J.P. Morgan Chase Review 2024

Pros

- Hugely respected brand with a long history in financial services

- Strong regulatory oversight with FINRA and SPIC membership

- Easy to manage, move and transfer funds on the Chase mobile app

Cons

- Limited payment methods supported

- No MetaTrader 4 integration

- No demo account to practice investing risk-free

J.P. Morgan Chase Review

J.P. Morgan offers two retail trading profiles via their Chase subsidiary. Users can choose either a flexible Self-Directed Investment Account or a fully managed Automated Account. Both investing profiles can be used alongside traditional banking services in a one-stop mobile solution.

This review of J.P. Morgan Chase will cover the difference between retail trading accounts, market access, margin rates, investing fees, customer service, promotions, and more.

Company Details

J.P. Morgan is a global organization that provides financial services in more than 100 countries.

Founded in 2000, the firm is headquartered in New York City and is one of the oldest financial institutions in the United States. Today, J.P. Morgan is made up of over 250,000 employees with $2.6 trillion of assets under management (AUM).

J.P. Morgan is regulated in the various jurisdictions in which it operates. In the US, it is registered with:

- Commodity Futures Trading Commission (CFTC)

- Financial Industry Regulatory Authority (FINRA)

- Securities & Exchange Commission (SEC)

- National Futures Association (NFA)

Retail Investing

The wealth management side of the business, J.P. Morgan Chase, is responsible for retail and investment services for everyday clients.

Self-Directed Investments

The J.P. Morgan Self Directed Investing Account enables individual investors to trade thousands of stocks, mutual funds, exchange-traded funds (ETFs), bonds, and more on their own terms.

The online Chase Investment solution gives users the flexibility to create their own portfolio alongside award-winning research resources and market analysis.

There is no minimum balance requirement to get started.

Automated Investments

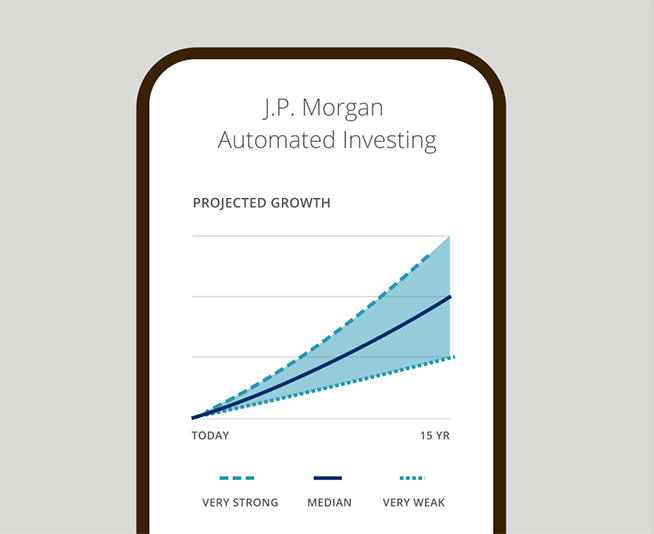

The J.P. Morgan Automated profile offers robo-advisor-designed portfolios that run automatically. A pre-built trade plan is created based on your individual criteria including risk appetite, timeframe, and investment goals.

These portfolios are crafted by J.P. Morgan investment managers who provide advice and support to help you achieve your financial goals.

There is a $500 minimum to get started.

Popular Alternatives To JP Morgan Chase

-

1

FOREX.comActive Trader Program With A 15% Reduction In Costs

FOREX.comActive Trader Program With A 15% Reduction In Costs

Ratings/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5

$1000.01 Lots1:50NFA, CFTCForex, Stocks, Futures, Futures OptionsMT4, MT5, TradingView, eSignal, AutoChartist, TradingCentralWire Transfer, Credit Card, Debit Card, Visa, Mastercard, Skrill, Neteller, ACH TransferUSD, EUR, GBP, CAD, AUD, JPY, CHF, PLN -

