LQDFX Review 2025

Please see the list of similar brokers or the Best Brokers List for alternatives.

Awards

- Best ECN Broker 2017

- Most Reliable Broker 2017

Pros

- Leverage is available up to 1:1000 for experienced day traders

- The broker offers the industry favorite MT4 platform and mobile app, with 30 technical indicators for chart analysis

- The $20 minimum initial deposit is accessible for beginners, and the Micro account will serve those looking to trade in smaller volumes

Cons

- Market research tools and educational resources are very limited compared to top brands like IG

- The lack of regulatory oversight is a concern, although the broker does claim to use segregated accounts and balance protection

- There are no additional charting platforms available, such as MT5 or a proprietary solution

LQDFX Review

LQDFX have rebranded to PlexyTrade.

LQDFX is an offshore, unregulated forex and CFD broker offering a range of currency pairs and leveraged CFDs. This 2025 review delves into the pros and cons of signing up with LQDFX, including minimum deposits, match bonuses, withdrawal times, and the MT4 trading platform. Find out whether to register for an LQDFX account and login to the client portal.

Company Details

LQDFX is owned and operated by LQD Ltd, a company registered in the Marshall Islands. The brokerage was established in 2015 and follows a straight-through processing (STP), no dealing desk (NDD) model, providing direct market access and removing requotes.

The company has a solid client base spanning multiple locations, from Canada to Australia. There are no deposit fees, spreads start from 0.01 pips and the brokerage offers 24/5 support.

LQDFX is currently unregulated by any financial body.

MetaTrader 4 Platform

LQDFX offers clients the well-rounded MT4 platform only, the precursor to MT5.

MT4 marries a rich selection of features with an intuitive design, making it great for traders of all levels. The trading platform supports 39 languages, 30+ technical indicators, customizable charting options, plus 9 timeframes.

Alongside one-click trading and deep market histories, MT4 also facilitates automated trading through Expert Advisors (EAs).

The MT4 terminal is available to download to Windows and Mac devices or can be used as a web-based profile. Useful links are provided on LQDFX’s website.

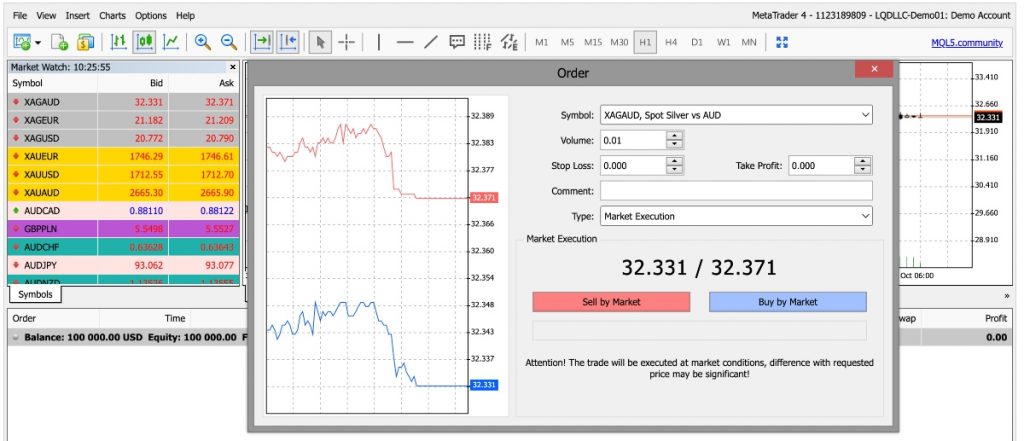

How To Place A Trade

- Register for an LQDFX account (you will need to submit basic contact details)

- Make a deposit of at least $20

- Download the MT4 platform or open the web terminal

- Login with your credentials

- Select an asset using the chart icon in the top left of the window

- Select the white page/add order button to the right of new asset

- Enter your trade parameters – trade size, execution mode, plus stop loss or take profit

- Select sell or buy to confirm the trade

Markets & Assets

LQDFX offers 100+ global instruments. This includes 71 forex pairs consisting of 7 majors, 21 minors, and 43 exotics. You can also trade 8 precious metals, including gold, silver, palladium, and platinum, as well as 11 global stock indices, 4 energy and agricultural commodities, and 16 cryptocurrencies. Trading on stocks and shares is also available.

