Best Day Trading Platforms and Brokers in South Africa 2025

The best day trading brokers in South Africa provide intuitive platforms with excellent charting features, competitive fees, fast execution speeds, and margin trading.

Many also offer accounts in a convenient currency like the South African Rand (ZAR), are regulated by a credible body like the South African Financial Sector Conduct Authority (FSCA), and facilitate trading on popular markets such as the Johannesburg Stock Exchange (JSE).

Find the top day trading platforms in South Africa. All the online brokers we list below accept clients from South Africa.

Top 6 Platforms For Day Trading In South Africa

After testing, reviewing, and rating 226 brokers, our exhaustive analysis reveals that these are the 6 best day platforms and brokers in South Africa:

Here is a summary of why we recommend these brokers in July 2025:

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- XM - XM is a globally recognized forex and CFD broker with 15+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC and CySEC and offers a comprehensive MetaTrader experience.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- RoboForex - RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

- Deriv - Established in 1999, Deriv is an innovative broker now serving over 2.5 million global clients. The firm offers CFDs, multipliers and more recently accumulators, alongside its proprietary derived products which can't be found elsewhere, providing flexible short-term trading opportunities.

Best Day Trading Platforms and Brokers in South Africa 2025 Comparison

| Broker | ZAR Account | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|---|

| AvaTrade | - | $100 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) |

| XM | - | $5 | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies | MT4, MT5, TradingCentral | 1:1000 |

| IC Markets | - | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Exness | ✔ | $10 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral | 1:Unlimited |

| RoboForex | - | $10 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures | R StocksTrader, MT4, MT5, TradingView | 1:2000 |

| Deriv | - | $5 | CFDs, Multipliers, Accumulators, Synthetic Indices, Forex, Stocks, Options, Commodities, ETFs | Deriv Trader, Deriv X, Deriv Go, MT5, cTrader, TradingView | 1:1000 |

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Bonus Offer | 20% Welcome Bonus up to $10,000 |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

Cons

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Bonus Offer | $30 No Deposit Bonus When You Register A Real Account |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | ASIC, CySEC, DFSA, IFSC |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of <2 minutes and now a growing Telegram channel.

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

Cons

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

- Although trusted and generally well-regulated, the XM global entity is registered with the weak IFSC regulator and UK clients are no longer accepted, reducing its market reach.

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, FSA, CMA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

Cons

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | CySEC, FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, DKK, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

Cons

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| Bonus Offer | $30 No Deposit Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

Pros

- RoboForex is known for its tight spreads starting from 0 pips and low minimum deposits from $10, making it accessible to those on a budget. The ability to trade with micro lots further lowers the barrier to entry for new traders.

- The broker offers two commission-free withdrawals each month in the Free Funds Withdrawal program, helping day traders to minimize transaction costs.

- RoboForex secured the 'Best Forex Broker 2025' title in DayTrading.com's Awards after broadening their FX offering, cutting spreads and opening up services in various countries.

Cons

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

- RoboForex provides a variety of account types, which, while offering flexibility, can be overwhelming for newer traders trying to choose the most suitable option for their trading style. Alternatives, notably eToro, provide a smoother entry into online trading with one retail account.

- Despite 15+ years in the industry and registering with the Financial Commission, RoboForex is authorized by one ‘Red-Tier’ regulator – the IFSC in Belize, lowering the level of regulatory protections for traders.

Deriv

"Deriv is ideal for active traders seeking alternative and unique ways to speculate on global financial markets, from multipliers and accumulator options to its bespoke synthetic indices, which mimic real market movements and are available 24/7, allowing for continuous trading opportunities regardless of market hours."

Christian Harris, Reviewer

Deriv Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Multipliers, Accumulators, Synthetic Indices, Forex, Stocks, Options, Commodities, ETFs |

| Regulator | MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA |

| Platforms | Deriv Trader, Deriv X, Deriv Go, MT5, cTrader, TradingView |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP |

Pros

- Deriv revamped its app in 2025, now sporting a slicker interface alongside improved position management and streamlined contract details for smarter mobile trading, earning it DayTrading.com's 'Best Trading App' award.

- Although response times trail alternatives in our personal experience, Deriv offers 24/7 support and is one of the few brokers to offer WhatsApp assistance.

- Account funding is a breeze with a very low minimum deposit of $5 and a huge selection of payment options, plus Tether was added to the cashier in 2023.

Cons

- Leverage up to 1:1000 will appeal to traders with a large risk appetite but frustratingly there is no ability to flex the leverage in the account area.

