GO Markets Review 2025

Awards

- No. 1 For Educational Materials, 2019-2021 - Investment Trends Australia Leverage Trading Report

- No. 1 For Value for Money, Spreads, Trading Ideas & Strategies and Margin Requirements, 2021 - Investment Trends Australia Leverage Trading Report

Pros

- 24/5 award-winning customer service

- 0.01 minimum lot size and zero spreads

- Copy trading service

Cons

- Only two account types

- $200 minimum deposit

- Multiple restricted countries including the US

GO Markets Review

GO Markets is an award-winning Australian forex broker and CFD provider, offering the MetaTrader 4 and MetaTrader 5 platforms. This 2025 review will unpack what GO Markets has to offer traders today, covering its demo and real-money accounts, as well as leverage and fees. Find out if you should start trading with GO Markets.

GO Markets Details

Founded in 2006, GO Markets is one of Australia’s first MetaTrader 4 (MT4) forex brokers. The provider has since added MetaTrader 5 (MT5), WebTrader, and mobile trading to its suite of services.

Based in Australia and licensed by the Australian Securities and Investment Commission (ASIC), the group now has offices in London, Taipei, and Hong Kong. In 2020, the broker obtained a license to expand into the Middle East and Northern Africa region, operating as GO Markets MENA DMCC in Dubai, UAE.

Over the past 15 years, the company has won a number of awards for its services including No.1 for Education Materials/Programmes as well as the highest rated broker in the service areas of Value for Money, Spreads, Trading Ideas & Strategies and Margin Requirements, by Investment Trends.

GO Markets also provides 24/5 customer support, spreads from 0.0 pips, plus no deposit fees, making it a popular brand with beginner traders.

Trading Platforms

Go Markets offers several industry-leading platforms: MetaTrader 4, MetaTrader 5 and cTrader. All systems are available to download on Mac and Windows PCs as well as mobile/tablet devices and web browsers.

MT4

The MetaTrader 4 (MT4) platform is a multi-feature terminal particularly popular amongst forex traders.

Key features include:

- Forex, indices, and commodities trading

- Access to over 600 trading instruments

- Instant and pending order types

- Automated trading features

- 25+ analysis indicators

- Customizable layout

- Economic calendar

- Real-time pricing

- Secure login

- VPS

MT4 is suitable for all. Its intuitive platform makes it easy for beginners to navigate whilst its suite of tools for analysis caters to more experienced traders.

MT5

Clients can also trade on MetaTrader 5 (MT5), a more advanced platform offering superior tools. MT5 provides flexible trading, professional analysis, algorithmic trading and virtual hosting. Other features include:

- Four types of order execution and six types of pending orders

- 80+ technical analysis indicators and objects

- Access to Expert Advisors (EAs)

- Hedging and netting

- One-click trading

- VPS

Traders should note that platform availability will vary between locations. UK based clients do not have access to MT5 through GO Markets, whilst the platform is supported in Australia.

WebTrader

The GO Markets WebTrader platform offers all the features available on MT4 or MT5, within a web-based terminal that can be accessed directly from any internet browser.

With no app or browser extension download needed, WebTrader allows users to trade CFD instruments and access price analysis from anywhere with an internet connection. It is a suitable option for clients and beginners seeking an easy-access platform.

WebTrader is compatible with Windows, Mac, and Linux OS.

How To Place A Trade:

- Click on ‘trading’ from the left-hand menu and then select ‘create order’ at the bottom. A ‘create order’ screen should then appear

- Enter the order details, including:

- Your account number

- Buy or sell

- The name or ticker of the security

- The size of the trade (e.g. the number of shares)

- The type of order (limit or market to limit)

- Your limit price

- Validity (good til cancel, good for day or good til date)

- Confirm the order

cTrader

The cTrader terminal is popular among experienced traders and algorithmic traders, boasting the C# programming language and a vast array of advanced indicators and order capabilities.

- Advanced order types including buy stop limit and sell stop limit

- Customizable charts, plus one-click trading functionality

- Integrated economic calendar, plus a news feed

- 6 chart types and 28 timeframes

- 55+ technical indicators

- Level 2 Depth of Market

Social Trading: Myfxbook

Myfxbook AutoTrade is a global copy platform and social trading community. With over one million customers, it easily connects with your GO Markets Standard trading account, allowing users to:

- Copy pre-approved investors who have a demonstrable history of successful trades

- Connect to Myfxbook straight from an internet browser

- Access a range of accurate analyses and statistics

- Have easy control over auto-copied trades

Upon receiving login details for MT4/MT5, traders can then register for a Myfxbook account through the website.

cTrader Copy Trading

The cTrader platform also includes a copy trading add-on – ideal for those who want a more hands-off approach to trading.

