StormGain Review 2025

See the Top 3 Alternatives in your location.

Awards

- Most Trusted Crypto Broker 2023 – World Finance

- Crypto Trading Platform of 2022 – AIBC

- Best Crypto Broker 2022 - World Finance

- Best Crypto Broker of 2021 – World Finance

- Best Crypto Broker of 2021 – UF

Pros

- Interesting instruments including crypto indices and tokenized gold and silver

- Tier-based account types with some decent mining rewards for high-volume traders

- Offers highly leveraged trading on 60+ crypto futures as well as indices, options and some spot cryptos

Cons

- Few futures compared to many similar competitors in the crypto sphere, such as Coinbase, Kraken and Binance, which offer hundreds

- Maker/taker fees are more than double some top rivals like Kraken

- Unregulated firm that has only been in business since 2019

StormGain Review

StormGain is a cryptocurrency trading platform that was founded in 2019 and, as of 2023, reports 12 million users, though like many other crypto firms it is unregulated. In this review, we look at StormGain’s main features and evaluate how they stack up against similar platforms and crypto brokers.

Regulation & Trust

Trust is top of our list when we review companies for day trading, and unfortunately like many other crypto firms StormGain is held back by its lack of regulation.

Our rating of 1.3/5 doesn’t mean StormGain is an untrustworthy firm – it reflects that trading with unregulated firms carries far more inherent risk than those overseen by a respected watchdog, and also that this is a relatively new firm and something of an unknown quantity.

This is even more of an issue when it comes to cryptocurrencies, which are extremely volatile. High-profile crypto firms have frequently collapsed due to mismanagement, scams or market downturns, the most recent example being the collapse of FTX in November 2022.

As a result, we recommend that traders consider using a crypto broker to get a taste of crypto trading with less risk.

Spreadex is a reliable, FCA-regulated option for UK traders who can access spread betting on eight crypto/USD pairs, and the CySEC-regulated FXCC also offers a decent range of crypto CFDs.

As for StormGain, I searched for evidence of any large-scale scams or security breaches in the company’s history and was relieved to find none.

However, it has only been around since 2019, a relatively short time compared to industry stalwarts like Kraken (2011) and Coinbase (2012).

Accounts & Banking

Crypto firms aren’t known to have varied account options, and StormGain follows suit with a single account for all traders.

I like the simplicity of having fewer accounts to choose between, but the problem here is that StormGain doesn’t offer very much to traders who sign up.

Rival firms allow traders to access a wide range of crypto and DeFi products from one account – OKX continues to provide great service in this area with an NFT marketplace and DeFi yield farming, while Nexo is known for its high yields on peer-to-peer loans.

