Topstep Review 2026

Topstep is a leading proprietary futures trading firm with a focus on providing discipline and healthy habits for long-term investing success. A generous share of profits can be achieved for clients with a funded trading account. In fact, registered users withdrew over $3 million in profits in 2021. Our review will cover how Topstep works, how to pass the Trading Combine program, ongoing fees, permitted instruments, and more.

What Is Topstep?

The company was founded in 2010 as Patak Trading Partners by owner Michael Patak. The funded trading account broker set out to provide a safe place for traders to professionalize their passion.

With headquarters located in Chicago, US, the company evolved to become Topstep Trader LLC in 2012 and launched the Trading Combine program, the very first funded trading opportunity for retail investors. Their mission remains clear; to turn people who trade into better traders, with healthier habits, through learning by doing.

The prop trading firm has been recognized by well-regarded financial companies for its achievements to partners, employees and traders. A few to mention include Forbes, Deloitte, Barron’s and MarketWatch. Topstep was acknowledged on the Inc. 5000 list of America’s fastest-growing private companies and nationally recognized on the Deloitte Technology Fast 500 list.

In 2021, Topstep funded an impressive 8,389 client accounts, similar vs FTMO with 6,000 new members joining in 2020. The company has an investing community spanning 143 countries including the US and the UK.

How Topstep Works

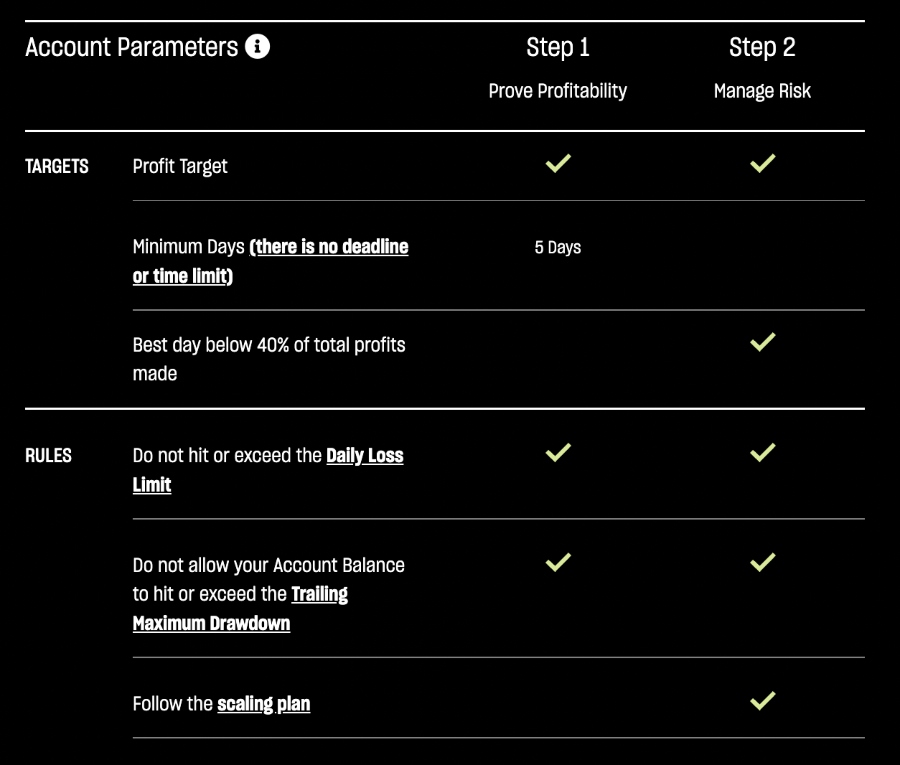

Prospective traders must complete a two-step evaluation process. Although this is an extra step vs competitors such as Earn2Trade and Uprofit, this is a sensible approach to ensure traders only receive a funded profile when they are truly ready. Other funded account providers, such as Leeloo or FTMO, also follow a two-step procedure.

The process stipulates users must demonstrate profit potential and risk management capabilities. Once the skill and qualification requirements have been met, users are offered a funded account. Buying power varies by profile type, but users can earn up to 90% of profits.

Topstep has the quickest funding trading program in the industry, with the evaluation process often navigated in as little as eight days.

Account Rules

The Trading Combine plan will help you grow an account balance and manage risk appropriately so you will be ready to trade capital with conviction within a funded profile.

The proving profitability rules entail that you meet the pre-determined profit target and trade for a minimum of five days (days do not need to be consecutive).

