Downside Risk (Types, Measurement, Python Code)

Downside Risk refers to the potential for an investment to decrease in value, specifically focusing on the likelihood and magnitude of negative returns.

This concept is used in financial risk management as it provides a more nuanced understanding of the risks investors face – beyond the traditional metrics that consider overall volatility.

Key Takeaways – Downside Risk

- Focus on Negative Outcomes: Downside risk quantifies the potential for financial loss or underperformance relative to a specific benchmark or expected return.

- Risk Perception: Assesses a trader’s/investor’s risk tolerance, particularly for those more concerned with potential losses than overall volatility.

- Portfolio Management Tool: Downside risk metrics, like Value at Risk (VaR) and semivariance, are used in portfolio management for minimizing exposure to unfavorable market movements.

Types of Downside Risk

Market Risk

Market risk is the most common.

Market risk, or systematic risk, is the risk of losses due to factors that affect the entire market or asset class.

Downside risk in this context refers to market downturns or bear markets.

Credit Risk

For fixed-income investments, downside risk includes the risk of a bond issuer defaulting on payments, which can lead to a loss of principal and interest.

Liquidity Risk

This involves the risk of not being able to sell an asset for its fair market value.

This can potentially lead to lower-than-expected returns in adverse market conditions.

Currency Risk

For international investments, downside risk includes the potential for loss due to adverse movements in exchange rates.

Measurement

Value at Risk (VaR)

VaR measures the maximum expected loss over a specified time period for a given confidence interval.

It focuses on the worst-case scenario within a specific percentile.

Conditional Value at Risk (CVaR)

CVaR, also known as Expected Shortfall, extends VaR by considering the average losses that occur beyond the VaR threshold.

This provides deeper insight into extreme downside risk.

Maximum Drawdown

Maximum Drawdown assesses the largest peak-to-trough decline in the value of an investment.

It offers a clear picture of potential losses during downturns.

Python Code for Downside Risk

Let’s do some code for Downside Risk, using the definitions we used in the above section.

To calculate Downside Risk using Value at Risk (VaR), Conditional Value at Risk (CVaR), and Maximum Drawdown in Python, we can use financial data such as historical returns.

Here’s a Python code snippet for each of these measures:

