Financial Conduct Authority (FCA) Brokers 2026

If you’re an active trader in the UK, choosing a broker regulated by the Financial Conduct Authority (FCA) is not just a no-brainer, it should be your first priority.

Since it was established in 2013, it has emerged as one of the most respected and active financial regulators globally, earning it ‘green tier’ status in DayTrading.com’s Regulation & Trust Rating.

Picking an FCA-regulated broker should give you essential safeguards:

- Up to £85,000 through the Financial Services Compensation Scheme should your broker go bankrupt.

- Responsible leverage limits for retail investors up to 1:30 to protect you from incurring substantial losses.

- Negative balance protection so that you cannot lose more pounds than you initially invested.

- Transparency about the fees you will incur and the significant risks of online trading.

- “Best execution” considering price, speed, order size and likelihood of execution.

Best FCA Brokers

We evaluated our first FCA-regulated broker, ETX Capital (now closed), in 2017. Since then, we've personally tested 140 trading platforms and have determined these are the 6 best FCA brokers in the market today:

Here is a short overview of each broker's pros and cons

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Gemini - Gemini is a cryptocurrency exchange set up in 2014 by the Winklevoss brothers, known for their early involvement in Facebook. The exchange is among the world’s 20 largest and most popular. Gemini clients can trade and stake 110+ cryptocurrencies, with derivatives trading available in some jurisdictions, an advanced proprietary platform and additional features including an NFT marketplace.

- Kraken - Kraken is a leading cryptocurrency exchange with a proprietary trading terminal and a list of 220+ tradeable crypto tokens. Up to 1:5 leverage is available with stable rollover fees on spot crypto trading and up to 1:50 on futures. The exchange also supports crypto staking and has an interactive NFT marketplace.

- Crypto.com - Crypto.com is one of the biggest names in cryptocurrency trading, developed with the aim to expedite the world's transition to DeFi technologies. The crypto exchange offers token lending, pre-paid cards, NFTs and more. The firm was established in Germany in 2016 and its quality is proven by its 150 million users.

- Coinbase - Launched in 2012 as a platform enabling users to buy and sell Bitcoin via bank transfers, Coinbase has emerged as a crypto behemoth, expanding its services to include 240+ crypto assets, developing sophisticated trading platforms for retail investors, listing on the US Nasdaq, and securing licenses with multiple regulators. In May 2025, Coinbase also became the first crypto company to join the S&P 500, a milestone that enhances its credibility.

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

FCA Brokers Comparison

| Broker | FCA Regulated | GBP Account | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | $0 | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | 1:50 |

| Gemini | ✔ | ✔ | $0 | Cryptos | ActiveTrader, AlgoTrader, TradingView | - |

| Kraken | ✔ | ✔ | $10 | Cryptos | AlgoTrader, Quantower | - |

| Crypto.com | ✔ | ✔ | Varies by payment method | Crypto, Stocks, ETFs, Prediction Markets and Strike Options (US only) | Own | - |

| Coinbase | ✔ | - | $0 | Crypto | Coinbase, Advanced Trade, Wallet, NFT, TradingView | - |

| Exness | ✔ | ✔ | Varies based on the payment system | CFDs on Forex, Stocks, Indices, Commodities, Crypto | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral | 1:Unlimited |

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- While primarily geared towards experienced traders, IBKR has made moves to broaden its appeal in recent years, reducing its minimum deposit from $10,000 to $0.

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

Cons

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

Gemini

"Gemini’s ActiveTrader platform and TradingView integration make it a good choice for serious crypto traders seeking a reliable charting environment, though we were disappointed by some unnecessary fees and previous security breaches."

Michael MacKenzie, Reviewer

Gemini Quick Facts

| Demo Account | No |

|---|---|

| Instruments | Cryptos |

| Regulator | NYDFS, MAS, FCA |

| Platforms | ActiveTrader, AlgoTrader, TradingView |

| Minimum Deposit | $0 |

| Minimum Trade | 0.00001 BTC |

| Account Currencies | USD, EUR, GBP, CAD, AUD, HKD, SGD |

Pros

- The exchange ensures high security standards with 2FA a requirement for all crypto investors

- There is a decent range of educational guides and tutorials suitable for beginners

- The TradingView integration delivers top-quality tools, including backtesting and algo trading capabilities

Cons

- The exchange has a history of concerning incidents including the collapse of its Earn program and a phishing breach

- There is no practice profile or demo account for prospective traders

- Some larger coins by market cap are not available to buy through Gemini

Kraken

"Kraken will suit traders looking for a diverse list of cryptos including Bitcoin and a good security track record."

