Why 96% of Day Traders Don’t Make a Living – and the 4% Secret

Day trading sounds exciting. You sit at a computer and click buttons and make money.

It’s very different from a 9-to-5 and even traditional entrepreneurship where you openly sell a product or service. (Trading primarily provides value through capital allocation and liquidity provision in financial markets.)

Yet, as we listed here, 96% of day traders don’t make a living from it.

But that also means 4% do.

What do these 4% do differently?

Let’s take a look.

Key Takeaways: Why 96% of Day Traders Don’t Make a Living – and the 4% Secret

- Most lose money – Studies show 96% of day traders don’t make a living from it. A few wins don’t change the odds over time.

- Luck vs. skill – Early wins typically come from the chance and randomness in markets, not strategy. Real success requires a tested edge.

- Competition – Individuals trade against hedge funds, algorithms, and institutions with better information, analysis, technology, and other resources.

- Why it’s so difficult to trade for a living – Lack of discipline, poor risk management, no edge, overtrading, and unrealistic expectations.

- What the 4% do differently – They treat trading like a business, focus on risk control, stay patient, keep learning, master their emotions, and think beyond quick trades. Even for shorter-term traders, they think over longer-term time horizons. They often niche down to specific strategies or are more process-driven.

The Harsh Reality of Day Trading

Studies show the vast majority lose money over time

If you’ve ever scrolled through trading-related YouTube or social media feeds, you’ve probably seen people making thousands of dollars a day from trading. Screenshots of brokerage accounts, flashy cars, the “I quit my job and now trade from the beach” stories.

Maybe it looks real and achievable. But once you look past the hype, the data tells a very different story.

Multiple academic studies across different countries show the same thing: most day traders lose money.

In Brazil, for example, researchers tracked thousands of retail traders over several years. Out of all of them, only a tiny sliver managed to consistently make profits.

In the US, similar studies show the same brutal odds: roughly 96% of traders don’t make enough to sustain themselves.

This isn’t a matter of bad luck. It’s the nature of the game.

Trading is a zero-sum competition where every dollar gained – relative to a representative index – comes from someone else’s loss, and the majority of that money is being taken by professionals with deeper pockets, better information, better analysis, better technology, and faster execution.

The average trader might get a win here and there, but due to variance.

Over time the costs of mistakes, commissions, and slippage add up. The math simply isn’t in their favor.

Common misconception: Confusing luck with skill in the short term

We’ve covered this in a separate article, but part of the reason so many people try day trading is because it can be surprisingly easy to feel like you’re good at it, at least in the beginning.

Maybe you open a trading account, buy a stock on a hunch, and watch it jump 5% in a few hours.

Suddenly, it feels like you’ve cracked the code. A couple of lucky trades can trick you into believing you’ve found a new career path.

But luck and skill are two very different things.

Short-term wins can come from randomness, market momentum, or simply being in the right place at the right time.

The problem is, people often mistake these lucky streaks for evidence of talent. That’s when confidence grows, risk increases, and eventually the luck runs out.

Think of it like going to a casino. If you hit a few early wins at the blackjack table, you might believe you’ve got a “system.” But over a long enough timeline, the house edge takes over.

In trading, the “house” is the market itself and its mostly sophisticated participants. Without an actual tested edge, the same outcome applies: the majority of people give back their winnings and more.

The real test of trading isn’t a week or a month of results, but whether you can generate consistent profits year after year.

That’s what separates a random lucky streak from true skill. And very few people ever make that leap.

Why it’s harder than it looks: Algorithms, institutions, and speed traders dominate

When people imagine day trading, they picture an individual sitting at their laptop, analyzing charts and making smart moves. The reality isn’t really like that.

Today’s markets are dominated by institutions, hedge funds, and algorithms that operate at speeds and scales an individual can’t touch.

High-frequency trading firms, for example, execute thousands of trades per second. They aren’t guessing whether Apple stock will go up or down today.