2

NinjaTrader

NinjaTrader

Ratings/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5

$00.01 Lots1:50NFA, CFTCForex, Stocks, Options, Commodities, Futures, CryptoNinjaTrader Desktop, Web & Mobile, eSignalACH Transfer, Debit Card, Wire TransferUSD -

3

eToro USAInvest $100 and get $10https://www.daytrading.com/ is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

eToro USAInvest $100 and get $10https://www.daytrading.com/ is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

Ratings/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5

$10$10SEC, FINRAStocks, Options, ETFs, CryptoeToro Trading Platform & CopyTraderACH Transfer, Debit Card, PayPal, Wire TransferUSD -

4

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States.

Ratings/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5

$00.01 Lots1:50NFA, CFTCForex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA)OANDA Trade, MT4, TradingView, AutoChartistWire Transfer, Visa, Mastercard, Debit Card, ACH TransferUSD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD

Trading App

J.P. Morgan’s retail trading solutions are primarily available on a mobile-based platform; The Chase Mobile App.

The app is available for download on iOS and Android devices; both versions have good reviews from users. In fact, the mobile application boasts an impressive 10 million+ downloads on Google Play with a 4.4/5 rating. But while the self-directed investing app is highly rated, some users may feel it is lacking in analysis tools vs TD Ameritrade, for example.

Features include:

- Earn rewards in return for daily spending

- Track spending with the in-built budget planner

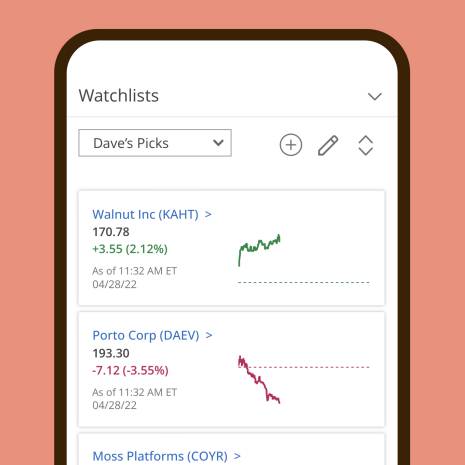

- Create custom watchlists of your favorite assets

- Deposit check payments directly through the app

- Set up automatic investments directly from bank accounts

- Access market screener tools to filter through available instruments

- Customize your portfolio with J.P. Morgan Equity Research and insights

The mobile app also works seamlessly with other Chase products including savings accounts and credit cards. Our experts were impressed with the intuitive layout and clear navigation, suitable for beginners. You can access your investments, view performance charts, and look at analysis and data insights.

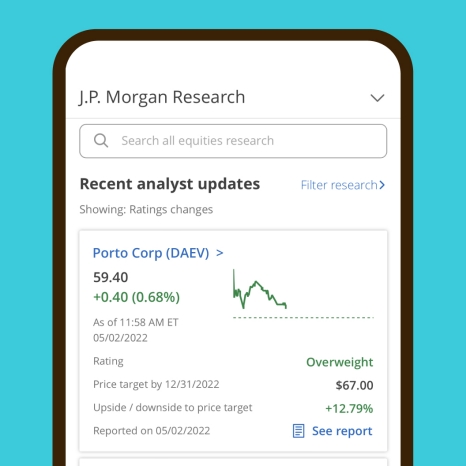

You can also stay up to date with the latest market news directly through the app, found under the ‘Explore’ icon. Here you can find news articles and analyst ratings from J.P. Morgan Securities.

