Passfolio Review 2024

Passfolio Review

Passfolio is a global online broker offering trading opportunities within the USA financial markets. This review will cover minimum deposit requirements, funding methods, sign in security measures, fees, available countries and much more, so you can make an informed decision before opening a Passfolio account.

Passfolio Headlines

Passfolio was established in 2018 via two wholly-owned subsidiaries; Passfolio Securities LLC and Passfolio Financial. The mission of the founder was to provide fast, easy and secure access to the US market. Today, the broker focuses on international transfer methods and partnerships with local exchange providers to make investments accessible in 170+ countries across the globe.

The broker is regulated by the Financial Industry Regulatory Authority (FINRA) and holds member status to SIPC, offering $500,000 protection for customers.

Trading Platform

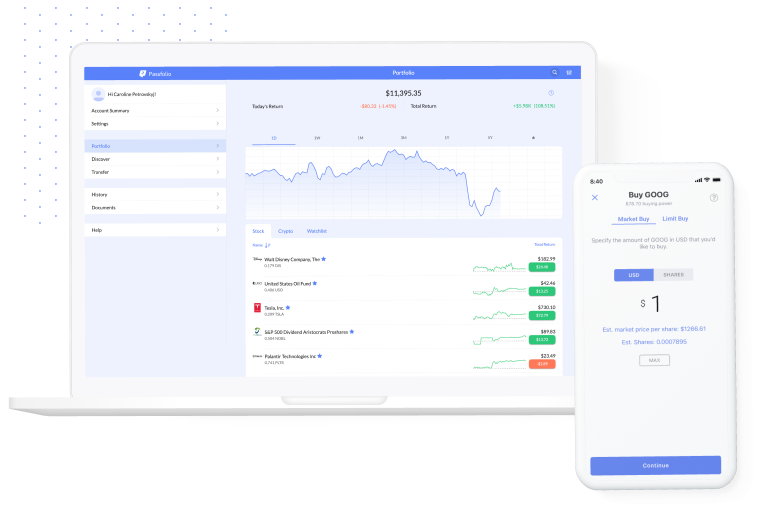

Passfolio offers a proprietary web-based trading platform that is compatible with all major browsers. It is not currently available for download to desktop devices. The web terminal is still in the Beta stage of its development.

Current features include:

- User-friendly interface

- Portfolio and fees reports

- Asset class search function

- Market and limit order types

- Two-step SMS authentication

- Available in English, Chinese, Hindi, Portuguese, and Spanish

Recommended improvements that the broker are working on include amplified user customisability, more order types and price alerts & notifications.

Assets

Passfolio offer clients investment and trading asset opportunities in the US markets:

- REITs: 600+ real estate investment choices, including Prologis Inc and Equinix Inc

- Cryptocurrency: 30+ cryptocurrency tokens, including Bitcoin, Litecoin and Ethereum

- ETFs: 600+ exchange-traded funds (ETFs) across several industries, including index trackers like S&P 500 funds.

- Stocks: Passfolio offers access to 3,800 US stocks available within US markets like NASDAQ. The stock list includes some of the most recognised businesses in the world, such as Apple, Google, Gamestop and Amazon

- Trust SPDR, Mobius and PowerShares QQQ

Passfolio also offers market orders for fractional shares trading.

Fees

It is free to open a live account with this broker. Passfolio trading fees do not apply for any assets, except cryptos, with a value above $5. Any orders with a value under $5 will be charged $0.02 per share. This includes REITs investments.

Cryptocurrency trading does have applicable trading fees, varying by order type. Limit orders are charged 1.5% per trade. Market orders apply a 0.5% fee plus an additional set charge depending on the order value.

The Passfolio robo-advisory service, Smart Portfolios, is available at a fixed annual charge of 0.75%. It is reassuring to see no additional charges like inactivity fees, ideal for long-term investors.

Leverage

Passfolio offers margin trading opportunities up to 1:2 (50% off all trades over $5). To access leverage, customers must join and subscribe to Passfolio Pro and have at least $2,000 in equity. Note, margin rates are high with this broker, at 8% plus the daily Federal Funds Rate (FFR). We would recommend implementing robust risk management strategies when using leverage.

Mobile Apps

Passfolio’s mobile platform creates a complete trading experience straight from your mobile or tablet device, no matter your location. The app is available for free download for iOS and Android (APK) devices via the relevant application store or from the logo on the broker’s website.

