Maximum Downside Exposure (MDE)

Maximum Downside Exposure (MDE) is a risk metric used in finance to measure the most significant loss that an investment or a portfolio could have experienced over a specified period.

This measure is useful for understanding the worst-case scenario risk.

So, it gives an idea of the potential losses a trade or investor might face in adverse market conditions.

Key Takeaways – Maximum Downside Exposure (MDE)

- Measure of Worst Loss: Maximum Downside Exposure quantifies the most significant loss experienced by an investment (or portfolio) over a specified period.

- Historical Performance Indicator: It shows the historical worst-case scenarios. This helps in understanding an investment’s/portfolio’s volatility and risk profile.

Calculation

Data Analysis

MDE is calculated by analyzing historical performance data of the investment or portfolio.

It involves identifying the largest drop from a peak to a trough before a new peak is achieved.

Timeframe

The timeframe for MDE calculation can vary.

It might be set over a specific historical period, like a year, or the entire lifespan of an investment.

Significance

Risk Management

MDE is useful for risk management because it helps traders, investors, and portfolio managers gauge the extent of potential losses during periods of market stress.

Related: Why Drawdowns are the Worst Thing in Trading

Investment Strategy

Understanding MDE helps in formulating strategies that align with a trader/investor’s risk tolerance.

For instance, a high MDE might lead to a more conservative investment approach.

Applications

Portfolio Construction

Traders can use MDE to construct portfolios that match their risk tolerance.

If an investor has a low tolerance for downturns, they might choose assets – or portfolio approaches – with lower historical MDEs.

Performance Evaluation

MDE provides a way to evaluate the performance of a portfolio manager – especially in terms of risk management and their ability to avoid losses during market downturns.

Advantages

Focus on Worst-Case Scenario

MDE provides a clear picture of the worst-case scenario.

This is good for understanding and preparing for potential risks.

Simple and Intuitive

It is relatively straightforward to calculate and understand.

So, it’s accessible for both professional investors/traders and general audiences.

Limitations

Historical Data

MDE is based on historical data, which might not accurately predict future risks or market downturns.

No Consideration for Recovery

It focuses solely on the downside and does not account for the subsequent recovery period, which can be an essential aspect of overall investment performance.

For example, one might tolerate a deeper drawdown if it’s easier to get out of.

On the other hand, if it takes many years to get out of, this may not be acceptable.

Potential for Misinterpretation

Without context, MDE might lead to overly conservative investment strategies – especially if traders/investors focus too much on avoiding worst-case scenarios.

Trading is ultimately a balance between offense and defense.

