Forex Trading In The UK

Forex trading in the UK is a thriving sector, with London being one of the world’s largest forex trading hubs. The UK accounts for a significant portion of global daily trading volumes, averaging around $4.7 trillion in April 2025 (up from $3.7 trillion in April 2022) – almost half the $9.6 trillion daily forex transactions that take place worldwide (up from $7.5 trillion in 2022).

Let’s discover the basics of forex trading in the UK through practical insights and an example trade.

Quick Introduction

- The British pound sterling (GBP) plays a part in around 10% of all forex trades globally (down from around 13% in April 2022), trailing only the USD, EUR and JPY in terms of trading volumes, according to the Bank for International Settlements (BIS).

- Given the UK’s prominence in the forex market, consider trading currency pairs like GBP/USD, EUR/GBP, or GBP/JPY. Familiarity with these pairs can provide opportunities specific to the UK economy and geopolitical events.

- Forex trading in the UK is regulated by the Financial Conduct Authority (FCA), among the most respected financial bodies globally, ensuring adherence to stringent standards for transparency and investor protection.

Top 4 UK Forex Brokers

As of February 2026, we've reviewed 139 brokers and found these to be the top 4 for UK traders:

-

1

Pepperstone71.9% of retail investor accounts lose money when trading CFDs

Pepperstone71.9% of retail investor accounts lose money when trading CFDs -

2

XTB70% of accounts lose money when trading CFDs with this provider.

XTB70% of accounts lose money when trading CFDs with this provider. -

3

IG68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

IG68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. -

4

FXCC

FXCC

See all Forex Brokers in the UK

How Does Forex Trading Work In The UK?

Forex trading in the UK involves buying and selling currency pairs in the foreign exchange market – such as GBP/USD (British pound sterling/US dollar) – aiming to profit from price fluctuations.

To start trading currencies online, you’ll need to:

- Open an account with a forex broker – we recommend choosing an FCA-regulated firm.

- Deposit funds – consider opting for a GBP account to minimise conversion fees.

- Execute trades – your broker will provide a desktop or web terminal or a forex app.

Is Forex Trading Legal In The UK?

Forex trading is completely legal in the UK and falls under the regulation of the Financial Conduct Authority (FCA), which supervises the nation’s financial markets. We consider the FCA a ‘green-tier’ regulator – affording the highest level of investor protections.

Forex brokers in the UK must secure a license from the FCA, ensuring adherence to strict regulatory standards and fostering a secure trading environment for traders.

Notably for short-term traders, this includes limiting leverage trading – the ability to control a larger position in the market with a smaller amount of capital, amplifying both potential profits and losses.

Leverage restrictions are set to protect retail traders from substantial losses on forex trading, alongside contracts for difference (CFDs) and spread betting (popular derivatives in Britain).

The FCA introduced regulations in August 2018 capping leverage for retail traders at 1:30 for major currency pairs (e.g. GBP/USD) and 1:20 for non-major currency pairs (e.g. GBP/CAD).

Is Forex Trading Taxed In The UK?

The tax treatment of forex trading profits depends on various factors, including whether trading is conducted as an individual or through a corporate entity, the frequency and volume of trading, and whether trading is considered to be speculative or part of a business activity.

Generally, forex trading profits may be subject to either capital gains tax (CGT) or income tax – both payable to HMRC (His Majesty’s Revenue & Customs).

If forex trading is conducted as a supplementary activity, you can benefit from the trading allowance, which permits you to generate up to £1,000 of additional income without being subject to taxation. However, any profits exceeding £1,000 may be taxed according to your income level.

As a full-time self-employed forex trader, you’ll be taxed on all of your profits over the tax-free personal allowance (£12,570 for the 2024/25 tax year).

I recommend seeking guidance from a tax advisor or accountant to understand the specific tax obligations related to forex trading in the UK based on your individual circumstances.

