AudaCity Capital Review 2025

AudaCity Capital is an established prop trading firm based in the UK, offering funded trading accounts to global clients. Our 2025 review will cover how the funded trader program works, account rules, associated fees and withdrawal payouts. Find out how to get funded with AudaCity Capital.

About AudaCity Capital

AudaCity Capital Ltd was established in 2012. The firm’s mission is to develop long-term relationships with traders by providing them with the best environment to prosper and perform. Investors can trade forex, commodities and indices on multiple exchanges via the MetaTrader 4 (MT4) platform.

AudaCity Capital provides services in 140+ countries, from a head office in London, UK. The funded trading firm distributes $2.8 million in monthly payouts via its platform.

Today, the company is globally recognized, with acknowledgements from MarketWatch, Reuters, Bloomberg and CNBC to name a few.

How It Works

As a prop trading firm, AudaCity Capital essentially lends out its capital to generate profits. The business aims to find talented and ambitious traders with proven experience and successful strategies ready to take their trading to the next level. Hired prop traders effectively work as the organizations’ contractors.

The Application Process

The application process to register as a funded trader varies between firms. AudaCity Capital uses an interview process rather than a standard evaluation program:

- Apply To The Program – Complete the online registration form (takes just three minutes). Details include years of trading experience, existing account balance, risk management skills and current strategy

- Attend An Interview – Based on your application, the company will schedule a telephone or face-to-face interview. Discussion points will include your strategy and trading history

- Results – Following the interview, investors will receive feedback within 24 hours. If successful, a contract and relevant fee details will be sent via email

- Start Trading – Once the contract is signed and payment complete, your AudaCity login details will be sent immediately and you can begin trading

The company is looking for investors with at least three to six months of live trading experience. Those who can demonstrate profit consistency whilst managing risk, and can display stability when following a strategy or trading plan are more likely to achieve a live-funded profile.

Rules

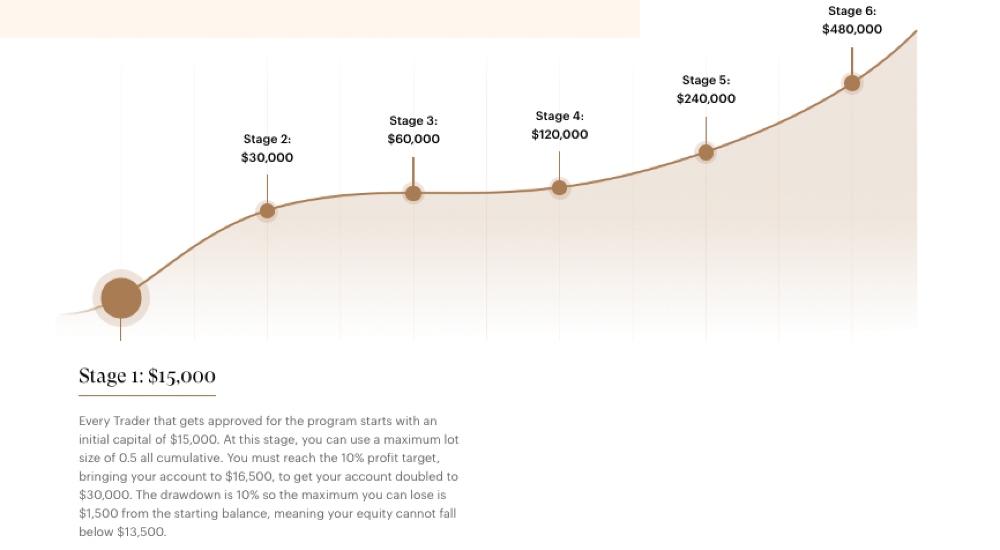

The AudaCity Capital funded trader program offers fully-funded live trading profiles, with varying account sizes from $15,000 to $480,000. Packages are designed with fairness and transparency in mind, with profits split 50/50. The funded account uses a scaling plan, with capital doubled for every 10% target met.