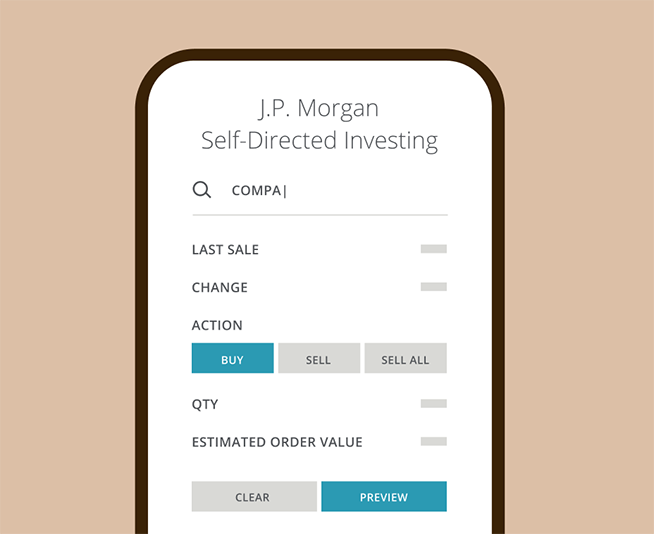

When we used J.P. Morgan Chase’s investing platform, we found the broker’s app supports the following order types; Market, Limit, Stop, and Stop-Limit. Investors can also open the following ‘time in force’ orders; Day, Good Til Cancelled, On the Open, On the Close, Immediate, or Cancel.

How To Place A Trade

- In the menu navigation bar, select ‘Trade’

- Choose the product you are interested in trading; ETFs, stocks, mutual funds, options, or fixed income

- Enter the order parameters and confirm the trade

- Alternatively, initiate the ‘Portfolio Builder’ for support to build a suitable assortment

Assets & Markets

The J.P. Morgan Self-Directed Investing profile offers thousands of stocks, ETFs, mutual funds, options, and fixed-income products. Clients are not permitted to purchase penny stocks, fractional shares, or securities under $5.

The J.P. Morgan Automated Investing portfolios can be made up of exchange-traded funds (ETFs). Each ETF can be a mix of bonds, stocks, and alternative securities bought and sold on an exchange. You can exclude up to three eligible ETFs from your portfolio if they are products you would prefer not to own.

Trading Fees & Commissions

Clients benefit from a transparent pricing model at JP Morgan Chase.

There are no charges to open an account. There are also no commissions for online stock and ETF trades, however, a transaction fee between $0.01 and $0.03 per $1000 in principle applies.

Options contracts are also commission free, however, investors will be liable for a +$0.65 charge per contract in addition to the transaction fee listed above. Call-in trades cost between $20 and $25.

Fixed-income bonds, US treasury bills, and new issues such as corporate bonds and municipal bonds can also be traded without commissions. Secondary market investments will be liable for a $10 fee per trade +$1.00 per bond over 10.

Other fees to be aware of:

- Stop Payments – $30 per item

- Late Payments – PRIME + 4.75%

- Brokerage Transfer – $75

- Retirement Account Termination – $75

- Bank Wire Transfers – $25 (excluding internal wire transfers)

An annual 0.35% advisory fee applies for Automated Investing profiles, meaning costs will vary by account balance. For example, an account balance of $50,000 will incur a monthly charge of $14.58.

Note, you will need to adhere to the minimum deposit requirement of $500 and you must maintain at least $250. Email alerts are activated if a profile balance falls below $300.

Leverage Review

J.P. Morgan offers leveraged trading opportunities from JPMS (private client advisors only). This involves borrowing funds from J.P. Morgan Securities LLC to increase your purchasing power. The broker provides competitive investing margin interest rates.

Reach out to a J.P. Morgan financial advisor for more details.

Payment Methods

Deposits

Our experts found that the J.P. Morgan Chase app is compatible with several payment methods. You can make both online and physical payments through the app.

Funding options for self-directed investing accounts and managed profiles include:

- Transfer Cash Or Savings – Deposit funds via check, savings or money market account

- Roll Retirement – Contribute with qualifying assets from a 401(k), IRA or alternative retirement profiles

- Transfer Investments – Transfer stocks, mutual funds, ETFs, or fixed income from an external investing account such as Fidelity or Vanguard

You can also move funds between your Self-Directed Investing accounts or from a J.P. Morgan Self-Directed Investing to a J.P. Morgan Automated Investing profile. Transfers between accounts are completed in real-time. Fund transfers from an alternative brokerage can take between 7 and 30 days if the transaction involves non-ACAT-eligible institutions.

