Commodity Futures Trading Commission (CFTC) Brokers 2025

If you’re an active trader in the US looking to deal in derivatives like futures and options then choose a broker regulated by the Commodity Futures Trading Commission (CFTC) to safeguard your dollars.

With a rigorous process to gain and maintain authorization, alongside increasing scrutiny and penalties in recent years, the CFTC has comfortably earned its ‘green tier’ status in DayTrading.com’s Regulation & Trust Rating.

Best CFTC Brokers

Since evaluating our first CFTC-regulated broker in 2017 (IG), hundreds of trading platforms have gone under our microscope. However, these 5 brokers that are licensed by the CFTC are the frontrunners in July 2025:

Here is a short summary of why we think each broker belongs in this top list:

- NinjaTrader - NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Plus500US - Plus500US is a well-established broker that entered the US market in 2021. Authorized by the CFTC and NFA, it provides futures trading on forex, indices, commodities, cryptocurrencies, and interest rates. With a 10-minute sign-up, a manageable $100 minimum deposit, and a straightforward web platform, Plus500 continues to strengthen its offering for traders in the US.

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

Commodity Futures Trading Commission (CFTC) Comparison

| Broker | USD Account | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|---|

| NinjaTrader | ✔ | $0 | Forex, Stocks, Options, Commodities, Futures, Crypto | NinjaTrader Desktop, Web & Mobile, eSignal | 1:50 |

| Interactive Brokers | ✔ | $0 | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | 1:50 |

| Plus500US | ✔ | $100 | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts | WebTrader, App | - |

| FOREX.com | ✔ | $100 | Forex, Stock CFDs, Futures, Futures Options | WebTrader, Mobile, MT4, MT5, TradingView | 1:50 |

| OANDA US | ✔ | $0 | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) | OANDA Trade, MT4, TradingView, AutoChartist | 1:50 |

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Stocks, Options, Commodities, Futures, Crypto |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

- Traders can get free platform access and trade simulation capabilities in the unlimited demo

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

Cons

- There is a withdrawal fee on some funding methods

- The premium platform tools come with an extra charge

- Non forex and futures trading requires signing up with partner brokers

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- There's a vast library of free or paid third-party research subscriptions catering to all types of traders, plus you can enjoy commission reimbursements from IBKR if you subscribe to Toggle AI.

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

- While primarily geared towards experienced traders, IBKR has made moves to broaden its appeal in recent years, reducing its minimum deposit from $10,000 to $0.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

Plus500US

"Plus500US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500US Quick Facts

| Bonus Offer | Welcome Deposit Bonus up to $200 |

|---|---|

| Demo Account | Yes |

| Instruments | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts |

| Regulator | CFTC, NFA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | 0.0 Lots |

| Account Currencies | USD |

Pros

- The trading app provides a terrific user experience with a modern design, a clean layout and mobile-optimized charts

- Plus500US excels for its low fees with very competitive day trading margins and no inactivity fees, live data fees, routing fees, or platform fees

- The straightforward account structure, pricing model and web platform offer an easier route into futures trading than rivals like NinjaTrader

Cons

- The proprietary platform is user-friendly but lacks advanced technical analysis tools found in third-party solutions like MetaTrader 4

- Although support response times were fast during tests, there is no telephone assistance

- Despite competitive pricing, Plus500US lacks a discount program for high-volume day traders, a scheme found at brokers like Interactive Brokers

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Bonus Offer | VIP status with up to 10k+ in rebates - T&Cs apply. |

|---|---|

| Demo Account | Yes |

| Instruments | Forex, Stock CFDs, Futures, Futures Options |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- The in-house Web Trader continues to shine as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- Despite increasing its range of instruments, FOREX.com's product portfolio is still limited to forex and CFDs, so there are no options to invest in real stocks, real ETFs or real cryptocurrencies.

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD |

Pros

- Seasoned day traders can access industry-leading tools, including an MT4 premium upgrade and advanced charting provided by MotiveWave

- There's a strong selection of 68 currency pairs for dedicated short-term forex traders

- OANDA is a reliable, trustworthy and secure brand with authorization from tier-one regulators including the CFTC

Cons

- The range of day trading markets is limited to forex and cryptos only

- It's a shame that customer support is not available on weekends

- There's only a small range of payment methods available, with no e-wallets supported

Methodology

To list the top brokers authorized by the CFTC, we:

- Took our directory of 226 brokers to find those claiming CFTC registration.

