Best Ripple Brokers Exchanges 2026

Ripple brokers and exchanges allow you to trade XRP by either buying the token directly or speculating on its price through derivatives. Dig into DayTrading.com’s pick of the best brokers and exchanges for trading Ripple, revealing high-trust, low-cost platforms with excellent tools.

Top 6 Ripple Brokers & Exchanges 2026

After testing 140 platforms, we’ve identified the 6 best options for secure XRP trading :

Why Are These Brokers the Best for Trading XRP?

Here’s a quick summary of why we believe these platforms lead the way for Ripple (XRP) trading:

- Interactive Brokers is the best XRP broker in 2026 - IBKR lets you purchase and hold Bitcoin, Bitcoin Cash, Ethereum, and Litecoin at competitive commission rates and without needing a crypto wallet. Additionally, there is a range of other diverse assets to explore, such as crypto indices like the NYSE Bitcoin Index, as well as futures contracts like the BAKKT Bitcoin Futures.

- FOREX.com - You can trade a small range of 8+ cryptos against USD, EUR, GBP and AUD with tight spreads and no virtual wallet required. Algo traders can also utilize Expert Advisors (EAs) to automate their crypto trades.

- xChief - xChief’s range of 5 cryptocurrencies paired with USD is smaller than most competitors. In addition, the average BTCUSD spread of 30 pips is not the cheapest. That said, the broker does offer some useful crypto trading guides for beginners.

- InstaTrade - InstaTrade offers a modest selection of around 12 cryptos against the USD, tradable via CFDs. Fees are low, especially for major assets like BTC/USD with spreads from 0. There's also a dedicated cryptocurrency blog with useful technical insights to support short-term trading decisions.

- Pionex - Make spot, future and leveraged trades on 120 cryptocurrencies via Pionex's proprietary platform with built-in trading bots and highly customizable automated trading options. On the negative side, the range of tokens is narrower than many alternatives.

- Nexo - Nexo offers trading on an impressive suite of around 70 tokens, including Bitcoin. Digital assets can be bought, sold and swapped directly on the exchange or traded in over 500 pairs. Digital assets can also be used as collateral for fiat loans or used to generate passive income with the ‘smart staking’ tool or from interest earned via peer-to-peer loans.

Compare the Top XRP Brokers and Exchanges Across Key Features

Find the best XRP trading platform for your needs by comparing critical features valued by active Ripple traders:

| Broker | XRP Margin Trading | Payment Methods | Regulators |

|---|---|---|---|

| Interactive Brokers | ✔ | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| FOREX.com | ✔ | ACH Transfer, Credit Card, Debit Card, Mastercard, Neteller, PayNow, Skrill, Visa, Wire Transfer | NFA, CFTC |

| xChief | ✔ | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, FasaPay, Neteller, Perfect Money, Skrill, UnionPay, Volet, WebMoney, Wire Transfer | ASIC |

| InstaTrade | ✔ | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Mastercard, Visa, Wire Transfer | BVI FSC |

| Pionex | ✔ | Bitcoin Payments | FinCEN |

| Nexo | ✔ | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Google Pay, Wire Transfer | - |

How Safe Are These XRP Trading Platforms?

Security matters - especially in crypto. See how the top XRP brokers protect user funds:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Interactive Brokers | ✘ | ✔ | ✔ | |

| FOREX.com | ✘ | ✔ | ✘ | |

| xChief | ✘ | ✘ | ✔ | |

| InstaTrade | ✘ | ✔ | ✔ | |

| Pionex | ✘ | ✘ | ✘ | |

| Nexo | ✘ | ✘ | ✘ |

Compare XRP Mobile Trading Platforms

We tested mobile apps for speed, reliability, and features - here’s how the best XRP brokers performed on mobile:

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| FOREX.com | iOS & Android | ✘ | ||

| xChief | iOS & Android | ✘ | ||

| InstaTrade | iOS & Android | ✘ | ||

| Pionex | iOS & Android | ✘ | ||

| Nexo | iOS & Android | ✘ |

Are These Top XRP Brokers Beginner-Friendly?

If you’re new to Ripple trading, here's how these brokers offer intuitive tools and educational resources to help you get started:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| FOREX.com | ✔ | $100 | 0.01 Lots | ||

| xChief | ✔ | $10 | 0.01 Lots | ||

| InstaTrade | ✔ | $1 | 0.01 | ||

| Pionex | ✘ | $0 | 0.1 USDT | ||

| Nexo | ✘ | $10 | $30 |

Are These XRP Brokers Suitable for Experienced Traders?

