FXCC Review 2026

See the Top 3 Alternatives in your location.

Awards

- Best STP Broker 2019 - World Finance Magazine Awards

- Best Trading Account (XL Account) 2019 - World Finance Magazine Awards

- Best Trading Account (XL Account) Europe 2018 - Global Banking & Finance Awards

- Best STP Broker Europe 2018 - Global Banking & Finance Awards

- Best Trading Account (XL Account) 2018 - JFEX Awards

- Best MT4 Broker 2018 - JFEX Awards

- Best Islamic Forex Broker (XL Account) 2018 - MENA Forex Show Awards

- Best STP/ECN Forex Broker 2018 - MENA Forex Show Awards

- Best Forex Trading Account 2017 - UK Forex Awards

Pros

- FXCC is trusted and licensed by the CySEC, a top-tier European regulator offering high standards of safeguarding

- Competitive and transparent ECN spreads from 0.0 pips with zero commissions, making FXCC one of the cheapest forex brokers

- There are no deposit fees except industry-standard mining charges on cryptos, which is advantageous for active traders

Cons

- There is a threadbare selection of research tools like Trading Central and Autochartist, value-add features available at category leaders like IG

- FXCC’s MetaTrader-only offering is a drawback compared to many alternatives, notably AvaTrade which provides five platforms to suit different trader preferences

- High withdrawal fees may catch out unsuspecting traders, including a significant $45 charge for bank wire payments

FXCC Review

In this FXCC review, we examine the broker across key categories, including its accounts and fees, trading platforms, and customer support, to find out how it competes with alternatives. These findings are based on our first-hand experience trading at FXCC and take into account the overall experience for day traders.

Regulation & Trust

FXCC’s regulation by the Cyprus Securities and Exchange Commission (CySEC), under FX Central Clearing Ltd (license number 121/10), makes it a secure choice for European traders.

CySEC is a top-tier regulator that helps ensure FXCC follows strict business standards and implements safeguards like negative balance protection and segregated client funds.

Looking at the negatives, the coverage outside Europe, while fairly industry standard is disappointing, with the global entity registered in Nevis as an International Business Corporation (license number C55272).

This means that clients of FXCC’s offshore branch won’t get the same level of protection and won’t have access to compensation schemes or trusted regulators if things go sour.

That said, this broker does implement negative balance protection across both EU and offshore entities, unlike alternatives such as Fusion Markets.

To improve its trust rating, I would like to see FXCC follow the lead of category leaders IG and Interactive Brokers, which are authorized by a long row of top-rate regulators.

Accounts & Banking

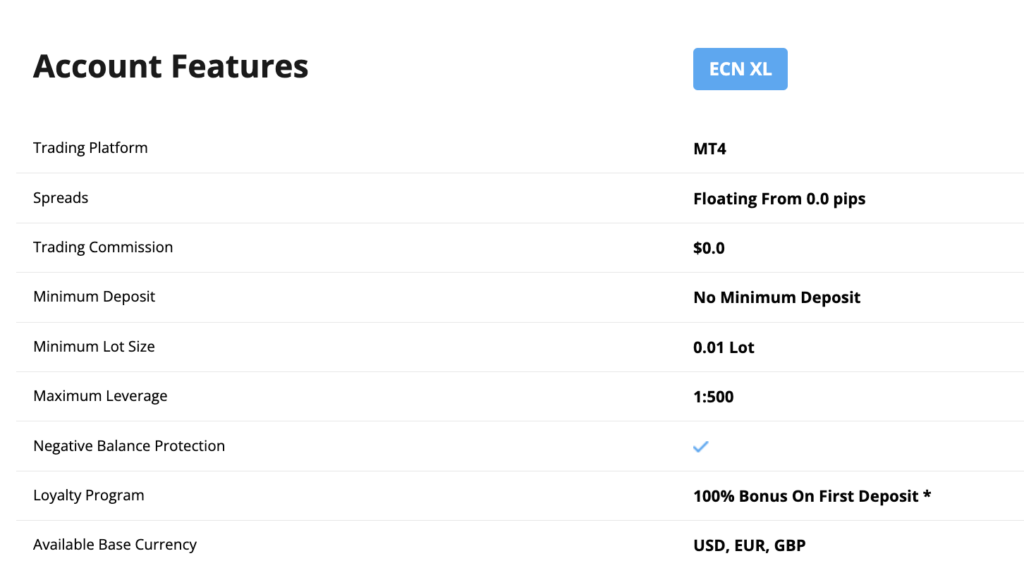

FXCC offers one live account: ECN XL. It also has an ‘ECN Promo’ account which is advertised as ‘coming soon’, but we’ve not seen this materialize in the many years we’ve been evaluating FXCC.

