Markets.com Review 2025

Awards

- Best Trading Platform 2020 - FXScouts

- Runner Up - Best FX Broker 2019 - DayTrading.com

- Best Forex Provider 2017 - UK Forex Awards

- Best FX Platform 2017 - UK Forex Awards

Pros

- There's good customer support with responses in <1 minute during testing

- Markets.com is a trusted broker with oversight from tier-one regulators including the FCA, CySEC and ASIC

- The $10 inactivity fee is only charged after 12 months of no trading activity (many competitors start charging after only 3 months)

Cons

- Unlike some top competitors like XM, customer support is not available on the weekend

- There are no auto or copy trading terminals outside of the MetaTrader platforms, such as DupliTrade

- The single retail account option doesn't offer traders any choice of trading conditions, or any additional perks for active trading

Markets.com Review

In this review of Markets.com, we weigh the pros and cons of signing up. Our team share their findings after testing the CFD broker, from accounts and minimum deposits to trading fees, platform features and regulatory credentials.

Assets & Markets

3.9 / 5The broker offers an excellent variety of assets available as CFDs, from major, minor and exotic currency pairs to stocks, indices, metals, energies, bonds, ETFs and crypto.

The breadth and depth of instruments beat most rivals we have evaluated, making Markets.com a good option if you want to speculate on popular financial markets.

Commissions & Spreads

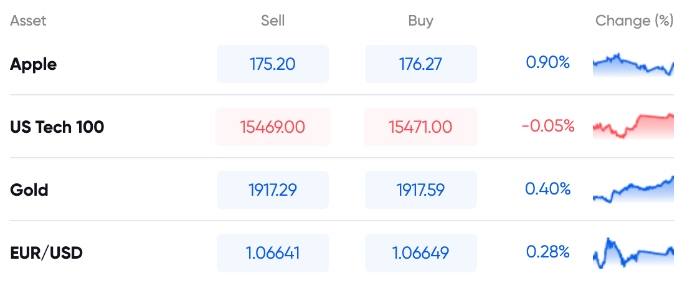

Trading fees at Markets.com are very competitive. During our evaluation, we got spreads of 0.7 pips on the EUR/USD and 1.3 pips on the GBP/USD. These are tighter than most brokers we use.

Note that exact spreads will vary based on numerous factors. Also, slippage, the difference between the expected price and the price at execution, can move against a trader, especially during periods of high volatility.

We also like that Markets.com does not charge a commission*. Spread-only pricing is often more straightforward for new traders to understand.

On the negative side, we found that inactivity fees apply after one year of no trading activity, with a $10 monthly charge. While not a dealbreaker in our opinion, it is worth being aware of for casual traders.

*Other fees may apply

Accounts

Markets.com offers two trading accounts, one for retail investors and one for ‘elective professional traders’:

- Retail – This is the standard live trading account that most users sign up for. You get access to the full suite of trading products and tools. I also found the three-step sign-up process straightforward, only taking a few minutes.

- Professional – This is for ‘elective professional traders’ who can access higher leverage if they fulfil two of the following three requirements: 1) The size of your financial instrument portfolio, including cash deposits, exceeds €500,000, 2) You work or have previously worked in the financial sector for at least one year in a professional position, 3) You have carried out transactions, in significant size, on the relevant market at an average frequency of 10 per quarter over the previous 4 quarters.

We were also pleased to find an Islamic-friendly account that operates in line with the Islamic Sharia Principle of interest-free trading is available.

Deposits & Withdrawals

Markets.com offers a good selection of convenient payment methods with an accessible minimum deposit of 100 of your base currency. This is low, making Markets.com an attractive proposition for new traders with limited capital. We also appreciate that there are no deposit fees.

You can fund your account with:

- Debit & credit cards – Available everywhere

- Bank wire transfer – Available everywhere

- Skrill/Neteller – Not available in the UK

- PayPal – Available in Europe only

- Ideal – Available in Europe only

- Sofort – Available in Europe only

To comply with money laundering laws, withdrawals must first be made via the initial deposit method. Again, there are no fees for withdrawing funds, which is an advantage over alternatives like eToro.

Average withdrawal times vary depending on the payment method, with bank transfers taking between two and five days while credit cards take up to 24 hours. This means if the market moves your way and you collect on 80 pips, withdrawing your balance will be quick and easy.

When we used Markets.com, we did find that there are minimum withdrawal requirements:

- Bank Transfer – 100 USD/EUR/GBP (20 EUR within the EU)

- Credit/Debit card – 10 USD/EUR/GBP

- Skrill/Neteller – 5 USD/EUR/GBP

- PayPal – 10 USD/EUR/GBP

Trading Platforms

Markets.com offers an excellent suite of trading software, including a user-friendly in-house platform, plus the popular MetaTrader 4 and MetaTrader 5 systems.