William Berg, Reviewer

Kraken Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Cryptos |

| Regulator | FCA, FinCEN, FINTRAC, AUSTRAC, FSA |

| Platforms | AlgoTrader, Quantower |

| Minimum Deposit | $10 |

| Minimum Trade | Variable |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF |

Pros

- Very good security track record with no hacks in a decade since launch

- Low minimum deposit of $10

- Mobile investing

Cons

- Does not accept fiat deposits

- Slow verification process on Pro account

- Low leverage on spot trading

Crypto.com

"Crypto.com is a snug fit for aspiring crypto traders who want to buy, sell and trade over 400 digital tokens. Its strike options and prediction markets spanning financial, economic, election, sport, and cultural events via its CFTC-regulated entity also make it a secure option for US traders interested in binary-style contracts on an intuitive app."

Christian Harris, Reviewer

Crypto.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Crypto, Stocks, ETFs, Prediction Markets and Strike Options (US only) |

| Regulator | SEC, FCA, MAS, AMF, CySEC, CBI, ASIC, FINTRAC, CIMA, VARA, OAM, HCMC, CFTC, OSC, KoFIU |

| Platforms | Own |

| Minimum Deposit | Varies by payment method |

| Minimum Trade | $1 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, PLN, CZK, AED, SAR, HUF, BRL, KES |

Pros

- Crypto.com uses a cold wallet solution that integrates multi-signature technology and geographic distribution to enhance security. This approach ensures robust protection of user assets with highly secure offline storage.

- The Crypto.com Exchange platform offers sophisticated bots, including Dollar Cost Averaging (DCA), Time-Weighted Average Price (TWAP), and Grid Trading bots. These tools allow traders to automate strategies, including leveraged perpetual trades, minimizing manual effort and slippage.

- Crypto.com has expanded beyond crypto in some regions, offering over 5000 stocks and ETFs for traders looking to build diverse portfolios and opportunities in different sectors.

Cons

- Withdrawal fees apply to crypto transfers and fiat withdrawals, and these can be significant for active traders making smaller transfers. The minimum withdrawal limits are also relatively high, which restricts flexibility for managing smaller portfolios or quick liquidity needs.

- Customer support primarily relies on chatbots and email, with limited reliable phone support from our testing. This can lead to delays in resolving urgent issues, such as account access or transaction problems, which can be frustrating for crypto day traders who need quick assistance.

- The app's high bid-ask spreads on many coins can be costly for traders placing market orders. Wide spreads mean the price you pay when buying is noticeably higher than the price you receive when selling, cutting into profits, especially on lower-volume trades.

Coinbase

"Coinbase is ideal for beginners looking for an intuitive platform to buy and sell a wide variety of cryptocurrencies, with robust security and regulatory compliance. However, its fees are higher compared to competitors in our tests, and it’s not as tailored for short-term traders."

Christian Harris, Reviewer

Coinbase Quick Facts

| Demo Account | No |

|---|---|

| Instruments | Crypto |

| Regulator | FinCEN, FCA, CBoI, MAS, OAM, DNB, BdE |

| Platforms | Coinbase, Advanced Trade, Wallet, NFT, TradingView |

| Minimum Deposit | $0 |

| Minimum Trade | $2 |

| Account Currencies | USD, EUR |

Pros

- As a Nasdaq-listed company, Coinbase follows strict financial regulations, with licensing across the US, UK, and Europe. Security includes FDIC insurance for USD balances (up to $250,000) and two-factor authentication (2FA).

- There are platforms for all levels: beginners can use the simple Coinbase app, while Advanced Trade provides lower fees and pro-level tools.

- Coinbase supports 240+ cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and more recently listed altcoins like $Trump, giving early access to emerging tokens.

Cons

- There are woeful research tools; Advanced Trade has TradingView charts but lacks features like news feeds, economic calendars, and AI market insights.

- Frustrating customer support during testing, with most help options hidden behind login, making it tough for locked-out users or non-account holders to get assistance.

- High crypto fees based on tests, especially compared to competitors like Kraken and BitMEX, and notably on the standard dealing platform.

