AAAFx Review 2025

Awards

- Best CFD Broker - Forex Expo Dubai 2023

- Best FX Service Provider - Forex Expo Dubai 2022

- Most Transparent Broker - Ultimate Fintech Awards 2022

Pros

- There are sophisticated MT4 and MT5 charting platforms for advanced day traders, featuring a huge selection of indicators, drawing tools, chart types, and analysis features.

- AAAFx supports a wide range of payment methods with near-instant funding and zero transfer fees, ensuring convenient deposits.

- The minimum deposit is low and opening an account is fast, taking less than 5 minutes.

Cons

- By discontinuing ActTrader and lacking a proprietary platform, traders are limited to MetaTrader, which is outdated and less ideal for newcomers.

- You can’t make deposits and manage your AAAFx account through an app, meaning you have to sign in to the website, dampening the mobile trading experience.

- There are no proprietary educational tools, relying on ZuluTrade, making AAAFx less attractive to beginners compared to brokers like eToro.

AAAFx Review

In this AAAFx review, we evaluate the key features of this broker and compare them to industry leaders to give you a balanced view of its strengths and weaknesses. We will draw on our firsthand experience testing the accounts, platforms and overall trading environment at AAAFx.

Regulation & Trust

3 / 5AAAFx gets an average trust score. Although it’s authorized by two credible regulators, it lacks the extensive global regulatory oversight, large client base and stock exchange listing of our most trusted brokers, notably IG and Plus500.

AAAFx is regulated by the Hellenic Capital Market Commission (HCMC), under Triple A Experts. This Greek regulator follows the MiFID regulatory framework laid out by the European Securities and Markets Authority (ESMA) and provides important safeguards for traders, including negative balance protection.

Additionally, up to €30,000 per client is available through the Greek Guarantee Fund in the event the broker becomes insolvent.

AAAFx is also regulated by South Africa’s Financial Sector Conduct Authority (FSCA), under Sikhula Venture Capital (Pty) Ltd. The FSCA is a respected regulator, offering a degree of reassurance for clients in Africa especially, but it isn’t a first-rate regulator.

Also, we’ve lowered AAAFx’s trust score after learning the FSCA suspended the firm’s license for three months in 2020 for contravening monetary requirements.

| AAAFx | Dukascopy | World Forex | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | HCMC, FSCA | FINMA, JFSA, FCMC | SVGFSA |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

3.8 / 5Trading Accounts

AAAFx offers a choice of ECN accounts that cater to traders of all levels, from beginners through to advanced traders.

For clients in the EU:

- ECN – Suitable for entry-level traders with a $10 minimum deposit.

- ECN Plus – Geared towards advanced traders with superior pricing in return for a $10,000 minimum deposit.

- ECN Zulu – Best for social traders with access to an industry-leading third-party platform in return for a $300 minimum deposit.

For clients that register with the global entity, there is no Zulu account with social trading features, however there is a Swap-Free account that will serve Islamic traders plus a Zero account for traders seeking ultra-tight spreads.

One notable strength is that there are no restrictions on strategies, meaning day traders, scalpers, and algo traders are all catered to.

With ultra-fast execution speeds from 10 milliseconds, short-term traders can also secure optimal prices in fast-moving markets.

Alternatively, a demo account is available, which would be my go-to if you’re new to online trading and want to explore the broker’s services before depositing money.

Getting Started

Opening an AAAFx account is straightforward. It only took me a few minutes to register my details, verify the account using the code sent to my email and configure the account settings. ID verification can take just 5 minutes.

My only minor criticism is the sign-up portal which sports an extremely outdated and clunky design that trails most top brokers today. There is also no AAAFx trading app to register through.

Deposits & Withdrawals

AAAFx supports a wide range of fast and low-cost payment methods that ensure convenient account funding.

You can load your account with bank cards, wire transfers, e-wallets like Skrill and Sofort, plus cryptos like Bitcoin, which still isn’t widely accepted at brokerages.

For the fastest account funding, I’d recommend Neteller, Visa, Mastercard or UnionPay, as these normally offer near-instant transfers.

Importantly, AAAFx charges no service fees on any method.