The broker-dealer does not charge a deposit fee however third-party charges may apply.

How To Deposit To Your Chase Investment Profile

- Log in to your Chase profile

- From the main menu, select ‘Account Transfer’

- Click on ‘Manage External Account’

- Submit baking details

- Enter the amount to deposit

- Click ‘Submit’

Processing times vary by funding source:

- From Chase Account – For deposits made before 4:30 PM, funds will be available immediately. Funding requests made after 4:30 PM will be processed the next working day

- From A Non-Chase Account – For deposits made before 4:30 PM, funds will be available the next working day. Funds requested after 4:30 PM will be processed within two working days

Withdrawals

Bank wire transfers are the only accepted withdrawal method. This is disappointing vs Fidelity which supports various removal options, including checks and e-wallets.

Transfers from a J.P. Morgan Automated Investing account to your Chase bank profile take four to five business days. In contrast, funds are available to withdraw immediately from a J.P. Morgan Self-Directed Investment profile.

Withdrawals are free of charge.

J.P. Morgan Chase Demo

While using J.P. Morgan Chase, we found the broker-dealer does not provide a demo profile. Although this is disappointing, particularly for new traders, you can open an account and start investing with as little as $1.

Potential users can also access a wealth of educational resources and step-by-step platform guides to get comfortable with the basics before investing personal funds.

It is worth downloading the Chase Investment Account mobile app or opening the web terminal to explore. You can access all the features and functions without having to deposit funds.

Deals & Promotions

Existing J.P. Morgan Chase Self-Directed Investing customers can receive a $50 bonus through the broker-dealer’s referral bonus scheme. Customers can use their unique referral code and earn up to $500 per year. New customers benefit from up to $625 in rewards (account balance dependent).

Our experts were not offered any financial incentives or bonus offers with the Automated profile.

Regulation & Licensing

J.P. Morgan investment accounts are offered through JPMorgan Chase & Co. Investment products and services are provided by J.P. Morgan Securities LLC (JPMS) which is a registered broker-dealer and investment advisor. The brokerage is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC).

However, it is worth noting that Chase Investment Accounts are not FDIC-insured.

Additional Features

Education & Resources

There is plenty of educational content and resources available to individual traders. This includes details of how to get started with a Chase brokerage retirement account and the requirements, plus details of assets, platforms, tools, and more. Retail traders can subscribe to the latest news, market commentary, and expert analysis from J.P. Morgan advisors directly to their inbox.

Investing clients have access to J.P. Morgan stock research on more than 1,200 U.S. companies. Additionally, you can view news feeds from Benzinga, Midnight Trader, and Comtex, plus access Morningstar analysis and CFRA reports which should provide an adequate amount of information for Self-Directed Investing Account holders.

Portfolio Builder

The Portfolio Builder is a great tool for Self-Directed investment clients wanting to make their own trade decisions, but looking for help to create a suitable portfolio. Users have the flexibility to invest in any created portfolios made up of stocks and ETFs including fixed-income bonds and US equities. You can review the potential returns of each portfolio suggestion in charts generated by J.P. Morgan’s patented Morgan Asset Projection System (MAPS).

Our experts see this tool as a mix between the Self-Directed account and the Automated investment profile. Traders remain in full control over their positions but are guided with portfolio and asset suggestions.

Note, you must have a minimum cash balance of $2,500 to use the tool.

Wealth Plan

All users can access the JP Morgan Wealth Plan via the Chase investment app. The free ‘digital money coach’ provides real-time investment tracking, guidance, and a goal simulator.

The all-in-one solution displays all your finances within an intuitive dashboard interface. This includes your savings, spending and investing profiles.

A major benefit is that you can also link any external, non-Chase bank accounts to your dashboard to include these details in your overall financial display.

Features include:

- Savings goals

- Goal monitoring and ‘what is’ simulator

- Real-time tracking and action plans

- Integrated meeting capabilities with an advisor

The tool can be found under the ‘Plan & Track’ icon in the Chase mobile app or via Chase.com.

