CMC Markets Review 2026

See the Top 3 Alternatives in your location.

Awards

- Best Trading App 2023 - DayTrading.com

- No.1 Platform Technology 2022

- No.1 New Tool 2022

- No.1 Most Currency Pairs 2022

- Best Trade Execution 2021

- Best Forex Broker For Beginners 2021

- Most Transparent Forex Broker Europe 2020

- Best Trading Platform 2020

- Best Trading App 2019

- Best Customer Service 2018

Pros

- The brokerage continues to stand out with its wide range of value-add resources, including pattern recognition scanners, webinars, tutorials, news feeds, and research from respected sources like Morningstar.

- CMC Markets is heavily regulated by reputable financial authorities and maintains its stellar reputation, helping to ensure a secure and trustworthy trading environment.

- We've bumped up its 'Assets & Markets' rating after almost monthly product additions in early 2025, from extended hours trading on US stocks to new share CFDs.

Cons

- The CMC Markets app offers the complete trading package but the design and user experience trails category leaders like eToro.

- An inactivity fee of $10 per month is applied after 12 months of inactivity, which may deter casual investors.

- Despite improvements, the web platform still requires enhancements to make it as intuitive to trade on as software from rivals like IG.

CMC Markets Review

This CMC Markets review will unpack the ratings we’ve given the broker following our first-hand experience testing the platform. Find out where CMC Markets stands out and where it falls short of alternatives, with a particular focus on the needs of active traders.

Regulation & Trust

With a commendable track record, stock exchange listing, and authorization by top-tier regulators, CMC Markets demonstrates strong safety indicators for traders.

The brokerage has been operating since 1989 and has licenses from multiple trusted bodies, including the FCA in the UK, CIRO in Canada, and ASIC in Australia.

This means, that in the event the broker becomes insolvent, UK clients are protected up to £85,000, EU clients up to €20,000, and Canadian clients up to CAD 1 million.

There is no specified protection amount for other clients and there is no protection for clients in Australia, New Zealand, Singapore or the Middle East.

Negative balance protection for UK and EU clients also means that your account balance can’t go into negative – an important safeguard for day traders using leverage.

CMC’s listing on the London Stock Exchange (LON: CMCX) further enhances its trust rating, as the company consistently and transparently releases financial statements.

Accounts & Banking

Accounts

CMC offers three account types for retail traders (CFD, FX Active and Spread Betting), distinguished by their availability in specific countries, accepted account base currencies, pricing structures, and tax considerations.

Unlike IG, for example, there is no option to open a separate account to trade real stocks. This won’t be a major issue for many day traders, but it will reduce the broker’s appeal to longer-term investors.

On the plus side, CMC’s account opening process is entirely digital and I completed account verification in a matter of minutes.

Each account grants complete access to trading platforms, complimentary market data, and educational materials. Different fees are applicable to different accounts, necessitating a thorough review of the user agreement.

Professional traders can also open a separate account granting access to higher leverage. Professional clients, in choosing this option, forego some of the enhanced protection afforded to retail clients, such as negative balance protection.

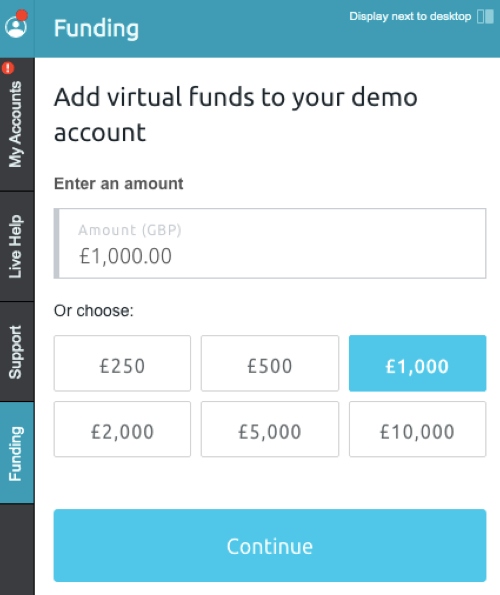

A complimentary demo account also lets you explore the platform and its various supported markets in a simulated environment with $10,000 in virtual funds, but doesn’t include Reuters news feeds or Morningstar research reports.

Incentives

CMC Markets also offers a premium scheme for traders with a large bankroll, Alpha. To be eligible, you must deposit at least $25,000, which will price out some investors.