- Although there’s a basic blog, there's little in terms of technical analysis or market reports which could help active traders identify potential opportunities.

- While the Academy launched in 2021 is a step in the right direction, there is limited education on advanced trading topics for seasoned traders and no live webinars to upskill new traders.

Choosing A Day Trading Broker In South Africa

Our extensive experience in the day trading sector has revealed that there are several crucial elements to take into account when choosing a broker:

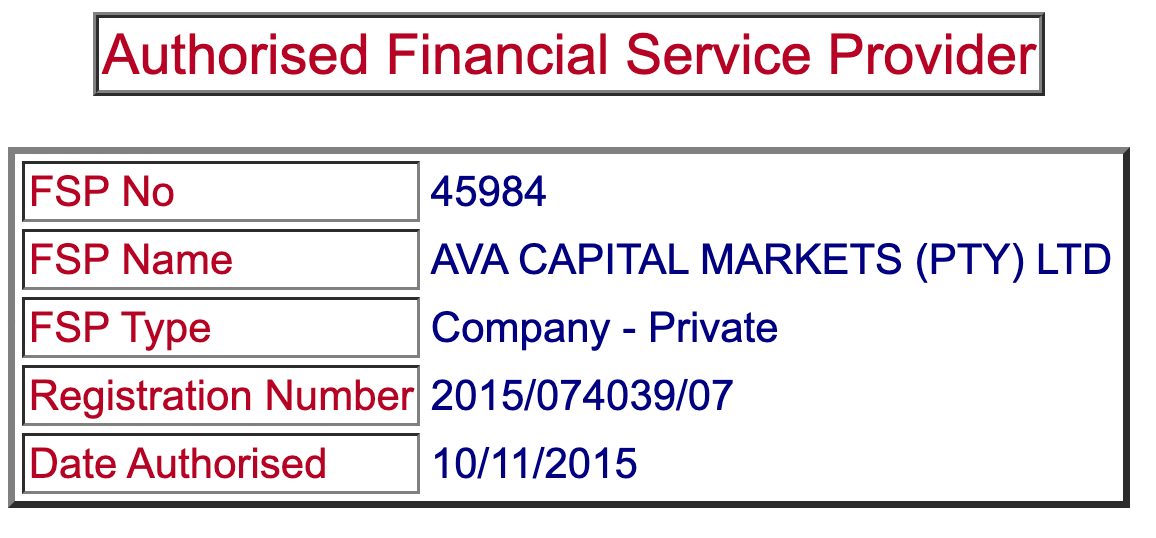

Trust and Regulation

It’s essential to select a trusted brokerage.

Doing so safeguards your funds against harmful trading practices, such as price manipulation and even fraud. Opting for a trustworthy broker is especially crucial considering South Africa’s history with trading scams.

One prominent example is Forex International, a company which offered guaranteed returns. Its scammer operators, Peter and Louis Henderson, who have since been jailed following an investigation by the South African Reserve Bank, were found to have stolen R 1.6 million before transferring the money to offshore bank accounts.

As a result, we routinely verify that day trading brokers are regulated by a credible authority, such as South Africa’s Financial Sector Conduct Authority (FSCA). The FSCA oversees brokers and permits popular short-term trading instruments like contracts for difference (CFDs).

Alternatively, we recommend global brokers regulated elsewhere that we trust, an assessment we make by verifying the number and quality of their regulatory licenses, their track record of treating day traders fairly, and their standing in the industry. It’s important to continue adhering to the FSCA’s regulations and local tax rules if you do opt for an overseas broker.

- AvaTrade earns our trust year after year owing to its regulation in 9 jurisdictions including South Africa. The over 400,000 traders and long row of industry awards also underscore its reliability.

Trading Fees

Choose a trading platform with low fees for both trading and non-trading activities.

For day traders, who typically engage in a high volume of transactions, it’s crucial to minimize transaction costs as they can significantly erode profits.

