A Brief History of Financial Derivatives

Derivatives have a long and complex history that traces back to ancient civilizations.

These financial instruments have evolved significantly over time and have become an important tool for managing risk, hedging investments, and even speculating on market movements.

We’ll take a look at the evolution of derivatives from ancient cultures to the modern era, highlighting some key milestones and events that have shaped their history.

We’ll also examine the advantages and disadvantages of using derivatives, exploring their potential benefits and potential drawbacks.

Key Takeaways – A Brief History of Financial Derivatives

- Derivatives have a long history, originating from ancient civilizations mostly as insurance products and risk management tools.

- Today, they’ve evolved into sophisticated financial instruments used for risk management, hedging, and speculation in modern financial markets.

- The advantages of derivatives include prudent hedging, risk-limited positions, tailored return profiles, convexity for non-linear gains and limited losses, and the ability to build out probability distributions on the underlying asset.

- However, derivatives also present disadvantages such as leverage risks, counterparty risk, complexity, higher transaction costs due to their lack of liquidity, and the potential for systemic risk.

- Proper understanding, oversight, and responsible use are important to prevent their downsides from impacting the stability of the financial system.

The Beginnings: Ancient Derivatives

The concept of financial derivatives can be traced back to ancient Mesopotamia.

It is said that the king of this ancient civilization passed a decree stating that in case of insufficient rain and subsequent crop failure, lenders would have to forgive the debts of the farmers.

This early form of risk management can be seen as a precursor to modern derivatives, which allow investors to hedge against various market risks.

The Evolution of Derivatives: Early Societies and Agricultural Markets

As societies developed and became more interconnected, the need for more advanced financial instruments to manage risk and facilitate trade emerged.

In ancient Greece and Rome, forward contracts were used by merchants to lock in prices for commodities, such as grains and olive oil, which helped to hedge against price fluctuations.

These early derivatives allowed participants to better manage the risks associated with trading and agriculture.

The Renaissance and the Emergence of Options

The Renaissance period witnessed the emergence of options contracts, particularly in the European commodity markets.

In the 17th century, Dutch merchants started trading options on the Amsterdam Stock Exchange, which allowed them to speculate on the future prices of commodities (even the infamous tulips).

This period marks the birth of modern financial derivatives and their use in hedging and speculation. (The Dutch are also responsible for modern capital markets.)

The Industrial Revolution and Financial Innovation

The Industrial Revolution brought about significant economic growth and financial innovation.

The development of new financial instruments, such as futures contracts, played a role in fostering global trade and managing risk.

The Chicago Board of Trade (CBOT), established in 1848, became the first organized futures exchange, paving the way for the growth of derivatives markets worldwide.

The 20th Century: Derivatives Go Mainstream

The 20th century saw the rapid expansion of derivatives markets as financial institutions and investors increasingly embraced these instruments for hedging and speculation.

There is also demand for being able to take positions in a risk-limited way.

For example, when one buys a stock, one can lose the entire investment.

The introduction of options on equities and the establishment of the Chicago Mercantile Exchange (CME) in 1919 further fueled the growth of derivatives trading.

The development of new derivative products, such as swaps and structured products, also contributed to the increasing popularity of these financial instruments.

The 2008 Financial Crisis: Derivatives under Scrutiny

The 2008 financial crisis brought the risks associated with derivatives into focus.

The excessive use of complex financial products, such as mortgage-backed securities (MBS) and credit default swaps (CDS), played a role in the collapse of some investment banks.

These institutions were leveraged long certain assets that ultimately lost all their value, leading to large holes on their balance sheets that impacted their solvency.

This had a role in the subsequent global economic downturn, which, at its heart, was about too much debt coming due relative to income, savings, and new lending available to service it, leading to forced asset sales and economic weakness.

Moreover, interest rates hit zero, which prevented monetary policymakers from easing further in the traditional way (lower interest rates), leading to asset buying (quantitative easing) to get more money and credit into the system.