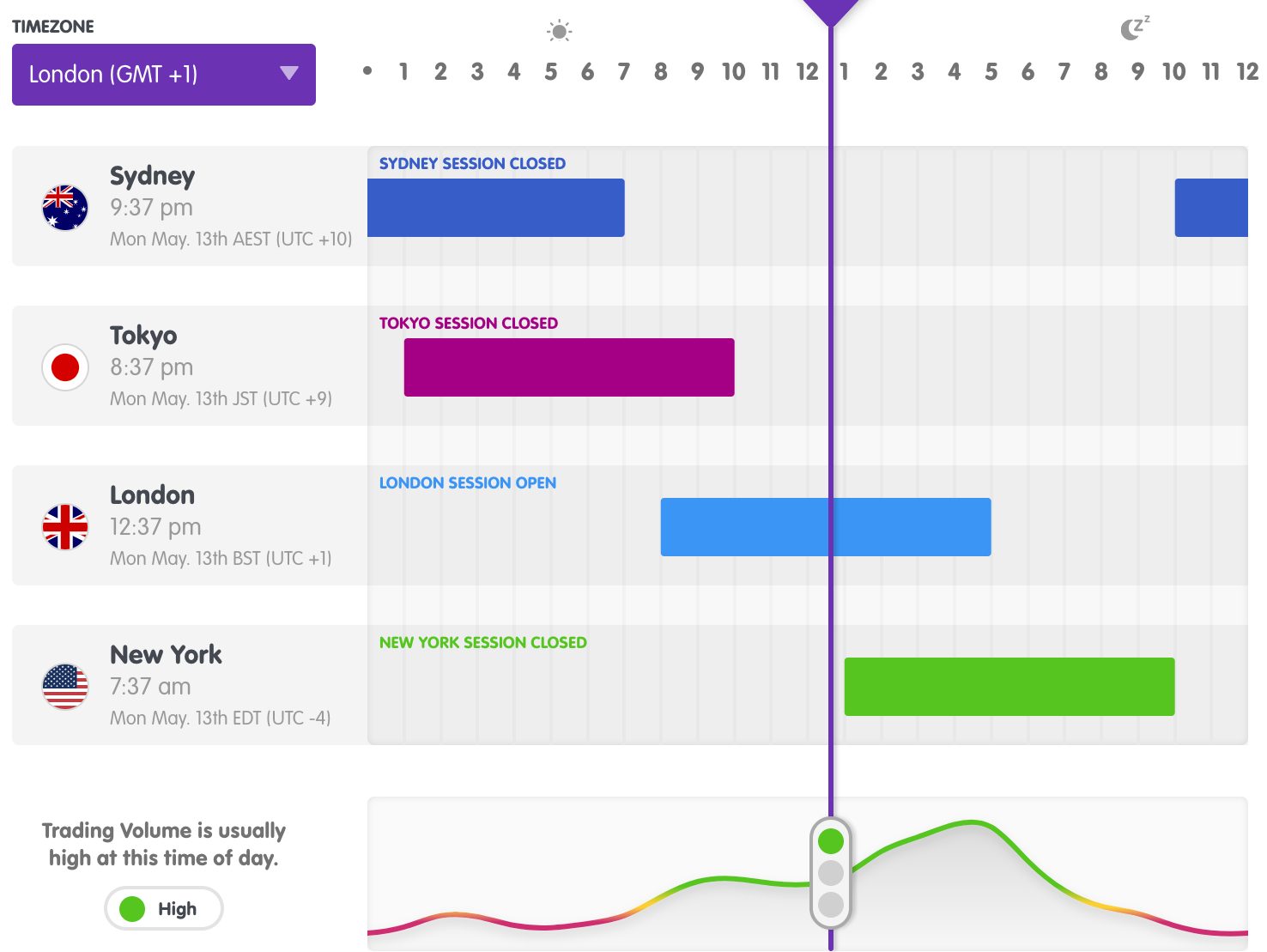

When Is The Best Time To Trade Forex In The UK?