My only gripe is that the range of methods for withdrawals is limited, with a much smaller suite of e-wallets and no Bitcoin.

| AAAFx | Dukascopy | World Forex | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Bitcoin Payments, Credit Card, Debit Card, Giropay, iDeal, Mastercard, Neteller, Przelewy24, QIWI, Skrill, Sofort, UnionPay, Visa, Wire Transfer | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Google Pay, Mastercard, Perfect Money, Visa, Volet, Wire Transfer |

| Minimum Deposit | $10 | $100 | $1 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Bonuses

AAAFx does not offer any bonus or incentive schemes to clients of its EU entity, in line with regulatory requirements.

That said, the global entity has several offers including a 100% deposit bonus that is added to clients’ accounts as trading credit, from $100 to a maximum of $40,000.

After reviewing the terms and conditions, I learned that you can withdraw profits made from the credit after meeting trading volume thresholds of 45% of the bonus amount. So, if you deposit $100, you’ll get $100 in trading credit and need to trade $45 before withdrawing any profits.

Assets & Markets

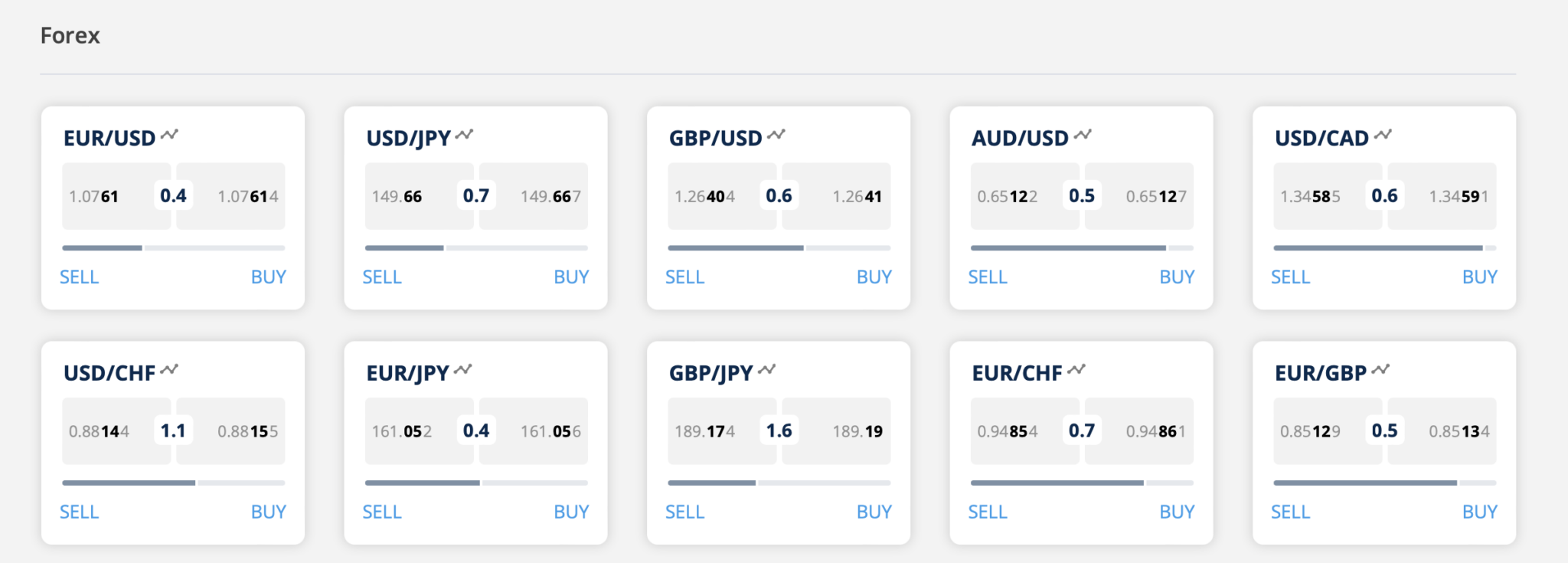

2.5 / 5AAAFx stands out with over 70 currency pairs, more than many competitors, making it a worthwhile choice for forex traders.

However, it seriously trails alternatives in the depth of its other asset classes, notably stocks (185+), indices (10+), commodities (10+), and cryptocurrencies (5+).