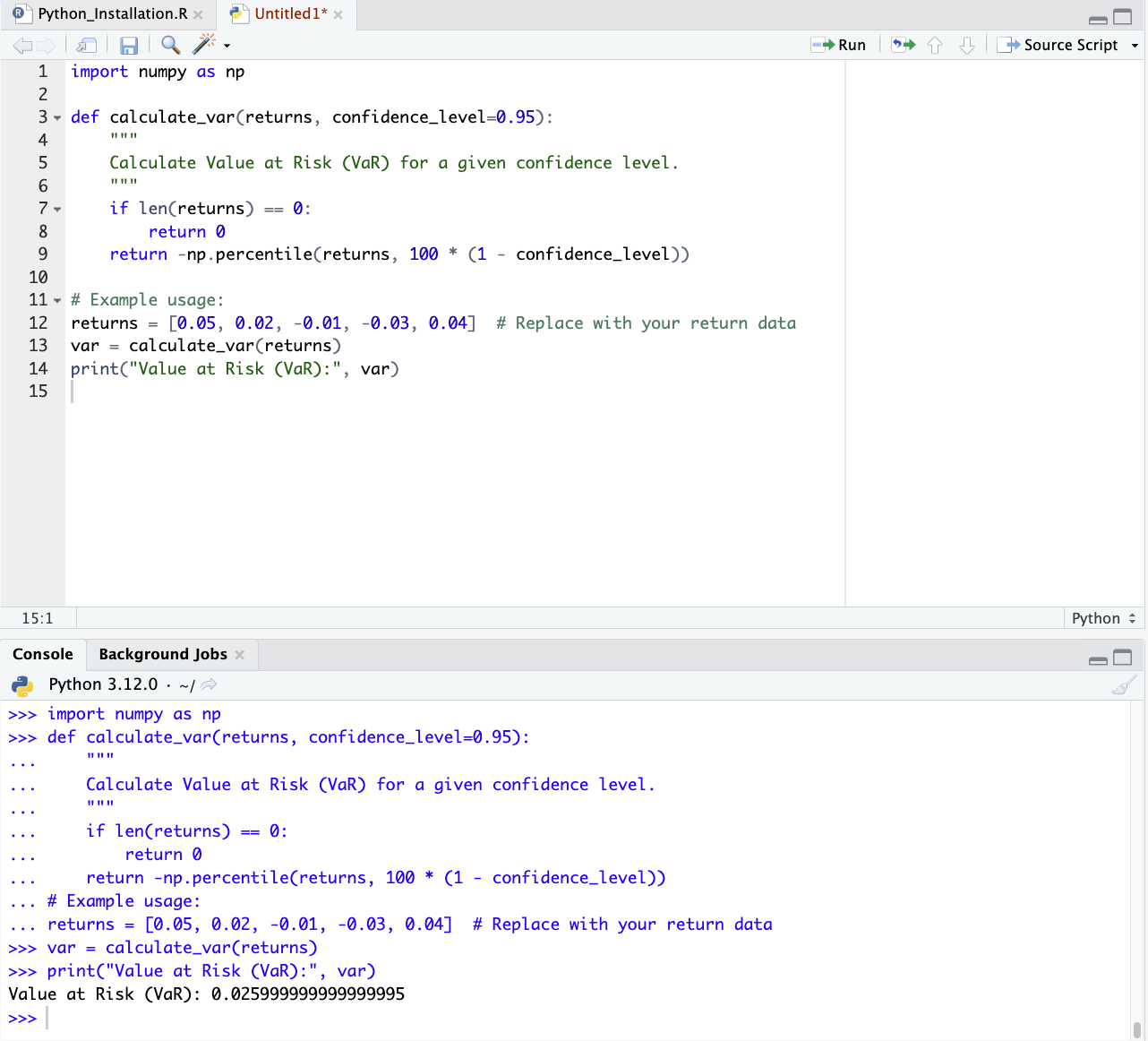

Value at Risk (VaR)

import numpy as np

def calculate_var(returns, confidence_level=0.95):

"""

Calculate Value at Risk (VaR) for a given confidence level.

"""

if len(returns) == 0:

return 0

return -np.percentile(returns, 100 * (1 - confidence_level))

# Example usage:

returns = [0.05, 0.02, -0.01, -0.03, 0.04] # Replace with your return data

var = calculate_var(returns)

print("Value at Risk (VaR):", var)

Conditional Value at Risk (CVaR)