That said, the perks are great with spread discounts of up to 40%, priority customer service, interest on your cash balance, and a subscription to the Financial Times.

Additionally, the broker has a loyalty incentive available to everyone, CMC Price+. The program is a tier-based discount scheme, in which you earn points each time you trade. The rewards are reduced spreads up to 40%, making it an attractive program for serious day traders.

Leverage

At CMC Markets, retail traders have a maximum leverage of up to 1:30, allowing the opening of positions valued at 30 times the deposited amount. For instance, a $100 deposit enables the initiation of a $3,000 trade position.

Notably, this 1:30 leverage is applicable solely to major currency pairs. Different instruments have varied maximum leverage, with indices and minor currency pairs capped at 1:20, and stocks at 1:5. Professional clients have access to even higher leverage, reaching up to 1:500.

To qualify for a Professional account, you must meet specific criteria, including having executed at least 10 trades of significant size in the previous quarter, maintaining a portfolio exceeding €500,000, and possessing a minimum one-year work experience in the financial sector.

Deposits & Withdrawals

Depositing and withdrawing to CMC accounts is typical of a regulated broker – the options are relatively limited, but secure. For an added layer of protection, I like the way CMC doesn’t let you deposit funds until your account details have been verified.

You’ll find that a lot of brokers are keen to take your money, but less likely to return it until you satisfy their Know Your Client (KYC) process – which can be problematic with an unregulated off-shore broker that entices you with a high leverage account.

CMC Markets supports depositing and withdrawing funds in up to 10 base currencies (USD, EUR, GBP, AUD, CAD, NOK, NZD, PLN, SEK, SGD), which is more accommodating than popular alternatives like XTB.

However, it’s not that straightforward. The choice of base currency is only available when using a CFD account, and all 10 currencies are most likely not accessible to the majority of clients around the world who will be typically limited to two or three major currencies – their home country and perhaps USD and EUR.

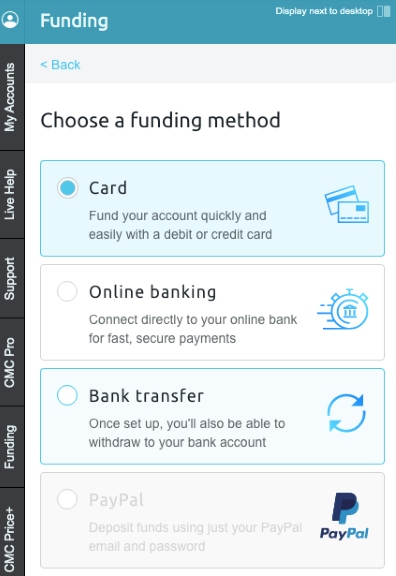

Transfer options include bank wire or debit card payments. Third-party payment providers like Wise and PayPal are out in some locations, including the UK, and you can forget about crypto transfers.

From my experience, card payments are typically processed the same day if requested before the cut-off time (11:00 ET), while bank wire transfers have been known to take up to three days.

There’s no limit to the amount you can withdraw to your registered bank account. CMC Markets also charges no deposit or withdrawal fees, and there are no minimum deposit and withdrawal amounts, a notable advantage over brokers like eToro which levies a $5 withdrawal fee.

Similar to other brokers, it’s worth remembering that withdrawing funds to a bank account with a currency different from your CMC account base currency will likely incur a conversion fee. For example, when withdrawing from a USD-based brokerage account to a EUR-based bank account.

The most efficient way to minimize conversion fees is to use a multi-currency bank account at a digital bank. I use Revolut for this purpose and it is excellent.

Assets & Markets

CMC Markets offers a diverse range of over 12,000+ CFD products encompassing commodities, currencies, ETFs, shares, forex indices, stock indices, share baskets and treasuries, surpassing the product range of the vast majority of online brokers.

It has also been on a role in recent years, enhancing its investment offering in 2024 with options trading in the UK, and expanding it to 150+ other countries in 2025, providing additional opportunities.

In January 2025, CMC introduced extended hours trading on the ‘Magnificent 7’ US tech stocks for opportunities outside of traditional market hours.

In March of the same year it went further, providing pre- and post-market trading on 87 US equities. The following month, it added four stock CFDs spanning emerging industries; quantum computing, AI learning, and online car sales.

The range of available markets, however, will vary based on the regulatory entity governing your CMC account.