Ordinarily, we prefer to see a choice between a commission-free account (geared towards beginners) and one with raw spreads and low commissions (geared towards advanced traders). However, FXCC has outdone many competitors by offering the kind of tight spreads you’d expect from ECN accounts without charging a commission.

On the surface, this is an ideal offering that provides the best of both worlds, though in practice we found some instruments pricier than others, so you shouldn’t expect superior pricing across the board.

Still, FXCC has done well by providing an attractive, affordable and simple account option for day traders who will appreciate having no trading restrictions or minimum deposit requirements.

The sign-up process is also pleasingly simple and there is a swap-free solution for Muslim traders available upon request.

Deposits & Withdrawals

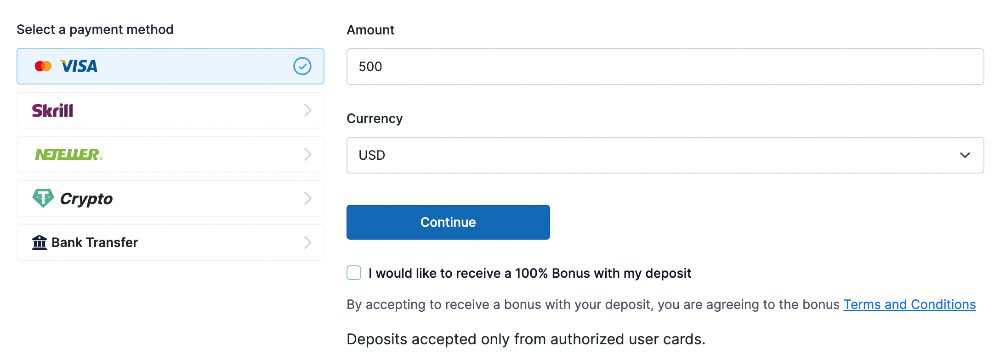

FXCC offers a decent selection of payment methods including standard card and wire transfers as well as crypto and e-wallet solutions. This is a convenient range and I was especially happy with the inclusion of crypto payments as these are highly flexible and should work for traders based almost anywhere.

I only really missed having PayPal available since this industry leader is one of the most widely used e-wallets and is accepted by rivals, including XTB and IG.

Importantly, all deposits are fee-free, and e-wallets like Skrill and Neteller process within an hour, compared to 5-7 working days for wire transfers.

On the downside, FXCC supports accounts in just a few currencies (USD, EUR, GBP), with USD only for wire transfers. As a comparison, Fusion Markets offers 10 deposit currencies, which can help prevent the need for often costly conversions.

Withdrawals at FXCC are also disappointing, with all methods besides cards and wire transfers incurring a percentage withdrawal fee that can reach a hefty 3.4%, depending on the method. Wire transfers incur a $30-$45 flat fee (minimum limit of $500), many times more than the $5 withdrawal fee at eToro.

Bonuses

FXCC runs bonus offers in certain jurisdictions, and when I opened an account with the global entity I was offered a 100% deposit bonus up to $2000.

This is essentially free credit that can be used for trading purposes, and I was pleased on this occasion that there were no minimum trading requirements.

That said, the bonus could not be withdrawn, and if your account balance reaches below 50% of the available bonus credit, the amount will be removed.

I do not recommend choosing a broker based solely on financial rewards. When testing brokers, I consider other factors such as regulations, trading fees, and customer service to be much more important.