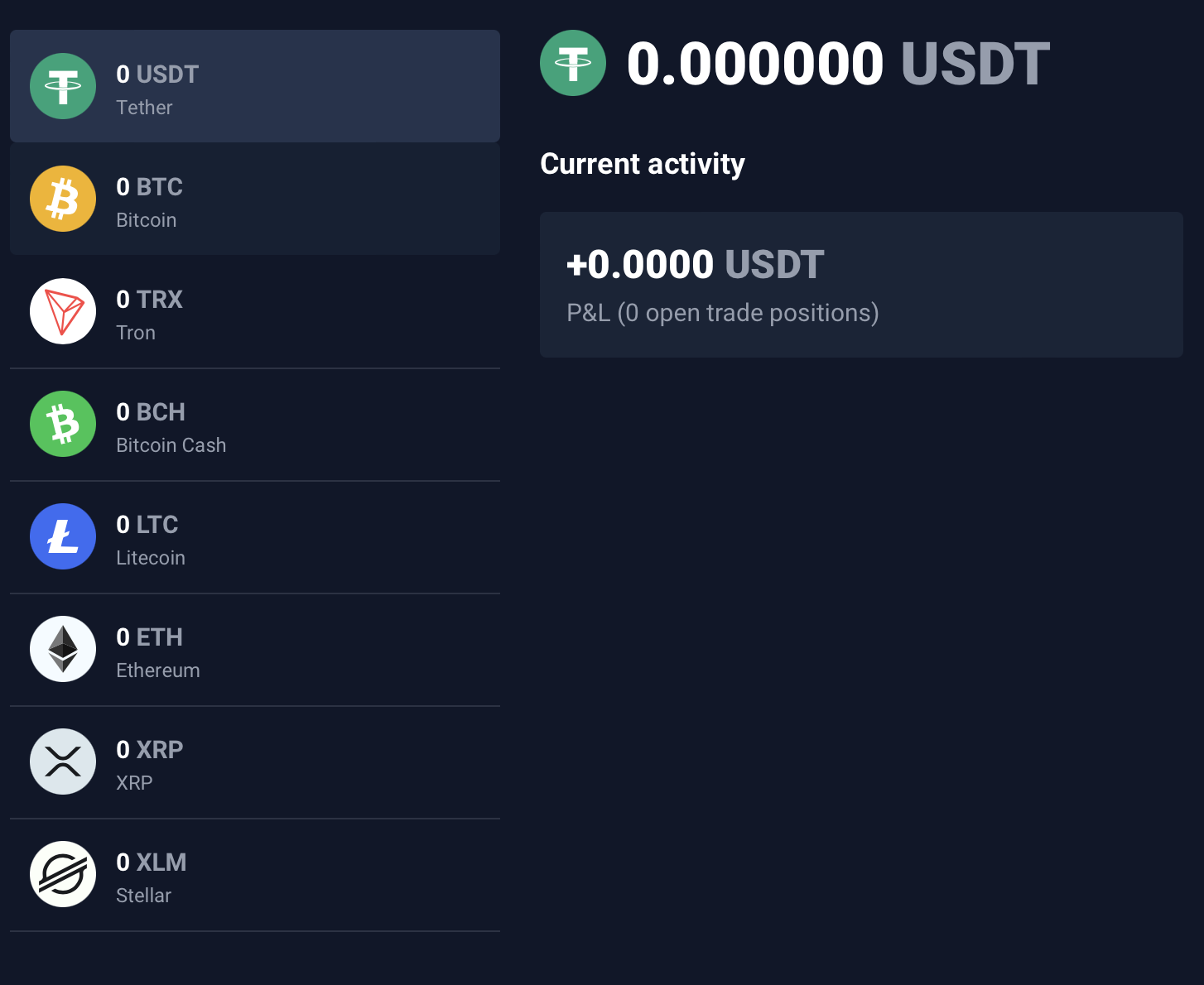

In comparison, StormGain’s wallets don’t offer you much, with just a handful of cryptocurrencies and tokenized gold and silver to buy and hold.

I do like the support for crypto staking and cloud mining, but both work effectively in a similar way to cashback schemes with higher interest rates and faster mining unlocked by increasing your trading volume.

This requires a very high monthly volume to reach a point where you’ll earn anything substantial, with at least $150,000 needed to access the first tier and $750,000 to access the tier after that. At these rates, I think most casual traders will be priced out.

Deposits & Withdrawals

StormGain traders need to fund their accounts with cryptocurrency, which can be done either via transfer from an existing wallet or by buying crypto via the Simplex on-ramp.

Direct crypto transfers are the cheapest with no minimum deposit and no charge on Stormgain’s end, though they will usually incur gas fees which can get expensive during busy periods.

