Paybis Brokers 2026

Paybis is a popular cryptocurrency payment solution and exchange platform based in the UK. The company supports 10 major digital currencies for a range of private and institutional services. This review of the Paybis platform will detail how it works, outline its fees and partnerships and highlight the pros and cons of using it. We also list the best brokers that accept Paybis deposits.

Best Paybis Brokers

Our evaluations have found that these are the best 6 brokers that support Paybis payments:

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

4

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

5

FOREX.com

FOREX.com -

6

Moomoo

Moomoo

This is why we think these brokers are the best in this category in 2026:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- NinjaTrader - NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

- eToro USA - eToro is a social investing platform that offers short-term and long-term trading on stocks, ETFs, options and crypto. The broker is well-known for its user-friendly community-centred platform and competitive fees. With FINRA and SIPC oversight and millions of users across the world, eToro is still one of the most respected brands in the industry. eToro securities trading is offered by eToro USA Securities, Inc.

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- Moomoo - Moomoo is an SEC-regulated app-based investment platform that offers a straightforward and affordable way to invest in Chinese, Hong Kong, Singaporean, Australian and US stocks, ETFs and other assets. Margin trading is available and the brand offers a zero-deposit account as well as several bonuses.

Compare The Best Paybis Brokers

| Broker | Minimum Deposit | Instruments | Platforms | Leverage |

|---|---|---|---|---|

| Interactive Brokers | $0 | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | 1:50 |

| NinjaTrader | $0 | Forex, Stocks, Options, Commodities, Futures, Crypto | NinjaTrader Desktop, Web & Mobile, eSignal | 1:50 |

| eToro USA | $100 | Stocks, Options, ETFs, Crypto | eToro Trading Platform & CopyTrader | - |

| OANDA US | $0 | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) | OANDA Trade, MT4, TradingView, AutoChartist | 1:50 |

| FOREX.com | $100 | Forex, Stock CFDs, Futures, Futures Options | WebTrader, Mobile, MT4, MT5, TradingView | 1:50 |

| Moomoo | $0 | Stocks, Options, ETFs, ADRs, OTCs | Desktop Platform, Mobile App | 1:2 |

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

- Interactive Brokers has launched ForecastTrader, a unique, zero-commission product where users can trade yes/no Forecast Contracts on political, economic, and climate events, with fixed $1 payouts per contract, 24/6 market access, and 3.83% APY on held positions.

- Interactive Brokers has been named Best US Broker for 2025 by DayTrading.com, recognizing its long-standing commitment to US traders, ultra-low margin rates, and global market access at minimal cost.

Cons

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Stocks, Options, Commodities, Futures, Crypto |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

- You can get thousands of add-ons and applications from developers in 150+ countries

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

Cons

- The premium platform tools come with an extra charge

- Non forex and futures trading requires signing up with partner brokers

- There is a withdrawal fee on some funding methods

eToro USA

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, ETFs, Crypto |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Account Currencies | USD |

Pros

- The online broker offers an intuitive social investment network with straightforward copy trading on cryptos

- eToro USA Securities is a trustworthy, SEC-regulated broker that is a member of FINRA and SIPC

- Investors can access Smart Portfolios for a more hands-off approach, covering a range of sectors and markets such as renewable energy and artificial intelligence

Cons

- Average fees may cut into the profit margins of day traders

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD |

Pros

- Day traders can enjoy fast and reliable order execution

- Beginners can get started easily with $0 minimum initial deposit

- There's a strong selection of 68 currency pairs for dedicated short-term forex traders

Cons

- The range of day trading markets is limited to forex and cryptos only

- There's only a small range of payment methods available, with no e-wallets supported

- It's a shame that customer support is not available on weekends

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Stock CFDs, Futures, Futures Options |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- The in-house Web Trader continues to shine as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

Cons

- Despite increasing its range of instruments, FOREX.com's product portfolio is still limited to forex and CFDs, so there are no options to invest in real stocks, real ETFs or real cryptocurrencies.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

Moomoo

"Moomoo remains an excellent choice for new and intermediate stock traders who want to build a diverse investment portfolio. What really stands out is the broker's user-friendly app and the low trading fees."