It’s the narrow suite of equities that is the biggest disappointment. While novice traders may be satisfied with speculating on major US stocks, intermediate and advanced traders looking to build a diverse portfolio with exposure to varied economies and sectors will be better off with a broker like CMC Markets, which provides over 10,000 stocks from around the world.

Access to trading products may also vary depending on the entity you sign up with.

| AAAFx | Dukascopy | World Forex | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Indices, Commodities, Cryptos | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Leverage

AAAFx primarily offers contracts for difference (CFDs), meaning users can go long or short using leverage, multiplying trading results.

Under the EU entity, you can trade with up to 1:30 leverage, while the global entity offers 1:500 leverage due to the more relaxed regulatory environment.

Fees & Costs

3.8 / 5AAAFx continues to earn its status as a low-cost broker with an ECN pricing structure that prioritizes tight spreads with low or no commissions.

In the EU, the entry-level ECN account provides spreads from near zero on its range of instruments, with commissions of $0.99 per side on forex, indices and commodities, and 0.93% on stocks.

That said, during testing I got spreads of 0.3 on EUR/USD, 0.2 on Apple, and 2.0 on the US 30. These are reasonable but trail the cheapest brokers, notably IC Markets and Fusion Markets.

Clients who deposit $10,000 can access the ECN Plus account, which has the significant benefit of commission-free forex trading. It also brings the commission to the low price of $0.74 per side on indices and commodities, and 0.075% on stocks, making it attractive for experienced day traders.

Pricing at the global entity is also strong, with the ECN and ECN Plus options offering similar raw spreads to the European accounts, but in this case, with a respective $100 and $1,000 minimum deposit. Commissions are $2.50 per lot for ECN and $1.50 per lot for ECN Plus.

The ECN Zero account, which is available to traders who deposit at least $50,000, takes the pricing even lower with the same raw spreads and no commissions, though it will be out of reach for the vast majority of retail investors.

| AAAFx | Dukascopy | World Forex | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.1 | 0.1 | From 0.6 |

| FTSE Spread | 1.0 | 100 | NA |

| Oil Spread | 3.5 | 0.1 | NA |

| Stock Spread | Variable | 0.1 | From 0.03 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

3.3 / 5AAAFx offers access to the reliable MetaTrader 4 and MetaTrader 5 platforms, which are great for active traders wanting advanced charting and algo trading tools.

ZuluTrade is also available, catering to investors seeking a hands-off trading solution.

On the downside, the lack of a proprietary platform designed with newer traders in mind is a serious drawback.

Also, despite ActTrader being advertised prominently on AAAFx’s website, there was no working download link for the platform during testing and after contacting customer support, I learned it’s no longer available.

I would like to see the AAAFx update its website so as not to mislead prospective traders about the availability of ActTrader.

MT4 and MT5

We’ve been testing MetaTrader for years, from the desktop software to the web trader and mobile apps:

- MT4 stands out as the premier choice for forex traders, the asset class the software was built for, featuring dozens of indicators and analytical objects, plus support for automated trading through its Expert Advisors. AAAFx also enhances its offering for algo traders by providing free VPS hosting for clients who deposit at least $5000.

- MT5 is best for multi-asset trading and advanced traders, owing to its wider selection of indicators, timeframes, order types and integrated features like newsfeeds. Automated traders are also catered for with robust backtesting capabilities.

On the downside, I’m growing tired of the outdated design and clunky feel across both MetaTrader platforms.

This is especially true when brokers like CMC Markets continue to enhance their Next Generation software, delivering a superior user experience with a slick design and a host of in-built research and analysis tools you can’t get in the MetaTrader suite.

ZuluTrade

For aspiring investors and hands-off traders, AAAFx also supports ZuluTrade.

One of the best-known social trading platforms, it provides access to over 90,000 strategy providers and a user-friendly environment for novice traders to learn and potentially profit from experienced investors.

The drawback for me is that weeding out suitable traders to follow can be challenging. ZuluTrade doesn’t formally vet signal providers, unlike DupliTrade, so it can be a manual and time-consuming process to find a provider that aligns with your goals and risk tolerance.