Markets.com

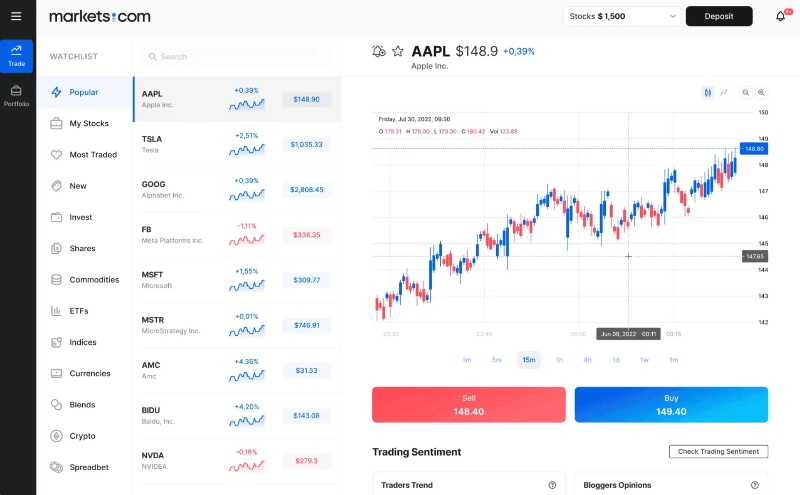

Markets.com offers its own proprietary trading platform, which I think is best for beginners. The platform is web-based and easily accessible if you have an internet connection. I find the user interface simple and clean, while still offering advanced charting and technical analysis tools.

The platform comes with a range of technical indicators to enhance chart analysis and 14 trading tools. This includes market insights from 50,000 bloggers, a Hedge Funds Confidence tool that uses SEC data, plus an Insiders Trades feature that flags increases and decreases in the shareholdings of over 36,000 companies.

A unique feature of the platform is also its trading cubes. This allows me to view numerous instruments at once, helping to streamline the trading process.

I also find value in the real-time news feed. This ensures I can monitor and react to the markets with ease.

MT4 & MT5

You also have the option of the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5). The download for both is available for Mac and PC users.

Once you have your MT4 or MT5 login details, you will have access to a powerful platform that offers advanced charts and in-depth analysis. A long list of custom indicators will also be at your disposal.

On top of that, you get sophisticated real-time trading tools and rapid execution speeds. The MetaTrader system is also easy to set up and there is a wealth of resources online to support you.

Mobile Apps

Markets.com mobile app reviews are mostly positive. Firstly, there is an app for Android and iOS users. The app download is quick and on-boarding takes just a few minutes once you have your mobile login details.

You still get access to the diverse product list, allowing you to speculate on everything from oil to stocks.

Both iOS and APK apps are also powerful and packed full of charts and technical analysis tools. You also have numerous risk management features, including: Stop loss, Take profit, Entry limit and Entry stop.

Overall, the app is good, promising a straightforward transition from the desktop-based applications. My only criticism is that the app doesn’t offer the following tools found on the web platform:

- There are no alerts

- You can’t access the news

- You can’t add indicators to your charts

As a result, those who do a lot of trading from their mobile may want to consider how to replicate those missing elements, if required.

Regulation & License

With an increase in the number of fake and fraudulent brokers around, finding one you can trust is important.

Fortunately, Markets.com holds licenses with several respected regulatory bodies, including the UK Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC).

This should put customers from the UK, France, Spain and the rest of the Eurozone at ease. Markets.com is also regulated by the Australian Securities and Investments Commission (ASIC), the BVI Financial Services Commission (FSC), and South Africa’s Financial Sector Conduct Authority (FSCA).

The multiple licenses Markets.com holds are a reassuring sign for us that the broker is legitimate and that standard client protection protocols are in place.

Markets.com also offer negative balance protection, meaning you cannot lose more than your initial deposit. This does mean, however, that traders must keep a healthy balance in their account, or trades may be closed if prices move against them. Stop losses are another valuable way to manage risk.