Jemma Grist, Reviewer

Moomoo Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, ETFs, ADRs, OTCs |

| Regulator | SEC, FINRA, MAS, ASIC, SFC |

| Platforms | Desktop Platform, Mobile App |

| Minimum Deposit | $0 |

| Minimum Trade | $0 |

| Leverage | 1:2 |

| Account Currencies | USD, HKD, SGD |

Pros

- The ‘Moomoo Token’ generates dynamic passwords for transaction security - a unique and helpful safety feature

- There are reduced options contract fees from $0.65 to $0

- It is reassuring that Moomoo holds licenses with the US Securities and Exchange Commission (SEC) and the Monetary Authority of Singapore (MAS), among others

Cons

- There is no negative balance protection, which is a common safety feature at top-tier-regulated brokers

- It's a shame that there is no 2 factor authentication (2FA), despite the other security features on offer

- There is no phone or live chat support - common options at most other brokers

How Did We Choose The Best Paybis Brokers?

To find the top Paybis brokers, we:

- Searched our database of 500 brokers and online platforms, prioritizing all those that support Paybis payments

- Ensured that they accept Paybis deposits and withdrawals for online trading

- Sorted them by their overall rating, based on 100+ data points and findings from our in-depth tests

What Is Paybis?

Paybis is a cryptocurrency payment solution where you can buy a range of tokens. The broker currently supports 10 major cryptos:

- TRON (TRX)

- Ripple (XRP)

- Bitcoin (BTC)

- Litecoin (LTC)

- Tether (USDT)

- Ethereum (ETH)

- Dogecoin (DOGE)

- Bitcoin Cash (BCH)

- Binance Coin (BNB)

- Stellar Lumens (XLM)