ZuluGuard is somewhat useful here, automatically unfollowing providers that deviate from their advertised strategies.

| AAAFx | Dukascopy | World Forex | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | MT4, MT5 | JForex, MT4, MT5 | MT4, MT5 |

| Mobile App | iOS & Android | iOS & Android | iOS, Android + Web Browser |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

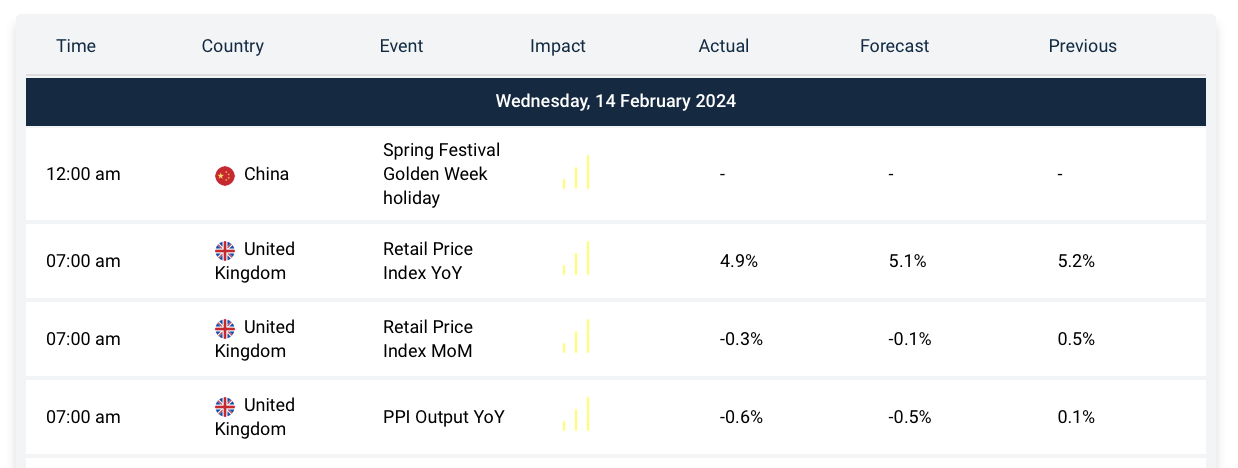

1 / 5AAAFx seriously trails the best brokers when it comes to research tools. There’s an economic calendar and trading calculators, but I consider these the bare minimum and there’s little else to help clients discover opportunities.

Not only is this limiting, but it makes for a frustrating trading experience because you need to toggle between the AAAFx platform and third-party resources.

As a comparison, category leaders like IG offer superior research tools that are integrated into the platform and app. These include market screeners, technical analysis, social/community research, comprehensive quote pages with diverse research segments, unique social analysis data, an engaging community forum, and IGTV for insightful video content, enhancing the trading journey for all levels of traders.

| AAAFx | Dukascopy | World Forex | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

0.5 / 5Educational content is another department where AAAFx falls far short of the mark, rendering it a poor choice for beginners.

Despite hours scouring the platforms and website for educational tools, and finally contacting customer support, I discovered there is nothing beyond the resources on ZuluTrade. Given that many active traders may not use the ZuluTrade platform, this is a major nuisance.

In contrast, eToro provides first-class educational tools for traders at all levels due to its Learning Academy and blogs. These provide a wide array of categorized and experience-tailored videos, articles, and weekly webinars, along with trading courses and a YouTube channel filled with educational content.

| AAAFx | Dukascopy | World Forex | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

4 / 5AAAFx offers decent support, available 24/5 via live chat, email and phone, with Greek and UK numbers available.

I’ve dealt with the customer service team on numerous occasions spanning a variety of issues from account safeguards and platform requirements to educational tools and tradable assets, and I’ve always got responses within 5 minutes.

Moreover, the agents who have dealt with me have been courteous and professional, even if they sometimes lack strong technical knowledge.

| AAAFx | Dukascopy | World Forex | |

|---|---|---|---|

| Customer Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Trade With AAAFx?

AAAFx is good if you want to trade forex on the MetaTrader platforms with ECN pricing, featuring tight spreads and low commissions. With no restrictions on strategies, fast execution and VPS hosting, it will serve day traders, scalpers and algo traders.