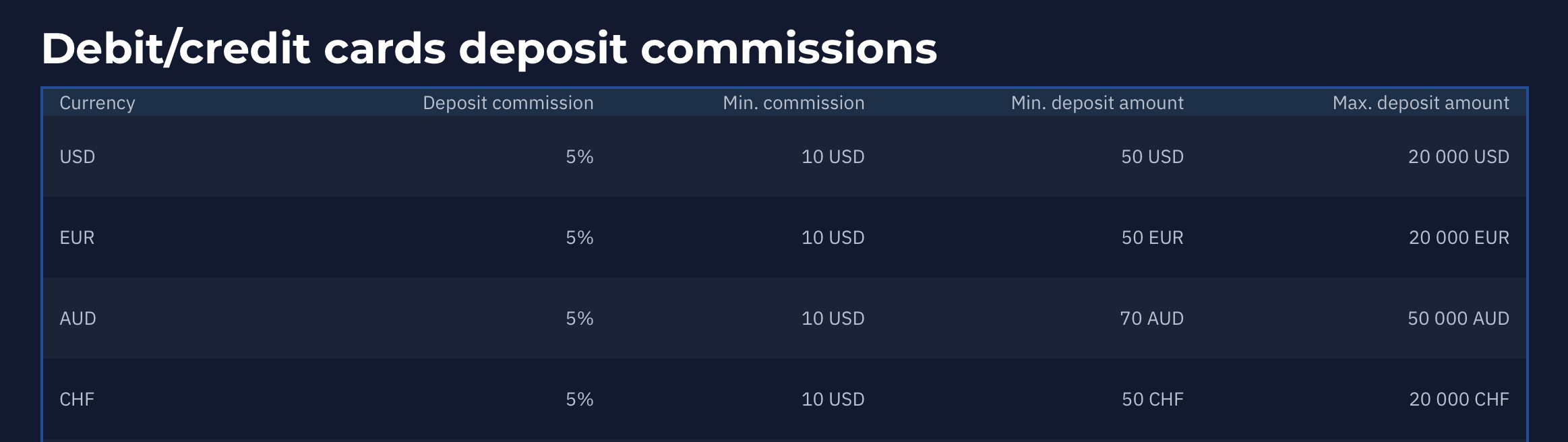

Buying crypto with a Visa or Mastercard is much more expensive, with a $50 minimum and a 5% card transaction fee (minimum $10) plus an exchange rate commission running from 1%-2.5%. This is a very high amount that will make it far more difficult to make a profit from trading, so I see it as a big disadvantage.

Bonuses

StormGain offers a few bonuses and incentives, though overall I find the brand lacking in this department.

Historically, StormGain has run sign-up bonuses like a $25 promo scheme, but no incentive was available at the time of research. The bonuses available now include a small trading credit supplement of up to $2 USDT for miners that can be accessed every 100 hours.

Besides this minor incentive, a deposit bonus of up to 20% of deposits is available, but you’ll need a high monthly trading volume to access them.

This starts at $150,000 trading volume per month to access a small 5% bonus, with the highest tier available for trading volumes about $75 million allowing just 20%.

All bonus payments are made in trading credit, are only used for increasing position size, and cannot be withdrawn.

We advise traders never to base their trading decisions on the availability of bonuses, but if you like to take advantage of these incentives while trading, we think offshore crypto brokers like IQ Cent offer better value, with a 20% deposit bonus for all traders and up to 200% available.

Demo Account

I was pleased to find a demo account available at StormGain, which gives all traders who register $50,000 USDT in virtual funds to practice trading with.

This is a great way to try out StormGain’s platform and services or to test new strategies, and it’s relatively unusual among crypto firms, so it was good to see here.