- Punched their details into the CFTC’s register (NFA Basic) to verify their authorization.

- Blended the findings from our hands-on tests and 200+ data entries to rank the top CFTC-authorized brokers.

How Can I Check If My Broker Is Regulated By CFTC?

Verifying if a broker is CFTC-regulated is essential; below is a six-step mechanism to ensure you deal with a legitimate and compliant provider.

I’ll bring these steps to life by taking you through the check I personally conducted on OANDA US.

Founded in 1996, OANDA is regulated in multiple jurisdictions, including by the CFTC in the US, and impresses with its transparency, robust trading platforms, and financial analytics.

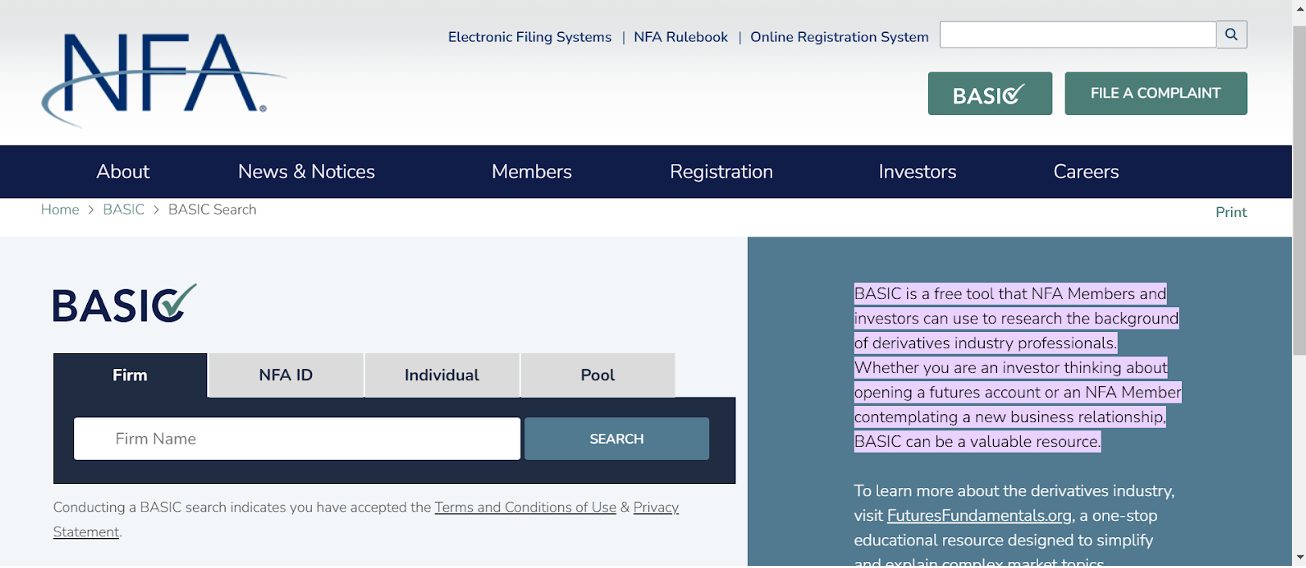

Step 1 – Visit The NFA Website

The NFA BASIC (Background Affiliation Status Information Center) is the official database for registered entities overseen by the CFTC.

Step 2 – Search For The Broker

In the box, type in the name of the broker you wish to search for, in this instance, OANDA Corporation.

For the most accurate results, use the exact name as listed in the broker’s materials or website.

You could also enter the NFA ID number (if provided).

Step 3 – Verify Registration Details

Once you locate the broker, check their registration status with the CFTC and the NFA.

The profile should state whether they are registered as a:

- Futures Commission Merchant (FCM)

- Introducing Broker (IB)

- Swap Dealer (SD) or other categories

The results will be displayed like the below. Four columns will be displayed: broker name, current NFA membership status, registration types, and regulatory actions.

We can see that OANDA Corporation is a CFTC-regulated broker and a registered NFA member with NFA ID 0325821.

This registration ensures that OANDA operates under the oversight of the CFTC, adhering to strict standards for transparency and accountability in the US derivatives market.

Step 4 – Active Registration

Confirm their registration is active and hasn’t been suspended or revoked.