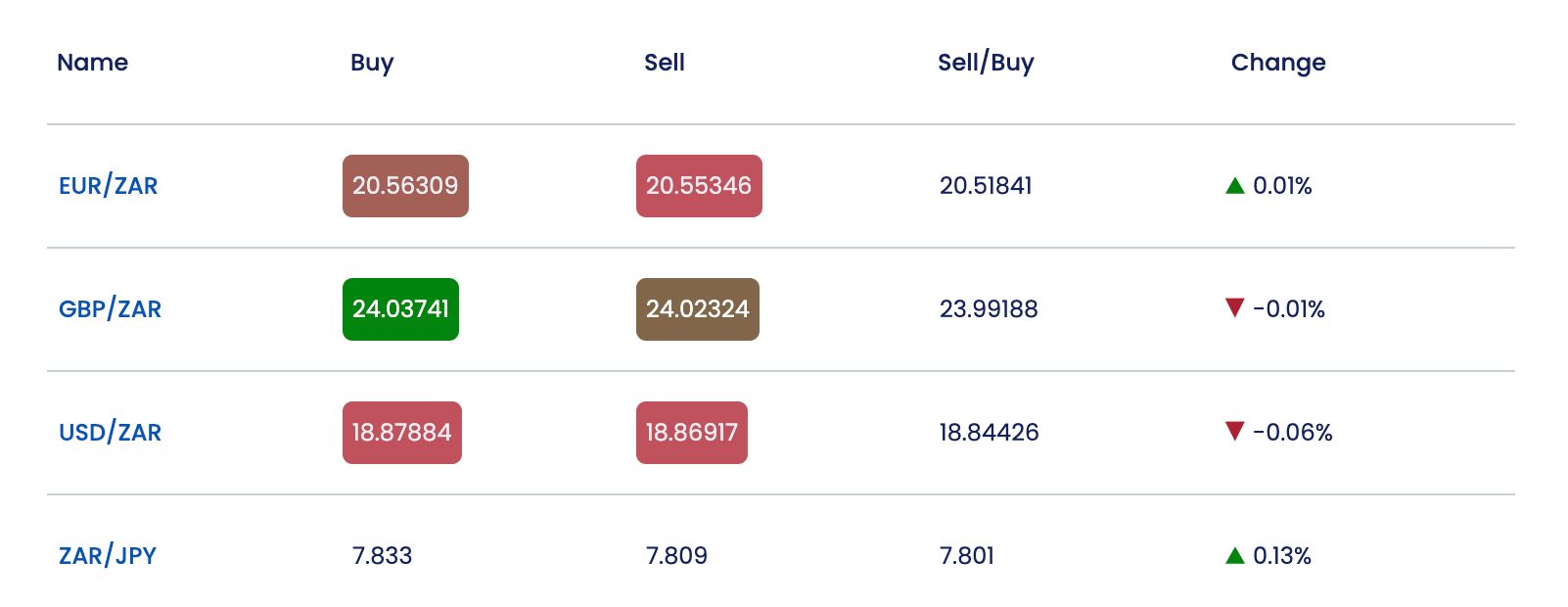

We recommend South African day trading brokers who offer attractive pricing, something we determine by recording and comparing their spreads on popular assets like the ZAR/USD.

We also evaluate any additional fees, such as those for deposits and withdrawals which can impact active traders, plus inactivity penalties which penalize casual investors.

Importantly, we then balance pricing with the quality of the broker’s tools and overall trading environment, as we know from first-hand experience that the cheapest brokers aren’t always the best.

- IC Markets stands out as one of the lowest-cost day trading platforms based on our tests using real money, with 25 liquidity providers helping to ensure ultra-tight spreads from 0.0 pips. There are also no deposit and withdrawal charges or inactivity fees.