The mobile app is user-friendly with a clear design and hosts sophisticated search functionalities. However, the mobile platform does not support the same alerts and notification capabilities as the web terminal, which is disappointing.

Payment Methods

Deposits

There are no minimum deposit requirements to open a live trading account with Passfolio, ideal for new investors. The broker does not charge a fee for any deposit payment methods, except local bank transfers, though third-party bank charges or currency conversion fees may apply.

A useful local currency conversion tool is available on the broker’s website. Customers can enter the funding amount in local currency to understand the estimated USD deposit, including applicable fees.

Funding methods vary by country of residence but include:

- Cryptocurrency: 3 working day processing

- Revolut: up to 5 working day processing time

- TransferWise: up to 5 working day processing time

- Bank Wire Transfer: up to 5 working day processing time

- Local Payment Methods: TED, PIX, SEPI, SWIFT, ACH, ACAT and SEPA

- Payment Cards: debit and credit cards, including Visa, Mastercard and Amex, up to 30 minutes processing time.

Note, all payments to a Passfolio account will require a fund transfer to DriveWealth before uploading the transaction confirmation to the platform.

Withdrawals

Passfolio withdrawal charges do apply, varying by transaction method. This includes:

- ACH: $0.25 fee, US only

- SEPI: 0.5% charge, MXN 2 bank charge

- International Wire Transfer (SWIFT): $35 charge

- Domestic Wire Transfer: $25 charge

- TED Withdrawals: 1.45% fee, 0.38% IOF currency conversion, $2 bank charge

Full details of how to deposit from and withdraw to a live account can be found on the broker’s website.

Demo Account

It is disappointing to see that Passfolio does not offer a demo trading account, given that alternatives like Robinhood, Trading212, eToro, Bamboo, Avenue and Trove all do. These accounts are a safe way to practise trading, navigate platform features and test strategies risk-free. Paper trading is standard practice for major online brokerages.

Deals & Promotions

Passfolio offers various bonus and incentive programmes to new and existing traders. Active promos may include a deposit reward sign up bonus worth up to $100 when you initially deposit $1,000. Always review bonus claim terms and conditions.

Regulation & Licensing

Passfolio is a United States SEC-registered broker-dealer. The company is authorised and regulated by the Financial Industry Regulatory Authority (FINRA).

The broker is a member of the Securities Investor Protection Corporation (SIPC). This scheme protects customers against the loss of securities in the case of business insolvency. The maximum protection is $500,000, which includes a $250,000 limit for cash. Note that some investment products, such as futures, are not covered by SIPC.

Additional Features

Passfolio has a smattering of additional features, including a tax guide for US investments, blog posts, trading examples and thesis publications. Topics include investing in an IPO, day trade tips and an introduction to investment assets including index funds, bonds and options. Supporting YouTube video content is also published on some areas of trading, such as understanding spread fees and orders types, including stop loss.

There is a Passfolio roadmap for customers to share ideas and make suggestions on improving the features and services offered by the broker. There are many listed suggestions and Passfolio.us customer reviews are currently live on the website.

Account Types

Passfolio offers two account types, available to US and international customers. These accounts can be opened via the mobile app or a desktop device and validation can be completed in just 15 minutes.

There is only one account base currency available, USD, with no minimum deposit requirements needed to open a live trading account. Local deposits are accepted for conversion for trading. Features on the standard account include:

- Commission-free trades

- Auxiliary tax documents

- Multilingual customer support

- Cryptocurrency deposits available

- Fractional shares trading is available

- Local currency deposits and transfer method

A Passfolio Pro account is available for $5 per month. Users can access advanced features including access to advanced order types, interest on uninvested cash, dividend reinvestment and margin trading. Pro customers also gain the first access to new features when they are rolled out.

Customers must complete an online registration form to open a live trading account. You may be required to provide identification verification documents such as proof of residency under the know-your-customer (KYC) compliance system.

Benefits

- No fees for trades over $5

- USD account base currency only

- No minimum deposit requirements

- Cryptocurrency purchasing available

- Deposit in your local currency and transfer method

- Member of the Securities Investor Protection Corporation (SIPC)

- Regulated by the Financial Industry Regulatory Authority (FINRA)

- Various security protocols including 2FA, TLS encryption and password hashing

Drawbacks

- No demo account

- No live chat option

- High margin trading rates

- Withdrawal fees applicable

- No forex, options or mutual funds

- No margin trading available for Standard clients

Trading hours

The brokerage follows standard office hours and US market hours run from 09:30 to 16:00 EST. The broker publishes USA trading holiday closure dates. It currently does not offer pre-market trading. Note, these timings may vary by instrument.