Leverage & Margin

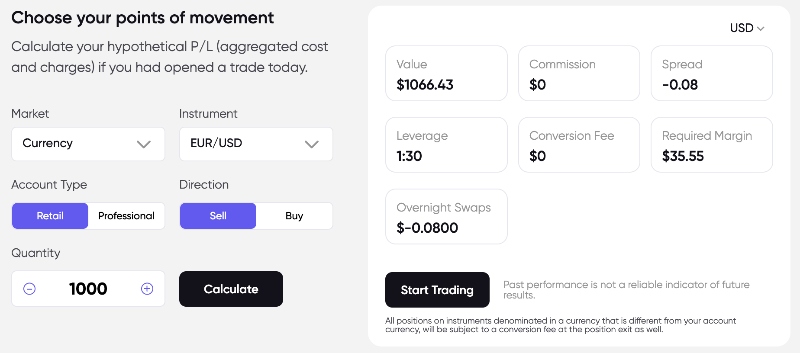

Markets.com offers leveraged trading in line with regulatory requirements. With that in mind, leverage levels for retail traders from the UK and Europe go up to 1:30 while in Africa and elsewhere the maximum leverage available climbs to 1:300. ASIC in Australia also capped leverage to a maximum of 1:30. Professional traders can request and arrange higher leverage.

Leverage allows traders to open positions with a value in excess of their account balance. This does, however, increase the risk and reward in each trade, and as such we recommend caution, especially for beginners.

Note maximum leverage will depend on your account type and instrument. Cryptocurrencies generally have low levels of leverage, whereas more liquid and less volatile assets such as popular forex pairs, can see higher leverage levels.

We found that Markets.com send traders a notification if margin levels drop below 70%, before receiving a margin call. The broker also reserves the right to close out positions should margin fall below 50%.

Demo Account

Markets.com does offer a free demo account. Funded with simulated money, their practice account is a fantastic opportunity to test drive a platform and explore intraday trading.

Then once you are comfortable with various tools and have built an effective strategy, you can open a live trading account.

We also rate that demo and live accounts can be open at the same time – this allows for strategies to be trialled and tested alongside real money trading.

Bonuses & Promotions

Bonuses vary depending on which country you are registering an account from, with users from the UK, Australia and Europe unable to claim promotions due to regulatory conditions.

Details of sign-up bonuses and refer-a-friend schemes are visible when you open a new account or via the Markets.com live chat service.

In our experience, bonus terms usually come with volume requirements and a restriction on bonus withdrawals, so bear this in mind when you opt into a promotion.

Additional Features

While testing Markets.com, we were impressed with the additional resources and research materials. Head to the Learn portal and you can find tools and industry commentary on a range of markets and asset types:

- XRay – Real-time financial opinions on news of company dividends, for example

- Acuity News Alerts – Top-line figures on how news activity from the likes of Bloomberg is affecting the markets

- Trends In Trading – Analyzes every trade, painting a picture of market sentiment

- Webinars – Free training and tips from industry experts

All of the features above can help you learn how to trade, from spotting potential opportunities to conducting in-depth market analysis. Once account verification is complete, you can access most of these tools from within your platform.

I also find the CFD Trading Calculator particularly useful for understanding planning trades and understanding costs and margin requirements:

On the negative side, I would like to see the broker do more in terms of social investing. There are no chat rooms or forums where traders can exchange ideas and have concepts explained. Also, copy trading isn’t available, which would allow beginners to replicate the trades of successful and experienced traders.

Finally, automated trading is not an option at Markets.com. The broker does not have APIs or offer any sort of trading algorithms and EAs, which will be a major drawback for some traders.

Company Details

Markets.com began serving retail traders in 2008. Following a string of high-profile partners, including Arsenal FC, plus a CEO committed to using technology to improve the user experience, the broker has earned a strong reputation.

The company has attracted more than 4 million users from around the world, executed over 42 million trades, and picked up a string of awards.

These are all promising signs for our experts that Markets.com is a legitimate and reliable broker.

Customer Support

3.8 / 5Markets.com scores well for its customer support, which is available in over 10 languages, 24/5. You can get in touch via email, telephone, live chat, or through an online query form.

I recommend using the live chat support for a fast response as wait times are usually less than a minute based on my tests. The query form and telephone support number for your respective area can be found on the ‘Contact Us’ page.

Customer service agents can help with a whole host of issues, from why a platform’s not working to helping you understand why an order was rejected.

Markets.com also houses an extensive support centre and FAQ section where you can find answers. Available are user guides, training videos, or even just simple instructions on how to delete an account.

My only criticism is that customer support isn’t available on the weekend, which is a downside, especially for crypto traders who may be active then.

Safety & Security

Our team are pleased with the multiple measures taken by Markets.com to ensure client security. Protocols include robust firewalls, SSL technology and advanced encryption.

These measures should put prospective traders at ease that their data and information are safe at Markets.com.

Trading Hours

The broker’s opening and trading hours are fairly industry-standard. For example, all major FX pairs will be available from Sunday 22:05 GMT through until 21:55 Friday GMT.