Demo Account

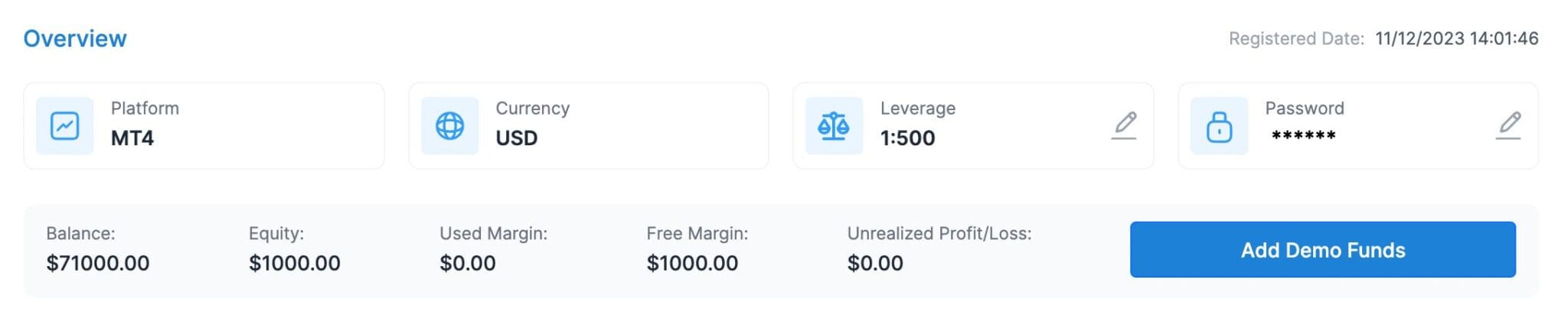

FXCC’s useful demo account allows traders to choose up to $5 million in virtual funds and trade with leverage between 1:1 and 1:500.

This is a much larger virtual bankroll than almost every other broker we’ve tested, but makes sense given the very high leverage.

It was simple to complete the demo registration process within the client portal with the benefit of not having to complete any identity verification requirements.

Assets & Markets

FXCC’s investment offering is excellent for forex traders but weak in other departments.

The 70+ currency pairs provide a wider range than many competitors. However, some FX specialists like Forex.com offer thousands of additional instruments, so it’s disappointing to find just 27 non-forex assets on the FXCC platform.

The most frustrating absence is stocks, which are entirely missing, though traders can at least speculate on stock markets through index CFDs.

| Forex | Indices | Metals | Energies | Cryptos | |

|---|---|---|---|---|---|

| Number of Assets | 70+ | 12 | 5 | 2 | 8 |

I would like to see stocks and ETFs introduced to the product lineup to serve traders looking for a broader range of speculative opportunities.

Leverage

Non-EU clients of FXCC can access leverage up to 1:500, which we see as sufficient for most traders even though it doesn’t reach the levels offered by competitors like Roboforex, which offers 1:2000.

I appreciated the flexibility to choose the leverage amount when I opened a live account using the dropdown menu. You can select a ratio in increments up to 1:500 for major forex pairs, though lower limits are available for other assets with crypto, for example, capped at a maximum of 1:10, owing to its volatility.

Fees & Costs

FXCC has earned a good score for its fees due to the tight ECN spreads combined with no commissions, an unusual pricing model that places this brand among the cheapest forex brokers we have reviewed.

