Sharekhan Review 2025

Pros

- Third-largest stockbroker in India with a good reputation

- Regulated by the SEBI

- Strong market research

Cons

- AMC charges after the first year

- Access restricted to local markets like the NSE and BSE

- Accounts are only available to Indian residents or NRIs

Sharekhan Review

Sharekhan is one of the largest stock and derivatives brokers in India. Founded in 2000, the brokerage was one of the pioneers of online trading in India and considers itself your guide to the financial jungle. Sharekhan is a company built on competitive pricing and great customer care, help and support. This review will run through everything you need to know about Sharekhan, including information on its trading platform, the assets available and the brokerage’s trading charges.

Sharekhan Headlines

Founder and former owner Shripal Morakhia, a Mumbai-based entrepreneur, started Sharekhan in 2000. Its history is full of growth and, since its inception, the broker has gone on to become the 5th largest retail brokerage and 8th largest stockbroker in India. Sharekhan was acquired by BNP Paribas, the French banking group in July 2015.

Sharekhan’s head office/headquarters are in Mumbai, India. The broker is regulated by the Securities and Exchange Board of India (SEBI). By 2020, the broker had acquired over 1.4 million customers and had 400,000 trades executed daily. These customers come from all over the world, comprised of resident and non-resident Indians (NRIs), who can open accounts and use both online and offline login options.

Offices

Whether you are in Pune or Vashi, if you are looking to find an “office or branch near me” Sharekhan has offices in Patna, Pune (J M Road), Jaipur (C Scheme), Jayanagar (3rd and 4th block branch), Kanjurmarg, V V Nagar, Vadodara (O P Road), Faridabad, Hyderabad, Goregaon West, Gandhinagar, Yelahanka, Ghatkopar East, New Dehli (Pusa Road), Gwalior, Jamshedpur, Jamnagar, Kolkata, Kalyan Branch, Karol Bagh, Kandivali West, Udaipur, Vasant Vihar and Vashi.

Recently, Sharekhan has also expanded into the United Arab Emirates (UAE).

Trading Platform

Sharekhan offers a wide range of options when it comes to trading platforms. The first is to trade through the website’s special web app. The web experience is simple and hassle-free from account opening to trading and account closure. The website is fully functional with the ability to set up alerts and get in-depth views of your portfolios. You can also access the Sharekhan classroom, an education centre, where you can learn the basics of the market and get tips through e-learning.

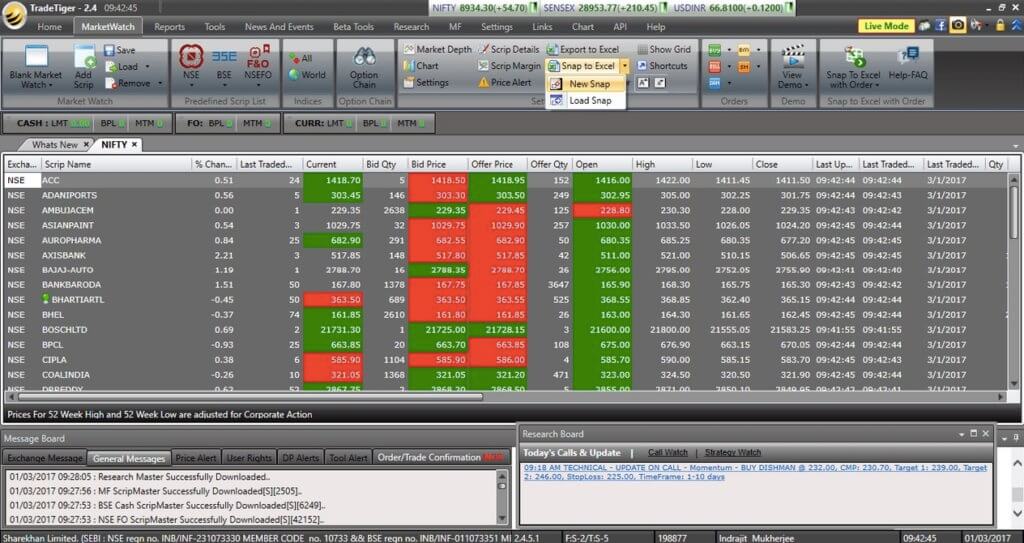

Sharekhan’s advanced desktop trading platform is Trade Tiger, named after the company’s logo. Currently, the Trade Tiger 2.6 software is available for download for Windows 7 and above. This is the most popular trading platform for the broker’s clients and is kitted out with many advanced charts and analysis tools, such as a heat map, which uses colour coding to indicate the performance of a sector’s stocks.

