $1000 minimum deposit which is higher than many alternatives.

Can You Use Hankotrade In The UK?

Yes, Hankotrade does accept customers from the UK. With that said, clients from India and Turkey are not accepted.

Does Hankotrade Accept US Clients?

Yes, traders from the US are permitted to open an account.

Where Is Hankotrade Located?

Hankotrade is based in a headquarters address in Saint Vincent and the Grenadines with an additional office in Dubai. With that said, the broker accepts traders from most countries and regions.

How Long Does A Hankotrade Withdrawal Take?

Hankotrade processes payout requests within one working day. However, the time taken for withdrawals to be received by clients will vary due to blockchain processing times.

How Can I Change The Leverage In My Hankotrade Account?

To change the leverage of an existing Hankotrade account, log in to the client portal and select ‘Account Operation’. Here you can choose the account ID and select the new leverage level from the dropdown menu. The broker aims to process change requests within 24 hours.

Top 3 Alternatives to Hankotrade

Compare Hankotrade with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Plexytrade – Established in 2024 and headquartered in Saint Lucia, Plexytrade is an ECN/STP broker. Geared towards active traders, it supports four account options, crypto deposits and withdrawals, plus very high leverage up to 1:2000 made possible by its unregulated status.

Hankotrade Comparison Table

| Hankotrade | IG | Interactive Brokers | Plexytrade | |

|---|---|---|---|---|

| Rating | 2 | 4.4 | 4.3 | 2.5 |

| Markets | CFDs, Forex, Indices, Commodities, Cryptos | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Indices, Stocks, Commodities, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $10 | $0 | $0 | $50 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 |

| Regulators | – | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | Unregulated |

| Bonus | 100% Deposit Bonus | – | – | 120% Cash Welcome Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:500 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:2000 |

| Payment Methods | 2 | 6 | 6 | 2 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

Plexytrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by Hankotrade and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Hankotrade | IG | Interactive Brokers | Plexytrade | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Hankotrade vs Other Brokers

Compare Hankotrade with any other broker by selecting the other broker below.

The most popular Hankotrade comparisons:

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Hankotrade yet, will you be the first to help fellow traders decide if they should trade with Hankotrade or not?