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

Cons

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

Methodology

To list the top FCA-authorised brokers, we:

- Analysed our almost-daily updated directory of 140 brokers to find those claiming an FCA license.

- Verified their status using the Financial Services Register, removing firms that aren’t officially authorised.

- Combined the results with testing insights and 200+ data points to identify the top 10 FCA-regulated brokers.

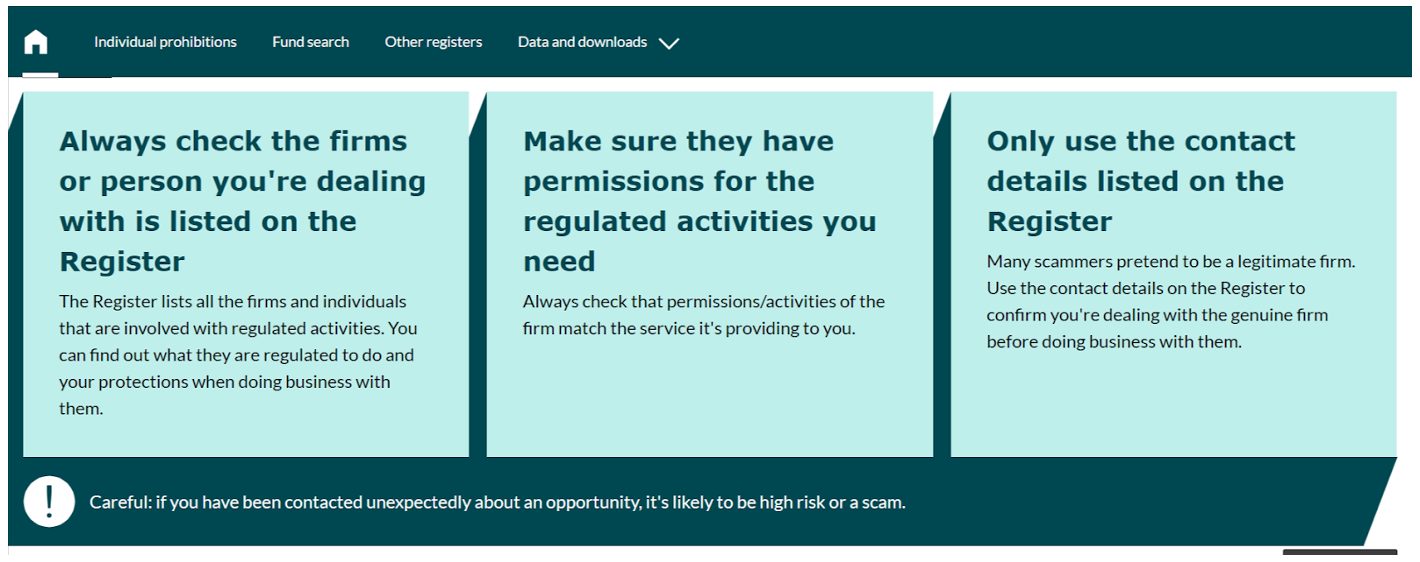

How Can I Check If A Broker Is Regulated By The FCA?

To check if a brokerage is regulated by the Financial Conduct Authority (FCA), follow these simple steps:

- Visit the FCA Register: Head to the FCA’s official website for the Financial Services Register. This searchable database lists all companies and individuals regulated by the FCA.

- Enter Broker Details: Type in the broker’s name, FCA reference number (if you have it), or even their trading name. This will help you narrow down results and find the exact entity you’re looking for.

- Verify Details: Once you find the brokerage, check that the details (like their address, website, and contact info) match what the broker has provided you. Scammers sometimes use similar names to mimic legitimate firms, so make sure all information aligns.

- Check Permissions: Look at what activities the FCA has authorised the broker to conduct. This section will show whether they’re legally allowed to offer the specific services you’re interested in (like CFD trading or forex trading).

- Confirm FCA Logo and Warning: UK-regulated brokers often display the FCA logo on their website but always double-check this on the FCA’s site. The FCA Register will also highlight if there are any warnings or restrictions on the broker’s activities.