Customer Support

Passfolio offers full support during trading hours (09:30 to 16:00 EST) available in English, Portuguese and Spanish. Help can be accessed via the below customer contact options:

- Telegram

- Online email contact form

- Telephone: +1(256) 530-2387

- Address: 1390 Market Street, Suite 200, San Francisco, CA, 94102

There is also an extensive support centre on the broker’s website, hosting useful FAQs including how Passfolio works, promo code help, API trading terminal installation and personal tax advice.

Safety & Security

Our app and trading platform review were pleased to see Passfolio offers a good level of security measures to all customers. This includes two-factor authentication (2FA) and additional multi-factor verification processes like TouchID, FaceID and customer pin for app unlocking.

Individual passwords are protected with Bcrypt hashing algorithms. All personal data and sensitive information between client terminals and the platform service are encrypted with Transport Layer Security (TLS) protocol.

Passfolio Verdict

Passfolio is a competitive broker with a low price trading environment that provides access to a range of US financial markets. While asset types are more limited than some, with no futures, bonds or options, the lack of minimum deposit and trading fees, strong security systems and reputable regulation stand the broekr in good stead.

FAQs

In What Countries Can I Open A Live Trading Account With Passfolio?

Passfolio provides trading opportunities in 170+ countries, including within Europe and Indonesia. Some supported countries are South Africa, Belgium, Romania, Ireland, UK Hong Kong, Turkey, Canada, Nigeria, Portugal, Qatar, Malaysia & Egypt.

Is Passfolio.us Legit?

Passfolio is a legitimate, regulated broker based in America. Both the SEC and FINRA regulate the firm. which is also a member of SIPC, providing clients with assurance of compensation in case of insolvency or malpractice.

What Are The Minimum Deposit Requirements To Open A Live Account With Passfolio?

There are no minimum deposit requirements to open a live trading account with Passfolio, meaning you can start trading from just £1/$1/€1.

How Can I Contact Passfolio Customer Support?

Passfolio offers some customer help options. These include a telegram group, online email form, and telephone number (+1(256) 530-2387).

Is Passfolio Regulated?

Yes, Passfolio is authorised by the Financial Industry Regulatory Authority (FINRA). This is a reputable regulatory body in the financial market with stringent compliance for all registered companies.

Top 3 Alternatives to Passfolio

Compare Passfolio with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Firstrade – Firstrade is a US-headquartered discount broker-dealer with authorization from the SEC. The company is also a member of FINRA/SIPC. With welcome bonuses, powerful tools and apps, plus commission-free trading, Firstrade Securities is a popular online brokerage. It is also quick and easy to open a new account.

Passfolio Comparison Table

| Passfolio | Interactive Brokers | IG | Firstrade | |

|---|---|---|---|---|

| Rating | 1.8 | 4.3 | 4.4 | 4 |

| Markets | Stocks, ETFs, Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, ETFs, Options, Mutual Funds, Bonds, Cryptos, Fixed |

| Demo Account | No | Yes | Yes | No |

| Minimum Deposit | $1 | $0 | $0 | $0 |

| Minimum Trade | N/A | $100 | 0.01 Lots | $1 |

| Regulators | SEC, FINRA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | SEC, FINRA |

| Bonus | – | – | – | Deposit Bonus Up To $4000 |

| Education | No | Yes | Yes | Yes |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Own |

| Leverage | – | 1:50 | 1:30 (Retail), 1:250 (Pro) | – |

| Payment Methods | 8 | 6 | 6 | 4 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

IG Review |

Firstrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by Passfolio and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Passfolio | Interactive Brokers | IG | Firstrade | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | No |

| Forex | No | Yes | Yes | No |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | No |

| Oil | No | No | Yes | No |

| Gold | No | Yes | Yes | No |

| Copper | No | No | Yes | No |

| Silver | No | No | Yes | No |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | No |

Passfolio vs Other Brokers

Compare Passfolio with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Passfolio yet, will you be the first to help fellow traders decide if they should trade with Passfolio or not?