Plus500 Starts Offering Prediction Market Betting

Plus500US has added prediction markets to its ‘Plus500 Futures’ platform. The offering has been made possible through a deal with prediction markets provider, Kalshi.

We put it through its paces, and Plus500 earned a spot in our ranking of the top prediction market betting sites.

Key Takeaways

- Plus500 has added event-based trading for US visitors, with opportunities spanning 10 areas like Financials, Entertainment, Science and Technology.

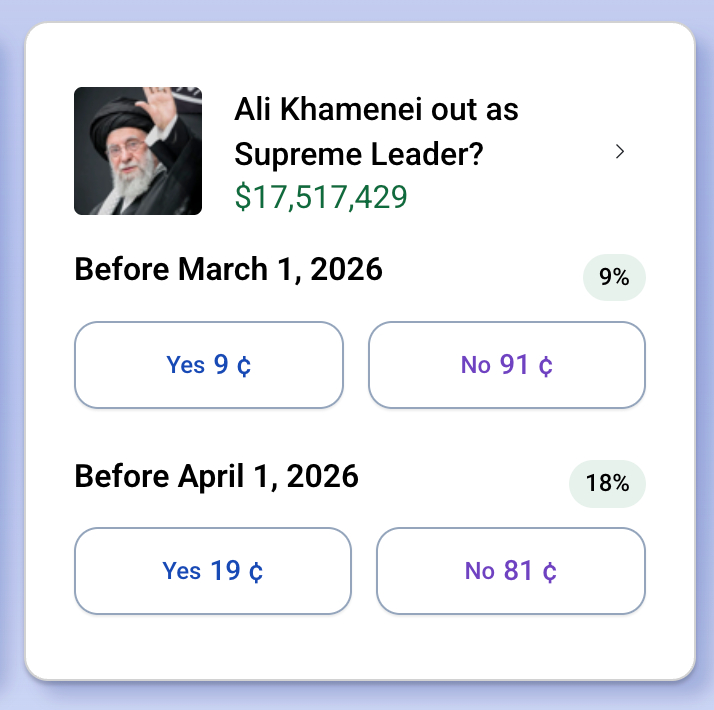

- Users press ‘Yes’ if they believe the event will happen or ‘No’ if they think it won’t. For example, will Ali Khamenei be out as the Iranian leader before 1 March 2026?

- Prices are displayed in cents, and indicate the extent to which users believe in an outcome, such as ¢25 ≈ 25% chance. When the contract ends, correctly predicted contracts return $1, while losing corrects return $0.

- The minimum trade size for prediction markets is $1 and a commission of $0.01 is payable per contract, with further exchange fees potentially applying.

- Multiple event contracts can be opened, but users can’t purchase contracts on opposing sides of the same event.

The Growth of Prediction Markets

Interest in prediction markets has boomed in recent years, with users drawn in by the binary-style setup that allows participants to bet on the outcome of events spanning various areas of life, from the price of the Nasdaq and who will win the next US presidential election to what will be the top AI model this month.

While initially the domain of specialist prediction market websites like Polymarket, traditional brokers have started introducing event-based contracts, with Plus500 joining big names like Interactive Brokers and Crypto.com.

However, prediction markets aren’t without their critics. They arguably encourage compulsive, betting-type behavior in some individuals given how easy it is to understand trades and their applicability to many areas of normal life. As a result, users must trade responsibly and take risk management seriously.

About Plus500

Plus500 is a trusted brokerage, operating since 2008 and authorized by a long row of ‘green tier’ bodies in our regulator trust system, including the CFTC in the US, FCA in the UK, and ASIC in Australia.

It offers a simple-to-use platform for trading prediction markets and futures in the US. We’ve used it and enjoy the clean design, easy navigation of contracts, plus the data and basic charts that accompany each event.

US traders interested in Plus500’s prediction markets can get started with a $100 minimum deposit.