We outline the key rules below:

- Withdrawals – Fund extraction can be requested once the 10% target has been hit

- Weekend Positions – Subject to approval by the risk management team, weekend trading may be permitted for select investors

- Drawdown – A 10% absolute drawdown is set, which is not trailing from profits. Investors are not liable for losses

- Major News Events – Positions must be closed during major events such as central bank speeches or interest rate publications

- Risk – An initial account balance of $15,000 is provided with orders capped at a maximum of 0.5 lots. Risk allowance is doubled once the account balance is doubled

In practice, getting started would look like this:

All new AudaCity Capital investors that gain approval for the funded trader program will begin with $15,000 in funding. Here you can use a maximum lot size of 0.5 lots.

To progress, you need to hit the 10% profit target set out in the scaling plan (the new account balance should be $16,500). Once achieved, your account balance will double to $30,000.

The drawdown is 10% so the maximum you can lose is $1,500 from the starting balance, meaning your equity cannot fall below $13,500.

Fees

There is a one-off joining fee of £199, with a monthly platform payment of £99 thereafter, similar vs the BluFX lite package. These costs remain the same regardless of account size.

The AudaCity Capital monthly subscription charge covers the benefit of not having to pay commissions or swaps. The firm uses a liquidity provider to give traders access to tight spreads and fast executions.

Profits are shared 50/50.

Platform & Assets

AudaCity Capital offers the MetaTrader 4 (MT4) terminal only. The platform is available for free download or can be used via all major web browsers. Additionally, it has an iOS and Android-compatible mobile app.

When using the terminal, clients have access to the full range of features, including customizable charts and dashboards, 30+ technical indicators, 9-time frames, one-click execution and real-time quotes in MarketWatch.

AudaCity does not offer a demo account, though the trading terminal can be used externally to practice trading risk-free.

The firm specializes in forex trading. Therefore, the only instruments available are major and minor currency pairs. This includes EUR/GBP, GBP/USD and USD/JPY.

Clients can request permission to trade commodities and indices after scaling an account balance to $120,000.

Payouts

AudaCity Capital permits profit withdrawals every time you hit your 10% target.

Once you have hit your target, email support@audacitycapital.co.uk for the profits to be withdrawn and the account balance to be doubled. You will receive an email confirmation once this has been actioned.

Remember, you will be liable for local tax payments, depending on your country of residency.

Accounts

AudaCity Capital offers six account sizes for funded traders. These vary from the initial funding amount of $15,000 all the way up to $480,000 by following the scaling plan.

Features that remain the same between account sizes include; drawdown remains at 10%, monthly subscription pricing is the same, there are no time restrictions to hit the profit targets and no trades can be executed during major news events. The firm offers 1:5 leverage, but the maximum cumulative exposure on the $15,000 account is 0.5 (half lot).

First Stage Account

- Lot Size – 0.5

- Account Size – $15,000

- Profit Target – 10% target ($1,500)

- Tradeable Assets – Forex pairs

Sixth Stage Account

- Lot Size – 16

- Account Size – $480,000

- Profit Target – 10% target ($48,000)

- Tradeable Assets – Forex pairs, Indices and Commodities

Additional Features

Ability Challenge

The Ability Challenge is a new venture for AudaCity Capital, creating an opportunity for new or more inexperienced traders to gain funding. Prospective users must invest virtual funds in a simulated profile to meet profit targets within a set period. Traders can select a trading volume.

The challenge has a variable upfront cost depending on the initial funding amount, though this is refundable if successful. Fees range from £149 for a $15,000 account to £629 for a $120,000 account.

Our review found those investors that pass all stages of the challenge are offered a live funded trading account with a profit split of 75/25.

The requirements of the challenge are as follows:

- Profit target – 10% profit

- Time – 30 days to complete

- Minimum Trading Time – 7 days

- Maximum Daily Drawdown – 7.5%

- Maximum Absolute Drawdown – 15%

Hidden Talents Program

An innovative approach to training, the unique Hidden Talents program provides a funded trading account. The educational package intends to identify, recruit and develop the next generation of talent using one-to-one training with fully qualified mentors.

