OANDA Review 2026

See the Top 3 Alternatives in your location.

Awards

- Best Trading Tools winner 2021 - Online Personal Wealth Awards

- Awarded highest overall client satisfaction 2021 - Investment Trends US Leverage Trading Report, Margin Forex

- Awarded highest client satisfaction for mobile platform/app 2021 - Investment Trends US Leverage Trading Report, Margin Forex

- Voted Most Popular Broker 2021 - TradingView Broker Awards

- Voted Best Forex and CFD Broker 2021 - TradingView Broker Awards

Pros

- With 68 forex pairs and access to a premium MT4 upgrade, the broker will serve active forex traders

- Oversight from tier-one regulators like the FCA and ASIC makes the broker reliable and trustworthy

- The OANDA Trade web platform serves serious day traders, with 100+ technical indicators, an economic overlay and a Dow Jones news feed

Cons

- The range of payment methods trail competitors, only offering a handful vs the 10+ available at alternatives like AvaTrade

- Weekend customer support and extended hours trading aren't available

- It's a shame that social and copy trading tools aren't supported for traders who want to explore other ways to trade

OANDA Review

In this review of OANDA, I assess the broker’s trading accounts, fee structure, platform features and more. I also consider how the brokerage compares to alternatives when it comes to market research, education and payment methods.

The OANDA Group has multiple subsidiaries who are licensed to offer products to clients around the globe. The OANDA subsidiary with whom a client contracts depends on their country of residence. Each subsidiary provides different products via different platforms, so clients will experience OANDA differently depending on their country of residence. Note, CFDs are not available to US traders.

Regulation & Trust

A key consideration for me when reviewing brokers is whether I can trust the firm to keep my funds safe and protect me from scams.

My research into OANDA uncovered a solid regulatory status and an excellent reputation, with a history spanning over 25 years. This gives me peace of mind and the assurance of a trustworthy broker.

Founded in 1996, OANDA is a globally recognized foreign exchange firm and CFD broker. With multiple awards and no history of major security breaches or scams, OANDA has gained a strong reputation.

I’m also glad to see that retail investors can be assured of negative balance protection and segregated client funds, thanks to the top-tier oversight from several authorities.

EU and UK traders also have access to investor compensation schemes in the event of broker insolvency. The UK Financial Services Compensation Scheme (FSCS), for example, covers traders up to £85,000.

I’ve listed OANDA’s jurisdictional licenses below:

- UK Financial Conduct Authority (FCA)

- Australian Securities and Investments Commission (ASIC)

- Canadian Investment Regulatory Organization (CIRO)

- Polish Financial Supervision Authority (KNF)

- Monetary Authority of Singapore (MAS)

- Japanese Financial Services Agency (FSA + FFAJ)

- British Virgin Islands Financial Services Commission (BVI FSC)

As you can see from my comparison table below, OANDA’s global regulatory status matches up well with that of its competitors.

| OANDA | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Regulator | FCA, ASIC, KNF, MAS, CIRO, FFAJ, BVI, CIRO | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Segregated Accounts | Yes | Yes | Yes |

| Negative Balance Protection | Yes | Yes | Yes |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

OANDA offers a Standard Account with access to all instruments, with the option of a professional account for eligible clients.

On the negative side, there is no swap-free account for Muslim traders, which I’ve seen at many alternatives, including AvaTrade.

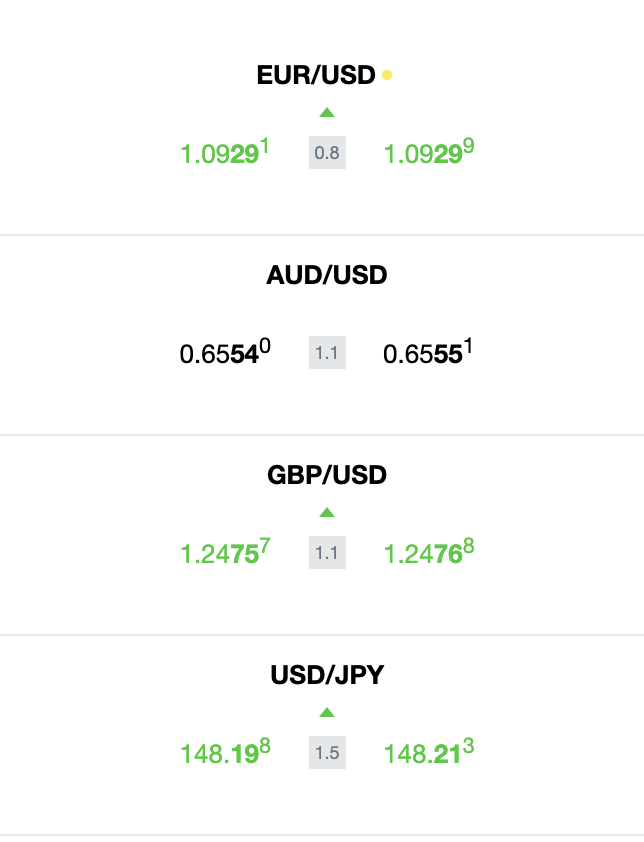

Competitive floating spreads are available from 0.8 pips on popular forex pairs, with zero commissions, making OANDA a good choice for casual and active traders alike.