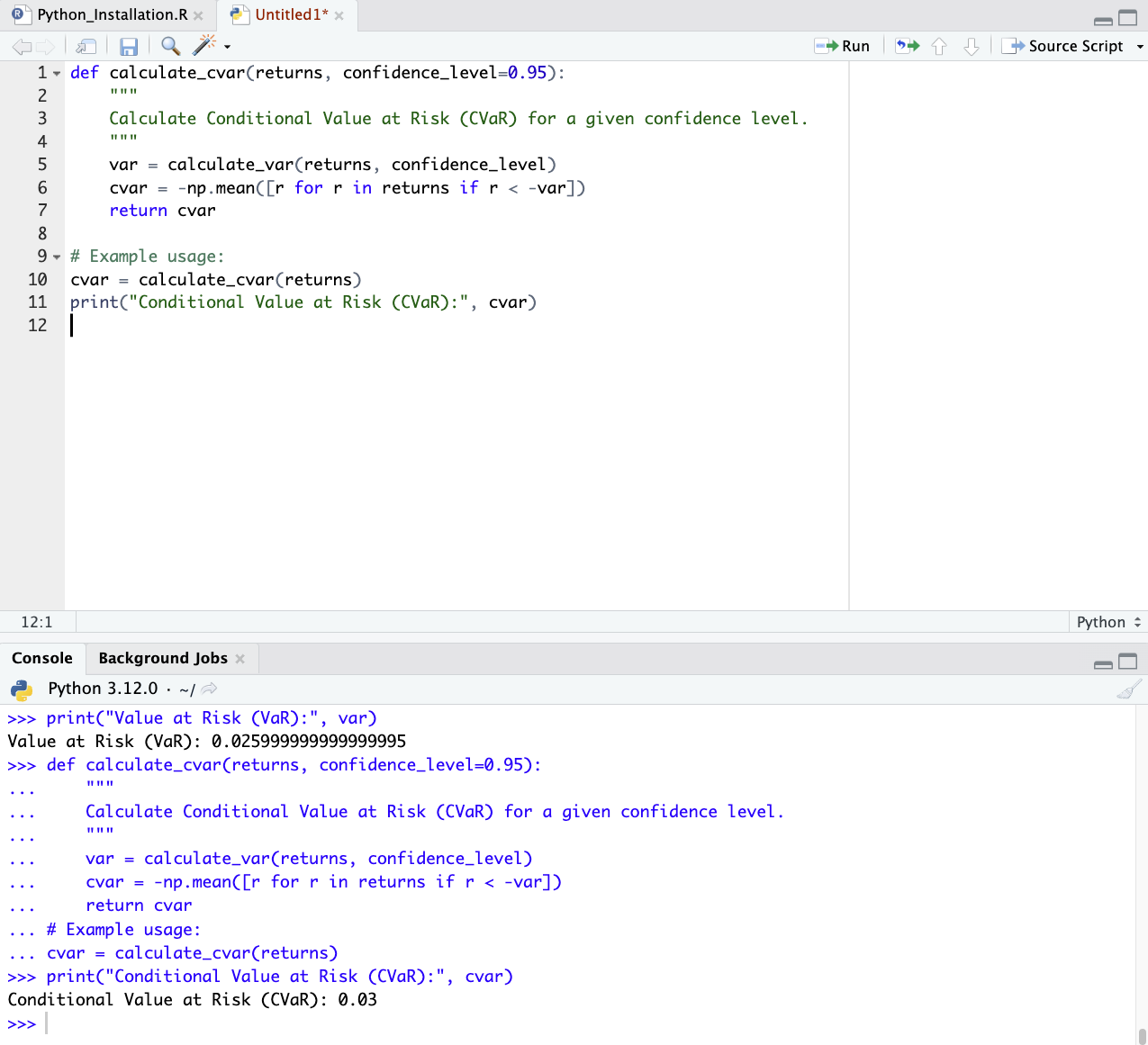

def calculate_cvar(returns, confidence_level=0.95):

"""

Calculate Conditional Value at Risk (CVaR) for a given confidence level.

"""

var = calculate_var(returns, confidence_level)

cvar = -np.mean([r for r in returns if r < -var])

return cvar

# Example usage:

cvar = calculate_cvar(returns)

print("Conditional Value at Risk (CVaR):", cvar)