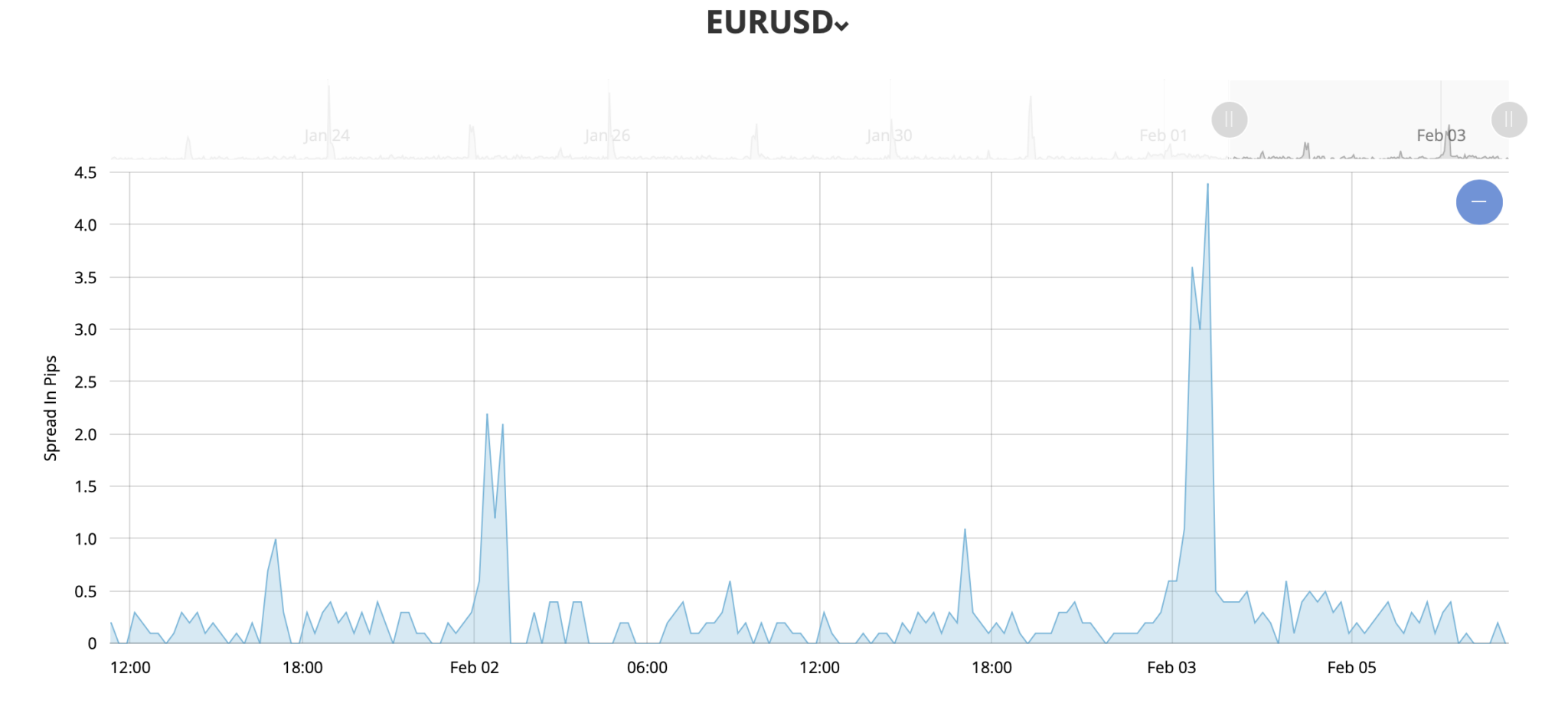

In our experience, the 0.2-pip average spread on EUR/USD is far tighter than most commission-free accounts, which regularly charge 1 pip or more for this major pair.

You may find it even cheaper in other ECN accounts – Fusion Markets, for instance, goes as low as 0.05 pips – but these usually incur commissions.

However, not all currency pairs are as generously priced – GBP/USD trades with a 1-pip spread, which is more expensive than the average of around 0.3 pips at Fusion Markets, for example.

I really like the ‘average spread tool’ available on the broker’s website which displays fees over recent trading sessions. This is a rare feature that you don’t see at many rivals, and a promising sign of transparency.

Besides the very frustrating withdrawal charge, FXCC’s non-trading fees include a $5 inactivity fee charged after 120 days of dormancy.

This is low compared to many brokers, but it’s still a downside since rivals like Vantage charge nothing, making them a better fit for casual traders.

Platforms & Tools

FXCC supports trading via the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, with MT5 added in 2025.

These long-time industry favorites are starting to show their age after decades since their release, and we prefer for brokers to offer a wider selection of platforms with newer and slicker options, especially for beginners.

The three chart types MT4 offers are far behind newer alternatives such as TradingView, and the 9 time frames from 1 minute to 1 month have also been surpassed by many other platforms.

However, they are still powerful platforms that will provide everything needed for experienced traders to conduct technical analysis while also being intuitive enough for beginners to pick up easily.

MT5, in particular, is a step up for advanced traders, providing more order types, timeframes, technical indicators, and an economic calendar.

On both platforms, placing a trade is a quick and straightforward affair that can be completed in a couple of clicks via the ‘Market Watch’ window or even more smoothly by turning on one-click trading.

One of these platforms’ biggest advantages are their support for automated trading via Expert Advisors (EAs), which have long been favored by algorithmic traders and which we feel are yet to be surpassed.

These combine well with FXCC’s free forex VPS, hosted by BeeksFX, which is available to traders who deposit at least $2,500 and trade at least 30 lots per month.

Although some brokers like Vantage offer a similar service with less stringent qualifying criteria, FXCC’s VPS, combined with its excellent pricing, will appeal to high-volume traders and algo traders.

Although MT4 and MT5 are reliable platforms with excellent charting tools, many traders nowadays demand more than this pushing 20-year-old software in the case of MT4.