Importantly, the $0 minimum deposit makes the broker accessible to beginners, especially when compared to similar brands:

| OANDA | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Minimum Deposit | $0 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | $1 (Binaries), 0.01 Lots (Forex/CFD) |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Additionally, retail traders get access to the broker’s full suite of platforms, including MetaTrader 4 (MT4) and TradingView, as well as the broker’s proprietary solution, OANDA Trade.

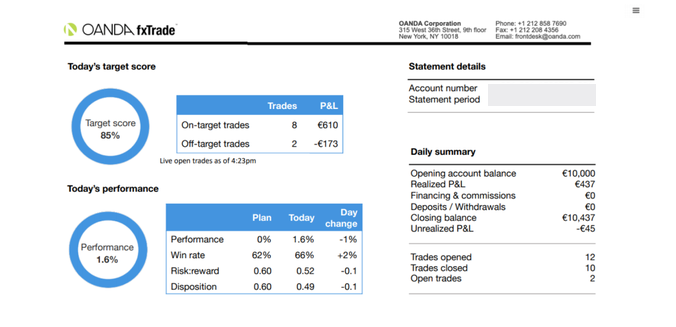

OANDA’s performance dashboard is also a useful feature not found at many alternatives. Use the handy downloadable account statements in your client dashboard to monitor your monthly trades and overall returns.

Deposits & Withdrawals

OANDA offers a fairly narrow selection of funding methods in comparison to other brokers I’ve assessed.

Clients can load their accounts with credit/debit cards and wire transfers, however, I found a limited choice of popular e-wallets like PayPal, which depend on your jurisdiction.

You can see from my comparisons below how OANDA trails behind top alternatives.

| OANDA | Pepperstone | AvaTrade | |

|---|---|---|---|

| Payment Methods | Credit Card, Debit Card, Mastercard, Neteller, Skrill, Trustly, Visa, Wire Transfer | BPAY, Credit Card, Debit Card, Mastercard, Neteller, PayPal, POLi, Skrill, UnionPay, Visa, Wire Transfer | Boleto, Credit Card, Debit Card, FasaPay, JCB Card, Mastercard, MoneyGram, Neteller, Perfect Money, Skrill, Swift, WebMoney, Western Union, Wire Transfer |

For the fastest processing times, I’d recommend Visa and Mastercard payments, which offer near-instant funding. I found that wire transfers are much slower and can take up to 5 working days based on tests.

Nonetheless, I appreciated that there are no deposit or withdrawal fees, an advantage over many alternatives. The $0 minimum deposit requirement will also appeal to newer traders on a budget.

How To Make A Deposit

I found depositing money through the OANDA client terminal fast. To fund your account:

- Log in to the client area and select ‘Deposit’ from the dashboard interface

- Choose the trading account you want to add funds to from the dropdown menu

- Choose a payment method, such as a wire transfer or bank card

- Follow the on-screen instructions to complete the payment (this will vary by method; you will need to add card details for example)

- Review the payment information and confirm the request

Note that a $1000 deposit limit applies if you have not verified your personal information.

Bonuses & Promotions

OANDA does not offer a welcome bonus. However, I don’t consider this a major drawback since they are prohibited by several regulators.

I think it’s a shame, though, that there’s no loyalty program for seasoned or high-volume traders. This would be an excellent way for investors to get discounts on trades alongside membership perks.

That said, I would never recommend picking a broker based on their loyalty schemes or promotional deals.

Demo Account

OANDA offers a demo account with up to $100,000 in virtual funds.

Importantly, there’s no time limit on the demo account, so you can continue testing strategies alongside your real money account. Many brokers automatically close demos after 30 or 60 days, so this is a standout feature for me.

| OANDA | Pepperstone | Eightcap | |

|---|---|---|---|

| Demo Account | Yes | Yes | Yes |

| Time Limit | Unlimited | 30 days | 30 days |

Assets & Markets

Initially, I was a little disappointed during testing to find that market coverage varies significantly at OANDA depending on your jurisdiction.

For example, UK clients can only access around 120 instruments, whilst the European entity offers over 3,200.

Still, the selection of currency pairs is above the market average and the range of stocks and ETFs is particularly strong, especially given the broker’s continued strides to provide additional trading opportunities with new European shares introduced in 2024.

