Saxo Bank Slashes Fees on Stocks, ETFs, Options & Futures

Saxo Bank has kicked off 2024 by lowering its trading and non-trading fees. The new prices take effect from 15 January.

Key Takeaways

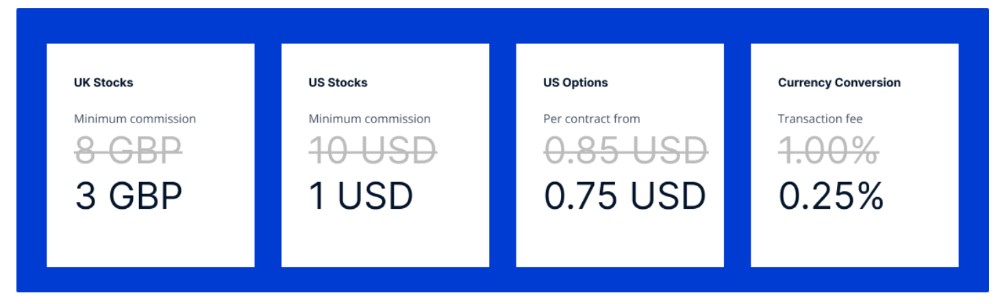

- The minimum commission on US Stocks has been cut from $10 to $1.

- The currency conversion transaction fee has been reduced from 1% to 0.25%.

- The inactivity fee charged on dormant accounts has been removed.

The key changes apply to commissions on stocks, ETFs, options and futures spanning major exchanges in North America, Canada, Europe, the Middle East, Africa and Asia Pacific.

Saxo Bank also continues to offer excellent pricing for forex and metal traders, with spreads from 0.4 pips.

About Saxo Bank

Saxo Bank is an award-winning broker, established in 1992 with authorization from a long row of trusted regulators, including FINMA in Switzerland, MAS in Singapore, ASIC in Australia and FCA in the UK.

For serious traders, Saxo Bank offers a comprehensive package, with a huge selection of 70,000+ instruments, excellent liquidity and top-rate research through webinars, videos, daily podcasts and more.

Between the SaxoTraderGO and SaxoTraderPRO platforms, alongside third-party solutions like Dynamic Trend and MultiCharts, the broker also offers a first-class suite of analysis tools and charting packages.