Is AI a Market Bubble?

The question of whether artificial intelligence (AI) is in a market bubble has become central to investors, economists, and policymakers.

On one hand, AI – i.e., by which we mostly mean automation and synthetic “thinking” technologies – is transformative.

It impacts industries, drives productivity, and enables new software, tools, programs, and other products to be built faster and more efficiently.

On the other hand, sky-high valuations, speculative capital, and pockets of unsustainable expectations do echo historical bubbles like the dot-com crash.

To understand whether AI is a true bubble, we need to examine both sides of the argument.

Key Takeaways – Is AI a Market Bubble?

- AI is reshaping industries, improving productivity, and enabling new products, tools, and software.

- Key bubble signs are present: prices far above earnings, overwhelming bullish sentiment, and speculative capital chasing AI buzz.

- But overall, it’s more mixed.

- The market is dominated by a few mega-cap tech stocks, echoing dot-com-era concentration risk.

- Many newer firms are overleveraged and reliant on hype.

- Seasoned players are cash-rich and structurally investing.

- AI isn’t purely a bubble, but a transformative shift with speculative excess layered on top.

- Focus on profitable, infrastructure-linked companies and avoid unproven pockets/companies.

- The best framing is generally that AI is a real boom containing localized bubbles, not a mania across the board.

What Is a Bubble?

First, what is a bubble?

It’s a term that’s thrown around easily, so let’s understand the criteria first.

You generally see these seven things first:

- Prices detach from fundamentals, trading far above historical valuation metrics like earnings or yields.

- Market optimism outpaces reality, with asset prices reflecting overly ambitious future earnings.

- Leverage is excessive, as buyers increasingly finance purchases with borrowed money.

- Sentiment is one-sided, with broad bullishness and few remaining skeptics.

- New, inexperienced investors flood in, often chasing trends and stories rather than doing valuation-based analysis.

- Easy monetary policy fuels the rise, with low rates and liquidity inflating asset values.

- Speculative hoarding emerges, as buyers over-purchase goods or inventory to front-run future price gains.

The Case for Bubble Dynamics

Overheated Valuations and Narrow Market Leadership

AI’s market dominance is reflected in the concentration of gains within a few companies.

As of this writing, the top 10 US stocks make up nearly 40% of the S&P 500, with eight belonging to tech or communications sectors.

This exceeds the concentration seen during the 2000 dot-com bubble.

Companies like Nvidia, Microsoft, Apple, and Alphabet have led the rally, but such narrow leadership increases market vulnerability.

Valuations Detached from Fundamentals

Leading AI companies trade at extreme valuation multiples, with price-to-earnings and price-to-sales ratios that far exceed historical norms.

Over $560 billion has been invested into AI by major firms in the past two years, yet the estimated incremental revenue is just $35 billion.

Analysts like Torsten Slok of Apollo Global warn that AI valuations surpass those of dot-com era giants before the crash.

Speculative Frenzy and Narrative Investing

AI has become a magnet for speculative capital.

Companies with little or no AI capability are adding AI-related buzzwords to their branding (a phenomenon dubbed “AI washing”) to attract investment.

The algorithms that trade the majority of the US stock market are now, in part, influenced by these sort of tactics because market edge is all about being quicker and having more information than others.

And there are many short-term trading strategies that don’t involve waiting a multi-year period to see the earnings show up. So perceptions are part of it.

Retail investors and momentum funds commonly chase stocks based on headlines, not earnings. Naturally, intentions and vision happen before they accumulate into profits.

This FOMO-driven behavior parallels past manias, where sentiment replaces analysis.

Sophisticated sentiment analysis typically involves looking for clues about how such “sentiment” actually translates into the money and credit flows that move prices in markets.

Fragile Sentiment and Excess Leverage

Speculative activity is high among post-IPO AI startups, many of which are funded by venture capital or rely on debt financing.

Volatility remains low in mega caps, but smaller speculative names show baton-passing behavior typical of late-stage bubbles.

If sentiment turns, these firms may face sharp corrections.

The Case Against an All-Out Bubble

Real Profits and Business Fundamentals

Unlike the dot-com era, many of today’s leading AI companies are profitable and cash-flow positive because they can use their cash flow from mature businesses to invest in newer frontiers.