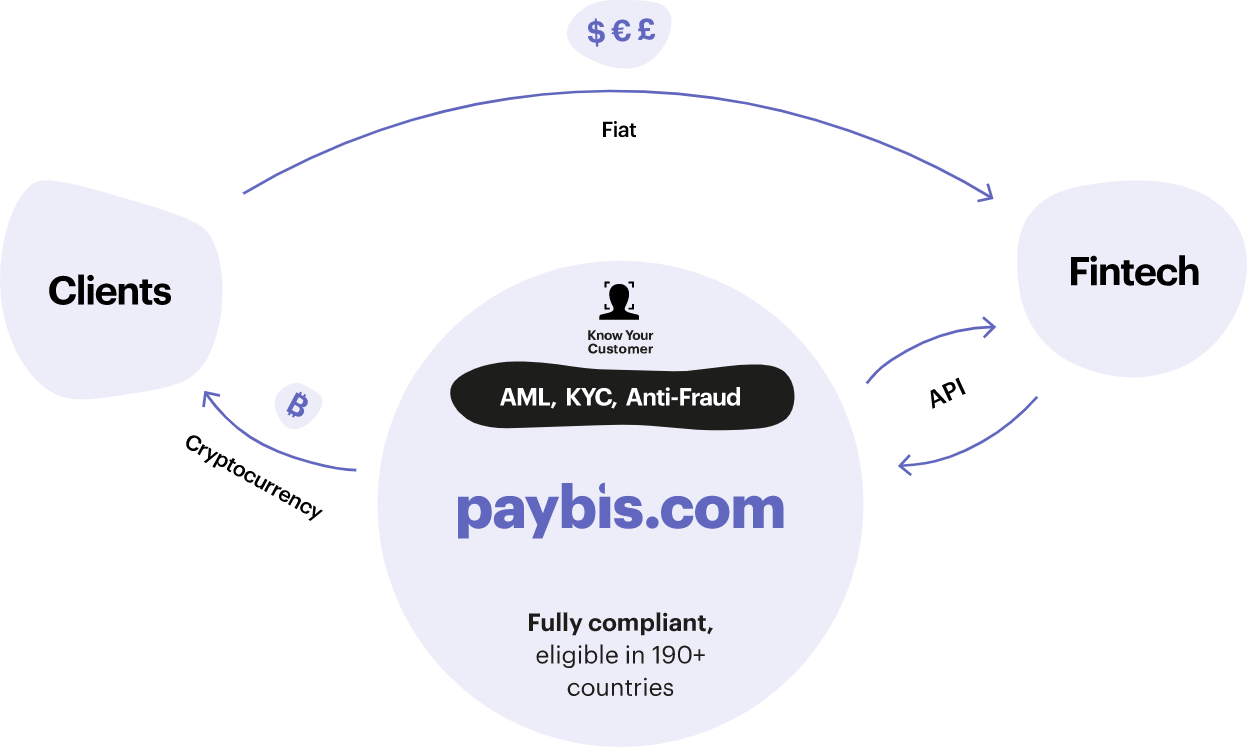

The exchange offers two services: private (for buying and selling cryptos) and business (for liquidity services). Paybis provides liquidity for banks, FinTech companies, payment processors, the gaming industry and more.

Paybis can accept or send crypto on the user’s behalf via simple API integration. The exchange also completes transactions in less than a minute. All of this has become possible due to Paybis partnering with Simplex, an Israeli payment processor that provides fiat infrastructure to the crypto industry.

Paybis also holds other key partnerships with crypto exchange Kraken and BlueOrange bank. In November 2020, The exchange’s partnership with FinTech company Money Service Business Zero Hash allowed it to offer its service across 48 states in the US.

The corporate entity behind the exchange, Paybis Limited (Ltd.), was founded in Glasgow, Scotland in 2014. Over the last 7 years, the company has developed into a highly reputable platform, acquiring operating licenses in the UK, the US and the EU. To date, Paybis Limited has customers from 180 countries.

Fees

Paybis boasts competitive trading charges and commissions, with no network, deposit or withdrawal fees.

Customers are not charged for their first transaction or sale of BTC, regardless of the payment method. Any subsequent payments may incur charges, though these vary with the method used.

Paybis crypto purchases are charged 0.99% from wire transfers and 3.99% from payment cards. There is also a $10 local currency minimum processing fee on transactions up to $225 for payment cards.

As part of the launch of new payment options, Paybis reduced its fee for cryptocurrency purchases via bank transfer from 2.99% to 0.99% as well as increasing its spending limits. Credit/debit card purchases are at 3.99%. Greater purchases are charged 4.5% for EUR, GBP and USD or 6.5% for other currencies.

Speed

Signing up to trade on Paybis is very quick and straightforward. Customers can use their Facebook or Google accounts to sign up securely. The average trader’s ID verification time is about 5 minutes.

Not only is registration with Paybis quick and easy, but so is the purchase of cryptocurrencies. Deposits are processed almost instantly when using credit or debit cards. Bank transfers can take a little longer, usually between 1-5 days. Withdrawal times can vary.

Security & Regulation

Paybis is a reputable and secure method with its robust security. Its non-custodial model encourages its users to use secure, private wallets which can be inconvenient but is best practice for security for traders. Your digital assets are going to be safer in your own wallet than on the exchange.

Paybis is considered a reputable exchange. As well as having operated for 7 years, Paybis Ltd is regulated by the UK’s Financial Conduct Authority (FCA). The company is also registered with the US’s Financial Crimes Enforcement Network (FinCEN).