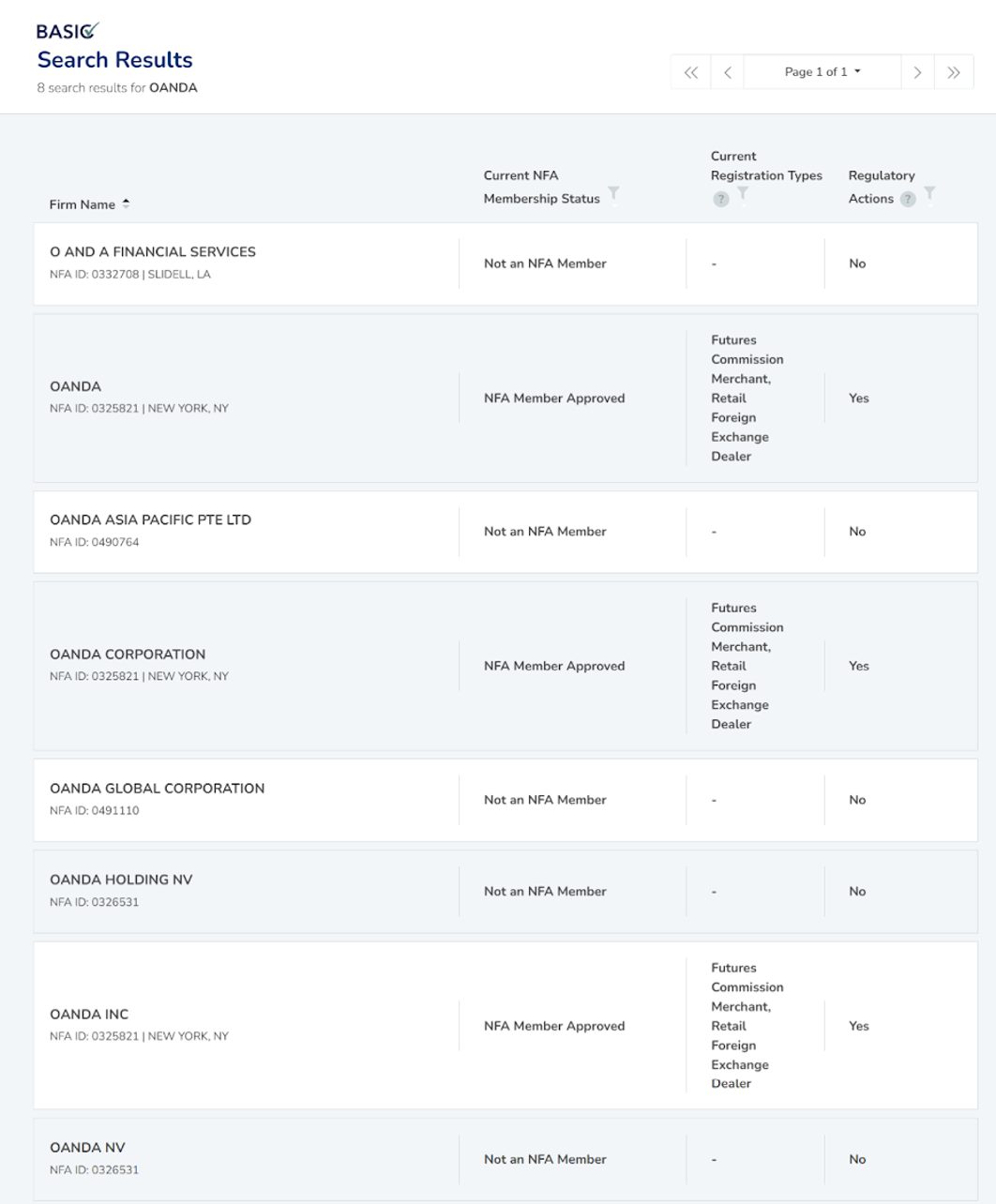

Step 5 – Review Disciplinary History

The NFA BASIC tool also displays any disciplinary actions, complaints, or regulatory violations involving the broker.