Overall, OANDA matches up well with top competitors:

| OANDA | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, ETFs, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

I’ve summarized the available asset classes below:

- Bonds – Trade 6 government bonds including the UK 10-year Gilt and US 5-year T-note

- Stocks – Over 2,200 shares including big US and European companies like Amazon, Tesla, Netflix and Adidas

- Indices – Speculate on 15 major global indices including the FTSE100, S&P500, DE30 and ASX200

- Forex – Trade 68 major, minor, and exotic currency pairs including EUR/USD, USD/CAD, AUD/JPY and GBP/USD

- Commodities – Speculate on over 12 precious metals, energies, and soft commodities including Brent crude oil, wheat, gold and silver

- Cryptocurrencies – 18 crypto tokens are available to trade against the USD, including Bitcoin, Ethereum and Litecoin

- ETFs – A strong range of 41 share baskets are available covering a range of sectors including technology, healthcare and raw materials

I think some notable improvements could be made by introducing shares to more OANDA entities, including the UK. This will ensure greater market coverage for traders who are keen to build a diversified portfolio.

Leverage

OANDA offers leveraged trading in line with regulatory requirements. For example, EU clients can trade forex up to 1:200, whilst the UK entity permits leverage up to 1:30. These are in line with similar brands, as per my comparison table below.

| OANDA | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Leverage | 1:200 | 1:50 | 1:200 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

I strongly recommend beginners approach high leverage with caution, as losses can be magnified. Employing tools like stop-loss orders can help to minimize your risk.

Helpfully, a margin call will be issued by OANDA if your account balance falls to 50% of the margin requirement.

Execution

My research found that OANDA is a market maker, or dealing desk broker.

Market makers essentially create liquidity in the market, and in return add a small markup to the buy and sell price of a security.

I was particularly impressed with the fast order execution speeds on the broker’s proprietary platform, with an average of 12 milliseconds. I consider anything below 100 milliseconds good.

Fees & Costs

Trading Fees

OANDA’s single pricing structure consists of floating spreads with zero commissions.

My conclusion: The broker’s zero-commission pricing model keeps things simple for beginners who will only have the spread cost to consider.

With that said, the lack of raw pricing available at other competitors may be a drawback for high-volume or active traders looking for the lowest spreads.

When I tested fees, I was offered spreads from 0.8 pips on the EUR/USD and 1.1 pips on the USD/JPY. This compares well against similar accounts at FxPro and Pepperstone, but not so much with FXCM and IC Markets. You can see my cost comparisons of these brands below:

| OANDA | FXCM | FxPro | Pepperstone | IC Markets | |

|---|---|---|---|---|---|

| EUR/USD | 0.8 | 0.7 | 1.4 | 1.0 | 0.8 |

| USD/JPY | 1.1 | 0.9 | 1.4 | 1.0 | 0.8 |

| Commissions | $0 | $0 | $0 | $0 | $0 |

Non-Trading Fees

My tests uncovered a $10 monthly inactivity fee which kicks in after 12 months of inactivity. These are more favorable terms than some competitors, who often begin charging after only 3 months.

There may also be a currency conversion fee if the instrument you are trading is denominated in a different currency than your account.

Finally, overnight fees also apply for open positions held after 5:00 pm (ET), which is fairly standard.

Platforms & Tools

OANDA offers MetaTrader 4 (MT4) and a proprietary solution: OANDA Trade, which is powered by TradingView software.

What’s my verdict after testing both options?

- OANDA Trade is my pick for beginners looking for a user-friendly web and mobile solution with powerful charting features and customization.

- MT4 will work for more experienced traders looking for automated trading tools and an online marketplace.

All in all, OANDA stands up well against competitors when it comes to platform access, as you can see below.

| OANDA | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| MetaTrader 4 | Yes | No | Yes |

| MetaTrader 5 | No | No | Yes |

| cTrader | No | No | No |

| TradingView | Yes | Yes | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader and OANDA API | Capitalise.ai, TWS API | |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