Advanced XRP traders demand more - see which platforms offer the tools, analytics, and speed needed for a serious edge:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | ✔ | ✘ | 1:50 | ✔ | ✔ |

| FOREX.com | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| xChief | Expert Advisors (EAs) on MetaTrader | ✘ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

| InstaTrade | Experts Advisors (EAs) on MetaTrader | ✔ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

| Pionex | Crypto bots | ✘ | ✘ | ✘ | - | ✘ | ✘ |

| Nexo | - | ✘ | ✘ | ✘ | - | ✘ | ✘ |

Compare Ratings of the Top XRP Brokers and Exchanges

See how each XRP trading platform scored in essential categories based on our expert-led evaluation:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| FOREX.com | |||||||||

| xChief | |||||||||

| InstaTrade | |||||||||

| Pionex | |||||||||

| Nexo |

How Popular Are These XRP Brokers?

Find out which XRP brokers and exchanges have built the biggest followings:

| Broker | Popularity |

|---|---|

| InstaTrade | |

| Pionex | |

| Nexo | |

| Interactive Brokers | |

| xChief | |

| FOREX.com |

Why Trade Ripple (XRP) with Interactive Brokers?

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Coins | BTC, LTC, ETH, XRP |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | 0.12%-0.18% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

- While primarily geared towards experienced traders, IBKR has made moves to broaden its appeal in recent years, reducing its minimum deposit from $10,000 to $0.

- IBKR continues to deliver unmatched access to global stocks with tens of thousands of equities available from 100+ market centres in 24 countries, most recently the Saudi Stock Exchange.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

Why Trade Ripple (XRP) with FOREX.com?

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Coins | BTC, BCH, ETH, LTC, XRP |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | BTC 1.4%, ETH 2% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Regulator | NFA, CFTC |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- The in-house Web Trader continues to shine as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

Cons

- Funding options are limited compared to leading alternatives like IC Markets and don’t include many popular e-wallets, notably UnionPay and POLi.

- Despite increasing its range of instruments, FOREX.com's product portfolio is still limited to forex and CFDs, so there are no options to invest in real stocks, real ETFs or real cryptocurrencies.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

Why Trade Ripple (XRP) with xChief?

"xChief continues to prove popular with investors looking to trade highly leveraged CFDs on the popular MetaTrader platforms. The broker's rebate scheme and investment accounts will particularly appeal to seasoned traders. However, the lack of top-tier regulatory oversight is a major drawback."

William Berg, Reviewer

xChief Quick Facts

| Coins | BTC, BCH, ETH, LTC, XRP |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Variable |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Regulator | ASIC |

| Account Currencies | USD, EUR, GBP, JPY, CHF |

Pros

- Traders can access a copy trading solution via the MetaQuotes Signals service

- The low minimum deposit of $10 will appeal to beginners, as well as the beginners’ guides in the Library

- The broker offers a turnover rebate scheme geared towards active investors, as well as trading credits and several other occasional bonuses

Cons

- The total range of 150+ assets is much lower than most competitors who typically offer hundreds

- The Classic+ and Cent accounts provide access to fewer instruments than the other account types, at 50+ and 35+, respectively

- xChief is an offshore broker with weak regulatory oversight from the VFSC, so traders will receive limited safeguards

Why Trade Ripple (XRP) with InstaTrade?

"Although InstaTrade offers active trading on a comprehensive platform, it stands out with its fairly unique Fixed Income Structured Product (FISP), providing passive investment opportunities with up to 50% returns in 6 months if conditions are met. "

Christian Harris, Reviewer

InstaTrade Quick Facts

| Coins | BTC, ETH, XRP, LTC, SOL, UNI, DOGE, BCH, FIL, ADA, DOT, LINK |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | InstaTrade Gear, MT4 |

| Minimum Deposit | $1 |

| Regulator | BVI FSC |

| Account Currencies | USD, EUR, RUB |

Pros

- InstaTrade delivers an excellent suite of charting tools for day traders with its web trader comprising 250+ indicators, 11 chart types and a user-friendly design.

- VPS hosting caters to algo trading strategies with a dedicated physical server providing rapid execution speeds as low as 9 milliseconds.

- Despite an average investment offering of around 300 assets, InstaTrade offers a particularly strong suite of currency pairs, catering to advanced traders seeking opportunities in volatile exotics.

Cons

- Marketing of the FISP, especially phrasing around the “guarantee of profitability” and the “elimination of risks of trading on financial markets” raises concerns.

- InstaTrade is registered in the offshore jurisdiction of the British Virgin Islands, resulting in limited regulatory safeguards for retail investors.