Overall, our review was pleased to see an adequate range of assets that will suit the needs of most beginners and experienced investors.

Spreads & Fees

A combination of spreads and commission fees are offered to LQDFX investors. These charges depend on account type, trading instrument and market conditions.

The Micro account has the widest spreads, with typical values of 1.7 pips for EUR/GBP, 1.2 pips for EUR/USD, and 1.8 pips for GBP/USD. In comparison, Gold and Islamic accounts have tighter spreads, with EUR/GBP at 1.2 pips, EUR/USD at 1.1 pips, and GBP/USD at 1.4 pips. The ECN and VIP accounts have the most competitive spreads, coming in at 0.5 pips for EUR/GBP and 0.1 pips for both EUR/USD and GBP/USD.

The Micro, Gold, and Islamic accounts are commission-free; however, the ECN account has a $3.50 per lot charge, and VIP traders will incur a $2.50 commission fee.

The broker also charges swaps for holding positions open overnight.

There is no mention of inactivity charges.

Leverage Review

As an unregulated organization, the broker offers substantial margin trading opportunities. The maximum leverage available is 1:500 with the Micro Account. Leverage on other accounts is capped at 1:300, with the exception of the VIP account, which provides rates up to 1:100.

Leverage is a way to increase market exposure by lowering the initial capital requirement for trades. However, it also increases potential losses, so be sure to understand the risks before you sign up for leveraged trading.

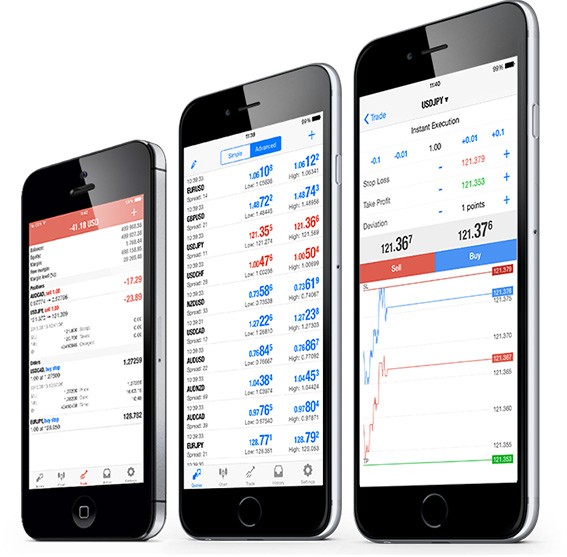

MT4 Mobile App

LQDFX offers mobile trading using a version of MetaTrader 4 designed for iOS and Android devices.

When using the MT4 platform, users can be sure of stable conditions and an easy-to-use interface. Day traders can access the tools, features and functionality found on the web trader and desktop terminals. You can manage your account, open and close positions, check live global pricing and view charts while on the go. Users can also set alerts and push notifications so opportunities don’t need to be missed when away from the computer.

LQDFX Deposits & Withdrawals

Payment methods are limited when it comes to funding an LQDFX trading account. Customers have the choice of credit/debit cards, PayRedeem and cryptocurrency only. It is disappointing to see no bank wire transfer option or flexible e-wallet solutions such as Skrill and Neteller.

Nonetheless, payment methods are free to use and offer processing times of less than 30 minutes. Visa & MasterCard debit and credit card payments have a maximum daily transaction limit of $2,000.

LQDFX offers all the same options for withdrawals, free to use, except for payment cards, which come with a $10 fee. Minimum withdrawal charges apply including $15 for crypto payments and $20 for credit/debit cards.

Withdrawals are processed instantly with a typical fund clearance time of one to two working days.

Demo Account

While using LQDFX, we found demo accounts are loaded with $100,000 of simulated money and replicate real-money trading conditions. Prospective clients can get to grips with the MT4 trading platform, delve into new markets, and test strategies with zero risk to capital.