Unlike some of its main competitors, such as Interactive Brokers, CMC doesn’t provide access to exchange-traded securities (non-CFDs) for international stock exchange participation. The platform also doesn’t include interest rate trading, or long-term investment opportunities via managed portfolios.

Overall, CMC Markets caters very well to day traders interested in CFDs or spread betting, especially with its market-leading selection of 300+ currency pairs. However, some traders unfamiliar with CFDs may find the range of trading options limited.

My biggest disappointment with the platform is the absence of real stocks or ETFs in the product selection, which limits my options for diversification.

CMC’s commission for trading stock CFDs is also high and starts from $10.

Fees & Costs

CMC’s fees for trading are relatively low, especially for forex, with the average spread on EUR/USD being 0.7 during peak trading hours.

On major indices, such as the S&P 500, 0.6 is the average spread cost during peak trading hours (the fees are built into the spread). The US 30, on the other hand, has a starting spread of 2.2.

By comparison, IC Markets offers some of the lowest spreads out of all brokers with a EUR/USD spread averaging 0.1 in its Raw account, and 1.4 for the US 30.

It’s important to mention that, similar to many other forex brokers, CMC’s spreads might elevate during periods of low liquidity compared to regular market conditions.

As with every broker, you will incur swap fees, calculated using tom-next rates, for positions held overnight, potentially subject to currency conversion charges for trading in a currency different from the account’s base currency. That said, day traders can avoid this charge by closing positions by the end of the trading session.

One notable bonus is that CMC Markets offers a guaranteed stop-loss order (GSLO) on some trades. There is a fee for this service, but this is refunded if the GSLO is not triggered.

A GSLO can ultimately be a great way to protect against market volatility and slippage. The fee varies based on the asset’s current market price but is displayed at the bottom of the order window.

CMC imposes no fees for account creation, deposits, or withdrawals, but there is a $10 monthly fee applied after 12 months of inactivity, unless the account holds no funds. We see this sort of inactivity penalty at the vast majority of brokers we review, and it’s only a notable drawback for casual investors.