- InstaTrade sports one of the most cluttered websites and client cabinets in the industry, potentially overwhelming new traders, especially compared to XTB’s intuitive trading journey and resources.

Why Trade Ripple (XRP) with Pionex?

"Pionex is an excellent option for crypto traders with an interest in cutting-edge AI like ChatGPT and automated trading."

William Berg, Reviewer

Pionex Quick Facts

| Coins | BTC, LTC, ETH, BUSD, EOS, BTT, TRX, NFT, DOGE, XRP, HT, ALICE, FIL, DOT, JST, AXS, UNI, AAVE, WIN, SUN, CAKE, LINK, BAKE, BCH, ETC, SNX, TFUEL, ADA, PUNDIX, ICP, MDX, FLOW, DODO, MFT, BSV, MATIC, CSPR, SHIB, ATOM, SUSHI and many more |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Market |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | Own |

| Minimum Deposit | $0 |

| Regulator | FinCEN |

Pros

- Money Services Business (MSB) license by US FinCEN

- Low trading fees compared with other major exchanges at 0.05% maker and taker

- Supports crypto derivatives via futures trading

Cons

- Does not accept fiat deposits

- Withdrawal fees and limits may apply

- Weak regulatory oversight raises safety concerns

Why Trade Ripple (XRP) with Nexo?

"Nexo gives crypto traders the capability to trade, invest, lend and borrow digital assets in one place, and it’s especially good for its credit functions that pay out very high yields to lenders. However, its fees are relatively high and many day traders will prefer a more tightly regulated crypto broker."

Michael MacKenzie, Reviewer

Nexo Quick Facts

| Coins | BTC, ETH, NEXO, USDT, USDC, AXS, RUNE, MATIC, DOT, APE, AVAX, KSM, ATOM, FTM, NEAR, BNB, ADA, SOL, XRP, LTC, LINK, BCH, TRX, XLM, EOS, PAXG, UNI, DOGE, MANA, SAND, GALA, SUSHI, AAVE, CRV, MKR, 1INCH, DAI, USDP, TUSD |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | N/A |

| Crypto Lending | Yes |

| Crypto Staking | Yes |

| Platforms | Nexo Pro |

| Minimum Deposit | $10 |

| Account Currencies | USD, EUR, GBP |

Pros

- Nexo Pro is a user-friendly proprietary platform that suits day trading strategies with great charting features

- Traders can access perpetual futures to open long or short positions on crypto assets, increasing strategic opportunities

- Value-add tools integrated into the trading platform including social media analysis and newsfeeds by asset

Cons

- High deposit and withdrawal fees for cards and e-wallets will price many traders out of the most convenient payment methods

- Very few educational resources are available, reducing its appeal to beginners who can find more helpful resources at category leaders like eToro

- Although Nexo has registered with some reputable watchdogs, it is riskier to trade with than established crypto brokers like AvaTrade and Vantage

How DayTrading.com Chose The Top XRP Brokers And Exchanges

We ranked Ripple (XRP) brokers and exchanges using overall ratings informed by over 200 metrics across eight core categories.

Hands-on platform tests were also conducted by our team, including traders who actively hold XRP in their own portfolios, ensuring practical, real-world relevance.

Broker Or Exchange?

The largest volume of crypto transactions, including for XRP, takes place on dedicated crypto exchanges like Binance, Kraken and BitMEX.

However, as the regulatory environment for cryptocurrencies developed, crypto brokers have also become commonplace.

From our standpoint, the most important difference between a Ripple exchange and a broker is that reputable regulators do not tend to licence exchanges as they do brokers.

This means that exchanges are not always obliged to meet the stringent criteria needed to obtain a licence from a regulator on our ‘green-tier’ list, such as the UK’s Financial Conduct Authority (FCA), and will not be obliged to regularly report activities to maintain a licence.

Traders on an exchange will also miss out on protections that must be provided to clients of brokers, such as the £85,000 indemnity cover available in the UK from FCA-regulated brokers.

Of course, there are some benefits to trading with an exchange – the range of crypto assets is usually higher, with more tokens paired with Ripple; the spreads might be slightly narrower; and you will not be constrained by regulatory rules like leverage caps.

But generally we opt for the more secure XRP brokers and suggest all but the most experienced crypto day traders to do the same.

How To Choose A Ripple Provider

These are the critical areas to consider when choosing an XRP trading provider:

Trust

Always take the time to ensure the broker or exchange you deal with is reputable and above board – this is the most important step you can take to protect your hard-earned cash.