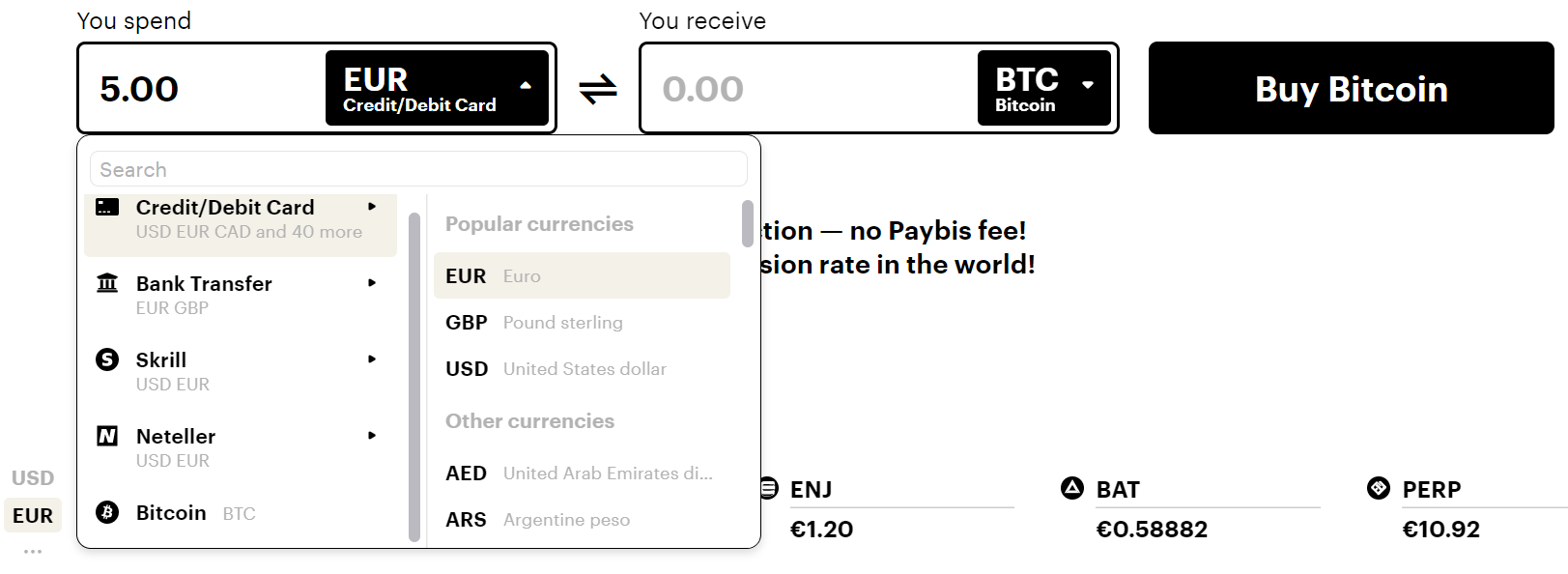

Payment Methods

Paybis allows its users to choose from a variety of deposit methods, including credit cards, bank transfers, or supported electronic wallets. This is good news for traders, especially beginners. Other payment methods include Neteller and Skrill.

Unlike some of its competitors, Paybis allows traders to purchase some crypto coins using fiat money, depending on the pairs available. This feature further legitimises the exchange, distancing it from claims of being a scam.

You need to fund your account before you can buy cryptocurrency. Go to the ‘Exchange’ page, choose your payment method, the fiat currency that you’re paying with and how much crypto you wish to buy. Click ‘Buy’, add your wallet address and complete the transaction.

Paybis also offers a prepaid gift card to Bitcoin option, supporting gift cards from US vendors including Amazon and Walmart. In September 2021 Paybis announced that it was launching Apple Pay, allowing traders to buy their cryptocurrencies in one click from their iPhone, iPad, or MacBook.

Paybis also offers an easy conversion calculator to work out how much a certain quantity of crypto costs. There are calculators for all cryptos, including a TRON calculator, provided on the Paybis website.

Wallets

Currently, Paybis does not have an in-built wallet, meaning it does not store your cryptos in hot or cold wallets. However, the lack of a wallet adds to the exchange’s overall security, reducing its risk of being hacked.

If you want to buy digital assets using Paybis, you need to get a wallet that is compatible with the digital currency you want to buy such as a Bitcoin wallet.

In positive news, Paybis supports all types of wallets, including online wallets such as the Trust Wallet app or MetaMask extension, and desktop and external (hardware) wallets such as Trezor or Ledger.