This event led to increased regulatory scrutiny and reforms aimed at improving transparency and reducing systemic risk in the derivatives markets.

The Advantages of Derivatives

Financial derivatives offer a range of benefits, including:

Prudent hedging purposes

Derivatives can be used to hedge against market risks, such as interest rate fluctuations, currency movements, and commodity price changes, helping to stabilize cash flows and protect investments and portfolios.

Risk-limited positions

Derivatives allow investors to take positions in the market with a limited downside, which can help manage risk and potential losses.

Tailored return profiles

Derivatives can be structured to capture the exact distribution of returns that a trader/investor is targeting, allowing for more precise portfolio management and risk control.

Leverage

Derivatives can provide market participants with leverage, enabling them to control a larger position with a smaller initial investment.

This can magnify potential gains. The positions can also be obtained with limited risk (the price of the option).

Convexity

Convexity in options refers to the non-linear relationship between the option price and the underlying asset’s price.

It offers two key benefits:

- Amplified gains through positive convexity when the underlying asset rises significantly, and

- Limited losses through negative convexity when the asset falls, providing downside protection to the option holder

This is a negative for the seller of the option (often a market maker), so they will tend to delta and gamma hedge.

Build out probability distributions

Traders can look toward derivatives markets to understand the forward expectations for the underlying asset.