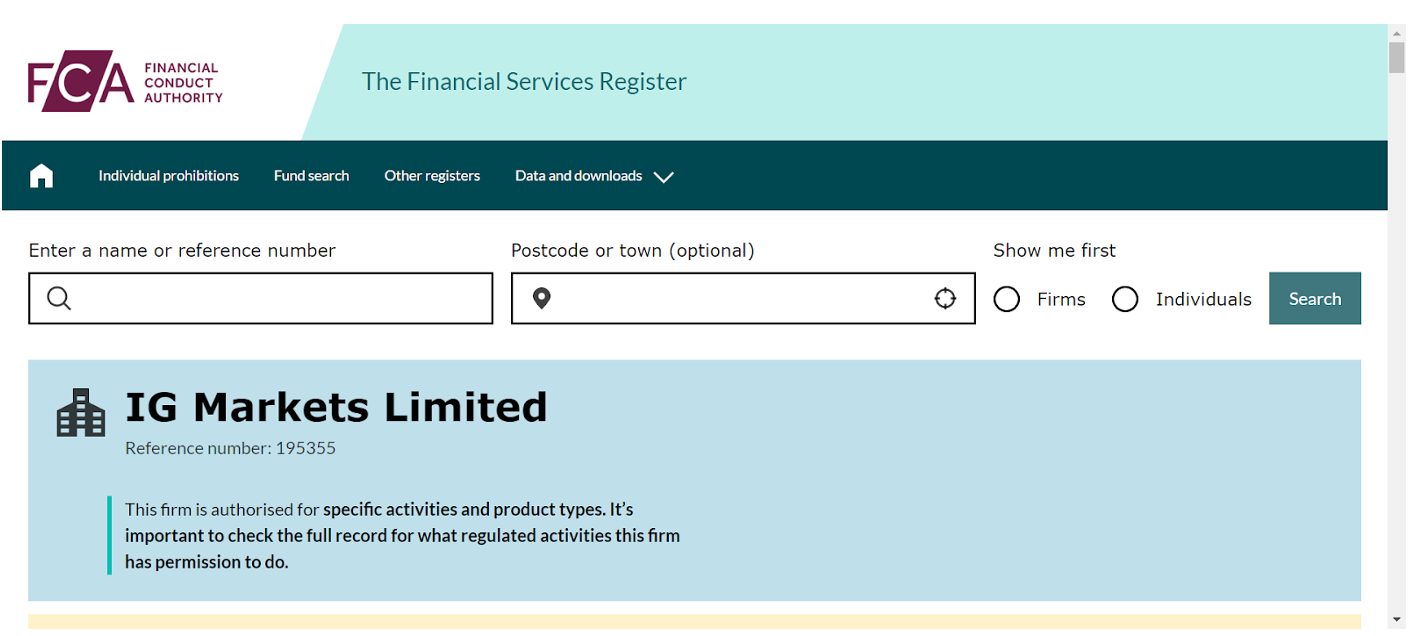

Broker Check Example

Suppose you’re considering trading with IG, one of our industry’s most prominent and oldest brokers, who began trading with a gold index in 1974, and who earned our ‘safest broker‘ status in 2026.

To give you some background, IG Group Holdings plc is a company floated on the London Stock Exchange.

All things considered, they’re a safe bet, yes? They should be, but that doesn’t mean we shouldn’t exercise our right to check them out.

We’re using IG as an example to illustrate the same level of due diligence you should employ if you’re considering trading with a small broker and not necessarily one of the industry behemoths like IG.