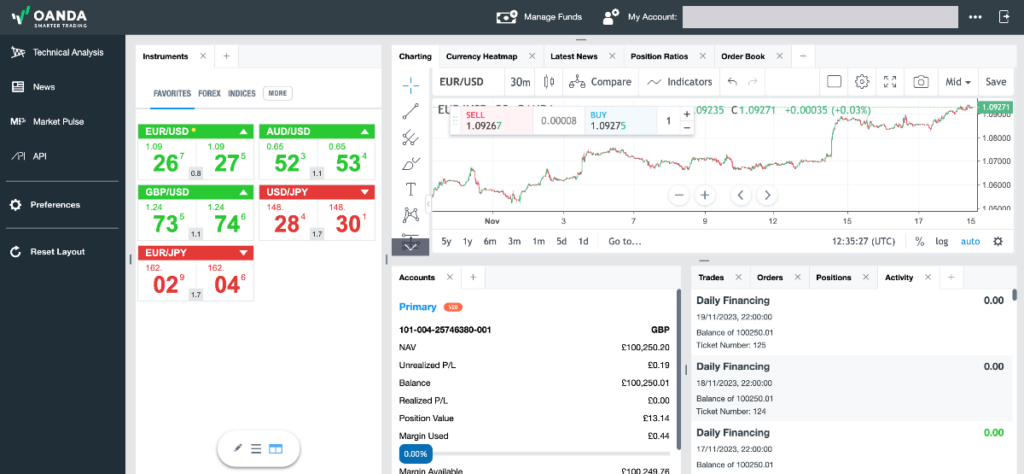

OANDA Trade

Design & Usability

The OANDA Trade terminal features a simple design and easy navigation. The workspace features instant snapshot views of pending orders and current open positions, as well as the markets window.

I was able to access good customization features, with the option of creating multiple profiles and adjusting the workspace using drag-and-drop windows.

The terminal is also integrated well within the client dashboard, and I was able to easily navigate to other areas of my profile.

My only minor complaint is that the terminal feels a little clunkier than others that I’ve tested. Some functions, such as the latest news, also take a couple of minutes to load.

Charting Tools

OANDA Trade’s interface is powered by TradingView, a widely used trading software with comprehensive charting and analysis tools.

There’s an impressive range of 100+ in-built technical indicators and 50+ drawing tools – easily rivalling the likes of MT4.

I also like that you can have up to 8 charts open simultaneously in a single layout, which is ideal for serious technical analysts.

In addition, you get:

- Access to Depth of Market (DoM) data

- Backtesting functionality using historical data, plus currency heat maps and real-time news to evaluate opportunities

- 12 different alert/notification settings based on a pre-defined strategy, indicator, or price conditions

- Performance behavior analytics and portfolio data overview with trade journal integration

- Advanced analysis tools including position ratios, news aggregator, and order book overlay