Nvidia and Microsoft generate massive revenues from AI tools, chips, and cloud services.

Eric Schmidt, former CEO of Google, describes AI as infrastructure for a new industrial era, not just a passing tech fad.

Stable Volatility Signals a Controlled Market

Bank of America notes that typical bubbles see rising volatility as valuations rise.

However, the S&P 500’s volatility has remained generally low.

This suggests investor behavior is more stable and less prone to a sudden reversal.

Early-Stage Boom with Long-Term Growth Potential

AI is already delivering real-world results.

From drug discovery and customer service automation to media production and logistics, companies are generating value from AI today.

Not as much as discounted, to be clear, but it’s already happening and will grow, especially as larger and more staid organizations integrate automation into their workflows.

This supports a thesis of transformation rather than pure speculation.

Structured models like the Capability Realization Rate (CRR) show a valuation mismatch, but not an unsustainable chasm.

Durable Capital Expenditure and Macro Tailwinds

Tech giants have committed over $340 billion to AI infrastructure, including chips, servers, and data centers.

These investments are structural and necessary for long-term growth, not just temporary capex bursts.

Bubble Indicators vs. Boom Characteristics

Let’s compare current AI dynamics to classic bubble signals:

- High prices vs. fundamentals – AI stocks are expensive, with forward multiples built on bold growth assumptions.

- Unrealistic earnings expectations – Many valuations imply productivity leaps that may not materialize soon.

- Leverage in asset purchases – Smaller firms rely on debt or VC funding, increasing systemic risk.

- One-sided sentiment – Few investors are bearish on AI; optimism dominates.

- Inexperienced buyers – Retail participants are often driven by hype and headlines, not analysis.

- Monetary stimulus – Many poor investments can become propped up by low rates – i.e., safer investments like cash and bonds don’t give adequate returns and force market participants to find something else.

- Speculative hoarding – Firms are hoarding chips, talent, and compute resources without clear ROI.

These trends don’t prove a bubble alone but show an ecosystem where speculation exceeds execution in key areas.