However, AAAFx’s mediocre investment offering beyond currencies makes it weak if you want to trade stocks, indices, commodities or crypto. Equally, its threadbare education and research means it’s less suited to beginners.

FAQ

Is AAAFx Legit Or A Scam?

AAAFx is a legitimate broker. It’s been operating since 2007 and is authorized by credible regulators, including the HCMC and FSCA.

Can I Trust AAAFx?

AAAFx has some of the hallmarks of a trustworthy broker; licenses from respected regulators, a long track record and safeguards like negative balance protection.

That said, its global branch is weakly regulated, it’s not as widely known as the larger, more established brokers, and it’s not listed on a stock exchange, which would enhance its transparency and foster confidence.

Is AAAFx A Regulated Broker?

Yes, AAAFx is regulated by the Hellenic Capital Market Commission (HCMC) in Greece and the Financial Sector Conduct Authority (FSCA) in South Africa.

Is AAAFx Good For Beginners?

AAAFx isn’t great for beginners. Despite offering a demo account, low deposit and social trading via ZuluTrade, it lacks the educational tools and research features available at category leaders like IG and eToro, which provide a more complete trading journey for newer traders.

Does AAAFx Offer Low Fees?

AAAFx offers competitive fees through its ECN trading model, with spreads near zero on forex pairs and low to no commissions. There is also no inactivity fee penalizing casual traders or deposit and withdrawal charges.

Is AAAFx A Good Broker For Day Trading?

AAAFx is suitable for day trading. It features fast execution speeds, tight spreads in its ECN accounts, and first-class charting tools through MetaTrader 4 and MetaTrader 5.

Does AAAFx Have A Mobile App?

AAAFx does not offer its own mobile app, but MT4 and MT5 can be downloaded to Android and iOS devices.

Both apps offer a stable trading environment, but you can’t manage your AAAFx account and make deposits – you need to sign in to the client area online.

Top 3 Alternatives to AAAFx

Compare AAAFx with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

AAAFx Comparison Table

| AAAFx | Interactive Brokers | World Forex | Dukascopy | |

|---|---|---|---|---|

| Rating | 3.9 | 4.3 | 4 | 3.6 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $10 | $0 | $1 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | HCMC, FSCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SVGFSA | FINMA, JFSA, FCMC |

| Bonus | 100% Deposit Bonus (global clients) | – | 100% Deposit Bonus | 10% Equity Bonus |

| Education | No | Yes | No | Yes |

| Platforms | MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 | JForex, MT4, MT5 |

| Leverage | 1:30 (EU), 1:500 (Global) | 1:50 | 1:1000 | 1:200 |

| Payment Methods | 14 | 6 | 10 | 11 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

World Forex Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by AAAFx and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| AAAFx | Interactive Brokers | World Forex | Dukascopy | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | No | Yes |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | No | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | Yes |

AAAFx vs Other Brokers

Compare AAAFx with any other broker by selecting the other broker below.

The most popular AAAFx comparisons:

FAQ

What documents does AAAFx require to open an account?

To register with AAAFx, clients need identification, proof of residence, proof of income, and proof of employment status. These documents can be uploaded to the account page or sent via email to the customer service team.

Is AAAFx trustworthy or a scam?

AAAFx is a legitimate broker that abides by regulations from authorities inside and outside of the European Economic Area. This coupled with over a decade of experience means we’re comfortable client capital is relatively secure.

Can I trade cryptocurrencies at AAAFx?

Six cryptocurrencies can be traded against the US dollar; Bitcoin, Litecoin, Ethereum, Ripple, and others.

Does AAAFx offer copy trading?

There are social and copy trading options offered by AAAFx with ZuluTrade.

Can you use MetaTrader 5 with AAAFx?

Yes, you can use MT5 on the AAAFx website and download it for desktop or Mac. MT4 is also provided on the the broker’s website. In addition, there is the ZuluTrade web-based platform that is designed for social and automated trading.

Can I open an AAAFx account in Canada?

No, Canada, along with the USA and China, belongs to the list of countries that do not allow the services provided by AAAFx.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Customer Reviews

There are no customer reviews of AAAFx yet, will you be the first to help fellow traders decide if they should trade with AAAFx or not?