Mobile App

FXCC enhances the mobile trading experience by offering the MT4 and MT5 applications, compatible with iPhone, iPad, and Android devices, ideally suited for day traders.

These apps come equipped with sophisticated charting tools, including dozens of technical indicators, different timeframes, and multiple varieties of charts, ensuring a comprehensive trading experience from your palm.

Accessing the MT4 or MT5 app through an FXCC account is also straightforward, requiring only three easy steps, while mobile traders get the same tight spreads and reliable execution provided by the broker.

Research

FXCC’s limited research and technical analysis tools are disappointing, especially given how useful these tools can be for discovering trading opportunities.

The research tools are available via the company’s blog, which includes daily links to market news from other sources, but little of the in-depth, in-house analysis available from a leading broker in this field like IG.

Similarly, the ‘Market Analysis’ section had a focus on just three currency pairs during testing which is not wide enough in my opinion.

There is a useful economic calendar, but for me, this area really needs to be improved to rank FXCC alongside alternatives such as Interactive Brokers, which offers a wealth of data streams, news feeds and market insights.

FXCC misses the mark with its research offering, which lacks the expert commentary and technical analysis provided by category leaders.

Education

FXCC does slightly better with its educational content, which includes some basic e-books, articles, and a glossary of key terms.

However, the selection falls short of the comprehensive educational offering available from best-in-class brokers like eToro, limiting the brokerage’s appeal to beginners.

I’ve also read much of the educational content and was struck by its bland delivery with long-form text and limited videos or engaging elements like quizzes, all of which could elevate the learning experience.

Customer Support

FXCC offers 24/5, multilingual and reliable customer support based on hands-on tests.

I used the live chat function on several occasions and received timely responses in a few minutes each time. The agents were friendly, and provided suitable answers to all my queries, in a personalized manner with no frustrating chatbots in sight.

The broker also provides an online email form and telephone number (+44 203 150 0832).

I’ve found the live chat service very dependable, with an agent on hand throughout the day for all my queries. Responses are always tailored to my needs.

Should You Trade With FXCC?

FXCC works very well for intermediate and advanced forex day traders seeking high leverage and tight spreads from a ‘frill-free’ broker.

However, traders seeking stocks or deep education and market research will need to look elsewhere. Also, the offshore regulation for non-EU traders and expensive withdrawal fees are notable drawbacks.

FAQ

Is FXCC Legit Or A Scam?

Our extensive tests show that FXCC is a legitimate broker. We have not experienced any security concerns during our many hours using the trading platform.

Can I Trust FXCC?

FXCC achieves an above-average trust score thanks to the tier-one regulation of its EU entity.

The international subsidiary, on the other hand, operates with limited oversight, and this holds the broker back from achieving a higher score.

Is FXCC A Regulated Broker?

Yes, FXCC is regulated by the Cyprus Securities and Exchange Commission (CySEC) and has registration in Nevis as an International Business Corporation.

Is FXCC A Good Broker For Day Trading?

FXCC is good for day trading thanks to its very tight spreads in the ECN account, leverage trading opportunities, and access to the fast and dependable MetaTrader 4 platform, as well as MetaTrader 5, which was added in 2025 and will serve seasoned traders.

Is FXCC Good For Beginners?

FXCC is an average pick for beginners. Positives are the no minimum deposit, free demo account and excellent support, however it lacks the educational tools or social trading features provided by category leaders like eToro.

Does FXCC Offer Low Fees?

FXCC is a low-cost brokerage with no commissions and spreads that are generally competitive, especially on currency pairs.

Spreads are slightly higher on alternative products, while the withdrawal fee and inactivity penalty lower its fee rating somewhat.

Does FXCC Have A Mobile App?

FXCC does not have a proprietary mobile app, though MT4 and MT5 can be downloaded to Android and Apple devices. The mobile applications have proven to be stable and reliable during testing. You can access all trading functions while on the go.