Accounts

There are two main account types; J.P. Morgan Self-Directed Investing and J.P. Morgan Automated Investing. Both offer different ways to access trading opportunities and are suited to traders of all experience levels and investment balances.

Self Direct Investment

Access thousands of products, including stocks, ETFs, options, mutual funds, and fixed income, and trade how you want to.

The traditional brokerage profile offers exclusive access to J.P. Morgan research and insights, a custom watchlist builder, and market screeners to help you make trading decisions.

Users can open a standard individual or joint investment account, traditional IRA, or Roth IRA.

Automated Investment

The broker’s professional investment managers will design a unique portfolio based on your goals, timeframe, risk appetite, and asset interests. It is an ideal account for traders looking for a more hands-off approach, or those getting started with their investment journey.

Your created portfolio will automatically rebalance to reflect changes and trends within the market. Investors can monitor and track their portfolio performance, view all finances in one dashboard, and easily transfer funds from an existing bank account.

The profile will incur a 0.35% annual advisory fee which is charged quarterly. This is reflective of your account balance. You can also get started with just $500.

Portfolio Types

There are four main portfolio ‘baskets’. These are flexible and therefore may not match exactly.

Conservative

A portfolio designed for modest, yet stable income opportunities.

- Relatively low risk

- Minimum three-year investment term

- 75% fixed income and 25% US & international equities

Moderate

A portfolio designed for stable account balance growth with increased risk vs the Conservative profile.

- Moderate risk

- Longer investment term

- 50% fixed income and 50% US & international equities

Growth

Designed for investors looking for above-average growth potential over a longer period

- Relatively high risk

- Longer investment term

- 25% fixed income and 75% US & international equities

Aggressive

A portfolio for investors seeking high growth potential, subject to market fluctuations

- High risk

- Long term investment

- 10% fixed income and 90% US & international equities

How To Open A Chase Investment Account

The good news is you don’t need to be a J.P. Morgan Chase bank customer to open a Self-Directed Investing or Automated Account.

You will need to sign up and register for the relevant J.P. Morgan profile which will automatically link to the Chase platform. Before you can log in, complete the online registration forms found on the website under ‘Brokerage Accounts’.

Note, to open a J.P. Morgan account, you must have a registered US address and a valid Social Security number. Investment profiles also have a minimum age of 18. For minors, consider opening a custodial account for an educational fund or tuition savings.

The broker will review all new applications within one working day. An email confirmation will be provided once your account is open.

Trading Hours

Trades can be placed via your online Chase Investment Account between 6 AM and 2 AM (ET).

The broker does not offer extended hours trading including after-hours. Note, any orders placed outside of normal trading hours (9:30 AM to 4 PM ET) will be queued and executed at the next available marketing opening time.

Your Automated Investment Account portfolio will normally be activated and an investment plan created within three working days.

Customer Service

JP Morgan’s customer service options are disappointing. There is no live chat functionality for potential customers and our experts were directed to self-help pages rather than any form of human interaction.

Nonetheless, there are plenty of guides, tips, and integrated video support so you can resolve most issues or queries yourself.

Below are direct numbers for both Chase investment account types:

- J.P. Morgan Chase Automated Investing – Customer service phone number, 1-800-776-6061. Monday to Friday 8 AM to 9 PM (ET) and Saturday 9 AM to 5 PM (ET)

- J.P. Morgan Chase Self-Directed Investing – Customer service phone number, 1-800-392-5749. Available Monday to Friday 8 AM to 9 PM (ET) and Saturday 9 AM to 5 PM (ET)

The broker-dealer also offers a complimentary investment discussion with a J.P. Morgan Private Client Advisor. An online contact form is available on the website to request a call-back service.

Security & Safety

The Chase investment app uses 128-bit encryption technology to protect personal data and transactions. The app supports Apple’s Touch ID and Face ID, or Android’s Fingerprint Login for quick and secure account access.

Additionally, any new sign-in attempts or logins from a new device will require multi-step authentication.