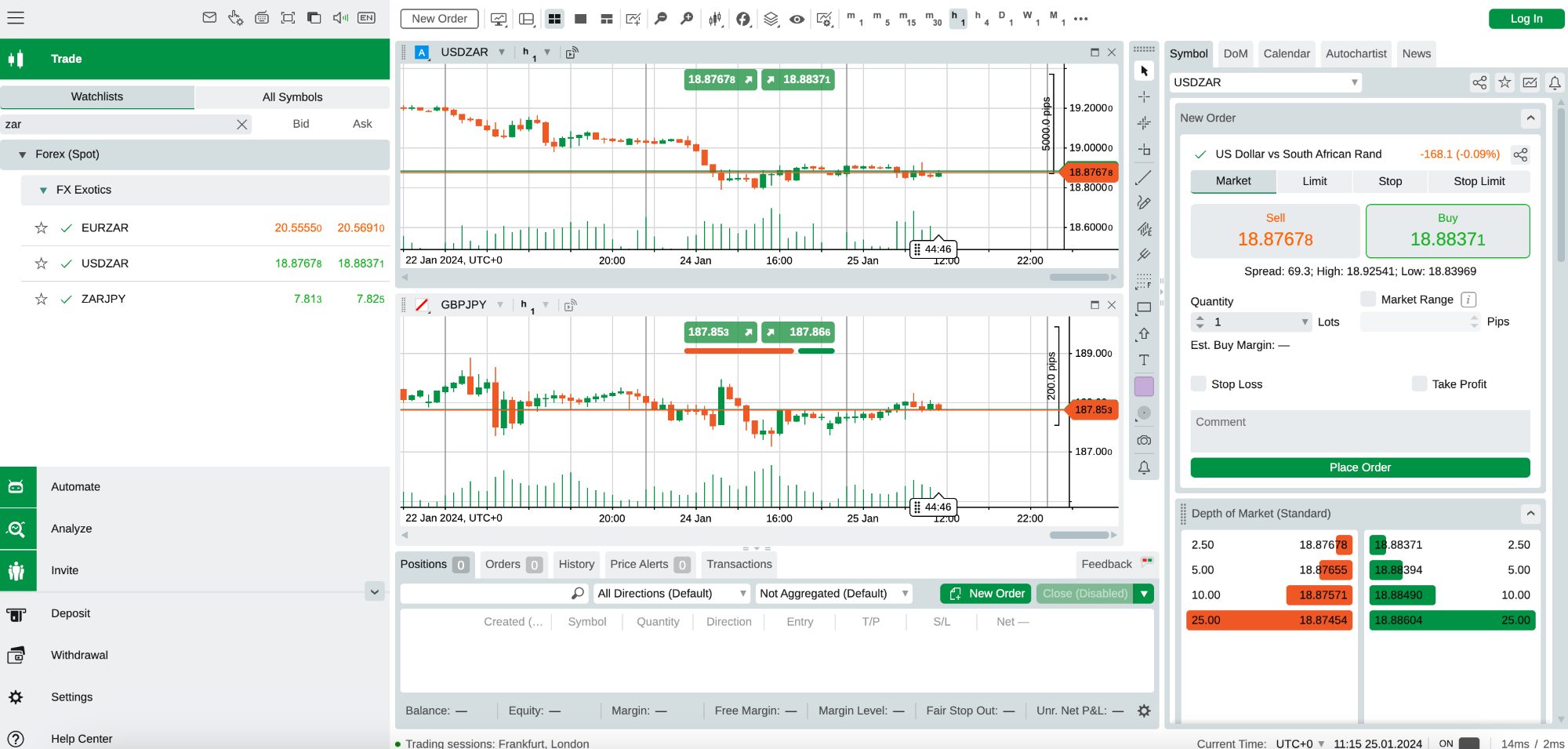

Trading Platforms and Tools

Select a user-friendly platform equipped with a good charting package.

Charting tools are especially crucial for day traders, as many depend on technical analysis for their short-term trading strategies.

Advanced day traders might require a range of sophisticated indicators and drawing tools, available from leading third-party platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5) and cTrader. These are also great for automated trading.

On the other end of the scale, beginners will find the essentials they need in most proprietary platforms, including popular day trading indicators like Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI).

Our experts always evaluate the trading platforms, apps, and tools as a part of our review methodology. We conduct hands-on tests of the software to ensure it delivers an excellent user experience, complete with the charting tools necessary for day traders at every experience level.

- Pepperstone continues to stand out for its charting platforms with MT4, MT5, cTrader and TradingView. It’s also one of the few day trading brokers in South Africa to support Autochartist, which identifies actionable trading opportunities in real time.

Day Trading Markets

Choose a brokerage that provides opportunities in your preferred markets.

For many day traders in South Africa, it will be important to have access to local stock exchanges, such as the Johannesburg Stock Exchange (JSE). Additionally, the ability to engage in short-term trading on currency pairs with the ZAR may be important.

Our top picks for South African day trading brokers offer a variety of asset classes, including stocks, forex, commodities, indices, and cryptocurrencies.

These brokerages also often feature products tailored for short-term trading strategies, like contracts for difference (CFDs).

CFDs are a derivative that lets you speculate on price movements, both upward and downward, without actually owning the asset you are speculating on, for instance, Naspers shares listed on the JSE.

- Forex.com has expanded its range of assets over the years to cater to the full spectrum of day traders, offering over 5,500 instruments spanning multiple asset classes, including four currency pairs with the ZAR.

Execution Speed

Sign up with a brokerage that ensures quick and dependable order fulfilment.

