The History of Stock Market Shutdowns

Most traders and investors, especially those in developed markets, have grown accustomed to the fact that markets are liquid and they reliably open and close at predefined hours during certain days of the week. However, capital markets can also dry up or even disappear altogether.

We also tend to be used to the idea that the Federal Reserve and other central banks will come to the rescue upon any dip. Government policy has provided cheap liquidity to help keep markets elevated.

But sometimes actions by leaders can cause stock markets to be shut down. War is usually the reason why.

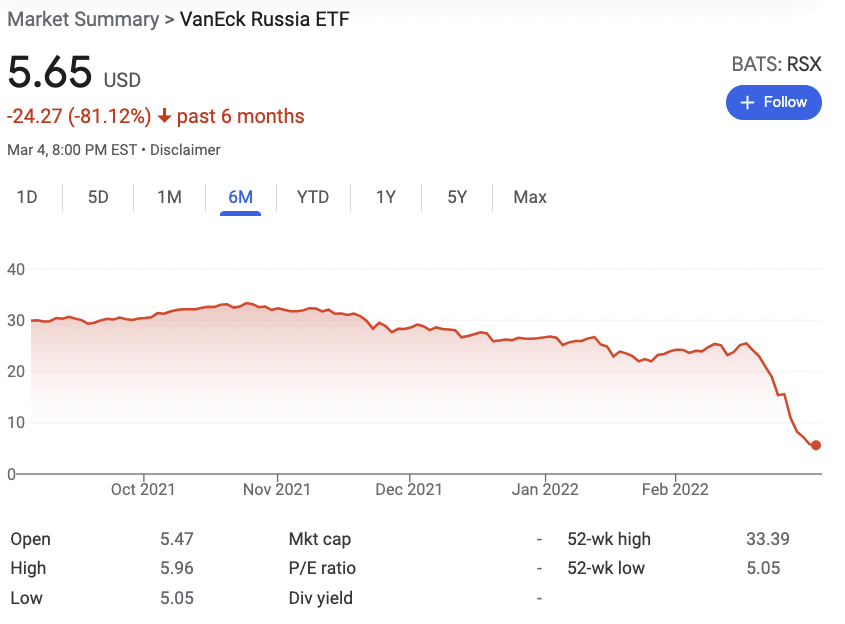

Upon Russia’s invasion of Ukraine in February 2022, the stock market was shut down in Moscow. Russian shares collapsed on other exchanges outside of Moscow and other trading hubs within Russia, including in London and New York.

ETFs that specialize in providing traders and investors exposure to Russian stocks are down 85 percent or more from their highs just before the invasion of Ukraine.

That’s bad enough. The fact that, in many cases, these investors are also shut out of their funds is another problem.

Investment losses are not fun. But when you can’t even get access to your money it’s practically the same as losing the money entirely.

Stocks aren’t necessarily the easiest or safest way to make money, but one of the reasons why people like them so much is because they’re liquid. You can traditionally get in and out of stock markets fairly reliably.

Stock market shutdowns throughout history

Yet stock market shutdowns where investors are locked out from getting their money is a recurring theme when it comes to history.

And many of these market closures occur when people don’t expect them.