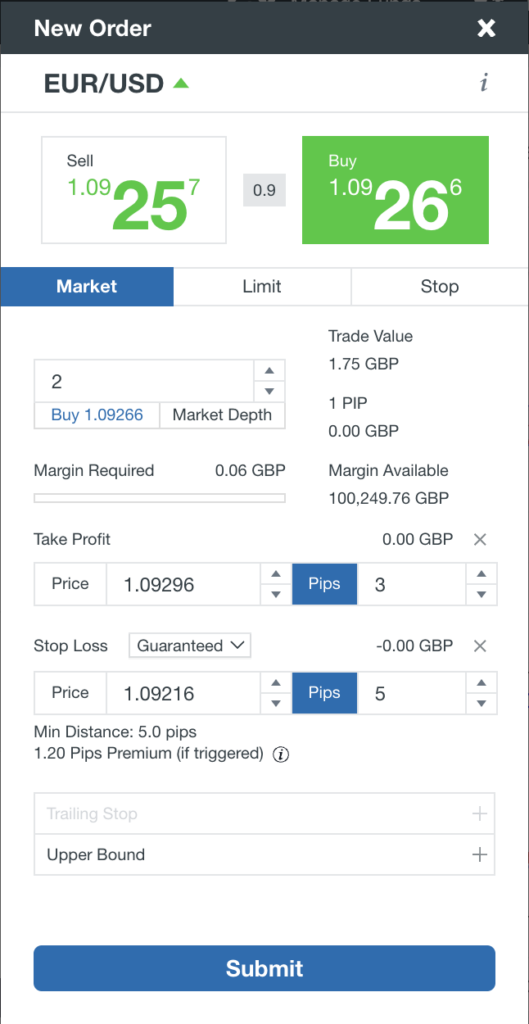

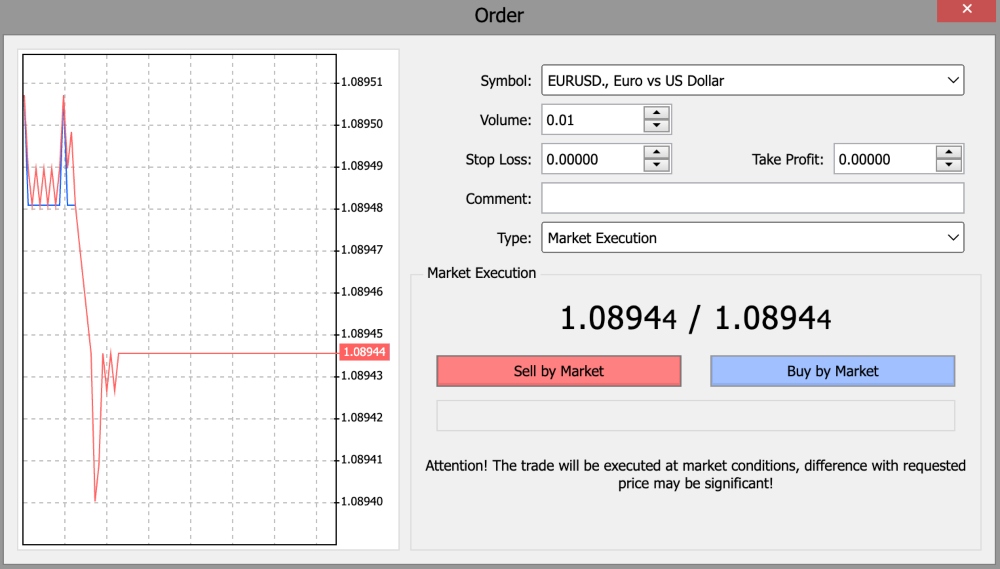

Order Types

I could execute market, limit and stop orders at OANDA, with the option to attach take profit and stop loss orders to each.

Additional risk management parameters are available including guaranteed stop-loss orders (GSLOs), which I strongly recommend utilizing, especially for beginners.

How To Place A Trade

Placing a trade on the OANDA Web platform was fairly straightforward, though not as seamless as MT4 in my view.

- Click the buy or sell icons above the chart (blue/red) to open the new order screen

- Highlight the order type (market, limit or stop)

- Use the arrows to increase/decrease the number of units to trade

- Review the trade value and margin requirements (these will change as you input the order size)

- Add stop loss or take profit prices (optional)

- Click ‘Submit’ to confirm the order

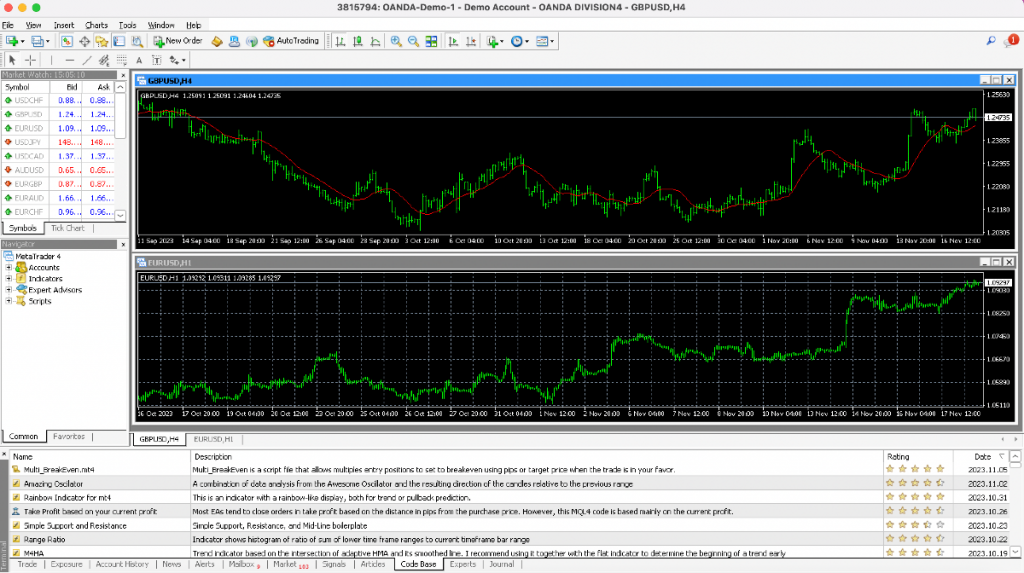

MetaTrader 4

Design & Usability

In contrast to TradingView-powered terminals, MT4 features a more traditional design. That said, MT4 doesn’t compromise on customizability or user-friendliness.

Many traders find the platform exceptionally easy to grasp, with a clean interface and intuitive navigation features.

Charts and windows can be easily customized, and it’s easy to find chart tools using the integrated toolbars.

Charting Tools

MT4 offers 30 customizable technical indicators and 31 drawing tools, plus 9 chart time frames.

Single-thread strategy testing is available, as well as the option to use Expert Advisors (EAs).

For dedicated algo traders, you can also access thousands of additional indicators and robots in the MQL4 marketplace.

Order Types

I was pleased to see that you can access the same order types at MT4 as you can with OANDA Trade:

- Market

- Pending (limit and stop)

- Take profit

- Stop loss

You can set these parameters easily using the drop-down functions in MT4’s trade order window.