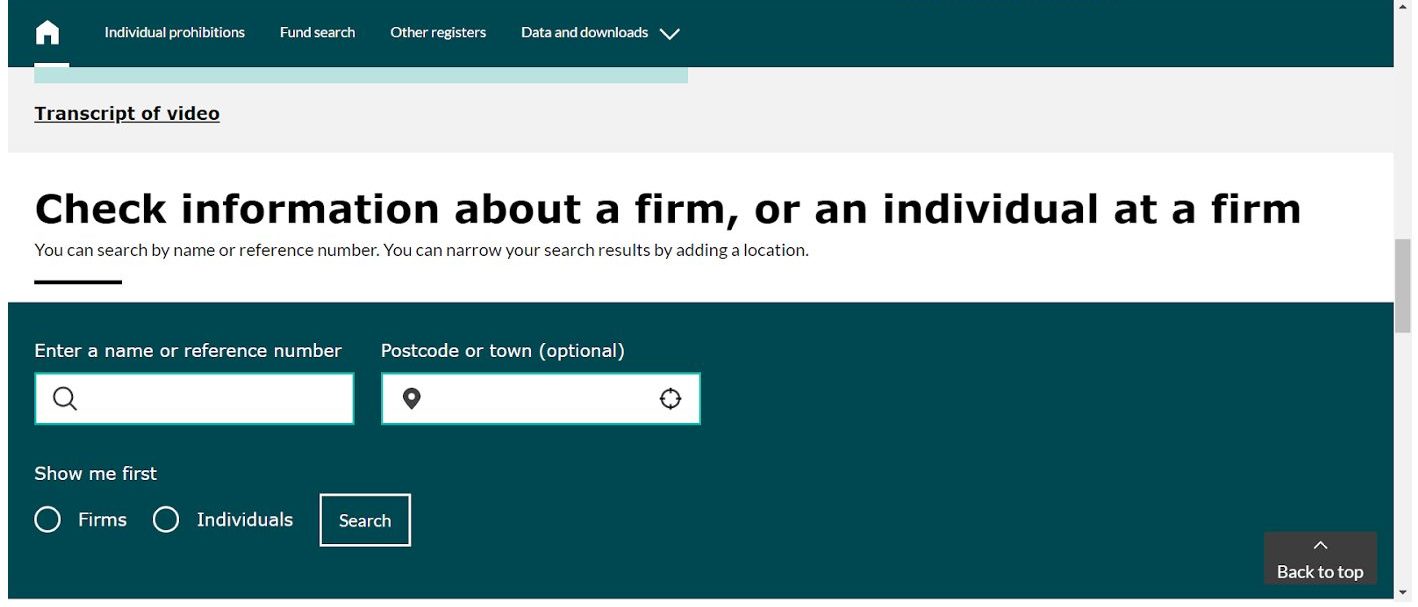

My first port of call is the Financial Services Register, the FCA page directing me to the register of regulated firms.

However, I want to concentrate on the register section on the website page. This is where you can enter the details you have on the firm to check its current status.

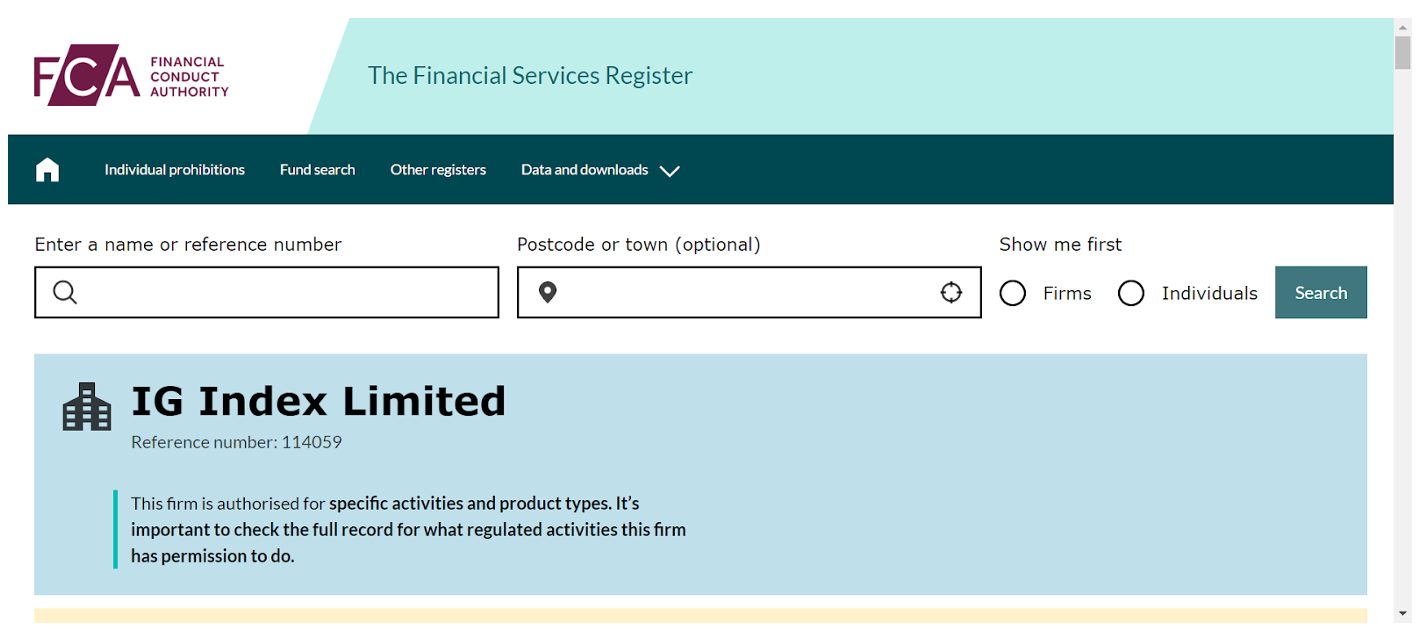

Now, IG is different in size from your average broker; a few subsidiary firms are connected to the overall holdings company. So, I decided to search the two entities listed on the IG website: IG Index Limited and IG Markets Limited.