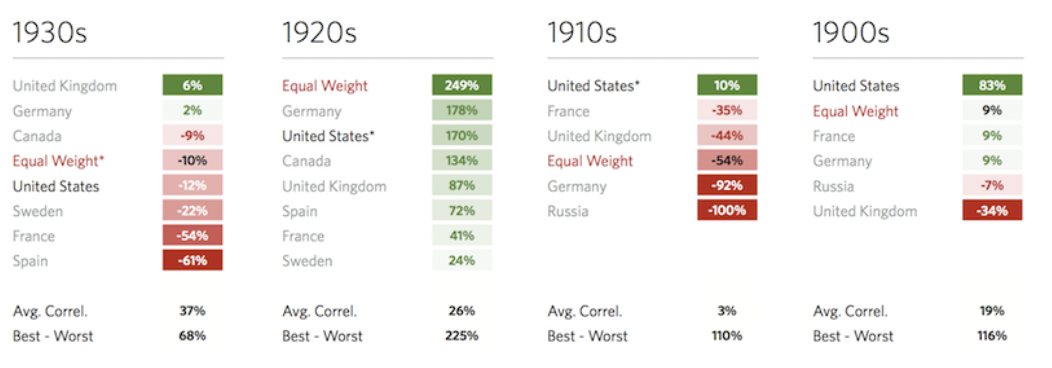

According to finance professors Philippe Jorion and William Goetzmann, trading in major markets outside the United States was halted at least 25 times during the 20th century. Many of these closures lasted for months or years.

And this doesn’t include the New York Stock Exchange, which closed from July 1914 to December of that same year because of the panic associated with the outbreak of World War I.

Most trading halts had to do with severe losses and attempts by regulators and government officials to stem them.

Our economic system will naturally go haywire when market closures take place and the fall in markets isn’t merely psychological. It reflects a huge re-rating in discounted expectations.

Moreover, stock market shutdowns lock people out of their money and an important source of savings that they can tap, if necessary.

Other stock market shutdowns often had to do with war, like in Russia’s case.

Many in the stock market believe that markets can be assumed to be permanent and profit is almost a guarantee as long as you hold long enough.

But those who’ve invested in many countries – Japan, Germany, Spain, Portugal, Greece, Egypt, Argentina, Russia – know that governments can shut their markets and keep them closed for months, years, or even decades.

Sometimes they do away with them altogether.

During the first decade of the 1900s and into the 1910s, Russia was the 5th-largest place to invest in the world behind the United States, United Kingdom, France, and Germany. It was responsible for around five percent of the entire capitalization of financial assets (stocks and bonds).

In 1914, the St. Petersburg Stock Exchanges had hundreds of companies listed publicly. When World War I hit that year, it closed like other world markets. It eventually reopened in 1917, but for only two months.

After the Bolsheviks, led by Vladimir Lenin, overthrew the imperial government starting in March 1917, the Russian stock market shut down again.

With the new system of government, capital markets were formally abolished. Russia’s stock market wouldn’t open back up again for nearly 75 years.

Then, just over 30 years past the reopening, the invasion of Ukraine, and the subsequent influx of sanctions on the country from other governments, pushed down the country’s market capitalization significantly.

The RSX ETF (VanEck Russia) is the most popular exchange-traded fund that tracks Russian equities. It fell 85 percent from its multi-year high set four months before the invasion.

Most investors were essentially frozen out of the market. Even if they wanted to sell their securities and take whatever value was left, they couldn’t.

The NYSE Arca exchange halted trading in ERUS (iShares MSCI Russia ETF), FLRU (Franklin FTSE Russia), and RUSL (Direxion Daily Russia Bull 2X Shares). The Direxion 2x leveraged fund has already announced that it will liquidate on March 18.

Trading in the other two available ETFs, RSX and RSXJ (VanEck Russia Small-Cap), could also be halted by CBOE Global Markets.

Could these Russia ETFs eventually pay off if you were to buy them cheap?

If Russian shares retain their value and Russia honors their contractual obligation to pay investors, it’s possible.

But these ETFs could also decide to liquidate and send investors back whatever value is remaining.

The importance of diversification

The thesis on Russia as a place to invest was ripped up based on a geopolitical event, not the typical math associated with investments are good or not.