Assets & Markets

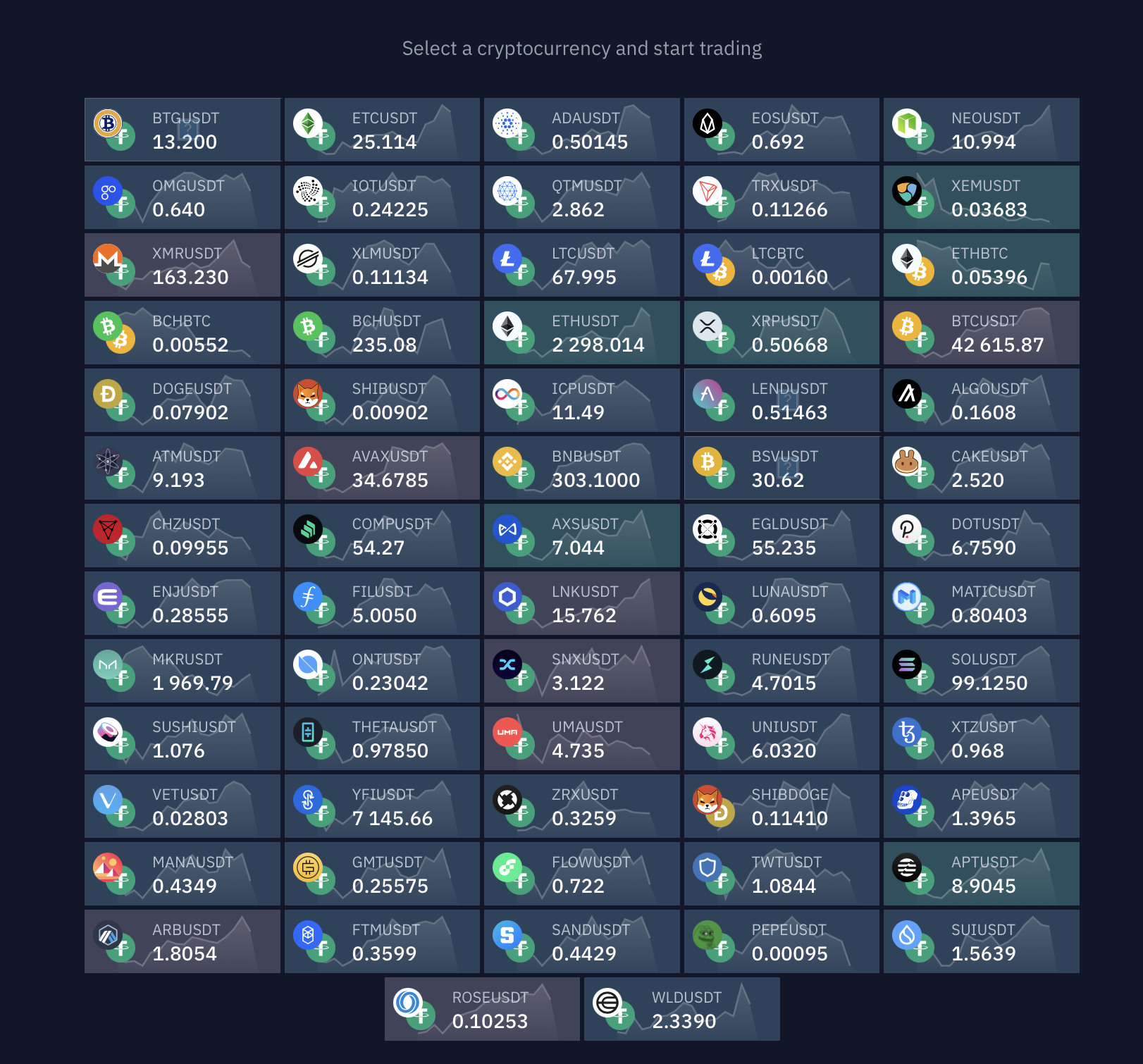

StormGain has a fairly good range of cryptos available for day traders who prefer derivatives, though we would have liked to see a larger range available for traders to buy and own directly.

The 70+ crypto futures and two crypto options are a big positive, as they allow traders to open long or short positions on popular crypto assets paired with USDT.

However, this is far below the range offered by big names like Kraken, which offers 115+ perpetual futures.

It was also disappointing to find just a few tokens available to buy and hold in your wallet. When competitors like Coinbase offer 248 or more, Stormgain simply doesn’t compete.

On the positive side, it does offer some less common assets in the form of three crypto indices, which group together three, five or ten popular tokens in a basket. I also like having the tokenized gold and silver, as these precious metals aren’t often available on crypto brokers or exchanges.

However, I don’t see these as enough to save an offering that overall is far narrower than most of StormGain’s main competitors.

Leverage

StormGain offers up to 1:300 leverage, which is very high for crypto trading and which traders who favour high-risk-high-reward strategies will see as a big advantage.

In practice, only the Bitcoin and Gold tokens are available to trade with this much leverage. Ethereum and Silver can be traded with up to 1:200, indices with up to 1:100 and everything else with a 1:50 maximum.

This is still a very significant amount of leverage, and we urge traders to use stop losses and other risk management strategies if they use it while trading these volatile instruments.