As an example, the IG Index Limited search provided the following result.

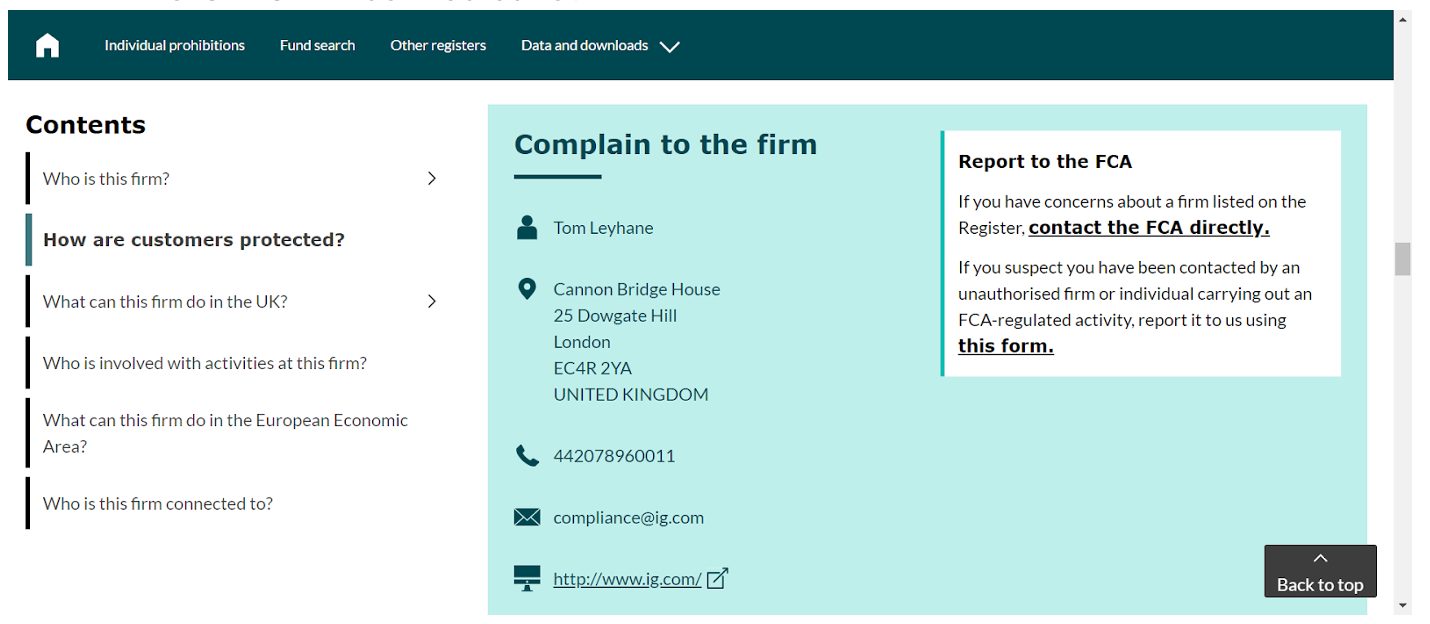

Here, you can discover the firm’s status and clearly see what permissions it has to trade. These questions are listed on the left-hand side; click, and you get the answers.

- Who is this firm?

- How are customers protected?

- What can this firm do in the UK?

- Who is involved with activities at this firm?

- What can this firm do in the European Economic Area?

- Who is this firm connected to?

One of the most important areas on the page is the contact details. So, if you ever have a significant issue with IG that you can’t resolve with a contact at the firm, the contact details of the compliance department are listed here.

For your information, the search on IG Markets Limited delivered a nearly identical result to that of IG Index Limited.

So, to summarise, our search on IG quickly discovered that (as you’d expect) the company, in the various guises relevant to me as an active trader, has all the regulatory approvals and permissions to trade, and there are no issues I should be concerned with.