Bonuses & Deals

LQDFX offers a 100% deposit bonus, matching your payment with tradeable cash. It applies to deposits between $250 and $20,000 and must be selected at sign-up.

The bonus can be withdrawn upon completion of trade volume requirements. Volume requirements depend on the size of the bonus, with $5 becoming withdrawable for every full lot that is traded (100,000 units).

Visit the broker’s website for the latest bonuses and rebates.

LQDFX Regulation

LQDFX is not licensed or regulated by any financial institution. Regulatory agencies help to prevent brokers from misleading customers and refusing to fund and process withdrawals.

The broker is quite transparent about its business model and has a range of legal documents on its website, which is better than most unregulated brokers. But while the broker states compliance with anti-money laundering policies and segregated client funds, there is no guarantee of that assertion given the absence of regulatory oversight.

Additionally, when using LQDFX, we came across some negative user reviews online, so exercise caution before opening an account.

Additional Features

LQDFX offers a good range of educational resources and trading tools. As well as an economic calendar, the broker has Fibonacci, pivot point, and deal size calculators.

Importantly, the website’s education section is well laid-out, offering a beginner’s course and a range of video tutorials on ECN trading, using MetaTrader 4 and mobile app functionality. There is an e-book provided on forex trading, offering a deeper dive into trading psychology, behavior and key concepts.

A range of articles are also on offer, exploring technical analysis and risk management, as well as a course on trading strategies for various experience levels and markets.

Account Types

When we used LQDFX, we found the brokerage offers five live accounts, each of which boasts access to MT4, the full range of educational material, a dedicated account manager and all tradeable assets. The broker also offers swap-free trading conditions for Islamic clients.

Below we the key features of each account:

Micro Account

- Leverage 1:500

- No commissions

- Typical spread 1 pip

- Minimum deposit $20

- Maximum trade size 5 lots

- Minimum trade size 0.01 lots

Gold Account

- Leverage 1:300

- No commissions

- Minimum deposit $500

- Maximum trade size 40 lots

- Typical spreads from 0.7 pips

- Minimum trade size 0.01 lots

ECN Account

- Leverage 1:300

- Typical spread 0.1 pips

- Minimum deposit $500

- $3.50 per lot commissions

- Maximum trade size 40 lots

- Minimum trade size 0.01 lots

VIP Account

- Leverage 1:100

- Typical spread 0.1 pips

- No maximum trade size

- $2.50 per lot commissions

- Minimum deposit $25,000

- Minimum trade size 0.1 lots

Islamic Account

- No swaps

- Leverage 1:100

- No commissions

- Minimum deposit $20

- Typical spread 0.7 pips

- No maximum trade size

- Minimum trade size 0.01 lots

Trading Hours

The broker’s MT4 platform is open 24/7, however, instruments are only tradeable when their respective markets are open. LQDFX’s servers run in the GMT+1 time zone, and the trading hours below are also in GMT+1.

Forex pairs open at 22:03 on Sundays and close at 21:58 on Fridays, with a daily break from 21:58-22:03. Precious metals open at 23:01 on Sundays and close at 21:58 on Fridays, though there is a daily break at 21:58-23:01. Commodities and stock indices have a range of opening times detailed in full on the broker’s website.

Customer Support

2.5 / 5The broker has several backoffice teams, operating a 24/5 support service. The team can be contacted using the following details:

- Email – support@lqdfx.com

- Live chat – right-hand side of the website

- Telephone number – +44 20 8064 1038

The support team can help with multiple account queries, from uploading documents for pending KYC verification to PAMM servers and ‘trade disabled’ error messages. Unfortunately, clients cannot consult an FAQ portal for margin call requirements and MT4 login issues.

Note that the support team cannot provide advice on taxes or name individual employees.

Security & Safety

LQDFX has a secure website that uses safe single sockets layer (SSL) encryptions on all website traffic. When using the MetaTrader 4 terminal, you can add additional security settings such as two-factor authentication (2FA) or one-time passwords.

Be cautious of scams, particularly when trading with unregulated brokers. There are no customer protection schemes available and your personal capital may be at risk.