The tool is easy to use and allows you to execute automated strategies with access to advanced risk management settings. Clients also benefit from a dedicated account manager for those requiring more personal support.

Share Trading Platform

TradeCentre by FinClear is a web-based and mobile platform that you can access and download from GO Markets’ website.

You can trade shares and manage your account. It allows you to purchase and sell, check market data, and receive news about incoming floats and dividends.

You also get useful tools like watchlists and heat maps. Additionally, it comes in a Pro version for advanced traders.

Markets

GO Markets users can trade over 600+ CFD products within six main asset classes:

- Indices – Invest long and short with 13 Cash CFDs and 2 Futures CFDs, including the FTSE 100, CAC 40, US 500 and ASX 200

- Commodities – Includes crude oil and gas. These can be traded both in spot and futures markets

- Shares – Trade Australian, US and Hong Kong share CFDs, including 200+ ASX shares and 80+ NYSE and NASDAQ equities, with over one thousand fresh stocks added in 2024

- Forex – 50+ major, minor and exotic currency pairs, including AUD/USD, EUR/GBP, and USD/CNH

- Metals – Invest in gold and silver CFDs with long or short positions

- Cryptocurrencies – Bitcoin, Bitcoin Cash, Ethereum, Tron and Litecoin

- Treasuries – Trade fixed income bonds across the US, UK, Europe and Japan, including EURO BUND Futures

- ETFs – Track the performance of an index, sector, commodity or asset class, including the Invesco QQQ Trust Series 1

Note, cryptocurrency trading is only supported in certain markets. Binary options is also not available at GO Markets, not even on demo accounts.

Spreads & Fees

Reviews show that spreads are competitive, ranging from 0.0 to 12.2 pips on major and minor forex pairs, while the minimum on indices starts at 0.1 points. Spreads on gold, silver, and crude oil are variable with live pricing available on the broker’s main page.

Other trading costs include commissions (only on the GO Plus+ account) of A$3.00 per side on a standard lot, as well as swap rates when you buy or sell a currency pair and hold it overnight.

Overall, if you compare GO Markets vs. the likes of Pepperstone or IC Markets, the broker’s commissions and spreads are competitive.

Leverage Review

GO Market offers leverage up to 1:500 on forex pairs, up to 1:20 on share CFDs, and up to 1:100 on indices.

All client accounts are set up with a default leverage rate of 1:100, and depending on account balance, you can choose a ratio between 1:1 and 1:500.

Leverage limits also vary between markets according to local regulation.

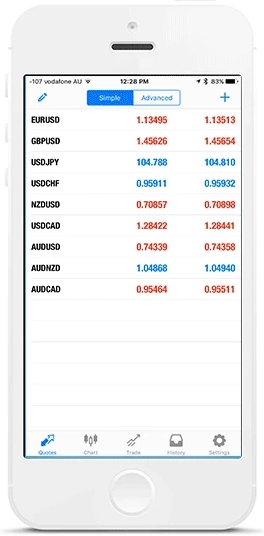

Mobile App

GO Markets offer the MetaTrader and cTrader mobile apps for iOS or Android smartphones, meaning users can trade 24/7 on the go. All terminals allow easy and convenient access to the same features as the desktop platform, including quotes, trades, and charts.

The mobile applications can be downloaded from your device’s Google Play or App Store.

Payment Methods

Deposits

When we used GO Markets, we found a range of account funding options in multiple base currencies are available:

- Bank wire transfer

- Mastercard & Visa

- Checkout.com

- Neteller

- Dotpay

- Skrill

There are no deposit fees on the part of the broker. All deposit options offer instant processing, apart from bank wire transfer and Checkout.com, which can take up to three days.

Payments to and from international banking institutions may attract intermediary transfer fees and/or conversion fees.

Withdrawals

All withdrawals use the initial funding source, where appropriate. Requests can be submitted via the secure online client portal. They are processed on the same day whenever possible. The payment provider will determine how long it takes for funds to appear in your account. Card and wire transfers can take two to five days on average to process.

Your bank may charge fees for withdrawals, especially on small amounts.

Demo Account

GO Markets offers a comprehensive demo account that allows you to practice trading over 350 CFDs, with real-time spreads, leverage up to 1:500, over 80 technical analysis tools, and 24/5 multilingual client support.