Take great care when trading with leverage, especially on volatile crypto instruments, and note that StormGain doesn’t provide negative balance protection.

Fees & Costs

We examined StormGain against similar exchanges and crypto brokers and found it to be a relatively expensive place for day trading crypto.

Firms like StormGain that offer crypto derivatives mainly make their money through maker/taker fees on trades, funding fees, commission fees on conversions and non-trading fees for things like card transactions.

Maker/taker fees, which are one of the main considerations for day traders, are very high at StormGain, and I was able to find competitors that were half the price or cheaper.

The basic 0.4% for makers and takers is double the 0.2% charged by Nexo, while Kraken charges just 0.05% and 0.02% to takers and makers respectively at its basic rate.

I also found the 5% charge for deposits very high, especially since an additional charge could be incurred for the exchange. This means crypto deposits are likely to be the most affordable, but these can also rack up high fees depending on the market conditions.

Additional fees include interest paid to fund a position. I was pleased to see that StormGain is transparent about these rates, which are typical for any firm that offers margin trading.

I think StormGain’s fees are the biggest barrier to it being a hit with day traders, who will find better value at better-known competitors.

Platforms & Tools

I enjoyed using StormGain’s margin trading and investing desktop platform, which is both user-friendly and powerful enough to conduct sophisticated analysis.

It is available via all major internet browsers, though the recommended access method is via the iOS and Android (APK) all-in-one apps.

The trading platform offers everything you need to trade, exchange and use digital currency coins. It’s available in over 10 languages and the in-platform live chat and video tutorials are useful for beginners.

When I used the terminal, I was impressed with the simple navigation and intuitive dashboard, which are ideal for new traders.

I also enjoyed the variety of charting tools to track trends and price movements, which are also easy to find and get to grips on the main screen.

One of the main selling points is free trading signals, which are available to StormGain users after signing up and which provide indicators based on probability and profitability.

While this is a decent feature, I don’t think it’s enough to sell StormGain as a leading platform. Rival exchanges’ platforms include some great features, like the social media analysis and newsfeeds on Nexo’s, and these were not present here.

Another thing I missed was having tools like copy trading and trading robots, which you will find on some good crypto brokers like IC Markets that offer trading through MetaTrader 4 and similar third-party platforms.

Other key features include:

- Customize charts using nine time-frames

- Exchange popular digital currency coins instantly

- In-built buy/sell recommendations with integrated trading signals

- Access 40+ technical indicators including Ichimoku Cloud and Stochastics

- Access advanced trading tools including position and risk-management software, an institutional level of liquidity and leverage up to 1:300

- Control your funds 24/7 in the app. Purchase and store crypto coins within a free, integrated multi-currency wallet

Research

StormGain’s research section is threadbare and I feel the brand is very weak compared to competitors in this department.

I found the main research tool, the Weekly Crypto Digest, to have some useful technical analysis on key crypto assets, suggested strategies and key events. However, this is far from a comprehensive look at the market and I felt the presentation was unprofessional, with duplicated text and poor editing.

Besides that, the website has a ‘Daily Review’ and a ‘Blog’ link, but both lead to the same page, which was more than eight months out of date when I visited.

This is very weak compared to exchanges like CoinBase, which keeps a regularly updated research and insights hub with analysis from experts, commentary and market intelligence reports.

Education

I like StormGain’s wide range of educational content, which contains enough to give beginners a great start while also having the depth to satisfy more experienced day traders.

My favorite educational content was in the intermediate to advanced section, which provided everything from lessons on technical analysis to topics on crypto regulation’s impact on fundamental analysis.

I was also pleased with the various step-by-step guides offered throughout. These cover many topics including how to purchase crypto, how to make a deposit and how to use the trading terminal, ensuring that even complete beginners won’t be lost on the platform.

Overall, there are some very useful resources for both new and seasoned investors, and though they might not reach the levels of our top picks for education like eToro, StormGain isn’t too far off.

Customer Support

We place a high priority on customer support because a helpful team makes it much easier to resolve difficulties and signals a professional operation.