Ripple’s own CTO, David Schwartz, has warned of the potential for crypto scams built on the XRPL network, illustrating the added risk of day trading crypto tokens like XRP.

This is why we always use the following steps to assess the reliability of a broker or exchange as a priority in our reviews:

- We thoroughly assess cover by regulators and other third-party organizations. For a broker, this involves identifying which regulators have granted licences and checking that all of these are up to date. For an exchange, we might check for third-party auditing and specific registrations (such as a Money Services Business registration in the US).

- We prioritize brokers and exchanges that have been in the business serving large client bases for a long time.

- We form our opinion about the broker by personally testing its products.

There are also some red flags we look out for when assessing whether a Ripple exchange or broker is reliable:

- We check the track record of Ripple brokers and exchanges to find and rule out any that have been involved in fraudulent or unscrupulous activity.

- We read through the firm’s website and promos to look for poorly spelt and ungrammatical material – in our experience, sure signs of an unprofessional if not openly fraudulent company.

- We carefully check the URL of a site to ensure it is not a clone of a legitimate firm.

- We instantly rule out any broker or exchange that approaches us via social media, or that advertises unrealistic or guaranteed returns on investment.

- Year after year, Pepperstone remains one of our most trusted Ripple brokers as it has consistently maintained the high standards required for its licences from numerous top regulators, including the FCA and the Australian Securities and Investments Commission (ASIC).

Trading Vehicles

Whether you buy and sell XRP directly or speculate on price movements through a crypto derivative, the trading vehicle makes a huge different to your trading style so choose wisely.

We’ve found that XRP day trading often relies on derivatives such as crypto CFDs as these can be used to make long or short plays with leverage.

- FXCC‘s XRP/USD CFDs continue to be an enticing way to speculate on Ripple, allowing both long and short plays with leverage of 1:5 – more than enough to take advantage of this volatile instrument’s price swings.

Charting Platforms

You should choose a provider with a platform that allows you to easily research markets and read Ripple charts.

Many experienced traders prefer the tried and tested MetaTrader 4 and MetaTrader 5 platforms, as these are available from the largest range of brokers and come with a good range of indicators and support for algorithmic trading.

Newer platforms like TradingView have gained traction among our team and other XRP traders, as they improve the user experience with the increased number of integrated tools and social-trading features.

Finally, proprietary platforms are commonly offered by exchanges and some brokers, and are sometimes custom-built to suit the available assets.

- FOREX.com still tops our Ripple broker charts for its platform options, which include MT4, MT5 and TradingView as well as a proprietary Web Trader. These are supplemented by news and data feeds as well as tools such as Trading Central, making for a comprehensive suite with the power to take your XRP trades up a level.

Pricing

We’ve found that pricing is paramount for day traders choosing a Ripple broker or exchange, as short-term trading quickly racks up fees.

In our experience, brokers and exchanges generally build their fees into the price of trading through a spread – the difference in price between buying and selling an XRP token.

We’ve also found that exchanges use pricing models based on ‘maker’ and ‘taker’ fees – that is, fees levied on the spread of market makers who add liquidity through limit orders, and takers whose market orders are executed immediately.

Maker fees are usually cheaper than taker fees, and many exchanges offer discounted rates for high-volume traders.

When it comes to pricing, I’ve found that exchanges usually beat out crypto brokers since they usually operate as peer-to-peer networks, whereas brokers are intermediaries. However, you have to weigh that against the additional services and added reliability provided by brokers, and I’m usually happy to trade XRP with the latter.