The managing risk rules entail that you must only trade permitted products at accepted times, you do not hit or exceed the daily loss limit (the daily loss limit is $3,000 in the $150K Trading Combine), you do not allow your account balance to hit or exceed the trailing maximum drawdown, and you follow the scaling plan.

Put simply, to get access to the funded trading program you must:

- Prove you can make a profit – Demonstrate that you have a winning strategy for the futures market

- Show you can manage risk – Establish consistency with your trading style to prove Topstep’s capital is safe in your hands. Your account will be evaluated against the Scaling Plan at the end of each day. It acts as a guide on how to responsibly leverage a growing account. For example, an account balance below $51,500 has a maximum position size of 2 lots

- Earn your funded account – Keep the first $5,000 in profits and 90% after that

Your account will automatically be reviewed once the trade reports are uploaded. If you pass step 1, you will receive a step 2 confirmation email.

Pricing

Once you have completed the Topstep Combine course, you do not need to pay a monthly subscription fee, though you will be responsible for the cost associated with running a professional account.

Our Topstep review found these fees are categorized into three categories; CME professional data subscription charges, round turn commissions and a platform license API key:

- Exchange Data Subscription – TSTrader or TradingView at $132 per month, all other platforms cost $116 per month

- Platform License – TSTrader, TradingView, T4 and RTrader are all free options for both Trading Combine and funded accounts. To use other platform terminals, third-party subscription fees may apply

- Round Turn Commissions And Fees – Brokerage commissions range between $0.72 and $2.04 for a funded professional account. Exchange fees vary by product but range from $2.46 and $4.30 for permitted products (for example E-Mini NASDAQ at $2.46)

To reduce costs, look out for relevant Topstep promos or discount codes. There may also be third-party deductions via the platforms.

Tools & Assets

Topstep investors can trade a subset of the Chicago Mercantile Exchange CME Futures Contracts. Permitted products include:

- CME COMEX Futures – Gold (GC), Silver (SI) and Copper (HG)

- CME Agricultural Futures – Lean Hogs (HE) and Live Cattle (LE)

- CME CBOT Equity Futures – Mini-DOW (YM) and Micro Mini-DOW (MYM)

- CME NYMEX Futures – Crude Oil (CL), E-Mini Crude Oil (QM), Natural Gas (NG) and E-Mini Natural Gas (QG)

- CME CBOT Agricultural Futures – Corn (ZC), Soybeans (ZS), Soybean Meal (ZM), Soybean Oil (ZL) and Wheat (ZW)

- CME Foreign Exchange Futures – Australian $ (6A), Canadian $ (6C), Japanese Yen (6J), British Pound (6B), Euro FX (6E), E-Mini Euro FX (E7) and Swiss Franc (6S)

- CME CBOT Financial/Interest Rate Futures – 2-Year Note (ZT), 5-Year Note (ZF), 10-Year Note (ZN), Ultra-Note (TN), 30-Year Bond (ZB), Ultra-Bond (UB) and Eurodollar (GE)

- CME Equity Futures – E-Mini S&P 500 (ES), Micro E-Mini S&P 500 (MES), E-Mini NASDAQ 100 (NQ), Micro E-Mini NASDAQ 100 (MNQ), E-Mini Russell 200 (RTY), Micro E-Mini Russell 200 (M2K), and Nikkei NKD (NKD)

Note, the forex program was closed in April 2022.

Platforms

Topstep provides a proprietary trading platform named TSTrader plus thirteen other third-party terminals. This includes NinjaTrader, TradingView, Sierra Chart and MotiveWave. This is significantly more vs Apex Futures, for example, which offers just one proprietary platform.

Look out for webtrader, desktop download, or mobile app compatibility to suit your trading needs. Platform features vary, though the bespoke platforms may offer favorable conditions.

Note, there is no MetaTrader 4 (MT4) download following the suspension of the forex trading program.