J.P. Morgan Chase Verdict

J.P. Morgan’s Self-Directed Investment Account is a simple trading solution that is great for beginners looking to learn how to buy and sell stocks and other assets. The option of an automated portfolio system is also ideal for those getting started or wanting to put their funds in the hands of the experts.

More advanced investors, however, may find the services lacking in terms of available assets and tools. You can view our list of the best alternatives to J.P. Morgan Chase below.

FAQs

What Is The Difference Between A J.P. Morgan Self-Directed Investment Account And The J.P. Morgan Automated Investment Account?

The J.P. Morgan Self-Directed Investing account offers retail clients full control to manage their investments. The J.P. Morgan Automated Investing profile uses the firm’s expert advisors to create managed portfolios designed to suit an individual’s investment goals.

Is The J.P. Morgan Self-Directed Chase Investment Account Good?

Our J.P. Morgan Self-Directed Chase Investment account review highlighted that it is a good option for beginners. It offers full flexibility to invest in stocks, ETFs, mutual funds, and bonds. Advanced traders, however, may feel the brokerage lacks analysis tools and technical features.

Does The Chase Investment Account Charge Any Fees?

You can use the J.P. Morgan Self-Directed account for free. There are no charges to open a profile, and you benefit from commission-free trading on stocks and ETFs. The J.P. Morgan Self Automated profile has an annual advisory fee of 0.35%.

How Can I Invest With J.P. Morgan?

J.P. Morgan offers two main investment accounts that users can access through the Chase Investment mobile app; the Self-Directed profile and the Automated Investment profile. The Automated Account is a fully managed brokerage service, with portfolios created by J.P. Morgan’s financial advisors. Fees apply. The Self-Directed profile offers full flexibility for users to invest in stocks, ETFs, mutual funds, and bonds.

How Do I Close A Chase Automated Investing Account?

The best way to close a chase Automated Investing Account is to contact an advisor. They can instruct you on the best way to settle your investments before closing your account. You can also consider closing your Chase brokerage account by transferring it to an external brokerage using the ACAT network.

Top 3 Alternatives to J.P. Morgan Chase

Compare J.P. Morgan Chase with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Firstrade – Firstrade is a US-headquartered discount broker-dealer with authorization from the SEC. The company is also a member of FINRA/SIPC. With welcome bonuses, powerful tools and apps, plus commission-free trading, Firstrade Securities is a popular online brokerage. It is also quick and easy to open a new account.

J.P. Morgan Chase Comparison Table

| J.P. Morgan Chase | Interactive Brokers | IG | Firstrade | |

|---|---|---|---|---|

| Rating | 3 | 4.3 | 4.4 | 4 |

| Markets | Stocks, Options, Mutual Funds, Bonds, ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, ETFs, Options, Mutual Funds, Bonds, Cryptos, Fixed |

| Demo Account | No | Yes | Yes | No |

| Minimum Deposit | $0 | $0 | $0 | $0 |

| Minimum Trade | $1 | $100 | 0.01 Lots | $1 |

| Regulators | FINRA, SEC, CFTC, NFA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | SEC, FINRA |

| Bonus | – | – | – | Deposit Bonus Up To $4000 |

| Education | No | Yes | Yes | Yes |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Own |

| Leverage | – | 1:50 | 1:30 (Retail), 1:250 (Pro) | – |

| Payment Methods | 3 | 6 | 6 | 4 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

IG Review |

Firstrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by J.P. Morgan Chase and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| J.P. Morgan Chase | Interactive Brokers | IG | Firstrade | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | No |

| Forex | No | Yes | Yes | No |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | No |

| Oil | No | No | Yes | No |

| Gold | No | Yes | Yes | No |

| Copper | No | No | Yes | No |

| Silver | No | No | Yes | No |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | Yes | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | No |

J.P. Morgan Chase vs Other Brokers

Compare J.P. Morgan Chase with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of J.P. Morgan Chase yet, will you be the first to help fellow traders decide if they should trade with J.P. Morgan Chase or not?