Maximum Drawdown

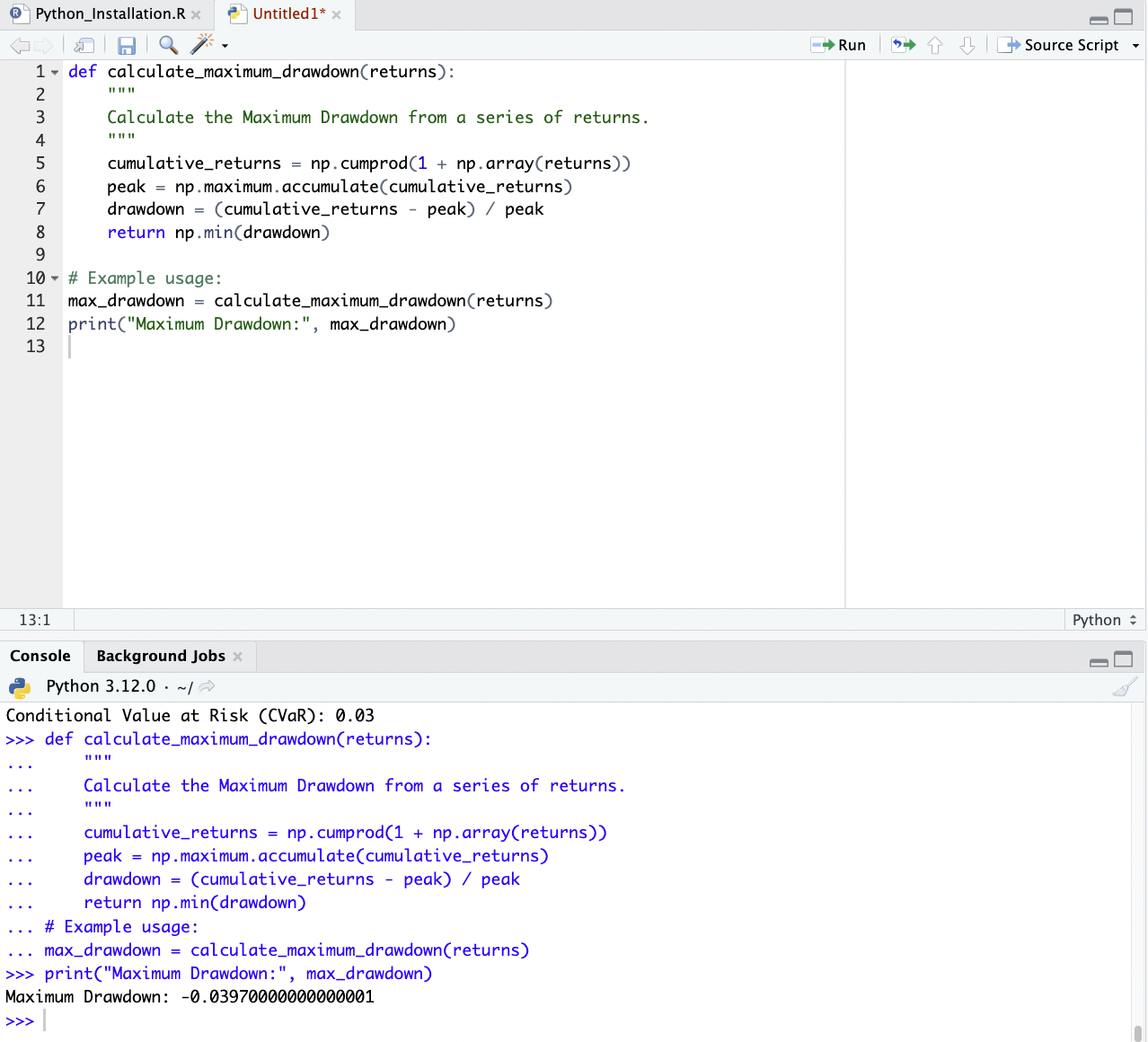

def calculate_maximum_drawdown(returns):

"""

Calculate the Maximum Drawdown from a series of returns.

"""

cumulative_returns = np.cumprod(1 + np.array(returns))

peak = np.maximum.accumulate(cumulative_returns)

drawdown = (cumulative_returns - peak) / peak

return np.min(drawdown)

# Example usage:

max_drawdown = calculate_maximum_drawdown(returns)

print("Maximum Drawdown:", max_drawdown)

These functions assume that returns is a list of daily returns.

You would replace it with your actual return data.

The functions for VaR and CVaR are set to a default confidence level of 95%, but this can be adjusted as needed.

The Maximum Drawdown function computes the largest percentage drop from peak to trough in the cumulative returns.

Management of Downside Risk

Diversification

Spreading investments across various asset classes, sectors, and geographies can reduce the impact of a downturn in any one area.

Hedging

Using derivatives and other financial instruments to offset potential losses can be an effective way to manage downside risk.

Stop-Loss Orders

Setting stop-loss orders can limit losses by automatically selling an asset when its price falls to a certain level.

Asset Allocation

Adjusting the mix of assets in a portfolio based on risk tolerance and market outlook can help in managing downside risk.

Importance in Trading & Investment Strategy

Risk-Averse Investors

For risk-averse investors, minimizing downside risk is often a priority.

It influences their choice of investments, trades, and asset allocation.

Long-Term Planning

Understanding and managing downside risk is essential for long-term financial planning.

This ensures that investment goals are met even in adverse market conditions.

Portfolio Resilience

A focus on downside risk can lead to more resilient portfolios, capable of withstanding market volatility and protecting capital.

Conclusion

Downside Risk is a concept in investment and risk management, focusing on the potential for loss rather than overall volatility.

By understanding and actively managing downside risk, traders, investors, and portfolio managers can better protect against significant losses.

Techniques like diversification, hedging, and careful asset allocation have a role in mitigating downside risk, making it an important part of developing robust trading/investment strategies and financial planning.