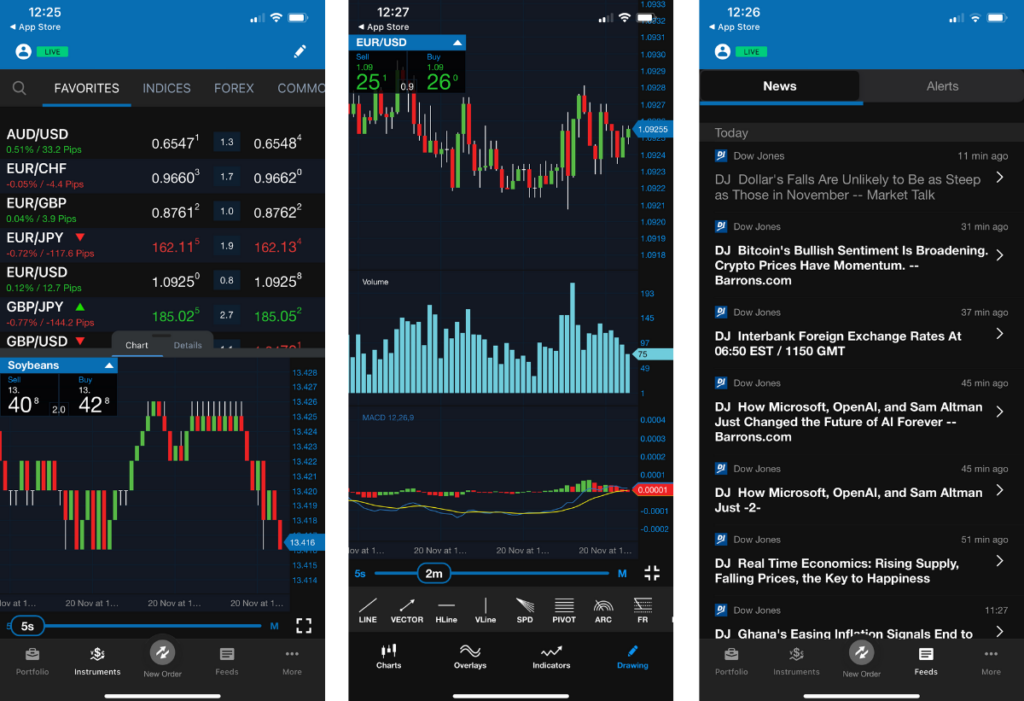

Mobile App

OANDA Trade is also available via an intuitive mobile app which stands up well against other apps I’ve tested.

The design of the app feels sleeker than the web version. The interface is user-friendly, and I was able to navigate all functions easily. Customization is also very intuitive – I was able to adjust my chart sizes easily.

Helpfully, you can set default parameters for trade orders, such as trade units and risk levels, to save time whilst on the go.

Unlike many other apps, OANDA Trade also lets you conduct technical analysis using 30+ technical indicators, 11 drawing tools and 9 chart types. Additionally, I was able to place orders directly from my charts.

Other excellent tools include signals, price alerts, a live newsfeed, an economic calendar, and the performance analytics dashboard.

Overall, I was thoroughly impressed with the functionality of the mobile app.

Beginners and more experienced traders alike should find sufficient tools for technical analysis, market research and account management whilst on the go.

Additional Tools

I’ve evaluated dozens of brokers and OANDA offers one of the best selections of additional tools to enhance the trading experience.

There’s a spread calculator, live and monthly FX rates, technical analysis from Autochartist, and an MT4 premium upgrade.

I have focused on some of the tools I found the most useful below.

Autochartist

I was particularly pleased to see Autochartist technical analysis, which integrates seamlessly with the OANDA platform.

Autochartist essentially monitors the market to identify chart patterns and uncover potential trading opportunities.

There’s an automated alert function for emerging patterns and correlating signals, which is highly useful for viewing real-time market volatility.

Overall, I think any trader looking to elevate their technical analysis strategies should use this tool. It’s easy to install from the client area and, importantly, it’s free for all clients.

MT4 Premium Upgrade

Another standout feature is the MT4 premium package which is also available to download for free.

The upgrade connects you to OANDA’s premium research features, including content from Dow Jones, plus market sentiment and two event calendars.

Additionally, I was able to access 28 additional tools and indicators including a mini terminal, correlation matrix, market manager, and a session map.

For those who prefer visuals like me, use the session map to view major trading sessions and economic data releases on a color-coded map, directly from your workspace.

OANDA Labs Trader

OANDA has also introduced a prop trading program, OANDA Labs Trader, providing skilled traders with a funded account and an 80% share in profits.

This is fairly unique – not many day trading brokers offer such a program, and even fewer with the reputation and track record of OANDA.

Available through its British Virgin Islands-regulated entity, you will need to pass one of the firm’s eight challenges, which each consist of two phases and have various profit and risk objectives, including achieving a reduced 8% profit target in Phase 1 and a 5% profit target in Phase 2.