Clients receive $50,000 in virtual funds to practice on MT4 and MT5, either on their portable device or desktop. The paper trading account can be set up easily via an online form on the broker’s website.

Deals & Promotions

GO Markets is running a 30% trading credit cash rebate. This promotion applies to any live trading account with any amount between $500 and $25,000 or the currency equivalent.

For future GO Markets bonuses, refer to their webpage. Their social media channels are also a good way to keep up to date with the latest promotions and sign-up offers.

Regulation & Reputation

GO Markets Pty Ltd is regulated and licensed by:

- Financial Services Commission (FSC) of Mauritius as an Investment Dealer (Discount Broker)

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

The broker ensures all user funds are held in separate client trust accounts at top-tier AA-rated Australian banks: National Australia Bank and Commonwealth Bank.

Additional Features

GO Markets offer various supplementary trading and education tools, designed for both beginners and experts alike. These include:

- a-Quant Daily Trading Strategies – Trading signals based on machine learning/artificial intelligence

- Trading Central – Better trade insights with analyst support, pattern recognition indicators, and more

- PAMM platform – Put your funds with a seasoned money manager and earn a share in any profits

- Autochartist – Real-time trading alerts and volatility analysis for MT4 & MT5 (Windows only)

- Education Centre – Forex Smart Guide, video tutorials, courses, webinars, and seminars

- MT4 and MT5 Genesis – MetaTrader platform advanced add-ons (Windows only)

- Virtual Private Servers (VPS) – Fast-access server for MT4 and MT5

- News – Podcasts, economic calendar, and more

Live Accounts

GO Markets offers two main account types (Standard and GO Plus+) plus a Professional solution. Both accounts are available in nine different currencies and require a minimum deposit of A$200.

Standard Account

The Standard account is spread-based with no commission. Users have access to spreads of 1.0 pips, a minimum trade size of 0.01 lots, and leverage up to 1:500.

It also has essential features such as 24/5 support, a dedicated account manager, free VPS, expert advisors (EAs), and scalping.

GO Plus+ Account

The GO Plus+ is an ECN-style account and offers all the same features as Standard, but instead includes ultra-low spreads from 0.0 pips. GO Plus+ accounts are subject to a $3.00 commission per side.

Professional Account

A professional account is also available for two categories of traders: sophisticated and high-net-worth investors. However, many retail traders won’t be able to use it because of the eligibility criteria.

The sophisticated investor must meet at least two of the following:

- Been employed or has experience in the financial sector / has a formal qualification relevant to trading / can demonstrate product knowledge (75% pass mark)

- Placed at least 20 trades with A$500,000 quarterly investment value / opened positions 50 times over the last 12 months with a value of A$25,000 each

- Has savings and investments over A$500,000 / a gross annual income of over A$100,000

High-net-worth investors must meet only one of the next criteria:

- A gross income of at least A$250,000 for each of the past two years

- A minimum of A$2.5 million in net assets

Professional accounts offer lower leverage requirements, high-volume trade rebates, a dedicated support desk, professional reports, and a single use A$100,000 negative balance protection.

Trading Hours

Trading hours for forex are open from 00:00 to 24:00 (GMT+3) Monday through Friday. Stocks and indices are dependent on the exchanges they are listed on, while cryptos are open 24/7.

A holiday schedule can be found at the bottom of the broker’s website.

Customer Support

4 / 5The multilingual customer support service can be contacted 24/5 via:

- Email – support.mu@gomarkets.com / newaccounts.mu@gomarkets.com / sales@gomarkets.com

- Telephone number – Cyprus: +357 25023910 / United Kingdom: +44 203 637 7618 / Australia: 1800 88 55 71 / International: +61 3 8566 7680

Quick Support, at the bottom of the page, is an alternative to the GO Markets live chat logo which was removed. You can download it from the broker’s website, similar to an app, and it is compatible with most operating systems.

The Chinese help desk can be reached at:

- Telephone number – 03 8658 0602 (墨尔本)

- Email – enquiry@gomarkets.com

- WeChat – gomarketsau3

Keep up with the latest news on GO Markets’ social media pages:

GO Markets’ headquarters are at Level 11, 447 Collins Street, Melbourne, Australia.

The European office is based at 73 Agias Zonis and Tertaiou Corner, Dena House, 3rd floor, 3090 Limassol, Cyprus.

The company also has a branch in the UK under the name of GO Markets London Limited, situated on Level 6 107 Cheapside, London, England, EC2V 6DN.