You can also check out our video run through below to see how you can perform this check yourself in under 45 seconds.

What Is The FCA?

The Financial Conduct Authority (FCA) is the UK’s watchdog for financial services. It monitors firms to ensure they abide by the rules and treat customers fairly.

The FCA regulates a wide range of financial firms and their activities, from banks and investment firms to insurance providers and financial advisers.

Founded in 2013, the FCA stepped in after the 2008 financial crisis, when trust in the financial sector was at an all-time low. It took over the responsibility of what was then the OFT, the Office of Fair Trading.

The FCA is independent and funded by the firms it regulates, which gives it the resources and freedom to investigate and hold businesses accountable.

Their mission is clear: protect consumers, keep the markets stable, and promote competition. The FCA can step in if a company is shady, dish out fines, and even revoke the licence, which is about as serious as it gets.So, if you’re dealing with an FCA-regulated broker, which I always do as a UK-based trader with over 10 years of experience, you’re in safe hands.

What Powers Does The FCA Have?

The Financial Conduct Authority (FCA) has a broad range of powers to keep financial firms in line and protect consumers. Here’s a breakdown of what they can do:

- Authorisation and Licensing: The FCA grants licences to financial firms that meet their standards. Without FCA authorisation, firms can’t legally operate in the UK. This gives the FCA control over which companies get a foot in the door.

- Supervision and Monitoring: Once a firm is licensed, the FCA doesn’t just sit back; they actively supervise it. They assess business practices, financial health, and how well the firm treats its customers, intervening if there’s any cause for concern.

- Enforcement and Penalties: The FCA has serious muscle when it comes to enforcing the rules. If a company breaks the rules or engages in misleading practices, the FCA can fine it, restrict its activities, or even shut it down.

- Product Intervention: To protect consumers from risky products, the FCA can ban or restrict certain financial products if they pose a high risk to the public.

- Criminal Prosecution: In cases of serious misconduct, like fraud or insider trading, the FCA can bring criminal charges. They investigate, gather evidence, and work with law enforcement to bring offenders to court.

- Setting Standards and Rules: The FCA also writes the rules that firms must follow. These cover everything from transparency and fair treatment of customers to advertising standards and financial reporting requirements.

These powers allow the FCA to intervene at any point if it spots unfair practices, prevent potential crises, and keep the financial system running smoothly for everyone.

What Rules Must An FCA Broker Follow?

Brokers regulated by the Financial Conduct Authority (FCA) in the UK must adhere to strict rules to ensure they operate fairly, transparently, and responsibly.

- Client Protection and Fair Treatment: Brokers must treat clients fairly, making sure their services are appropriate and that they’re transparent about risks, fees, and terms. They can’t mislead or take advantage of clients and must disclose all relevant information.

- Client Funds Segregation: UK-regulated brokers must keep client funds separate from their own operational funds. This means client money is held in segregated accounts, which protects it from being used to cover the broker’s debts if they run into financial trouble.

- Capital Requirements: Brokers must meet specific capital requirements, which means they need enough financial reserves to operate safely. This is designed to ensure they can cover losses and weather financial difficulties without jeopardising client funds.

- Risk Management and Reporting: FCA trading platforms must have robust risk management frameworks and report regularly to the FCA. This includes reporting any significant risks, suspicious activities, or potential vulnerabilities in their financial health.

- Best Execution Standards: Brokers must aim for the “best possible outcome” for clients when executing trades. This means they need to provide fair prices, low latency, and transparent order handling practices, ensuring clients get the best available execution for their trades – vital for day traders.

- Transparency in Marketing and Advertising: FCA brokers need to be truthful in their marketing. They can’t make exaggerated claims or hide risks in fine print. This includes clear risk warnings, especially on high-risk products like CFDs or forex.

- Complaints Handling and Compensation Scheme: FCA trading providers must have clear, efficient processes for handling complaints. Clients may be eligible for compensation through the Financial Services Compensation Scheme (FSCS), which can cover up to £85,000 per person if a broker goes bust or mishandles funds.

- Anti-Money Laundering (AML) and Compliance: FCA brokers must implement strict AML policies to prevent illegal activities, including conducting identity verification and monitoring suspicious transactions.

- Leveraged Crypto Derivatives: From January 2021, the FCA mandated that brokers could no longer sell, market or distribute derivatives like contracts for difference (CFDs) and exchange-traded notes (ETNs) tied to unregulated cryptoassets.