The minor downside is that the minimum entrance fee is $169, while some specialist prop trading firms we’ve evaluated, such as Audacity Capital, offer a lower fee of $129.

Still, for skilled day traders with limited funding, it’s an attractive scheme.

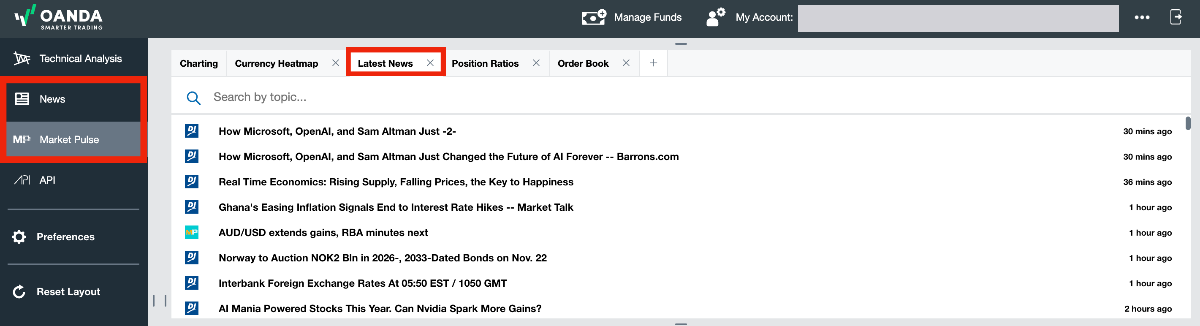

Research

Alongside the additional research tools in the MT4 premium upgrade, OANDA also offers comprehensive forex research tools within the platform.

The Dow Jones FX Select feature gives you live news bulletins, expert trend analysis and analyst commentary, all from one dashboard.

Additionally, the broker’s proprietary research portal, MarketPulse, is packed with news reports, technical insights, an economic calendar, plus podcasts and videos.

Both features are directly accessible from your platform workspace or client dashboard menu.

Education

OANDA also scores well when it comes to education, offering high-quality resources for aspiring traders.

Though not as extensive as the likes of eToro, I think there are plenty of resources to help you get the most out of your online trading experience.

Topics include fundamental and technical analysis, how to apply indicators and oscillators to trading and an introduction to trading with leverage.

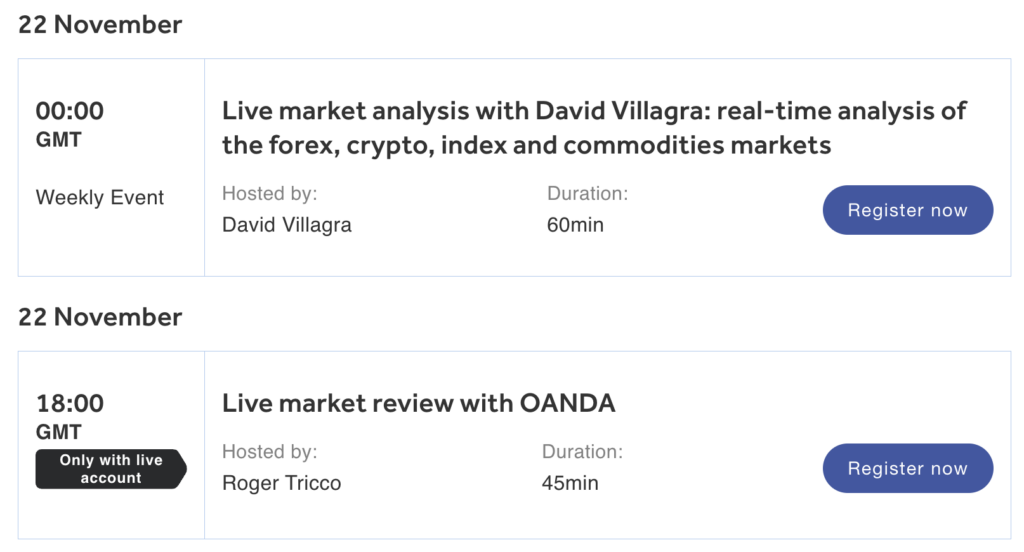

I particularly rated the live market analysis webinars, which are hosted weekly with insights into forex, indices, commodities, and cryptocurrency markets. These events are available to customers with a live account only.

On the negative side, I didn’t find any integrated tutorial videos or more interactive learning mediums. The articles are also quite text-heavy in my view, which may deter some beginners.

Customer Support

My personal experience with OANDA’s customer support has been very positive.

Telephone support is available from Monday to Friday, 8:00 am to 8:00 pm (CET). This includes agents in English, Spanish, French, and German. Alternatively, you can contact the broker by email or online chat 24/5.