LQDFX Verdict

LQDFX offers a solid basic service as an online broker, with 71 currency pairs and a range of metals, commodities, cryptocurrencies, and indices. There is also a good selection of account options, including a dedicated Islamic account, plus a good education center and support for scalping, hedging, and other trading strategies. However, customers have expressed some negative opinions in online reviews, flagging withdrawal and client portal login issues. We’re also hesitant to recommend unregulated brokers due to scam concerns. As such, we would consider other providers first.

FAQ

Does LQDFX Integrate With TradingView?

No, you cannot use TradingView charts on LQDFX. However, the broker integrates with MT4, which can be utilized to view live price charts and market data.

Does LQDFX Provide VPS?

No – virtual private servers (VPS) aren’t offered by LQDFX. On the other hand, the broker provides direct market access.

Is Arbitrage Allowed On LQDFX?

No. The account opening agreement clearly states that arbitrage and fraud, manipulation, or anything the platform deems as suspicious are strictly prohibited. The brokerage reserves the right to remove any gains obtained through such methods and even close user accounts.

Which Are Is Best LQDFX Vs. Hugo’s Way, Traders Way, Or FX Choice?

They are very similar, all providing forex, crypto, stocks, indices, commodities, and use of the MT4 trading platform. The most significant difference is made by FXChoice, which is regulated. Regulated brokers provide additional protection to traders.

What Trading Account Types Does LQDFX Offer?

LQDFX offers five account types to day traders, with direct market access. All profiles offer access to all trading instruments, tight spreads and flexible leverage.

Can I Register With LQDFX In The US?

No – clients from the US are not accepted.

Can I Fund An LQDFX Account With PayPal?

No, many methods can be used for transactions with LQDFX, including e-wallets, payment cards and cryptocurrencies, but PayPal is not supported.

Does LQDFX Provide Clients With MetaTrader 5 Access?

No, the broker offers MetaTrader 4, the predecessor to MetaTrader 5, which has won many awards over the years and has established itself as the industry’s standard retail trading platform.

Does LQDFX Offer Cryptocurrency Trading?

Yes, the broker supports trading on cryptocurrencies. It offers 16 major cryptos, of which most are paired with the US Dollar or Euro.

Is LQDFX A Legit Online Broker?

LQDFX is not a regulated broker, limiting your legal protection if the broker refuses withdrawals or acts improperly. Some brokers are intentionally unregulated, allowing them to provide otherwise restricted services. With that said, LQDFX does have a wide client base and is well-regarded by some traders.

Top 3 Alternatives to LQDFX

Compare LQDFX with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Plexytrade – Established in 2024 and headquartered in Saint Lucia, Plexytrade is an ECN/STP broker. Geared towards active traders, it supports four account options, crypto deposits and withdrawals, plus very high leverage up to 1:2000 made possible by its unregulated status.

LQDFX Comparison Table

| LQDFX | Interactive Brokers | Dukascopy | Plexytrade | |

|---|---|---|---|---|

| Rating | 4.5 | 4.3 | 3.6 | 2.5 |

| Markets | Forex, CFDs, Stocks, Indices, Commodities, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | CFDs, Forex, Indices, Stocks, Commodities, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $20 | $0 | $100 | $50 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 |

| Regulators | – | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | – |

| Bonus | 100% deposit bonus up to $20,000 | – | 10% Equity Bonus | 120% Cash Welcome Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | MT4, MT5 |

| Leverage | 1:1000 | 1:50 | 1:200 | 1:2000 |

| Payment Methods | 6 | 6 | 11 | 2 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Plexytrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by LQDFX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| LQDFX | Interactive Brokers | Dukascopy | Plexytrade | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

LQDFX vs Other Brokers

Compare LQDFX with any other broker by selecting the other broker below.

The most popular LQDFX comparisons:

Customer Reviews

3 / 5This average customer rating is based on 1 LQDFX customer reviews submitted by our visitors.

If you have traded with LQDFX we would really like to know about your experience - please submit your own review. Thank you.

Available in United States

Available in United States

They do accept US traders!

They have an issue since Feb 2024 with MT4/MT5 mobile app , their name does not appear in the broker’s list anymore, but old accounts still work fine.

Withdrawals have a high fee.