Platforms & Tools

Trading Platforms

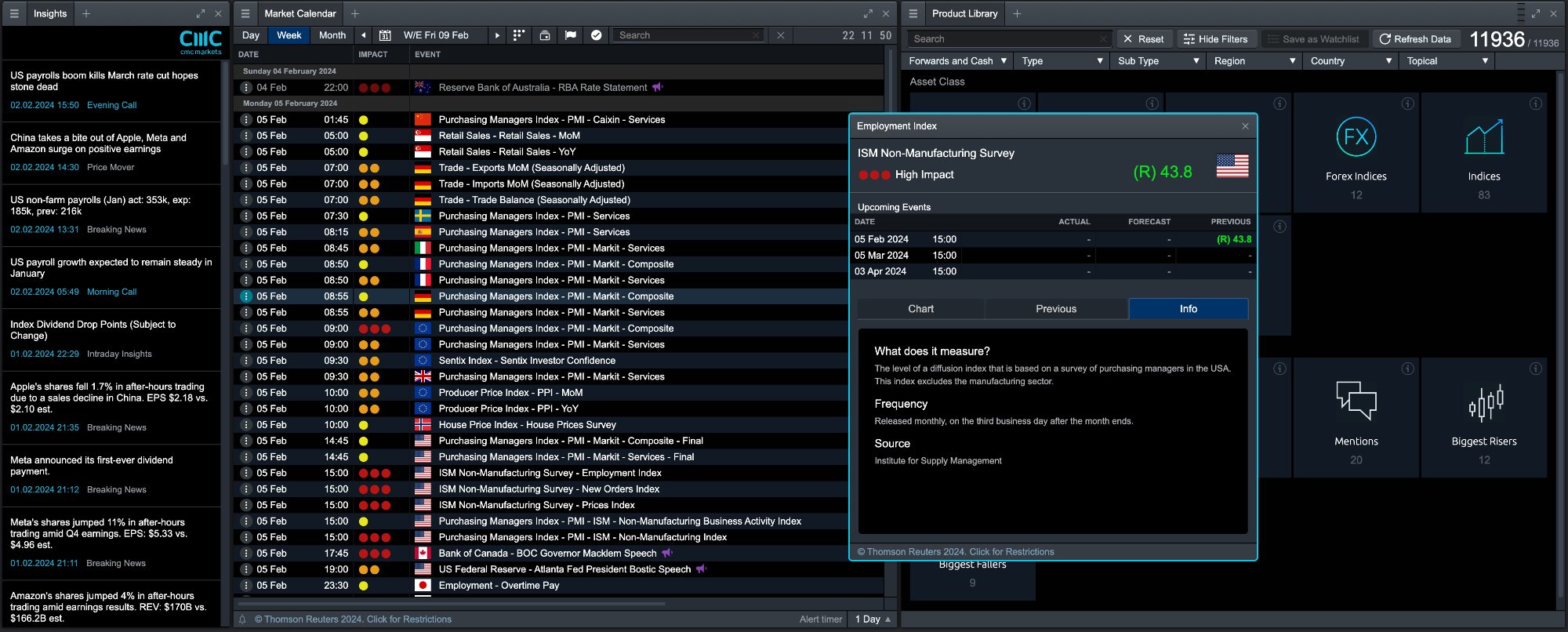

CMC Markets provides three trading platform options: the proprietary web-based solution or third-party software MetaTrader 4 and TradingView (added in 2025).

While all three platforms offer advanced functions, I find CMC’s online terminal a lot easier to use so I focused on that during testing.

The platform boasts numerous analytical features, integrated services such as pattern indicators, 13 chart types, platform video tours, and live news streams.

Some of my favorite features include the over 80+ technical indicators, 40+ drawing tools, fully customizable workspace (windows are resizable and dockable), support for Renko charts, advanced order types, an in-built strategy backtesting, personalized performance data, and useful pattern recognition scanner.

However, similar to most broker’s own platforms, it doesn’t support the ability to run automated trading strategies. MT4 is the better option if you want to use automated trading strategies thanks to its support for Expert Advisors (EAs).

While the online platform is web-based and stable, the lack of a desktop software option might be a drawback if you prefer a standalone application for stability and performance, especially during periods of high market activity.

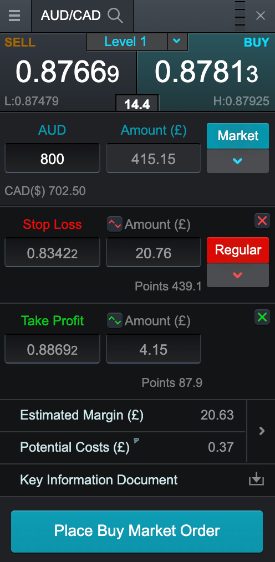

Placing A Trade

From my time personally using CMC Markets, placing a trade on the web platform isn’t quite as intuitive as it could be, but after a little time, you should come to appreciate the various methods to initiate the process.

For example, you can utilize the main search bar, watchlist, or product library icons located in the top left of the platform interface to locate a trading instrument.

Opting for the ‘Buy’ or ‘Sell’ pricing to the right of the instrument name initiates the trade, prompting an order screen to appear. However, there aren’t actually any labels next to the buttons, so you’ll have to play around in demo so you don’t make any trading mistakes with real money.

To complete the trade, you then need to specify the volume/value, choose an order type (e.g., ‘Market’ or ‘Limit’), add optional parameters like Stop Loss or Take Profit, review estimated margin and potential costs, and finally, confirm the position by selecting ‘Place Buy Market Order’ or ‘Place Sell Market Order.’

While relatively straightforward, I don’t like the way my Take Profit and Stop Loss levels aren’t displayed on the chart until I actually place the order, because visualizing price areas helps me to picture a trade and minimize pricing errors. This made for a slightly frustrating experience during my hands-on tests of the CMC Markets platform.

Also, displaying a trade’s risk-to-reward ratio would be very helpful. Thankfully, altering TP and SL levels after a trade had been placed simply requires me to drag and drop the line levels on the chart.

Mobile App

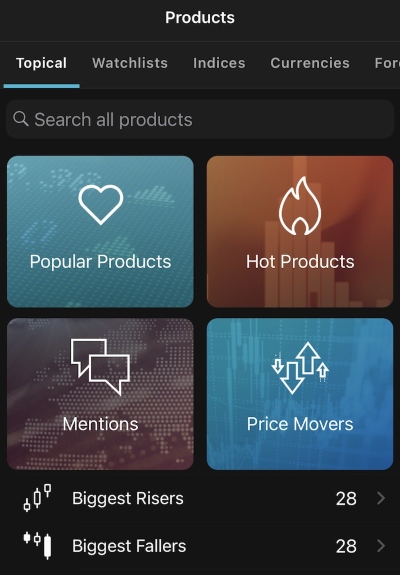

I rate the slick and user-friendly mobile app that is available to download for free on iOS and Android devices.

