Group Theory in Finance

Group Theory, a branch of abstract algebra, is fundamentally about the study of symmetry and structure.

While it might not seem immediately relevant to finance, trading, and investing, Group Theory’s principles and concepts find application in these fields, particularly in quantitative finance, risk management, and complex financial modeling.

Key Takeaways – Group Theory in Finance

- Group theory is the study of mathematical groups, which are sets of elements combined with an operation that satisfies certain conditions, like closure, associativity, identity, and invertibility.

- The application of Group Theory in finance enables the modeling of complex financial systems.

- Group Theory could aid in the design of new financial instruments and strategies.

- It provides a framework for understanding the underlying structure of financial products and assets, and help in creating innovative derivatives, optimizing portfolio construction, and developing algorithmic trading strategies.

Group Theory – A Non-Technical Example

Imagine a Rubik’s Cube, a well-known puzzle consisting of a cube with colored squares that can be rotated in various directions.

The goal is to get all sides of the cube to be a uniform color.

Basic Concepts of Group Theory

Elements and Operations

In Group Theory, a “group” consists of “elements” and an “operation” that combines any two elements.

In the Rubik’s Cube analogy, each possible state of the cube is an “element,” and the “operation” is the act of rotating a part of the cube.

Closure

Closure means if you combine two elements of a group using the group’s operation, the result will always be another element of the same group.

In the Rubik’s Cube, no matter how you twist it (the operation), you always end up with another valid state of the cube (another element of the group).

Associativity

This means that when combining multiple elements, the order in which you combine them doesn’t change the final result.

With the Rubik’s Cube, if you plan a series of rotations, the final state of the cube will be the same no matter how you group these rotations.

Identity Element

There’s always one element in a group that, when combined with any other element, leaves the other element unchanged.

In the Rubik’s Cube, this is the solved state.

If you don’t make any moves (the identity operation), the cube stays solved.

Inverse Elements

For every element in the group, there is another element that, when combined, results in the identity element.

On the Rubik’s Cube, for every sequence of moves, there’s a reverse sequence that brings the cube back to its solved state.

Group Theory in Portfolio Construction

Here are some examples of how group theory might be used in portfolio construction:

Hierarchical risk parity

This is a type of risk parity that uses group theory to construct a hierarchy of asset classes.

This hierarchy is used to allocate capital to different asset classes in a way that balances risk and return.

Group-based diversification

This is a type of diversification that uses group theory to identify groups of assets that have low correlations with each other.

These groups are then used to construct portfolios that are more diversified than traditional portfolios.

Group Theory in Other Applications of Finance

Risk Management and Portfolio Theory

In finance, risk and return profiles of assets often exhibit certain symmetrical properties.

Group Theory can help in understanding these symmetries.

For instance, the concept of diversification in portfolio theory can be examined through the lens of symmetry – how different investments behave in relation to each other under various market conditions.

Algorithmic Trading

Financial markets can exhibit patterns that repeat over time or under certain conditions.

Group Theory can be used to model these patterns and their transformations.

This can be extremely valuable in algorithmic trading strategies where recognizing and exploiting patterns is the name of the game.

Related: Market Microstructure & Algorithmic Trading

Pricing Models

Derivatives pricing, particularly for complex instruments, can involve understanding symmetries and invariances in market behaviors and asset relationships.

Group Theory provides a framework for analyzing these relationships for more accurate and robust pricing models.

Financial Cryptography

Group Theory forms the mathematical basis of many cryptographic techniques used in secure financial transactions.

Public-key cryptography, used for secure online transactions, often relies on the properties of mathematical groups.

Econophysics and Market Analysis

Group Theory can be applied in the analysis of large-scale market behaviors (drawing parallels from physics).

This interdisciplinary approach, known as econophysics, uses concepts from physics, like statistical mechanics (which often employs Group Theory), to understand complex financial systems.

Statistical Arbitrage

This involves using statistical methods to identify and exploit market inefficiencies.

Group Theory can assist in identifying patterns and relationships between different financial instruments, which can be important in developing arbitrage strategies.