For intraday trading especially, choosing a broker that focuses on rapid order execution is crucial. Delays in order processing can lead to lost trading chances or less favorable pricing, all of which can impact your bottom line.

Additionally, execution quality is a critical factor, encompassing aspects like speed, price, and the probability of order completion.

We recommend South African day trading platforms with rapid and reliable order execution, based on our extensive evaluation of their execution policies and analysis of average execution times, where such data is available.

- FxPro emerges as one of the fastest brokers with most orders filled in under 13 milliseconds. This makes the platform superior for short-term setups like scalping and algo trading.

Leverage and Margin Trading

Register with a broker that provides leverage and clearly defined margin requirements.

Opting for a broker that facilitates leverage trading is vital for many day traders. It enhances the potential for higher profits by enabling the handling of larger positions using a small amount of capital.

For instance, your platform might give you 1:5 leverage on South African stocks. This means with an investment of 2000 Rand, you can control a position of 10,000 Rand (5x your investment).

However, this also increases the risk of greater losses, and it is particularly important for novices to be cautious.

Risk management and a good understanding of your broker’s margin requirements are crucial. These requirements determine the capital needed to maintain your positions.

This is particularly important for day traders in South Africa, as the FSCA does not mandate a leverage limit of 1:30, which is commonly found in heavily regulated regions like Europe and Australia. As a result, much higher leverage is often available.

- XM offers very high leverage up to 1:1000 through its global entity – more than most trading platforms based on our tests of hundreds of firms. It has a stop-out level which will automatically close your positions if you don’t maintain enough capital.

Minimum Account Deposit

Select a trading platform with a deposit requirement suitable for your circumstances.

This is especially crucial for beginners with limited funds for online trading. Fortunately, our analysis shows that most leading day trading platforms accepting South African traders typically set their minimum deposit at 5,000 Rand or lower (approximately 250 USD).

There are even platforms with no minimum deposit requirement, such as Pepperstone, making them ideal for traders on a tight budget.

- Trade Nation continues to be a compelling choice here with its ZAR trading account and no minimum deposit. It’s also regulated by the FSCA in South Africa.

Methodology

In our search for the top day trading platforms in South Africa, we relied on both quantitative data and qualitative insights from our comprehensive broker reviews, focusing on several key aspects:

- We made sure the brokerage accepts day traders in South Africa.

- We verified that the company was regulated by the FSCA or another reputable regulatory body.

- We analyzed the fees associated with conducting day trades to make sure they are competitive.

- We tested the platform and/or app to ensure it is conducive to short-term trading strategies.

- We assessed the assets available for day trading, including those in South African markets.

- We examined the speed and effectiveness of order executions.

- We considered the options for leveraged trading and the associated margin requirements.

- We confirmed the minimum deposit to begin day trading in South Africa is accessible.

Bottom Line

Starting with our pick of best day trading brokers in South Africa is an excellent strategy for identifying the best platform for your requirements – we’ve undertaken the rigorous process of testing, assessing, and grading these firms for you.

Should you remain uncertain about which brokerage to choose, consider trying out their platforms through a demo account.

FAQ

What Is Day Trading?

Day trading involves the act of purchasing and selling financial assets, like stocks on the Johannesburg Stock Exchange, all within the span of one trading day.

This approach is adopted by individuals seeking to profit from brief price movements over the short term.

Is Day Trading Allowed In South Africa?

Yes, day trading is allowed and legal in South Africa. The financial markets and trading products like forex and CFDs are overseen by the country’s regulator – the Financial Sector Conduct Authority (FSCA).

Which Brokers Do South African Day Traders Use?

The number of day trading brokers located in South Africa and regulated by the local Financial Sector Conduct Authority (FSCA) is limited.

That’s partly why many day traders choose to sign up with respected global brokers, regulated by other trusted bodies.

Still, local investors should understand that intraday trading with an international broker could restrict your avenues for legal action should problems arise.

How Much Money Do I Need To Day Trade In South Africa?

Our exhaustive analysis indicates that the majority of top day trading platforms catering to South African traders often have a minimum deposit requirement of 5,000 Rand or less, which is roughly equivalent to 250 USD.

Some of the best day trading brokers in South Africa, such as Pepperstone and Trade Nation, even have no minimum deposit, making them an attractive option for beginners.

Recommended Reading

Article Sources

- Financial Sector Conduct Authority (FSCA)

- Johannesburg Stock Exchange (JSE)

- South African Reserve Bank

- Witness News - South African International Forex Scam

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com