TSTrader

- News streams

- No platform fees

- One-click order entry

- 40+ technical indicators

- Trade directly from charts

- Fully customizable drag and drop setup

- $0.79 per contract/side commission in the funded account

- Available via all major web browsers or downloadable to iOS and Android devices

NinjaTrader

- Fully customizable charts

- Precise data and execution

- Integrated guides, video library and daily webinars

- Access several order entry interfaces including Chart Trader

- Several analytical tools including EasyLanguage and RadarScreen

- Available via all major web browsers or downloadable to desktop, iOS and Android devices

- Automated strategy using ‘point and click’ construction or via NinjaTrader’s C-based framework

TradingView

- 50+ smart drawing tools

- 100+ pre-built indicators

- Intuitive advanced charting

- Multi timeframe market analysis

- Access to the largest social network for traders

Payouts

Traders receive 100% of initial profits from payouts, up to a total of $5,000. After this, the profit split will become 90/10. Individual investors will receive 90% of profits ongoing, with Topstep retaining 10%. You can request a payout of up to 50% of your account balance after accumulating five winning trading days (when a day’s net P&L is $100 or more).

Let’s look at an example:

Let’s say you start your funded account with a $100 account balance. On your 10th day, you have had five winning trading days with an account balance of $5,000. Here you can request a payout of 50% of the profit and receive $2,500. You can continue trading with the remaining $2,500. After this, you can continue trading for an additional five winning days to request a 50% profit payout again.

Our experts were pleased to see that over $3 million was withdrawn by investors in 2021. Traders can withdraw their profit share via an online form on the app. Funds are removed immediately from your Topstep account, however, payouts are typically credited within two to five working days.

Withdrawal methods are limited to bank wire transfers only; ACH wire is available for investors with a US-based bank account and international traders can use standard bank wire requests.

There are no payment fees, however, there is a $50 cost for any failed transfers. It is your responsibility to pay the relevant taxes based on your local jurisdiction.

Accounts

Once you have completed all the requirements in the evaluation process, you will be able to invest professionally with Topstep. There are three account types to choose from, which offer variable buying power with an associated monthly fee.

You can have multiple Trading Combine accounts working simultaneously towards becoming funded. Though, after this, the brokers’ rules stipulate that only one funded account may be open at a time.

$50k Buying Power

- Profit target – $3,000

- Daily loss limit – $1,000

- Weekly loss limit – $1,000

- Monthly Subscription Fee – $165

- Maximum position size – 5 contracts

- Trailing maximum drawdown – $2,000

$100k Buying Power

- Profit target – $6,000

- Daily loss limit – $2,000

- Weekly loss limit – $2,000

- Monthly Subscription Fee – $325

- Maximum position size – 10 contracts

- Trailing maximum drawdown – $3,000

$150k Buying Power

- Profit target – $9,000

- Daily loss limit – $3,000

- Weekly loss limit – $3,000

- Monthly Subscription Fee – $375

- Trailing maximum drawdown – $4,500

- Maximum position size – 15 contracts

Note, holding positions overnight or across days is not permitted.

The standard funded account is a live profile that allows you to trade live markets backed by Topstep’s capital. The funded account has all the same account parameters as Step 2 of the Trading Combine, including starting with a $0 balance.

The premium funded account is a live trading profile with a starting balance equal to the simulated profits in your pro account ($5,000 for a standard premium funded account and $2,500 for a swing premium funded account). The premium funded account begins after you have met the pro account targets without breaking any rules.

When using Topstep’s services, this can feel quite confusing, so we have outlined it simply below:

Trading Combine Profile

- Scaling Plan – Updated automatically at the end of the day

- Commissions And Fees – $3.70 per round turn ($1.85 per side)

- Trailing Maximum Drawdown – Calculated end of day based on net P&L

- Monthly Subscription Costs – Account fees ranging from $165-$375 per month, reset charges at $99

Pro Account

- Monthly Subscription Costs – None

- Scaling Plan – Updated automatically at the end of the day

- Commissions And Fees – $3.70 per round turn ($1.85 per side)

- Trailing Maximum Drawdown – Calculated end of day based on net P&L

Funded Account

- Scaling Plan – Contact the brokerage’s support team to adjust tiers

- Trailing Maximum Drawdown – Calculated intraday based on net P&L

- Commissions And Fees – Variable depending on the platform and traded instruments

- Monthly Subscription Costs – Exchange data fees ($116-$132 per month), platform subscription costs (free versions available), and commissions. A useful calculator is available on Topstep’s website which outlines relevant costs based on individual investing conditions

Demo Account

Topstep offers a 14-day free trial account for all investors, an advantage vs OneUp Trader with a 7-day trial period.

This is a great way to test platform features risk-free with $150,000 in virtual money, before purchasing a monthly subscription. Test strategies and products without affecting your evaluation.

You also have unlimited access to a second account, allowing you to toggle between a live and demo profile via the user dashboard.