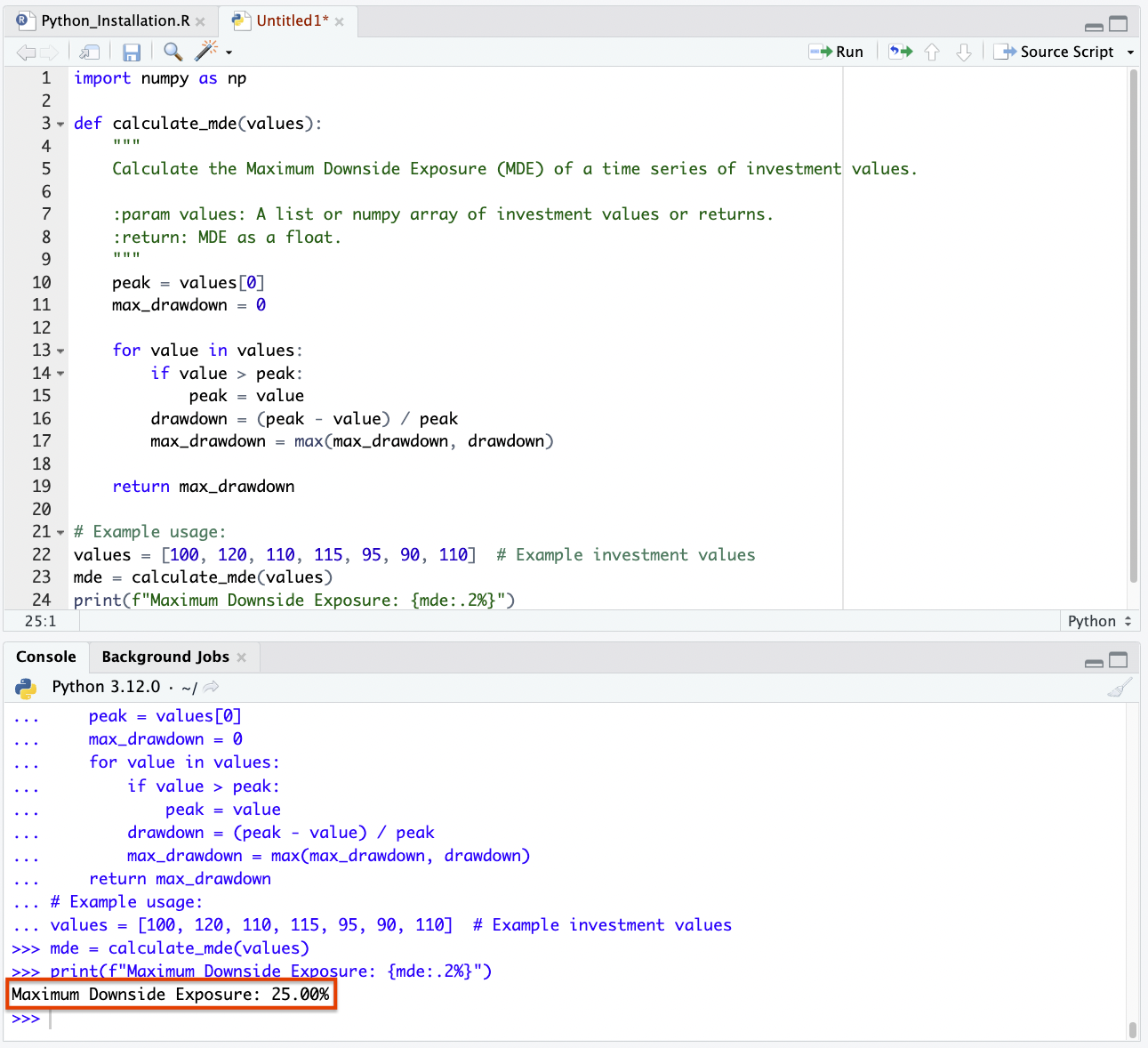

Maximum Downside Exposure (MDE) – Simple Python Code

To calculate the Maximum Downside Exposure in Python, you need a time series of investment values or returns.

The MDE is the largest peak-to-trough decline in the value of an investment over a specified period, so that’s what the code needs to cover.

Here’s a simple Python code to calculate MDE:

import numpy as np def calculate_mde(values): """ Calculate the Maximum Downside Exposure (MDE) of a time series of investment values. :param values: A list or numpy array of investment values or returns. :return: MDE as a float. """ peak = values[0] max_drawdown = 0 for value in values: if value > peak: peak = value drawdown = (peak - value) / peak max_drawdown = max(max_drawdown, drawdown) return max_drawdown # Example values = [100, 120, 110, 115, 95, 90, 110] # Example investment/portfolio values mde = calculate_mde(values) print(f"Maximum Downside Exposure: {mde:.2%}")

This code assumes values is a list of investment values over time.

It iterates through these values, tracking the highest value (peak) and calculating the drawdown from the peak at each step.

The maximum drawdown encountered during the iteration is the MDE.

The function returns the MDE as a proportion of the peak value.

In the case of this simple example code, it is 25%.

Conclusion

Maximum Downside Exposure (MDE) is a tool for assessing the potential risk of significant losses in an investment or portfolio.

It helps in understanding the worst-case scenarios and guides traders/investors and portfolio managers in aligning trading/investment strategies with risk tolerance levels.

MDE is useful in risk assessment and portfolio construction. But it should be considered alongside other metrics and factors, given its focus on historical data and the exclusion of recovery periods.

Balancing MDE insights with other analyses ensures a well-rounded approach to decision-making and risk management.