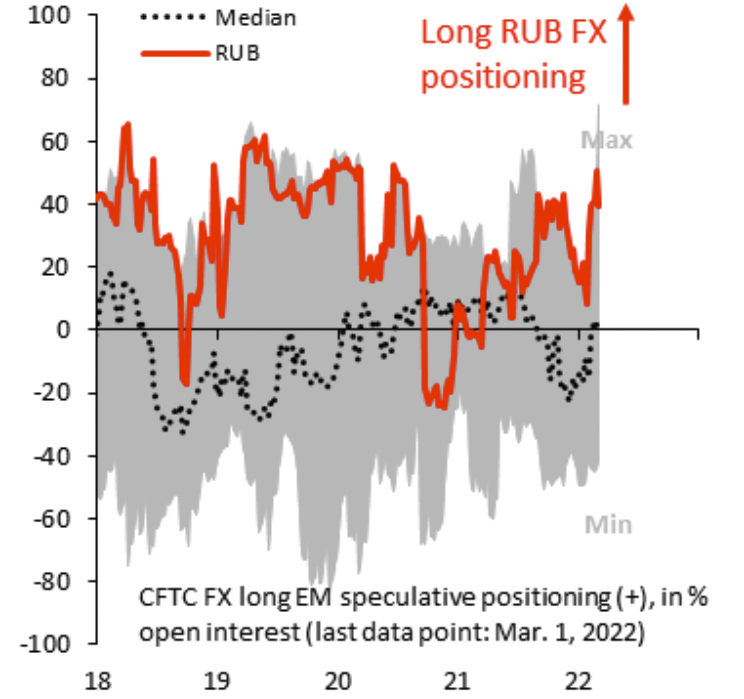

Going into the invasion, market positioning on the ruble was near all-time highs.

(Source: CFTC)

This is why diversification is important.

Russia was four percent of emerging market indices at the end of 2021 and roughly half of one percent of global stock market capitalization, based on MSCI data.

If you had only up to those types of weightings in your portfolio, you lost small amounts.

The contagion to other emerging markets was minimal.

In 1998, the Russian debt crisis caused problems elsewhere in emerging markets when Russia was much smaller, but today there’s a lot more liquidity in global markets that’s better absorbing any blow. Moreover, Russia was already quite isolated from global markets.

There were some signs of funding stress in US markets, but they were minor. This showed the 3-month spread between interbank lending and the risk-free rate.

What will happen to the Russian stock market?

Within Russia, the market froze again.

Some Russian companies are listed on other markets.

For example, oil and gas giant Gazprom PJSC (OGZPY), trades in New York. In the week after the invasion, it was priced at 0.5x earnings from the past 12 months.

Sberbank Russia PJSC traded at under 0.2x its earnings over the previous 12 months.

In other words, their price/earnings (P/E) ratios were less than 1x.

This type of ratio is extremely rare. Companies typically trade at many multiples of their annual earnings.

For example, 10x to 20x annual earnings is a common multiple for a mature company that’s no longer growing much.

This means, if you put up a lump sum, you might expect to get your money back in dividends and distributions in 10 to 20 years.

Put another way, you expect a 5-10 percent annual yield, taking the inverse of the 10x to 20x multiples.

At an earnings multiple of 0.2x, that means you’d expect to receive your principal back in 2-3 months. An earnings multiple of 0.5x would suggest six months. In other words, implied yields are beyond 100 percent.

It prices in some combination of:

i) lack of access to the investment

ii) a massive drop in earnings

iii) de facto nationalization of the companies

If the Russian government wanted to, it could take these companies and nationalize them cheaply.

Every major company could be subject to this.

So with one invasion, the market goes from considering the future growth and development of Russia’s capital markets to… does Russia even need them?

Russia is classically a tricky country to think of from a macro perspective.

It has all the raw ingredients that would signify that it could become one of the largest economies and markets in the world:

- large population (roughly 45 percent of that of the United States and close to 45 percent of the population of the Euro Area)

- large land space (1.7x bigger than the US)

- rich in natural resources

Yet, for various reasons, it hasn’t materialized.

While it had many achievements during its time at the Soviet Union and became a top nuclear power, it wasn’t able to develop strengths beyond its military and it allocated resources in a very inefficient way.

Its growth after the collapse of the Soviet Union led to a $1.5 trillion economy by 2022 – the 11th largest in the world.

But through its actions and subsequent sanctions from the West, Russia is now increasingly isolated.