These rules ensure that FCA brokers operate in a way that protects clients, promotes transparency, and keeps the UK’s financial markets stable.

How Does The FCA Protect Active Traders?

A practical example of how the FCA protects short-term traders is its restrictions on CFD product offerings, aimed at minimising the risks that retail traders face. In 2019, the FCA introduced rules specifically for CFD and CFD-like products.

Here’s how these rules work to protect traders like us:

- Leverage Limits: The FCA placed strict limits on leverage for retail traders, capping it at levels between 1:30 and 1:2 depending on the asset. For instance, major currency pairs like GBP/USD are limited to 1:30. At the same time, more volatile assets like British stocks are capped at 1:2. By reducing leverage, the FCA helps CFD traders avoid rapid losses that can wipe out accounts.

- Negative Balance Protection: Another critical rule is negative balance protection, meaning traders cannot lose more than the funds in their accounts. Previously, with high leverage, a trader could end up owing more than their initial investment if the market moved against them. Now, losses are capped, giving traders more peace of mind.

- Standardised Risk Warnings: Brokers must display clear, standardised risk warnings on their platforms, including the percentage of retail clients who lose money on CFD products. This gives traders a realistic view of the risks associated with CFDs, allowing them to make better-informed decisions.

- Ban on Monetary Incentives: The FCA has prohibited companies from offering cash bonuses or gifts to encourage CFD trading, which can lure inexperienced traders into risky positions. Instead, brokers focus on education and responsible trading practices.

- Enhanced Transparency: The FCA mandates that brokers disclose fees, spreads, and other charges upfront so traders aren’t surprised by hidden costs that could eat into profits.

Through these rules, the FCA significantly reduces the likelihood of excessive losses, prevents misleading marketing tactics, and ensures active traders have access to transparent and safer trading environments.These measures have transformed the CFD market, making it a safer place for retail traders.

Does The FCA Have Teeth?

Yes. The Financial Conduct Authority has issued substantial fines to online brokers and financial services firms over the years, especially when companies have engaged in practices like manipulating forex rates, failing to protect client funds, or misleading customers.

Here are some notable examples:

- FXCM UK (2014): The FCA fined FXCM, a major retail forex broker, £4 million. The brokerage was found to have engaged in “asymmetric slippage,” which meant that positive price changes for customers were often ignored while unfavourable changes were passed on to them. FXCM also failed to disclose conflicts of interest.

- Interactive Brokers (2018): The FCA fined Interactive Brokers £1.05 million for “for failings in its post-trade systems and controls for identifying and reporting suspicious transactions”.

- ForexTB (2024): The FCA fined ForexTB (FXTB) £276,100 for unfair treatment of customers, unauthorised investment advice, pressuring inexperienced clients into risky CFD trading, and encouraging false information for “professional client” status.

These cases illustrate the FCA’s commitment to cracking down on misconduct within the online trading industry, ensuring that brokers prioritise transparency, market integrity, and client protection.

The FCA’s fines act as a powerful deterrent, reinforcing the high standards expected of brokers in the UK.

Yet while it remains one of the most respected financial regulators globally, the FCA is not without criticism.

For example, a damning report, produced by some MPs and Peers in 2024, and with input from the victims of trading scams, has said it’s “too often failing” and are calling for some of its functions to be overhauled.

Bottom Line

The Financial Conduct Authority (FCA) continues to play a crucial role in maintaining trust, stability, and fairness in the UK’s financial markets. Through rigorous rules, they ensure that brokers operate transparently, protect client funds, and treat customers fairly.

This regulation adds a valuable layer of security for retail investors, helping you choose reputable brokers and trade with peace of mind.

By selecting an FCA-regulated brokerage, you’re opting for a provider that’s held to high standards, monitored for compliance, and backed by a robust framework for consumer protection.

To get started, use DayTrading.com’s pick of the best-FCA regulated trading platforms.

Article Sources

- Unauthorised Firms Warning List - FCA

- Financial Conduct Authority (FCA)

- Financial Services Register (FS Register)

- Financial Services Compensation Scheme (FSCS)

- Office of Fair Trading

- FCA bans the sale of crypto-derivatives to retail consumers

- Report on the Call for Evidence about The Financial Conduct Authority - APPG Investment Fraud and Fairer Financial Services

- MPs brand UK financial regulator 'incompetent' - BBC News

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com