Opening and closing trades is easy and there is even the option to place advanced orders like bracket orders, big trades and bulk orders. Through this platform, you can also look at recently released IPOs, such as the Zomato IPO, and decide whether to invest or not. It is also easy to track and view profit and loss (p&l) reports and statements through your ledger, as well as quarterly results and settlements for companies.

Finally, for those without access to the internet, Sharekhan offers a dial-n-trade service. There are dedicated toll-free numbers that direct you to a tele-broker. Orders can be placed via this method with no limit. Calls can be placed for other services too, such as research calls where advice and stock recommendations are offered by Sharekhan in 2025 according to their 3R research philosophy.

Assets

Through Sharekhan you can trade a variety of markets: Stocks, ETFs, forex, mutual funds, bonds, futures and options (F&O). At this point, you cannot trade CFDs and crypto.

Sharekhan gives access to two stock Indian stock exchanges, the NSE and BSE, and over 130 ETFs, which offer an opportunity for traders to invest in US stocks. Forex can only be traded as futures and there are six currency pairs on offer. There are over 50 mutual fund providers on offer.

Sharekhan lets you access futures and options (F&O) after filling out the activation form online. These can be traded on either of the two exchanges available. Profits can also be calculated through F&O brokerage calculators.

Sharekhan Fees

There are many charges associated with trading on Sharekhan. Demat accounts are subject to annual maintenance charges (AMCs) of INR 400, though there are no fees during the first year.

Trading fees are also charged by Sharekhan, with intraday trading incurring fees of 0.1%. Delivery charges are 0.5% and commodities are charged 0.1%. There are no charges for mutual fund trading.

Futures and options trading with Sharekhan are charged varying fees, with futures incurring a 0.1% charge. Options are charged either INR 100 per lot or 2.5% of the premium (whichever is higher). Forex currency futures are charged a 0.1% commission.

Leverage

Leverage and exchange margin funding (EMF) rates for Sharekhan vary depending on whether you are intraday trading or not. The intraday leverage rate is 1:6, while other forms of margin trading are capped at 1:2. You can use a margin calculator online to see a full breakdown of the options for different assets.

Mobile Apps

The broker has two mobile trading apps, Sharekhan mini and Sharekhan app, both of which are available for download on Android and iOS. The two apps are fully functional, with Mini designed for use in low bandwidth situations. Both apps update regularly, the interfaces are intuitive and minimalistic and page loading is quick. Both apps can open and close trades easily and view up-to-date share prices.

Payment Methods

With Sharekhan, it is only possible to deposit and withdraw funds via bank wire transfer. Credit/debit cards and electronic wallets are not accepted. Typically, it takes around 2-3 days for deposits and withdrawals to be processed and for the money to appear in the recipient account.

Demo Account

Sharekhan does not offer a demo account. However, the broker regularly has demonstrations on the website for things like order placements to teach its users a little more about its services.

Deals & Promotions

Sharekhan runs a refer and earn scheme through which traders earn 15% of every referred friend’s brokerage charges for one year. The referee receives the benefit of free research coverage, one year of free access to Trade Tiger and free access to the Sharekhan classroom.

Regulation & Licensing

Sharekhan is regulated by the Securities and Exchanges Board of India, a reputable regulator. This, combined with the fact that its parent company, BNP Paribas, is listed on the Euronext Paris stock exchange leads Sharekhan to be considered a safe and trustable company and stock brokerage.

Education

Education is a huge part of Sharekhan’s services. The broker has been providing financial education globally for over 10 years. There are six locations across India where education is provided in person and there is a wealth of resources provided online, including training courses and webinars. Whether you are a beginner or an experienced trader, Sharekhan can teach you something new about forex, stock or derivatives trading. There are also resources uploaded to YouTube that can provide further advice.

Discount Broking

Espresso is Sharekhan’s discount broking site. With this sub-broker, traders only pay when they profit at a flat rate of INR 20 per order. Order placements are also designed to be quick and easy, with dynamic price alerts and a synchronized watchlist.

Sharekhan also plans to release a new discount broking site, Express, in September 2021.

Pattern Finder

Pattern finder is a Sharekhan trading tool that analyses stocks and indices to find profitable opportunities and inform you. It scans all listed stocks on supported markets each night and outputs charts, patterns and forecast prices. This information is then given to you the next day before the market opens.

Account Types

Sharekhan offers four account types to suit different customers’ needs. There is the first step account (for beginners), classic account (for investors), trade tight account (for active traders) and advisory account (for High-net-worth investors or HNIs).