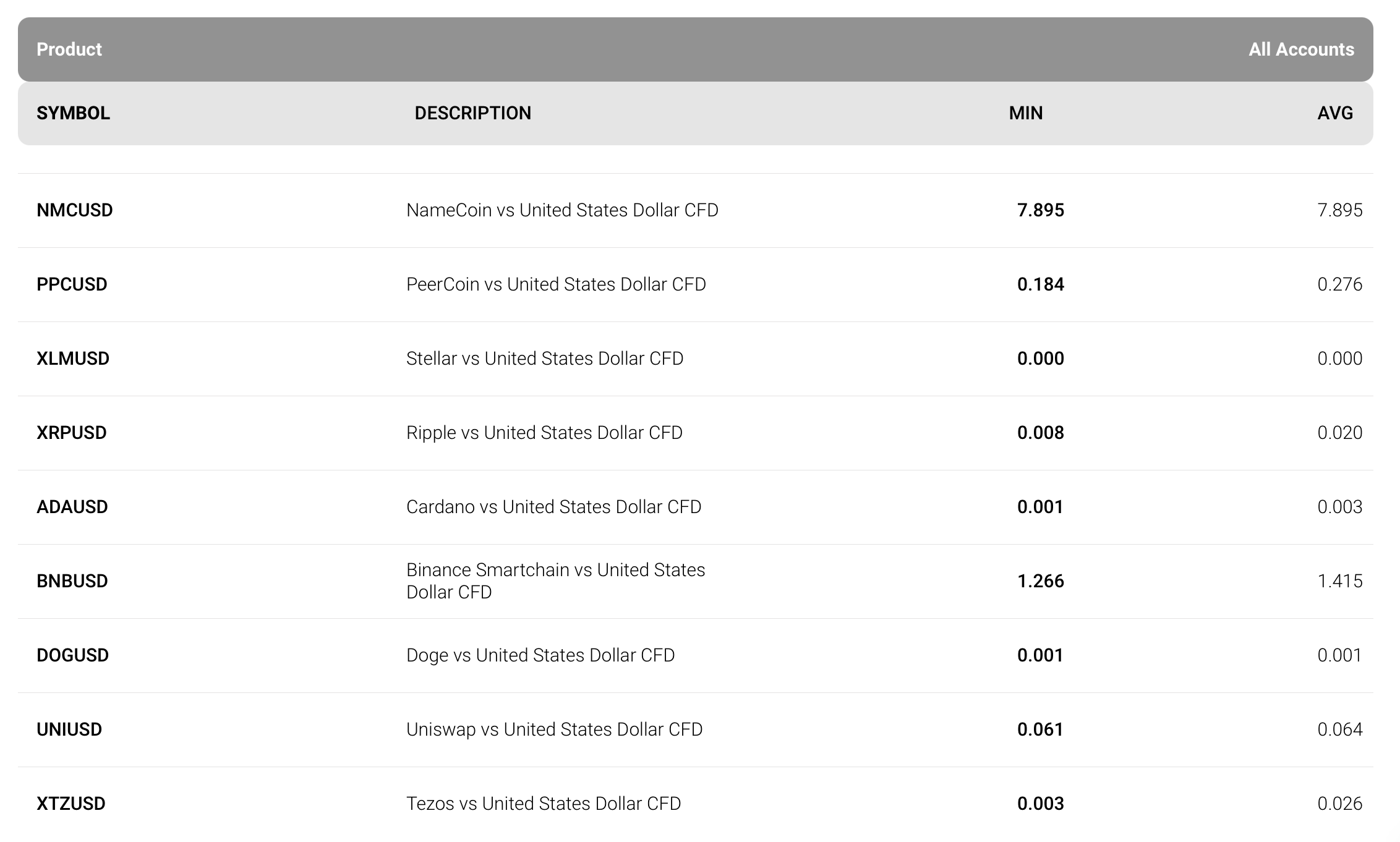

- IC Markets consistently beats out other Ripple brokers when it comes to pricing, with no commission charged on its crypto CFD trades and transparent pricing on its website, which quotes its minimum and average spreads, both of which are in our experience among the lowest on the market.

Execution Quality

You should choose an XRP provider with high execution quality because you’ll need fast execution with minimal slippage to make the most of your Ripple day trades.

In our experience, execution speeds below 100ms can be considered fast, though some Ripple brokers achieve average speeds that are significantly faster.

Some brokers also provide guarantees against requotes, ensuring that your order will go through at the quoted price.

- Our experts rate FxPro as one of the best Ripple brokers for execution quality due to its consistently fast execution – often under 13 milliseconds – with minimal slippage and a no requotes policy.

Account Options

Fast and low-cost deposits and withdrawals are an under-appreciated feature of a good broker, but we place a high value on this.

It’s incredibly frustrating to miss out on a golden trading opportunity because trading funds don’t reach your account on time, or to see your profits melt away in withdrawal charges or other non-trading fees, so you should pay attention, too.

Other important account options to look out for include crypto deposits – a big plus for Ripple traders – and the provision of swap-free accounts for Islamic traders.

- As a binary options broker, IQCent provides a less usual way to trade XRP with some great account options including welcome and deposit bonuses, a cashback system, free rollovers and free deposits and withdrawals for diverse payment methods including crypto tokens.

Bottom Line

Ripple brokers enable traders to speculate on the price of XRP, a unique altcoin that acts as a bridge, complementing other currencies.

Reviewing the features and account types offered by each broker will ensure you get the best deal on XRP.

To get started, see our pick of the top XRP trading platforms.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com