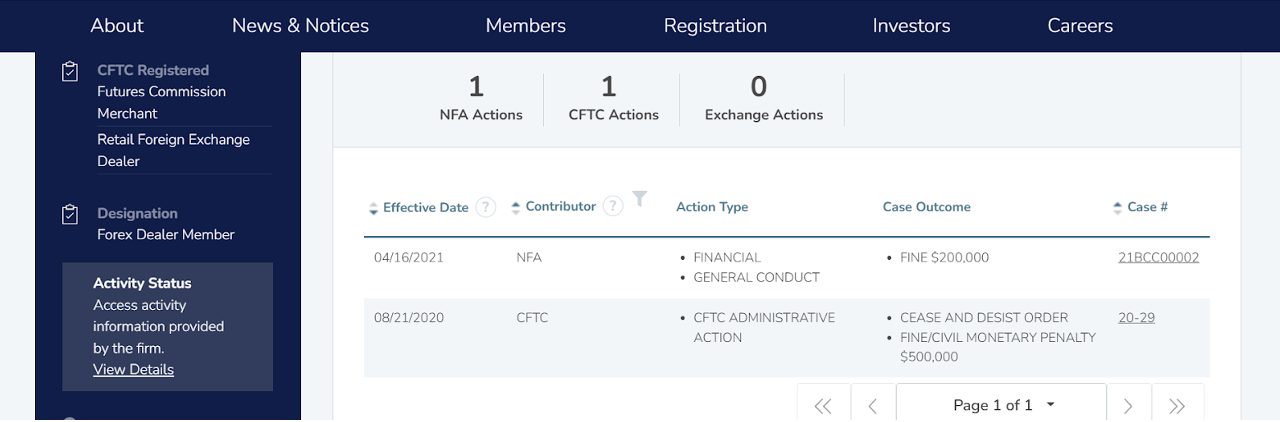

We can see that the NFA has taken regulatory action against OANDA US. Clicking on the actions will take you to this page, which will produce the results.

Clicking the “view all actions” button takes you to this results page:

If you hover over the details of a specific case number, you can click through to the details surrounding the claim.

Step 6 – Check The Broker’s Website Claims

Many CFTC-regulated brokers will prominently display their NFA ID and registration details on their website. However, don’t rely solely on the broker’s claims; always verify independently via the NFA website.

If you’re uncertain about a broker’s status or the information you find, you can directly contact the CFTC or the NFA for assistance:

- CFTC: www.cftc.gov

- NFA: www.nfa.futures.org

As the example highlighted above shows, the CFTC is highly active in protecting traders’ interests and has a deserved reputation as the strictest financial authority worldwide.

Red Flags To Watch For

Here are some things to be vigilant about drawing on my own years in the industry:

- Unregistered Brokers: Any broker offering services in futures, options, or swaps in the US must be registered with the CFTC. Unregistered brokers are operating illegally.

- No NFA ID: Legitimate brokers should be able to provide their NFA ID. Be wary if this information is missing.

- Misleading Claims: Avoid brokers that claim to be “regulated by the CFTC” but don’t appear in the official database or have unverifiable credentials.

What Is The CFTC?

The Commodity Futures Trading Commission (CFTC) is a US government agency that’s responsible for regulating the derivatives markets, notably futures, options, and swaps.

These markets play a critical role in risk management and price discovery for industries ranging from agriculture to energy and finance.

They are also popular instruments with day traders in the US.

Here are the CFTC’s primary objectives:

- Ensuring Market Integrity: The CFTC works to maintain fair and efficient markets where participants can confidently engage in trading without fear of fraud or manipulation. It enforces laws against deceptive trading practices, insider trading, and price manipulation to promote trust in the system.

- Protecting Market Participants and the Public: One of the CFTC’s top priorities is safeguarding participants, especially smaller retail traders, from fraud, misrepresentation, and abusive practices. The CFTC actively investigates and takes action against entities that violate rules, ensuring those who break the law are held accountable. Educational initiatives help market participants better understand the risks and opportunities in derivatives trading.

- Promoting Financial Stability: Derivatives markets are deeply interconnected with the global financial system, so the CFTC monitors them to prevent risks from spiraling into broader economic crises. The CFTC aims to prevent excessive speculation and manage systemic risks that could destabilize the economy through regulations like margin requirements and position limits.

- Fostering Innovation and Competition: As markets evolve, the CFTC adapts its oversight to incorporate new technologies and products. For example, in recent years it has turned its crosshairs to cryptocurrencies and blockchain-based derivatives. The CFTC supports healthy competition among exchanges and market participants, ensuring innovation doesn’t come at the expense of regulatory safeguards.

- Promoting Transparency and Accountability: The CFTC requires detailed reporting of trades and positions, which allows it to monitor market activity in real-time and identify potential risks. Publicly available data on derivatives activity ensures transparency, enabling participants to make informed decisions.

- Enforcing Compliance: The CFTC oversees and audits registered entities such as exchanges, clearinghouses, and intermediaries like brokers to ensure compliance with federal regulations. It collaborates with domestic and international regulators to maintain consistent enforcement across global markets.