Demat Account

All traders intending to invest in the financial markets in India need a Demat account. Any prospective customers without one can open a 3-in-1 Demat account with Sharekhan, which lets you log in as a resident or non-resident Indian.

Sharekhan is a depository participant (DP) of both NSDL and CDSL. When you open an account, you will receive a Sharekhan DP ID. The type of DP ID depends on which depository you use: NSDL DP ID or CDSL DP ID.

Trading Hours

Sharekhan’s trading hours match those of the stock exchanges they offer trading on. The market opens at 09:00 IST (GMT +5:30) and closes at 17:00 IST. The broker also offers an after-hours market from 23:00 to 09:00 that allows customers who cannot trade in the day to set orders to be executed the next day.

In Sharekhan’s calendar, there are 14 holidays in 2021, which match the holidays for the NSE and BSE stock exchanges.

Contact Details

Sharekhan prides itself on strong levels of customer support. If you forgot your password or old login ID, want to change your password or have any other queries or issues, the broker’s 24 -hour customer care is there. The team can be contacted via a telephone helpline, email or a live chat function on the website:

- Live Chat: Lower right corner of the website

- Email Address: myaccount@sharekhan.com

- Telephone Numbers: 022-25753200, 022-33054600, 022-61151111

Safety & Security

Sharekhan offers a two-step login to keep your account and data safe. This feature must be turned on in settings under two-factor authentication (2FA). Authentication can be completed through apps like Google authenticator. The broker also requires that customers comply with know-your-customer (KYC) protocols. It is possible to update your KYC details once they have been filled out.

Competitors

So how does Sharekhan compare to competitors like Zerodha, Upstox, Groww, 5paisa, Angel Broking, Geojit and Motilal Oswal.

Overall, Sharekhan offers equal or better services than most of its rivals. It offers more trading platforms and charges for account opening and AMC charges. However, trading charges and brokerage rates can be higher for Sharekhan compared to some of its competitors.

Sharekhan Verdict

Sharekhan is a unique broker offering Indian traders a wealth of exciting and innovative services. The broker’s asset range is competitive, along with its trading platforms educational content and customer support. However, trading charges and the lack of CFDs or cryptos hold Sharekhan back slightly. Additionally, only Indians can open an account, greatly inhibiting its customer base and anyone from a different country must find another option.

FAQs

Is Sharekhan A Depository Participant?

Yes, Sharekhan is a depository participant (DP) for both NSDL and CDSL depositories.

Is Sharekhan A Discount Broker?

Yes, Sharekhan is a discount broker with its own subsidiary, Espresso, specialising in quick, easy, discount services.

Is Sharekhan A Good Broker?

Sharekhan offers low fees, free signals and a range of trading platforms, providing a little bit of something for everything. However, only Indian clients are accepted and markets are limited to the NSE and BSE.

Is Sharekhan A Custodian?

No, Sharekhan is not a custodian. It is a broker, a custodian can be appointed separately to guard your assets.

Can I Open An Account In The UK?

Only if you are a non-resident Indian. Other traders cannot open an account as Sharekhan only accept Indian residents and NRIs.

Top 3 Alternatives to Sharekhan

Compare Sharekhan with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- NinjaTrader – NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand’s award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

Sharekhan Comparison Table

| Sharekhan | Interactive Brokers | FOREX.com | NinjaTrader | |

|---|---|---|---|---|

| Rating | 3.2 | 4.3 | 4.4 | 4.5 |

| Markets | Forex, Stocks, ETFs, Futures, Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, Stock CFDs, Futures, Futures Options | Forex, Stocks, Options, Commodities, Futures, Crypto |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $100 | $0 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | SEBI | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC | NFA, CFTC |

| Bonus | – | – | VIP status with up to 10k+ in rebates – T&Cs apply. | – |

| Education | No | Yes | Yes | Yes |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | WebTrader, Mobile, MT4, MT5, TradingView | NinjaTrader Desktop, Web & Mobile, eSignal |

| Leverage | – | 1:50 | 1:50 | 1:50 |

| Payment Methods | 1 | 6 | 8 | 4 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

FOREX.com Review |

NinjaTrader Review |

Compare Trading Instruments

Compare the markets and instruments offered by Sharekhan and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Sharekhan | Interactive Brokers | FOREX.com | NinjaTrader | |

|---|---|---|---|---|

| CFD | No | Yes | No | No |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | No | Yes |

| Silver | No | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | No | Yes |

| Futures | Yes | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | Yes | Yes | No | No |

| Bonds | No | Yes | No | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | No |

Sharekhan vs Other Brokers

Compare Sharekhan with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Sharekhan yet, will you be the first to help fellow traders decide if they should trade with Sharekhan or not?