StormGain has done fairly well with its support, which consists of a live chat with human team members during European business hours. Outside working hours, traders can use the same live chat window to leave a message with the team.

When I tested the chat function I received a response from a human agent within a minute and was able to find the information I asked for quickly.

The agent was helpful, though I was surprised that my simple questions related to the number of crypto tokens available were not answered directly and I was instead directed to a link.

Should You Trade With StormGain?

StormGain isn’t a bad option for day traders who want to access highly leveraged crypto futures on an easy-to-use platform, but it’s let down by far higher fees than similar crypto firms. We think you’ll find better value on an alternative exchange or from a good crypto broker.

FAQs

Is StormGain Legit Or A Scam?

StormGain has not been reported for any major security breaches or scams, and it is a fairly popular firm, but it has only been around since 2019 and isn’t regulated so we urge traders to take care.

Can I Trust StormGain?

Although we did not uncover any clear evidence of unscrupulous practices from StormGain, this is an unregulated company so you should always be careful when dealing with them.

Is StormGain A Regulated Broker?

StormGain is not a regulated crypto platform, so traders will be without some important safeguards.

Is StormGain Good For Beginners?

StormGain has some good features for beginner day traders, including a good range of educational content and an easy-to-use platform. However, we advise new traders to start their journey with a regulated broker since the level of risk is much lower.

Does StormGain Offer Low Fees?

We found StormGain’s fees very high compared to similar crypto firms. The maker/taker fees are considerably higher than some exchanges, and there is also a high 5% deposit fee for card transactions.

Is StormGain A Good Broker For Day Trading?

While StormGain has some positive for day traders, including the range of 60+ crypto futures, we think the fees will make it difficult to turn a profit.

Does StormGain Have A Mobile App?

StormGain’s mobile app works on Android and iOS devices.

Best Alternatives to StormGain

Compare StormGain with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Kraken – Kraken is a leading cryptocurrency exchange with a proprietary trading terminal and a list of 220+ tradeable crypto tokens. Up to 1:5 leverage is available with stable rollover fees on spot crypto trading and up to 1:50 on futures. The exchange also supports crypto staking and has an interactive NFT marketplace.

StormGain Comparison Table

| StormGain | Interactive Brokers | Kraken | |

|---|---|---|---|

| Rating | 3.9 | 4.3 | 3.9 |

| Markets | Cryptocurrency | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Cryptos |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $50 | $0 | $10 |

| Minimum Trade | $10 | $100 | Variable |

| Regulators | – | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, FinCEN, FINTRAC, AUSTRAC, FSA |

| Bonus | Tiered Loyalty Program | – | Lower fees when trading volume exceeds $50,000 in 30 days |

| Platforms | own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | AlgoTrader, Quantower |

| Leverage | – | 1:50 | – |

| Payment Methods | 6 | 6 | 6 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Kraken Review |

Compare Trading Instruments

Compare the markets and instruments offered by StormGain and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| StormGain | Interactive Brokers | Kraken | |

|---|---|---|---|

| CFD | No | Yes | No |

| Forex | No | Yes | No |

| Stocks | No | Yes | No |

| Commodities | Yes | Yes | No |

| Oil | No | No | No |

| Gold | Yes | Yes | No |

| Copper | No | No | No |

| Silver | Yes | No | No |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes |

| Options | Yes | Yes | No |

| ETFs | No | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

StormGain vs Other Brokers

Compare StormGain with any other broker by selecting the other broker below.

The most popular StormGain comparisons:

Customer Reviews

5 / 5This average customer rating is based on 1 StormGain customer reviews submitted by our visitors.

If you have traded with StormGain we would really like to know about your experience - please submit your own review. Thank you.

I had an excellent experience recovering and withdrawing funds from Stormgain.us.com. The merging of my USDT account went smoothly, the KYC verification was approved within a short time, and the withdrawal process was completed in just minutes. The system is efficient, and their response time is fast. I’ve been using Stormgain for a while, and I’ve never faced any serious issues. It’s refreshing to deal with an exchange that truly values its users and ensures their satisfaction.