It continues to offer excellent functionality, supporting trading on all instruments and offering mobile-optimized charting with scroll and zoom, a choice of notification types, and clear order tracking. I’ve found the best charting view to be accessed by turning your phone horizontally.

I also appreciate that the in-app navigation is easy to follow from the menu at the bottom, and I like the wide range of trade ideas and insights available on the app, which can help aspiring traders discover opportunities. These include a ‘Hot Products’ function and the largest ‘Price Movers’, which highlights trending products with significant activity.

In addition, the MetaTrader 4 platform offers a mobile app, with an iOS and Android download. You can access most of the features and functions of the desktop software including watchlist creation, technical analysis features, and customizable charts.

However, compared to the CMC Markets mobile app, my personal view is that MT4 feels more outdated, with a less modern design but a similar bottom menu to switch between windows.

Research

CMC provides a variety of excellent research tools. The platform offers access to technical analysis, fundamental analysis, and market insights.

You can find up-to-date news streams, economic calendars (with ‘market impact’ meters), and analysis from reputable sources including Reuters, Morningstar and Thomson Reuters.

The web trading platform also includes a link to CMC TV. Similar to IG’s IGTV, this YouTube channel regularly releases updates on market movements and provides technical analysis several times each week.

Education

The educational content provided by CMC is well above par, especially beneficial for beginner traders.

The platform offers a variety of learning materials, including specific trading guides for CFDs, spread betting, forex, and stocks, as well as more advanced topics including fundamental and technical analysis.

I applaud the extensive range of generic and product-specific information relevant to trading on CMC Markets, covering a range of topics from login procedures to opening positions and applying technical tools, but the lack of a simple filtering system by experience level on the educational platform might make it slightly challenging for beginners to navigate through the available resources.

A more user-friendly categorization could enhance the learning experience for novice traders.

Once you’ve set up a live account you will have access to various data sources, including up-to-date news, online webinars, and in-person events.

Customer Support

CMC’s customer service stands out as one of the industry’s best, offering localized (English, Chinese, French, German, Italian, Norwegian, Polish, Spanish and Swedish) phone and email accessible 24/5.

While the absence of live chat for prospective clients is disappointing, there is live chat available from within your demo or live account – albeit only within working hours Monday-Friday. When I tested the chat service a representative joined my chat within 5 minutes and resolved my query.

CMC provides 24-hour email support on business days. During my tests, I received a relevant response within 2 hours (mid-afternoon on a Friday).

The platform further excels with a comprehensive online help section, featuring well-organized FAQs, platform user guides with integrated trading videos (on YouTube), instrument-specific e-books, a glossary of key terms, and strategy-based trading guides.

Should You Trade With CMC?

Overseen by top-tier regulators and offering competitive pricing and a wide selection of instruments across various markets and asset classes, CMC is an excellent option for trading CFDs and forex.

The custom platform is powerful and customizable, but probably a little intimidating for new traders. Experienced traders also have the option to trade using MetaTrader 4, which is an excellent option for algo traders and those familiar with the most popular forex trading software.

I’m just left slightly disappointed by its high fees for stock CFDs and no access to real stocks or ETFs.

FAQ

Is CMC Markets Legit Or A Scam?

CMC Markets is a legitimate and reputable online trading platform. It is a well-established financial services provider with a history dating back to 1989. The company is publicly listed on the London Stock Exchange (LSE: CMCX) and is regulated by top-tier financial authorities.

Can I Trust CMC Markets?

CMC Markets is a longstanding broker with a rich operational history that operates under the FCA’s Client Money rules, mandating the segregation of client funds from the company’s own.

With a robust market capitalization exceeding $470 million as of 2024, CMC is well-capitalized, reinforcing its standing as a secure broker for safeguarding client assets, including cash holdings.

Is CMC Markets A Regulated Broker?

CMC Markets is a heavily regulated broker under the supervision of various regulatory bodies across different regions.

It operates under licenses from financial authorities including the UK Financial Conduct Authority (FCA), Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin), Canadian Investment Regulatory Organization (CIRO), Australian Securities and Investments Commission (ASIC), New Zealand Financial Markets Authority (FMA), Monetary Authority of Singapore (MAS) and Dubai Financial Services Authority (DFSA).