Additional Features

When you sign up with Topstep, you gain access to the investing community. The social space currently has 10,000+ members, with many using the platform to discuss market news, evaluate investments and strategies, share resources, and connect with fellow traders around the world.

View 320+ integrated YouTube videos, economic calendars, Topsteptrader blog posts, 10+ live shows per week, and daily market forecasts. When using the platform, we also found free group coaching sessions available twice per week or one-on-one training available by request.

As standard with prop trading firms, any time a rule is broken within a program, the account will become temporarily ineligible for investment activity. Topstep offers a reset function within the Trading Combine profile, meaning you can change the status of your profile from ineligible to eligible. This comes at a cost of $59 in swing Trading Combine and $99 in all other Trading Combine accounts. The reset feature is designed to replicate the feeling of losing real capital in the markets.

Pros Of Topstep

- Economic releases

- Paper trading profile

- Secure dashboard login

- Account reset option available

- Free 14-day trial to enter program

- Access to 14 platforms to execute trades

- Responsive customer service including live chat and telephone number

- Keep up to 90% profits with a 50% account balance withdrawal available

- A real focus on improving trading skills via the Trading Combine program

- Extensive educational resources, community access, coaching and live webinars

Cons Of Topstep

- No weekend positions

- Futures instruments only

- Relatively low buying power vs competitors

- Withdrawals are limited to ACH or international bank wire transfers

Opening Hours

Opening hours run from 5 PM (CT) Sunday to Thursday, closing for the weekend on Friday at 3:10 PM (CT). All positions must be closed before 3:10 PM (CT).

A full futures holiday calendar is available via the platform interface.

Security

As Topstep is not a broker-dealer, it is not regulated by any financial body. This is standard for private funds, with no legal security requirements. It is still worth reviewing the safety of platforms, however, including access to two-factor authentication or biometric logins.

As an additional security measure, Topsteptrader has a risk management team to monitor accounts.

Customer Support

Topstep provides various customer contact methods, though these are only available on weekdays 7 AM – 6 PM (CT). Nonetheless, our experts were pleased with the help and support which includes live chat, email and phone number. There is a 24-hour response time for email.

Contact details:

- Email contact form

- Telephone – +1(888) 407-1611

- Live chat – available bottom right of each web-page

Topstep also hosts a comprehensive FAQ section on their website, which can be found within the online ‘help center’. Topics include the difference between the pro account vs the express funded account, step 1 and 2 trader rules, how to reset an account and verification requirements.

Alternative contact methods include social media accounts such as Instagram, LinkedIn and Discord.

Topstep Verdict

Topstep was created to fund and educate traders through a “learn by doing” approach in a simulated futures trading environment. The funded profile provides exciting conditions for both beginners and experienced investors, including access to various platforms, educational resources, plus free trial and reset options. This all makes it one of our top picks for investors looking to profit from their skills.

FAQs

What Is Topstep Trading?

Topstep is a futures prop trading firm that helps traders earn funding. The company uses bespoke technology and Trading Combine to evaluate prospective retail traders’ abilities to succeed in a funded account environment.

How Does Topstep Work?

Traders work towards meeting requirements to qualify for a funded account. Investors are recruited via a two-step evaluation process in real-time simulated accounts. Those that pass with TopstepTraders can progress to a funded futures account with a 90% profit payout.

How Much Does A Topstep Funded Trading Account Cost?

Monthly fees for a Topstep funded account vary by buying power; $165 per month for $50,000, $325 per month for $100,000, or $375 per month for $150,000.

What Instruments Can You Invest In With Topstep?

TopstepTraders can invest in a subset of Chicago Mercantile Exchange CME Futures Contracts. This includes equity futures; S&P 500 and NASDAQ, CME NYMEX Futures such as Crude Oil and Natural Gas, or CME CBOT Equity Futures including Mini-DOW (YM) and Micro Mini-DOW (MYM).

Is Topstep A Legit Prop Trading Firm?

Topstep is a legitimate private trading fund. As it does not offer any financial services, regulation is not required. Security features, industry acknowledgments and responsive customer service are indicators of legitimacy and reliability.

How Do I Pass The Topstep Combine Account Requirements?

Passing the Topstep Combine requirements entails meeting two parameters; demonstrating profit potential and managing risk. There is no direct answer as to how to pass the Topstep Combine program, so make use of the free trial to finesse your skills. Ultimately you will be in a better position to handle a live account.