Usually, the UK forex market experiences its highest activity levels shortly after the London session commences at 8 am (UK time), characterised by increased liquidity and volatility as traders engage in trading activities.

Liquidity typically diminishes around 10 am (UK time), only to rebound once the US markets open at approximately 12 pm (UK time).

This period offers increased liquidity and volatility, as it encompasses the most active trading hours for both European and American markets. Due to the time difference, the Asian session is considered one of the least liquid major sessions for forex trading from the UK.

As the final trading window to close on the 24-hour forex trading clock, the US session frequently witnesses elevated trading volume as traders endeavour to capitalise on the latest news announcements and events influencing currency prices before the session concludes.

Example Trade

To provide insight into practical forex trading, I’ll outline the steps I took in executing a short-term (intraday) trade on the GBP/USD currency pair:

Event Background

I closely monitored upcoming economic events that could influence currency markets and observed that the Bank of England (BoE) was scheduled to announce its latest interest rate decision.

Technical Analysis

Ahead of the BoE’s interest rate decision, I researched market sentiment and analyst forecasts to gauge expectations. Market consensus suggested that the BoE might maintain its current interest rate amid economic uncertainties.

Economic Indicators

I also monitored relevant economic indicators, including UK inflation data, employment figures, and GDP growth reports. These indicators provided valuable insights into the health of the UK economy and potential factors influencing the BoE’s decision.

Interpretation Of Data

When the BoE announced its interest rate decision, I closely observed the immediate market reaction. As the central bank opted to keep interest rates unchanged at 5.25%, I anticipated a potential rally in the GBP/USD pair because the higher a country’s interest rate, the more likely its currency will strengthen.

Pre-Trade Entry

On the day of the BoE’s interest rate decision, I ensured that I was well-prepared to react swiftly to market developments. I had my trading platform ready and closely monitored any pre-announcement volatility in the GBP/USD pair.

Position Sizing & Risk Management

When I prepared to execute the trade, I calculated my position size according to my risk appetite. Additionally, I applied a suitable risk management strategy, such as setting a stop-loss order, to cap potential losses at 2% of my account balance, should the market move unfavourably against me.

Trade Entry

As the UK trading session began, I closely monitored the GBP/USD currency pair for a favourable long (buy) position. Using technical analysis on a 15-minute candlestick chart, I identified key support and resistance levels to pinpoint potential entry points.

Upon confirming a failed break of support, I entered a long position on GBP/USD.

Trade Exit

Throughout the trading day, I monitored price action on the GBP/USD pair. As the market approached a key resistance level, I observed signs of weakening bullish momentum, prompting me to consider an exit strategy.

Utilising a trailing stop-loss, I trailed the price movement to lock in profits while allowing for potential further upside. Eventually, as the market showed signs of reversal and approached a key resistance zone, I exited the trade after 3 hours and 15 minutes for a gain of 43.6 pips.

Post-Trade Analysis

The next day, I reviewed the outcome of my forex trade. By adhering to my predefined plan and reacting strategically to market developments, I successfully capitalised on the volatility of the GBP/USD currency pair generated by the UK economic event.

Bottom Line

With London being a major global financial hub, the UK forex market accounts for a significant portion of daily trading volume worldwide. Forex trading in the UK also boasts a robust market infrastructure and regulatory framework overseen by the top-tier FCA, ensuring trader protection and market integrity.

UK traders also benefit from access to a wide range of currency pairs and competitive trading conditions, including tight spreads and high liquidity, particularly during the overlapping London and New York trading sessions.

To start trading currencies online, sign up with a trusted UK forex broker.

Recommended Reading

Article Sources

- 2025 Triennial Report - Bank For International Settlements (BIS)

- Restricting contract for difference products sold to retail clients - FCA

- Tax-free allowances on property and trading income - HMRC

- Forex market time zone converter - Babypips

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com