Is CMC Markets Suitable For Beginners?

CMC is potentially suitable for beginners thanks to its educational resources and the availability of a demo account for practice. The platform is regulated by reputable authorities, ensuring a secure trading environment, and it offers responsive customer support.

The only drawback for new traders is the intimidating web platform that could make it clearer how to place and manage trades, despite noticeable improvements in recent years.

Does CMC Markets Offer Low Fees?

CMC generally has a competitive fee structure, especially when you factor in its Alpha and Price+ schemes, and it does not charge for depositing or withdrawing funds.

However, there are brokers, notably IC Markets, that offer better spreads for active traders.

Is CMC Markets A Good Broker For Day Trading?

CMC Markets is a great broker for day trading. Intraday trading often requires high liquidity and CMC, as a well-established broker, provides access to liquid markets. Execution times are fast and the higher volume of liquidity reduces the chances of your orders getting rejected.

In addition, CMC Markets supports popular short-term trading products like CFDs and spread bets with access to a massive selection of 12,000+ underlying assets.

Does CMC Markets Have A Good App?

CMC provides a proprietary mobile app, offering a convenient means to trade on the move. The app features a clean design and is equipped with a range of research tools, robust charts, predefined watchlists, integrated news, educational content, and various other functionalities.

But while functional, the mobile app doesn’t lack the intuitiveness of apps from eToro.

Best Alternatives to CMC Markets

Compare CMC Markets with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

CMC Markets Comparison Table

| CMC Markets | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Rating | 4.7 | 4.3 | 3.6 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | $1 (Binaries), 0.01 Lots (Forex/CFD) |

| Regulators | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Bonus | – | – | 100% Anniversary Bonus |

| Platforms | Web, MT4, TradingView | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Leverage | 1:30 (Retail), 1:500 (Pro) | 1:50 | 1:200 |

| Payment Methods | 6 | 6 | 10 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by CMC Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| CMC Markets | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | Yes | No | Yes |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | Yes | Yes | No |

| ETFs | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | Yes | No | No |

| Volatility Index | Yes | No | Yes |

CMC Markets vs Other Brokers

Compare CMC Markets with any other broker by selecting the other broker below.

The most popular CMC Markets comparisons:

- Vanguard vs CMC Markets

- Oanda vs CMC Markets

- CMC Markets vs CMTrading

- CMC Markets vs Moomoo

- CMC Markets vs Freetrade

- eToro vs CMC Markets

- CMC Markets vs IC Trading

- CommSec vs CMC Markets

- IC Markets vs CMC Markets

- CMC Markets vs IG

- CMC Markets vs Interactive Brokers

- CMC Markets vs Saxo Bank

- Tiger Brokers vs CMC Markets

Customer Reviews

4.5 / 5This average customer rating is based on 4 CMC Markets customer reviews submitted by our visitors.

If you have traded with CMC Markets we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of CMC Markets

Article Sources

- CMC Markets Website

- CMC Markets UK plc - FCA License

- CMC Markets Singapore Pete Ltd - MAS License

- CMC Markets Stockbroking Limited - ASIC License

- CMC Markets NZ Limited - FMA License

- CMC Markets Canada Inc - CIRO License

- CMC Markets Germany GmbH - BaFin License

- CMC Markets Middle East Limited - DFSA License

- CMC Markets London Stock Exchange Listing (LON: CMCX)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I’m sorry but youre an idiot if you day trade Forex and dont use CMC Markets (I know because that was me up until about 9 months ago). By far and away the most currencies ive ever seen on a platform (I can see literally hundreds) including niche ones i wouldnt be able to trade elsewhere. The Next Gen software is super fast at putting my trades through after major news evenets like fed announcements.

I switched to CMC Markets earlier this year after they added some US tech stocks like NVIDIA that I wanted to trade out of hours. Their Next Generation platform took some getting used to (I’ve spent years using MT4 but felt it was time for a change). But now I’ve got my dashboard and charts set up the right way it’s super easy to use and the order execution has been reliable, even after hours! Glad I made the switch.

No complaints from me about CMC Markets. Forex spreads are always tight, order execution is always reliable and I can always get through to customer support when I need them. Would recommend.

I use CMC Markets for day trading forex and have been impressed with the package. It’s got the largest choice of currency pairs I’ve seen, reliable execution, plus the rebates through the loyalty scheme help keep spreads low.