Best Alternatives to FXCC

Compare FXCC with the best similar brokers that accept traders from your location.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

FXCC Comparison Table

| FXCC | Dukascopy | FOREX.com | |

|---|---|---|---|

| Rating | 4.6 | 3.6 | 4.4 |

| Markets | CFDs, Forex, Indices, Commodities, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, Stock CFDs, Futures, Futures Options |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $0 | $100 | $100 |

| Minimum Trade | 0.01 Lots | $1 (Binaries), 0.01 Lots (Forex/CFD) | 0.01 Lots |

| Regulators | CySEC | FINMA, JFSA, FCMC | NFA, CFTC |

| Bonus | 100% First Deposit Bonus Up To $2000 | 100% Anniversary Bonus | VIP status with up to 10k+ in rebates – T&Cs apply. |

| Platforms | MT4, MT5 | JForex, MT4, MT5 | WebTrader, Mobile, MT4, MT5, TradingView |

| Leverage | 1:500 | 1:200 | 1:50 |

| Payment Methods | 15 | 10 | 9 |

| Visit | – | Visit | Visit |

| Review | – | Dukascopy Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by FXCC and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| FXCC | Dukascopy | FOREX.com | |

|---|---|---|---|

| CFD | Yes | Yes | No |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | Yes | No |

| Silver | Yes | Yes | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | No |

| Futures | No | No | Yes |

| Options | No | No | Yes |

| ETFs | No | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | No | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | Yes | No |

FXCC vs Other Brokers

Compare FXCC with any other broker by selecting the other broker below.

Customer Reviews

4.4 / 5This average customer rating is based on 30 FXCC customer reviews submitted by our visitors.

If you have traded with FXCC we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of FXCC

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I traded there for a few years, I think they are great. But definitely not for everyone. I feel like each one of us needs to find 1 broker he “clicks” with. For me it was FXCC, simply because theire is no bull@it here.

Like, they dont lure you in with leverage, dont create 15 account types. They give me free VPS, faster exec speeds. They dont have their own cooked up half-working trade platform, instead its tried and tested MT4 which is the best trading platform for retail by far.

They have 1 account type, and its ECN, with almost 0 spread, no minimal deposit, trading bonus. Allow the use of EAs. Have protection from negative balance, and servers near all the major exchanges: London, HK, NY.

I feel this is by far the best conditions to trade with. But there is 0 dongs and whistles, so, again, not everyone might like it. Im a bit more oldschool I guess so I find this refreshing.

Oh, and withdrawal works best with crypto here. Bank transfers cost too much, be aware.

Honestly, I was having a lot of doubts before I started working with this brokerage company because I have not heard a lot about them. Anyway, after reading some reviews I decided to give it a shot and signed up for this company. To my surprise everything was better than I expected, I didn’t have any problems with the registration process.

The diversity of financial instruments which this company offers to customers is really huge. They have been running the business for over 14 years, so it seems they managed to add a lot of instruments for all this time. I like how tight spreads they provide on the forex market and the spreads are even more tighter than from other major and famous brokers. The technical support is good and it is noticeable that there are competent guys working.

execution is faster than the speed of falling comets during shooting stars season, thank you guys for that.

The very first thing I noticed when I started trading with the ECN XL account was the instant execution. I was trading with another broker previously, and after I pressed the buy or sell button, there was a little time to wait for the trade to be executed. So many times my trades were executed at a different price than the one I saw on the chart.

Here things are completely different. Execution is instant and I am impressed by it. Plus the spreads are tight.

My overall trading experience and profits improve by far just by changing the broker I trade with.

Their ECN XL account offers excellent trading conditions. It is not surprising that they have won awards for this account. I recommend you to check it out.

I have bought a trading AI robot from another broker and I needed to make it work around the clock. Recently one of my friends told me to check out FXCC broker and he wasn’t wrong, I solved the problem by using a VPS server. They provide free VPS service for clients of the company. Thanks to this my AI robot works smoothly. I am glad that I came across this company and thanks again to FXCC!

Very good and simple broker. It is safe and has the necessary security tools in place, and also has a lot of good trading conditions.

This is a great broker with a wide range of useful services. They are also a highly reliable company cuz they have been running since 2010 and it indicates that the company experienced a lot of economic shocks and they are capable of existing for another decade.

If I am not mistaken they are authorized by EU member state regulator that allow them to provide their services worldwide and the number of countries really impressed me. That’s a key factor for me and that’s why I decided to join them and I can say since the moment I started trading through this broker I didn’t have any problems.

I think there’s for improvement at FXCC. It’s fine if you want a no-fuss trading experience but seriously lacking in the research tools, analysis features. The lack of stocks is also a weak point. Why don’t they offer them? Most brokers do these days.

I use FXCC for forex trading and have been impressed with the huge range of currency pairs, transparent fees and reliable MetaTrader 4 platform. I think the client dashboard and website could do with an overhaul though – they are pretty dated.