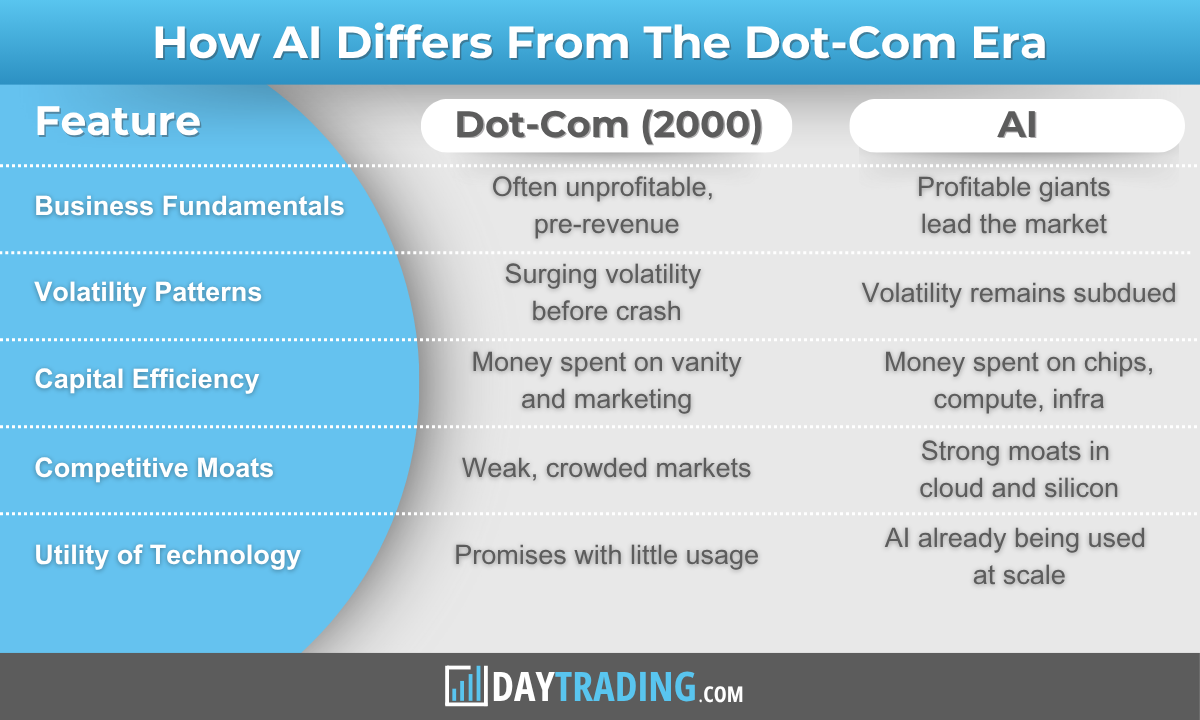

How AI Differs from the Dot-Com Era

This comparison shows a more grounded, though still frothy, market than in 2000.

Implications

What to Do:

- Diversify across the AI stack – Favor not just AI software but semiconductors, data centers, and foundational tech.

- Think of second-order influences – Air travel was a transformative technology, but did more for industries like tourism and logistics than the shareholders in airliners themselves.

- Stick with profitability – Focus on firms with earnings, not just hype.

- Watch CRR and sentiment indicators – Measure delivery vs. expectations.

- Manage exposure to mega caps – Avoid over-concentration in Nvidia and Microsoft.

Risks to Monitor:

- Slower-than-expected monetization or adoption.

- Competition from firms like those from China or those able to copy technologies cheaply.

- Regulatory crackdowns or export restrictions.

- Sharp reversal in speculative capital flows.

So, Is AI a Bubble?

Let’s go back to our criteria:

Prices detach from fundamentals

Yes.

Many leading AI stocks trade at extreme price-to-earnings and price-to-sales multiples, pricing in growth far beyond current capabilities.

While some firms justify high valuations with real profits, others reflect expectations that may be difficult to meet in the near term, especially among smaller players and recent IPOs.

Many smaller firms that provide unique value but have trouble keeping costs under control might end up being acquired and essentially swallowed up into bigger tech.

Market optimism outpaces reality

Yes.

The narrative around AI has created a consensus that it will transform every industry, but earnings and adoption have not yet caught up.

Investors often project exponential returns from early-stage technologies that are still being tested or have unclear monetization paths.

Leverage is excessive

Yes, though unevenly.

While established firms like Nvidia fund growth from cash flow, many startups rely heavily on venture capital or debt to scale.

This introduces fragility if capital tightens or growth expectations falter, particularly in speculative corners of the AI market.

Sentiment is one-sided

Yes.

Bullishness dominates both institutional and retail sentiment, with very few prominent bearish voices taken seriously.

This imbalance can be dangerous.

It removes healthy skepticism and increases the risk of sharp corrections if confidence is shaken.

New, inexperienced investors flood in

Yes.

Retail participation has surged in AI-themed stocks, with many buyers driven by headlines, social media, or hype rather than valuation models or earnings analysis.

This echoes patterns seen in previous speculative cycles, where crowd enthusiasm outpaces due diligence.

Easy monetary policy fuels the rise

Partially.

While interest rates have risen from pandemic lows, liquidity remains abundant in capital markets.

Mega-cap tech firms still benefit from relatively low borrowing costs and strong cash positions.

And AI continues to attract large allocations despite tighter monetary conditions overall.

Speculative hoarding emerges

Yes.

Companies are stockpiling AI chips, data center capacity, and AI engineering talent in anticipation of future demand.

In many cases, this front-running occurs before clear business models or ROI are established, creating capital risk if demand growth slows.

Final Verdict: Bubble, Boom, or Both?

AI shows many features of a classic bubble: exuberant valuations, retail frenzy, concentrated leadership, and aggressive spending.

But it also rests on a foundation of real technological transformation, tangible productivity gains, and profitable infrastructure players.

That’s why bubbles can be so difficult to know without the benefit of retrospect.

Rather than labeling it a binary bubble or not, the current phase is best described as a boom with bubble pockets.

Just like the internet era, the overvalued will fall, but the survivors could become generational winners.

For investors, success will depend on separating sustainable innovation from unsustainable speculation.

Overall, stay vigilant, diversified, and go about with discipline.