Note that Markets.com will be closed for trading during certain holiday periods. See the official website for a breakdown of both instrument-specific opening times and holiday hours.

Markets.com Verdict

Overall, Markets.com delivers an optimal trading experience. Stand-out features for us are the range of assets and trading tools, excellent customer service (live chat being particularly effective), plus reputable regulatory oversight.

On top of that, the low minimum deposit ensures Markets.com is a worthwhile choice for both beginners and experienced traders.

FAQ

Can I Trust Markets.com?

We consider Markets.com a trustworthy broker. It has millions of clients, multiple industry awards, an excellent reputation, plus oversight from tier-one regulators.

Is Markets.com A Good Or Bad Broker?

Markets.com is a very good broker based on our evaluation. It offers access to a wide range of markets with user-friendly and sophisticated trading tools, alongside competitive spreads and fees. We also appreciated the fast and straightforward sign-up process and low deposit, making it easy to get started.

How Can I Withdraw Money From My Markets.com Account?

To withdraw money from your Markets.com account, select ‘menu’ in the top right of the trading platform. Then select ‘withdrawal’. Withdrawals will be processed via the same payment method used for deposits. Withdrawals can also be requested from the mobile app.

What Spread Does Markets.com Offer?

Markets.com uses a floating spread. This means the spread varies throughout the day depending on market volatility and liquidity. It can result in tighter spreads but it also means it’s harder to predict trading costs in advance.

Does Markets.com Offer Negative Balance Protection?

Negative balance protection is applied to all Markets.com accounts by default. This means traders cannot lose more than their deposit.

Does Markets.com Handle Tax Reporting?

Markets.com does not handle tax reporting for its clients. On request, it can provide useful information, but tax obligations fall on the user and will vary depending on the jurisdiction you open and operate an account from.

Does Markets.com Offer Copy Trading?

Markets.com does not currently support copy trading, which was a key drawback in our review. This means traders are not able to copy the strategies and trades of high-performing traders.

Top 3 Alternatives to Markets.com

Compare Markets.com with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Markets.com Comparison Table

| Markets.com | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| Rating | 4.4 | 4.3 | 3.6 | 4.4 |

| Markets | CFDs, Forex, Stocks, Commodities, Indices, Crypto, ETFs, Bonds, Spread Betting (UK Only) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, Stock CFDs, Futures, Futures Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $100 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | FCA, CySEC, ASIC, FSCA, FSC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | NFA, CFTC |

| Bonus | – | – | 10% Equity Bonus | VIP status with up to 10k+ in rebates – T&Cs apply. |

| Education | Yes | Yes | Yes | Yes |

| Platforms | Markets.com Web/App Platform, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | WebTrader, Mobile, MT4, MT5, TradingView |

| Leverage | 1:30 | 1:50 | 1:200 | 1:50 |

| Payment Methods | 8 | 6 | 11 | 8 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by Markets.com and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Markets.com | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | No |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | Yes | No | No | No |

| Crypto | Yes | Yes | Yes | No |

| Futures | Yes | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | Yes | Yes | Yes | No |

| Bonds | Yes | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | Yes | No | No | No |

| Volatility Index | Yes | No | Yes | No |

Markets.com vs Other Brokers

Compare Markets.com with any other broker by selecting the other broker below.

The most popular Markets.com comparisons:

Customer Reviews

1 / 5This average customer rating is based on 1 Markets.com customer reviews submitted by our visitors.

If you have traded with Markets.com we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Markets.com

Article Sources

- Markets.com Website

- Markets.com FCA License

- Markets.com CySEC License

- Markets.com ASIC License

- Markets.com FSCA License

- Markets.com BVI License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I am writing this to warn other traders.

I traded with Markets.com (under Finalto South Africa) and built up my account over time. Everything seemed smooth—until I attempted to withdraw my $340,000 balance. Instead of processing the withdrawal, they rejected it without a clear explanation.

After requesting clarification, they referred to vague “liquidity abuse” and started coordinating with a third-party compliance firm. This raised red flags for me.

I was never told my strategy was unacceptable during trading. I provided full documentation and had no violations or margin issues. I used normal trading patterns, and their system accepted my trades and spreads. When I asked for detailed clarification, I received generic replies and delays.

I’ve submitted a complaint to the FSCA and escalated my case to the FAIS Ombud. It’s under assessment now, and I hope justice is served. Until then, I cannot recommend Markets.com.

If you’re a serious trader or scalper, be very cautious. A broker that rejects withdrawals after profits is a major red flag.

🚨 Final Thought:

I lost trust in Markets.com. I advise other traders to document everything, avoid large balances without regulatory protection, and think twice before using this broker for serious day.