Ultimately, the CFTC supports economic growth and financial stability while protecting public confidence in these vital markets, helping ensure traders like us have the utmost protection.

Who Is The CFTC Answerable To?

The Commodity Futures Trading Commission is an independent agency within the US federal government, meaning it operates autonomously in its day-to-day regulatory activities.

However, it is ultimately answerable to Congress and the President:

- Congress

- Legislative Oversight: Congress has the authority to create, amend, or repeal laws that govern the CFTC. It also oversees the agency’s activities to ensure they align with the law and serve the public interest.

- Budgetary Control: Congress decides the CFTC’s funding, giving lawmakers a degree of control over the scope of its operations.

- Reporting Requirements: The CFTC regularly reports to Congress on its activities, enforcement actions, and the state of the derivatives markets. For instance, it submits an annual report outlining its achievements, challenges, and priorities.

- The President

- Appointments: The President appoints the five CFTC Commissioners, including the Chairperson, with the advice and consent of the Senate. These appointments allow the President to influence the agency’s leadership and direction.

- Policy Alignment: While independent, the CFTC’s policies may reflect the administration’s broader economic and regulatory priorities, such as promoting financial stability or addressing emerging risks like cryptocurrencies.

- Judicial Oversight: Though not directly answerable to the judiciary, the CFTC’s actions are subject to legal review. If the CFTC enforces a rule or takes an action deemed unlawful or exceeding its authority, it can be challenged in federal courts.

Key Points On Independence

While the CFTC is answerable to Congress and the President, its independent status ensures it can make decisions based on market needs and regulatory principles, free from undue political influence.

This independence is crucial for maintaining impartiality, especially in enforcing rules against powerful market participants.

The powerful bodies the CFTC is answerable to: Congress, The President, and Judicial oversight mean the CFTC is probably the tightest-run financial authority worldwide.

What Rules Must CFTC-Regulated Brokers Follow?

CFTC-regulated brokers, also known as Futures Commission Merchants (FCMs) or Introducing Brokers (IBs), must adhere to strict rules designed to maintain market integrity and protect traders.

These rules are rooted in the Commodity Exchange Act (CEA) and further defined by CFTC regulations.

Here’s an overview of the critical rules brokers must follow and how they ensure trader protection:

- Registration and Licensing: All brokers must register with the CFTC and the National Futures Association (NFA), a self-regulatory body overseen by the CFTC. Registration ensures brokers meet specific qualifications, including financial standards and background checks.

- Segregation of Funds: Brokers must segregate client funds from their operational accounts. This rule ensures that a trader’s deposits cannot be misused or lost due to the broker’s business activities or financial troubles.

- Capital Requirements: Brokers must maintain minimum net capital levels to prove financial stability and meet client obligations, even during periods of market stress.

- Disclosure Obligations: Brokers must provide clear and detailed disclosures about risks associated with trading derivatives, as well as any fees or costs clients may incur. They must also inform clients about the possibility of losing more money than initially invested (in cases of leverage – a popular tool with short-term traders).

- Fair Dealing and Best Execution: Brokers must execute trades fairly and on time, ensuring they act in the best interests of their clients. They must avoid conflicts of interest or practices that could unfairly disadvantage clients. This is vital for active traders executing frequent transactions where profit margins may be slim.

- Recordkeeping and Reporting: Detailed records of client transactions must be maintained and made available for audits or regulatory review. Brokers also report trading activities to the CFTC and NFA for monitoring purposes.

- Prohibition of Fraud and Manipulation: Brokers are strictly prohibited from engaging in fraudulent activities, market manipulation, or deceptive practices.

- Monitoring and Surveillance: The CFTC actively monitors derivatives markets and trading activity to detect fraud, manipulation, or other irregularities. Advanced systems, like the CFTC Market Surveillance Program, help identify suspicious behavior.

- Enforcement Actions: The CFTC investigates complaints against brokers and takes enforcement actions, such as imposing fines, suspending licenses, or pursuing legal action against violators.

- Whistleblower Program: The CFTC offers financial rewards to individuals who report misconduct or violations, encouraging transparency and accountability.

- Regulatory Audits: The CFTC regularly audits registered brokers to ensure compliance with rules. Non-compliance leads to sanctions or expulsion.

- Trader Education: The CFTC provides resources to educate traders about risks, fraud prevention, and how to choose reputable brokers. Programs like SmartCheck help traders verify a broker’s registration and disciplinary history.