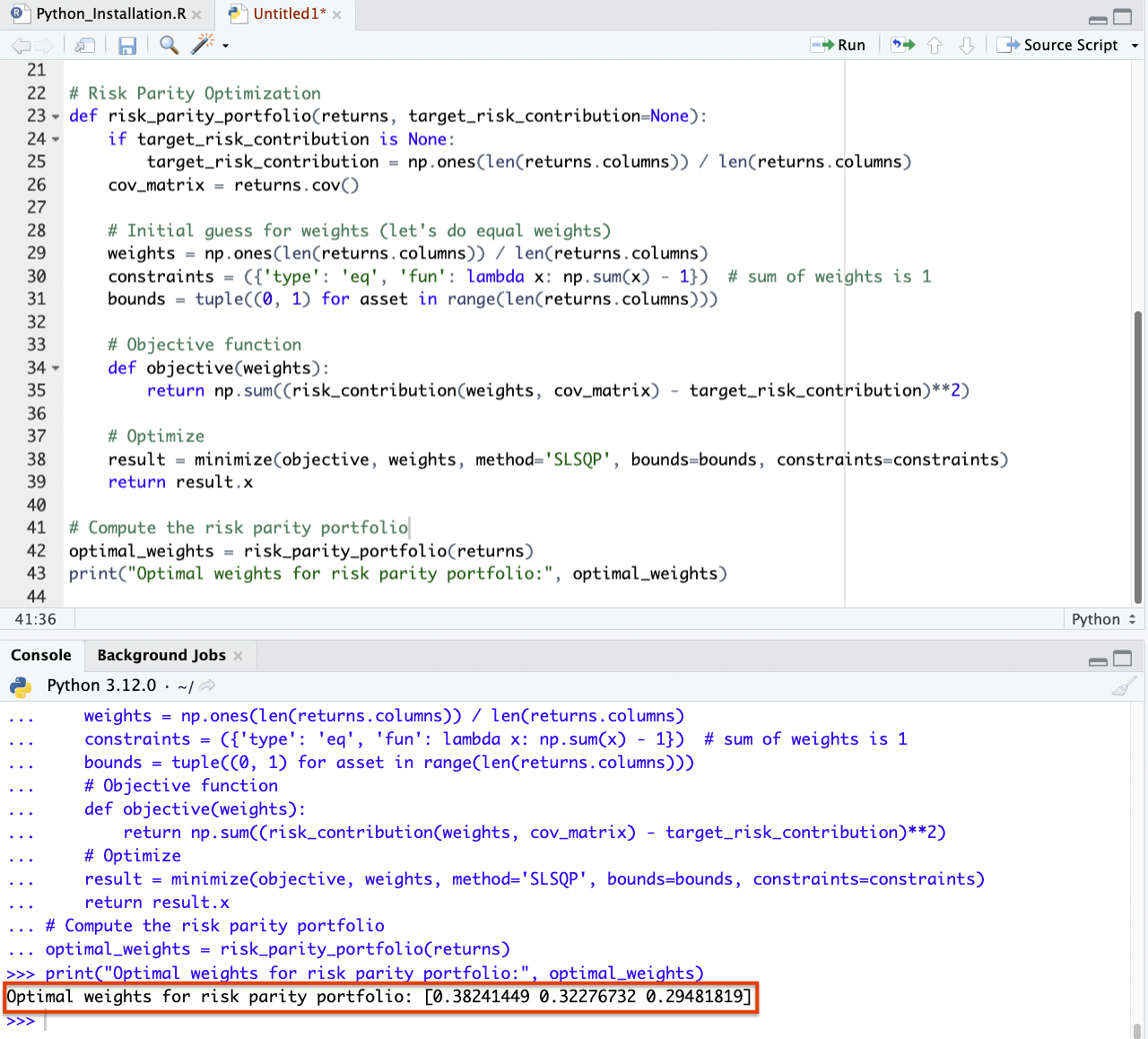

Python Code for Group Theory in Finance – Example: Risk Parity Portfolio

Given we talked about risk parity as an example application of Group Theory in finance, let’s use it in our coding example.

Risk parity is a portfolio allocation strategy that balances the risk contributed by each asset in the portfolio.

In a Group Theory context, we can think of different asset allocations as elements of a group.

And the operation of the group could be the rebalancing process that aims to achieve risk parity.

For simplicity, we’ll generate synthetic data. In a real-world application, you would replace this with actual financial data, typically obtained from a financial data API or database.

Let’s write the Python code for a basic risk parity model:

import numpy as np

import pandas as pd

# Generate synthetic asset return data

np.random.seed(42)

dates = pd.date_range('2020-01-01', periods=100)

assets = ['Asset1', 'Asset2', 'Asset3']

data = np.random.randn(100, 3) # synthetic returns for 3 assets

returns = pd.DataFrame(data, index=dates, columns=assets)

# Function to calculate portfolio risk

def portfolio_risk(weights, cov_matrix):

return np.sqrt(np.dot(weights.T, np.dot(cov_matrix, weights)))

# Function to calculate risk contribution of each asset

def risk_contribution(weights, cov_matrix):

total_portfolio_risk = portfolio_risk(weights, cov_matrix)

marginal_risk_contribution = np.dot(cov_matrix, weights)

risk_contribution = np.multiply(marginal_risk_contribution, weights) / total_portfolio_risk

return risk_contribution / total_portfolio_risk

# Risk Parity Optimization

def risk_parity_portfolio(returns, target_risk_contribution=None):

if target_risk_contribution is None:

target_risk_contribution = np.ones(len(returns.columns)) / len(returns.columns)

cov_matrix = returns.cov()

# Initial guess for weights (equal weights)

weights = np.ones(len(returns.columns)) / len(returns.columns)

constraints = ({'type': 'eq', 'fun': lambda x: np.sum(x) - 1}) # sum of weights is 1

bounds = tuple((0, 1) for asset in range(len(returns.columns)))

# Objective function

def objective(weights):

return np.sum((risk_contribution(weights, cov_matrix) - target_risk_contribution)**2)

# Optimize

result = minimize(objective, weights, method='SLSQP', bounds=bounds, constraints=constraints)

return result.x

# Compute the risk parity portfolio

optimal_weights = risk_parity_portfolio(returns)

print("Optimal weights for risk parity portfolio:", optimal_weights)

In this example, the risk_parity_portfolio function calculates the optimal asset weights for a risk parity portfolio.

(Be sure to indent the code where appropriate like in the image below.)

It uses the squared difference between actual and target risk contributions as the objective function to minimize.

Note that this example is a simplified version of risk parity.

In practice, you would need to consider additional factors like transaction costs, liquidity constraints, and more sophisticated risk models.

Also, the integration of group theory into this model is more conceptual, focusing on the idea of balancing elements (assets) in a group (portfolio) to achieve a desired state (equal risk contribution)

Conclusion

In finance, Group Theory translates to identifying patterns, correlations, and structures that can be mathematically described and used for various financial strategies and analyses.