Security & Safety

GO Markets complies with data protection laws under the Australian Privacy Act 1988 and the European Union General Data Protection Regulation (GDPR).

MT4 and MT5 use the highest security standards, where data exchange between the client terminal and the platform servers is encrypted. Two-factor authentication can also be applied upon login.

GO Markets Verdict

GO Markets’ investing experience, award-winning support, and trading tools have earned it a solid reputation in the online forex industry. The MT4 and MT5 platforms are ideal for traders of all levels, and the tight spreads and low commission fees make them an attractive option for anyone looking to trade assets efficiently.

FAQ

Does GO Markets Offer A No Deposit Bonus?

No – GO Markets doesn’t provide this type of bonus. All current promotions require capital and a live trading account. Cash rebates are available to active traders.

Is There A GO Markets Office In The United Kingdom?

Yes, GO Markets UK Trading Limited is based at Level 6 107 Cheapside, London, England, EC2V 6DN.

Does GO Markets Have PAMM Accounts?

PAMM (percent allocation management module) accounts are available at GO Markets. These allow traders to put their funds with experienced money managers. The minimum deposit to access the PAMM account is $500.

What Is Myfxbook At GO Markets?

Myfxbook is a free, automated online trading tool that enables traders to evaluate and compare their trading strategies and performance. The tool links directly to your GO Markets trading account. Copy trading is also available via the solution.

Is GO Markets A Good Broker?

GO Markets is a reputable, regulated broker offering a secure platform to trade a range of assets and markets. For traders looking to trade on the MT4 or MT5 platforms, it offers competitive spreads and flexible account options and could be worth considering.

How Much Capital Do I Need To Trade With GO Markets?

The starting deposit is A$200 on both the Standard account and the GO Plus+ account.

What Account Base Currencies Are Available On GO Markets?

You can hold funds in one of the following base currencies: AUD, USD, GBP, EUR, NZD, SGD, CHF, CAD, and HKD.

Does GO Markets Offer A Demo Account?

You can open a demo account by filling out a straightforward form on the broker’s website. The demo account will give you access to $50,000 in virtual funds to practice trading.

How Quickly Are GO Markets Withdrawals Processed?

GO Markets aims to process all withdrawal requests received before 1 pm AEST on the same day while any received after 1 pm AEST will be processed the following day. In general, local transfers take 1-2 business days and international transfers take 3-5 days for funds to clear.

What Is The Difference Between The Standard & Advanced GO Markets Accounts?

Clients will enjoy tighter spreads with the GO Plus+ account, however, there will be a commission for every trade placed. The commission is $3.00 per side on a standard lot.

Top 3 Alternatives to GO Markets

Compare GO Markets with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- xChief – xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

GO Markets Comparison Table

| GO Markets | Interactive Brokers | Dukascopy | xChief | |

|---|---|---|---|---|

| Rating | 3.9 | 4.3 | 3.6 | 3.9 |

| Markets | CFDs, forex, indices, shares, energies, metals, cryptocurrencies | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $200 | $0 | $100 | $10 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | ASIC, CySEC, FSC of Mauritius | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | ASIC |

| Bonus | 30% cash rebate | – | 10% Equity Bonus | $100 No Deposit Bonus |

| Education | Yes | Yes | Yes | No |

| Platforms | MT4, MT5, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | MT4, MT5 |

| Leverage | 1:500 | 1:50 | 1:200 | 1:1000 |

| Payment Methods | 7 | 6 | 11 | 12 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

xChief Review |

Compare Trading Instruments

Compare the markets and instruments offered by GO Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| GO Markets | Interactive Brokers | Dukascopy | xChief | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | Yes | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | Yes | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

GO Markets vs Other Brokers

Compare GO Markets with any other broker by selecting the other broker below.

The most popular GO Markets comparisons:

Customer Reviews

4 / 5This average customer rating is based on 1 GO Markets customer reviews submitted by our visitors.

If you have traded with GO Markets we would really like to know about your experience - please submit your own review. Thank you.

As someone who’s been trading forex and indices for over six years, GO Markets has been a reliable staple in my broker lineup. The execution speed on MT4 is excellent, and I’ve rarely experienced slippage (even around news events). I especially like their raw spread account with tight EUR/USD spreads and reasonable commission per lot. Their ASIC regulation gives me peace of mind too, especially compared to some of the offshore names I’ve used in the past.

The one area I think they could improve is the client portal and general design (it feels a bit dated). Also the range of CFDs is solid but not the best if you’re looking for more exotic FX pairs or crypto.