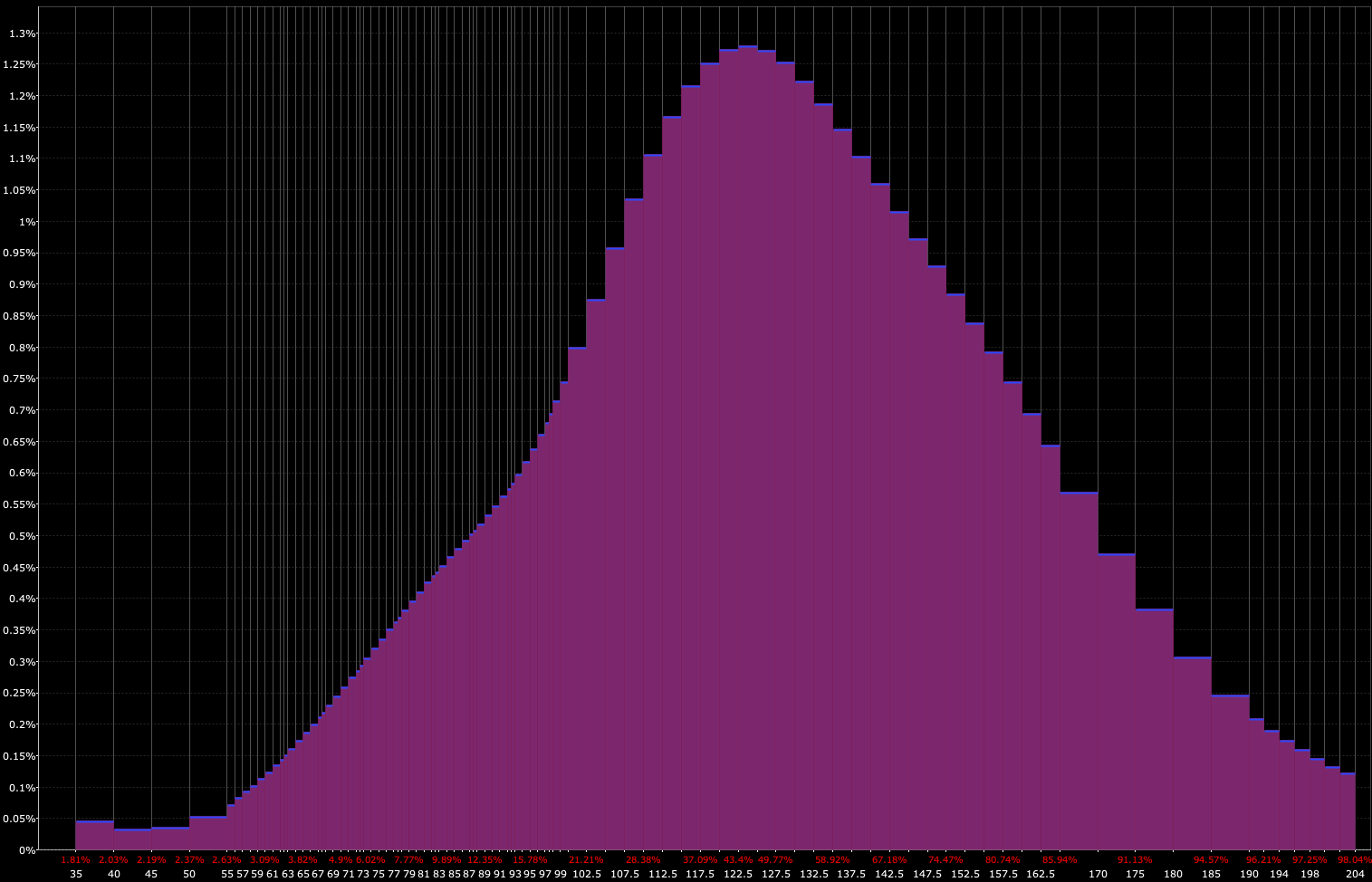

Below is an example. This probability distribution (i.e., where will the price be by date X?) on Google (GOOG) is built out using the underlying options markets:

This represents a unique layer of information that traders can use.

Having a differing opinion relative to the distribution can open up tactical trading opportunities.

The Disadvantages of Derivatives

Despite their benefits, derivatives also come with potential drawbacks, including:

Leverage risks

While leverage can amplify gains, it can also magnify losses when employed in a risky way.

Investors/traders using derivatives may be exposed to significant losses if the market moves against their positions.

Leverage risks are most important for those holding derivatives short. This provides limited upside but often unlimited downside.

For example, if you’re short a call option, your upside is limited to the premium of the option. Your downside is theoretically infinite because there’s no limit to how high the stock can go.

Counterparty risk

Derivatives involve contracts between two parties, and there is a risk that one party may default on its obligations, causing losses for the other party.

Counterparty risk was high during the 2008 financial crisis.

Complexity

Some derivative instruments can be highly complex, making it difficult for investors to fully understand the risks involved.

This complexity can also make it challenging for regulators to effectively oversee the market. “Offense” is generally ahead of “defense.”

Costliness

Trading derivatives can be expensive, with transaction costs (e.g., wide bid-ask spreads) and other fees potentially reducing the profitability of an investment strategy.

Illiquidity

While many derivatives markets are highly liquid, some derivative instruments may be illiquid or difficult to trade, which can limit an investor’s ability to enter or exit positions.

Systemic risk

The interconnected nature of derivatives markets means that the failure of one institution or the unwinding of large derivative positions can have consequences in many other ways, potentially leading to systemic risk and financial instability.

What is the history of the derivatives market?

Conclusion

The history of financial derivatives stretches back thousands of years, with these instruments evolving from basic insurance and risk management tools in ancient societies to the sophisticated and complex products used by traders and investors today.

Derivatives have played a significant role in the development of financial markets and the growth of global trade, offering numerous benefits, such as prudent hedging, risk-limited positions, tailored return profiles, a source of convex leverage, and unique market information.

However, the 2008 financial crisis highlighted the potential dangers of risky use of derivatives and the need for transparency and oversight.

While derivatives can provide valuable risk management and investment opportunities, they also come with potential drawbacks, including potential leveraged losses for sellers, counterparty risk, complexity, costliness, illiquidity, and systemic risk more broadly.

This knowledge can be useful in promoting responsible use of these instruments and ensuring the stability and resilience of the global financial system.