I find that live chat is the fastest way to get help. I received a response within 3 minutes each time I tested the broker. The email service was equally impressive, with responses received within 30 minutes on average during testing.

Here’s a breakdown of support methods:

- New Customers – info@eu@oanda.com

- Existing Customers – cxsupport@oanda.com

- Telephone Number (Existing Customers) – Poland (+48) 799366830, Malta (+356) 20345018, Spain (+34) 910479707, France (+33) 182884361 and Germany (+49) 6995019607

- Telephone Number (New Customers) – Poland (+48) 799399910, Germany (+49) 6995019606, Spain (+34) 911120029, France (+33) 184131722, Italy (+39) 0684009607 and Netherlands (+31) 203233130

Should You Trade With OANDA?

My extensive assessment has uncovered some notable reasons why beginners and experienced traders should trade with OANDA.

The $0 minimum deposit, unlimited demo account and zero-commission pricing will serve novices looking for a budget-friendly and flexible service.

Additionally, the advanced trading packages, best-in-class research and powerful trading platforms make OANDA a good choice for seasoned investors looking for reliable tools.

FAQ

Is OANDA A Good Broker?

Yes, OANDA is a good broker based on my evaluation. The firm is overseen by tier-one regulators, including the UK Financial Conduct Authority, has low trading fees, more than 65 forex pairs, plus excellent tools from MetaTrader, TradingView, Autochartist, and its in-house web platform.

Is OANDA A Reliable And Trustworthy Broker?

My research has found that OANDA is a trustworthy broker with strong regulatory credentials, thousands of clients, and multiple awards.

The broker also offers negative balance protection, segregates client funds, and facilitates access to compensation schemes (country-dependent) for retail investors.

I also didn’t uncover any reports of scams or malpractice associated with the broker.

Is OANDA Good For Day Trading?

OANDA is a very good broker for day trading. Its spreads are tight, helping to reduce costs for active day traders, while the web platform offers a superb selection of technical indicators and charting tools. OANDA also supports multiple day trading strategies and systems, including scalping and algo trading.

Does OANDA Have Low Fees?

Tests have found that OANDA offers lower-than-average trading fees. When I used OANDA, I was offered the EUR/USD with a 0.8 pip spread with zero commissions. That said, spreads are not the most competitive in the industry.

Does OANDA Have A Mobile App?

Yes, OANDA offers a proprietary mobile app which facilitates on-the-go trading and straightforward account management. I highly rated the custom charting and in-app research. The application is available on Apple and Android devices.

Best Alternatives to OANDA

Compare OANDA with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

OANDA Comparison Table

| OANDA | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Rating | 4.3 | 4.3 | 3.6 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, ETFs, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | $1 (Binaries), 0.01 Lots (Forex/CFD) |

| Regulators | FCA, ASIC, KNF, MAS, CIRO, FFAJ, BVI, CIRO | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Bonus | – | – | 100% Anniversary Bonus |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist, Quantower | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Leverage | 1:200 | 1:50 | 1:200 |

| Payment Methods | 9 | 6 | 10 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by OANDA and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| OANDA | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | Yes | No | Yes |

| Silver | Yes | No | Yes |

| Corn | Yes | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | Yes |

| Bonds | Yes | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | Yes | No | No |

| Volatility Index | No | No | Yes |

OANDA vs Other Brokers

Compare OANDA with any other broker by selecting the other broker below.

The most popular OANDA comparisons:

- Oanda vs Exness

- OANDA vs Ingot Brokers

- OANDA vs FXCM

- Oanda vs FP Markets

- Oanda vs CMC Markets

- FOREX.com vs OANDA

- IG vs OANDA

- IC Markets vs Oanda

Customer Reviews

4 / 5This average customer rating is based on 3 OANDA customer reviews submitted by our visitors.

If you have traded with OANDA we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of OANDA

For Specific Countries

Article Sources

- OANDA Website

- OANDA FCA License

- OANDA ASIC License

- OANDA CIRO License

- OANDA KNF License

- OANDA MAS License

- OANDA BVI FSC License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

It is not true that they allow traders from Panama. I had an account with them for several years, and one day they sent me a message (kind of rude, if you ask me) saying that they no longer accepted traders from my country and were closing my account.

Thank you for pointing this out, we have updated our database to reflect that Oanda does not accept traders based in Panama any longer. We are sorry to hear that they closed your account with little regard for your long history with them. We hope that you were able to find a new broker that happily accepts your location.

I use OANDA because it’s one of the few brokers I’ve seen to support a reliable web platform and guaranteed stop loss orders for risk management. I think a rebate program would be a nice addition though – I know other firms offer that.

Oanda gets my vote. One of the most reliable brokers out there. I can’t fault the trading platform and it also has guaranteed stop loss orders which I couldn’t find at many alternatives.