Training sessions can be on a full-time or part-time basis, though are designed to be completed within four weeks. Content includes technical, fundamental and intermarket analysis, trading psychology and risk management.

Trading Therapy Course

The AudaCity Capital trading psychology course is ideal for both new and experienced investors. The program entails 14 modules of online videos and webinars. The program follows a systematic concept to allow you to understand how patterns and habits are formed, and how to manipulate mental patterns of behavior within your daily trading environment.

The syllabus is available as a one-off purchase of £349.

Education

When completing our AudaCity Capital-funded trader program review, we were pleased with the level of educational content available. There are plenty of success stories with integrated YouTube video content, a help center zone for quick fixes and various online guides and forums covering keywords, top tips and strategies.

Pros Of AudaCity Capital

- Instant account funding

- No commissions or swap fees

- Payout on every 10% profit target met

- Comprehensive educational content and additional courses

- Industry acknowledged firm with many positive user reviews

- Ability Challenge and the Hidden Talents program for inexperienced investors

Cons Of AudaCity Capital

- £199 joining fee

- Only one platform (MT4)

- Training fees with some packages

- Profit share limited vs competitors

- Thorough interview process may deter potential traders

- Forex trading only until a minimum account balance is hit

- No weekend trading or positions opened during major news events

Security

The company has a reputation for backing and funding traders since 2012.

As AudaCity Capital does not carry out financial activities it is not required to be authorized by a regulatory authority, such as the FCA. Prop trading and professional training services do not have to be overseen by a global authority. Nonetheless, AudaCity Capital’s preferred clearers conduct regulated activities and are authorized to do so by a financial authority.

Note, there is a slightly different interview application process vs competitors with more advanced two-step evaluations from FTMO and Topstep, for example.

Note, never risk more than you can afford to lose, regardless of sign-up requirements.

Customer Support

AudaCity Capital offers several customer contact options. When using the service, we were pleased with the responsiveness, with email queries replied to within 24 hours. An adequate FAQ page is also available on the website.

Contact details:

- UK Phone Number +442080501985

- Email Address – support@audacitycapital.co.uk

- Social Media Profiles – Facebook, LinkedIn and Twitter

- Headquarters Address – One Canada Square, Level 8- Office 8.05, London, E14 5AA

Note, there is no live chat service to answer a real-time query or technical issue.

AudaCity Capital Verdict

AudaCity Capital could be an exciting prospect for skilled traders looking to increase their investment capital and experience. The funded trader program provides competitive trading conditions including no commission charges to open positions and comprehensive educational resources. The proprietary Ability Challenge and Hidden Talents programs are also ideal for upcoming talent. This is a major player in the prop firm market and is worth checking out.

FAQs

Is AudaCity Capital A Legit Prop Trading Firm?

Yes – AudaCity Capital is a legitimate firm offering funded trader programs. It is registered on Companies House, org number 08865122, incorporated in January 2014. The current registered CEO is Abdelkrim Yousfi. User reviews are positive, with various published success stories.

Where Is The AudaCity Capital Prop Trading Firm Located?

AudaCity Capital has a registered head office in London, UK. Our review found the firm also offers services on a global scale, spanning 140+ countries including the US.

Is AudaCity Capital Really Free For Funded Traders?

There are no commissions or swap charges when trading with AudaCity Capital. However, there is a one-off funded trader program joining fee of £199 and a monthly platform fee of £99.

What Is AudaCity Capital?

AudaCity Capital is a forex prop trading firm designed for talented and motivated investors with proven capability and skills. Innovation is also being introduced to welcome more inexperienced, but upcoming investors to the funded trader program.

Is AudaCity Capital Regulated?

No – AudaCity Capital is not regulated. Because it doesn’t offer financial services like a traditional retail broker, regulation is not required. We are comfortable with the security measures, glowing customer reviews and industry acknowledgements, making this a relatively safe prop trading firm.