Payment Limits

Paybis assigns transaction limits dependent on the trader’s payment method of choice. The minimum amount is $50 worth of cryptos for all payment methods ($60 for credit/debit cards). Paybis’ maximum transaction limits apply on a range of timelines. These include a daily Bitcoin limit of $20,000 and $50,000 a month for Visa and Mastercard. Skrill and Neteller have weekly limits of $50,000 and $200,000 respectively. Bank transfer limits are $200,000 weekly and $500,000 monthly.

Pros Of Using Paybis For Traders

Paybis is highly ranked on Trustpilot with millions of its customers recommending it for its security, user-friendliness and ease of access to buying crypto with 47 supported fiat currencies.

User Friendly

Users can create a free account by signing up with an email address and password. As part of registration, you will also need to agree to Paybis’ terms and conditions and complete an ID verification process. Paybis’ KYC verification allows you to choose from several types of ID, including your passport or driving license. The time it takes to complete is about 5-10 minutes.

Paybis offers educational videos and tutorials on its YouTube channel. There is also a Paybis blog, news page and support portal that provides information on a variety of topics.

Accepted Countries & States

Paybis supports up to 48 fiat currencies around the world, including USD, EUR, GBP and JPY.

Paybis is available in 180 countries and accessible in 9 languages.

Paybis’ supported countries include Canada, Hong Kong, India, Japan, Latvia, Malaysia, Mexico, New Zealand, Nigeria, Singapore, South Africa and the UAE.

In the USA, Paybis is available in 48 supported states, excluding New York and Hawaii.

Security

As well as being regulated by the FCA, Paybis has operating licenses in the US and the EU. This offers important buyer protection. Paybis enforces quite strict KYC requirements meaning with no ID verification, you cannot buy and sell cryptos on Paybis. Its non-custodial model means it does not store your cryptocurrency on its platform.

Customer Support

Should you run into any issues, Paybis has 24/7 customer support available via its live chat. Support can also be found via email: support@paybis.com.

Its support portal can address issues and questions on how to cancel a transaction and get a refund, how to delete your account, if there is a payment error, a payment has failed, the broker status is stuck on checking your info, an error in processing your card or a payment under review or if your account is suspended. The news section of its website provides updates when elements of the platform are not working.

Paybis is also present across various social media platforms including Facebook, Twitter and LinkedIn (which states it is registered in Edinburgh). Despite there not being a contact phone number, the company’s customer support has received high praise from its users.

Cons Of Using Paybis For Traders

Currently, Paybis only supports the purchase of 10 cryptocurrencies and you can only sell Bitcoin. This is very small compared to Paybis alternatives like Coinbase, eToro and Kraken, which offer at least 50 coins.

As it is not regulated by the US Securities and Exchange Commission (SEC), Paybis.com is not available to all US traders. Clients based in New York and Hawaii cannot use the Paybis exchange and some restrictions also apply to Texas residents.

Is Paybis Good For Day Trading?

Paybis’ fast and streamlined service makes it an increasingly popular exchange to buy and sell cryptocurrencies. The payment system is partnered with a range of DeFi companies and boasts a competitive fee structure and decent security.

FAQ

Is Paybis.com Legit And Safe To Use With My Trading Account?

Paybis is legit and has no known history of scams. It is a payment solution that offers regulated services for retail and institutional traders in the DeFi industry. It is considered a trustworthy site as it has maintained compliance with requirements in the UK, the US, and the EU.

How Does Paybis Work With My Trading Account?

The Paybis exchange enables traders to buy and sell various cryptocurrencies, including Ethereum and Ripple. It also provides a wide range of banking options, including a bank or wire transfer, Skrill and credit/debit card payments, making it convenient for traders to transfer funds to and from their live trading accounts.

How Fast Are Deposits To My Trading Account When Using Paybis?

Deposits can be fast when using Paybis and are processed instantly when using a debit or credit card. That said, payments via bank wire can take up to 5 days and some brokers may also have their own processing timelines.