- Complaint Resolution: Traders can file complaints with the CFTC if they encounter misconduct. The agency investigates these complaints and may provide restitution to affected clients in cases of proven violations.

- Market Safeguards: Through regulations like position limits and margin requirements, the CFTC ensures excessive speculation doesn’t lead to market disruptions that could harm traders.

Does The CFTC Have Teeth?

Yes, the Commodity Futures Trading Commission (CFTC) has substantial regulatory “teeth,” meaning it wields strong enforcement authority to uphold the integrity of US derivatives markets.

Here’s why:

- Significant Penalties: The CFTC imposes hefty fines for violations such as fraud, manipulation, spoofing, and inadequate supervision. For example, it has levied multi-million-dollar penalties on major institutions like JPMorgan Chase and HSBC.

- Broad Investigative Power: The CFTC can investigate individuals and firms across the derivatives market, subpoena records, and compel testimony to uncover wrongdoing.

- Civil and Criminal Referrals: While the CFTC cannot prosecute criminal cases, it refers evidence of criminal conduct to the Department of Justice (DOJ) and often collaborates with them on enforcement actions.

- Whistleblower Program: The agency incentivizes whistleblowers by offering financial rewards for information leading to successful enforcement actions. In some cases, whistleblower rewards have exceeded $200 million.

- Spoofing and Market Manipulation: The CFTC has aggressively targeted spoofing practices, fining firms, and banning individuals from trading. High-profile cases include fines on Tower Research and others for distorting market prices.

- Recordkeeping Enforcement: In 2023, banks like BNP Paribas and Société Générale faced penalties totaling over $260 million for failure to maintain proper records, showcasing the CFTC’s focus on transparency.

While the CFTC is powerful, it faces resource limitations and jurisdictional constraints, especially as new markets like cryptocurrency grow.

However, its collaboration with other agencies like the DOJ, SEC, and international regulators amplifies its reach.

The NFA has fined several trading brokers in recent years for various compliance failures. Notable cases include:

- Trading.com Markets Inc.: In 2024, the firm was fined $50,000 for failing to file timely financial and trade reports, not adhering to internal financial controls, and insufficient supervision. FX News Group.

- GMG Brokers: In 2023, the NFA fined GMG Brokers and two employees $350,000. Violations included deceptive trading practices, prioritizing certain clients over others, and inadequate supervision. FX News Group.

- OANDA: In 2021, the NFA fined OANDA $200,000 for deficiencies in anti-money laundering (AML) procedures, failure to handle customer complaints per regulations, and inaccuracies in financial reporting. These issues were repeat offenses identified in prior NFA examinations. FX News Group

These fines underscore the NFA’s focus on ensuring brokers meet extremely high compliance standards, transparency, and customer protection.

Bottom Line

The CFTC has adapted to new challenges, such as the rise of cryptocurrencies and decentralized finance, balancing innovation with oversight.

It enforces strict rules to protect active traders from fraud, manipulation, and abusive practices. Its actions promote confidence in markets like futures, options, and swaps.

However, it’s not perfect. As markets evolve rapidly, the CFTC’s funding and staffing levels sometimes struggle to keep pace with growing oversight demands, particularly in emerging sectors like crypto.

Modern financial instruments can also outstrip existing regulatory frameworks, requiring constant adaptation to ensure comprehensive oversight.

But overall, while challenges remain, the agency’s commitment to protecting traders and ensuring market stability continues to enhance its importance.

To get started, see DayTrading.com’s choice of the best CFTC-regulated brokers.

Although regulatory oversight provides a level of protection, it’s key to understand that trading derivatives represent significant risks to your US dollars.

Article Sources

- Commodity Futures Trading Commission (CFTC)

- Chairman & Commissioners - CFTC

- Commodity Exchange Act (CEA)

- Market Surveillance Program - CFTC

- Smart Check - CFTC

- Division of Swap Dealer and Intermediary Oversight (DSIO)

- BASIC (Background Affiliation Status Information Center)

- Futures Commission Merchant (FCM) - CFTC

- Introducing Broker (IB) - NFA

- Swap Dealer (SD) - NFA

- Department of Justice (DOJ)

- Whistleblower rewards - CFTC

- Deceptive schemes and spoofing - CFTC

- Record keeping and supervision failures - CFTC

- JP Morgan fine - CFTC

- HSBC fine - CFTC

- Trading.com CFTC fine - FX News Group

- GMG Brokers CFTC fine - FX News Group

- OANDA CFTC fine - FX News Group

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com