They’re exploiting microsecond inefficiencies (e.g., stat arb) and making money on the spread (market making).

Then there are hedge funds with teams of analysts, advanced models, and millions of dollars in research budgets.

Now picture the average individual trader competing against this landscape. You’re not playing a friendly game of poker with other amateurs. You’re sitting at the table with professionals who know the odds, have more chips, and can literally read your every move.

Even if you’re disciplined, even if you avoid obvious mistakes, the structural disadvantages are large. Your internet connection can’t compete with co-located servers sitting next to the stock exchange. Your research can’t match entire teams running statistical models and every small edge trying to succeed. And when you hit a losing streak, you don’t have billions in capital to absorb the drawdowns.

This doesn’t mean no one can succeed; small businesses and individual traders can and absolutely do succeed.

But they tend to be more niched down and they tend to have longer term time horizons (even if they trade actively). Some might be heavily in private markets – which are less combed over – rather than exclusively in liquid markets.

But the bar is much higher than most people realize.

The few who make it into the 4% do so not by playing the same game as the majority, but by developing unique strategies, focusing on risk control, and treating trading like a professional craft rather than a quick hustle.

Why Most Traders Fail (The 96%)

Lack of discipline: Emotional trading, chasing losses, greed, fear

If there’s one common thread running through the stories of failed traders, it’s generally the absence of discipline.

Emotions have a way of hijacking decision-making when money is on the line.

A trader might start the day with a solid plan (enter at this price, exit at that one) but as soon as the trade turns red, fear sets in.

Instead of cutting the loss, they hold on, hoping it’ll bounce back. Sometimes it does, but often it doesn’t, and the losses snowball.

On the flip side, greed takes over when a trade is in profit.

Instead of taking gains as planned, traders hold on longer, convinced the stock will keep climbing. The market turns, and what could have been a win becomes a loss.

This emotional tug-of-war leads to impulsive decisions: doubling down on a bad trade, chasing after a missed opportunity, or just abandoning strategy entirely.

Even indexers fall prey to this. There’s a bad week, and some are ready to tear up their portfolio.

Discipline is what separates gamblers from professionals.

This is why so much of trading is systematic. For discretionary traders who are manually doing their own trading, discipline will be key.

Poor risk management: Overleveraging, oversized positions, no stop-loss strategy

Even disciplined traders can sink themselves if they ignore risk management.

Novice traders always think about gains almost exclusively, and some go wild swinging for the fences.

Risk is the one variable you can actually control, yet most new traders underestimate it.

They take oversized positions, use leverage, neglect stop-loss orders, and/or don’t use protective options because they’re convinced they “know” where the market is going.

But markets are probabilistic; no one knows with certainty. A single bad trade can wipe out weeks or even months of gains if the position size is too large.

Leverage magnifies this effect, as small market moves to destroy entire accounts. When you become more advanced, leverage can be a tool for capital efficiency, but with a lack of experience, that never turns out well.

Professional traders obsess over protecting their downside. The hedge fund Millennium Management literally fires portfolio managers after 7.5% drawdowns.

As such they don’t risk more than a small percentage of their account on any single trade or security – unless there are guardrails.

Survival matters more than being right.

When we’re new to all this, we tend to learn this lesson the hard way: by blowing up accounts before having a chance to get consistent.

No edge: Trading without a tested system or relying on random tips

A harsh truth of trading is that without an edge, you’re essentially gambling.

An edge is a repeatable strategy – that’s ideally scalable – that gives you a higher probability of success over time.

It might be based on technical analysis, price patterns, or a specific reaction to news events.

But it has to be tested, defined, and consistently applied.

Most traders never develop this. Instead, they jump from one idea to another.

One day they’re following moving averages, the next they’re copying signals from a trading room, and the day after that they’re chasing hot stock tips from social media.

This constant strategy-hopping creates inconsistent results, which usually trend downward.

Imagine trying to build a business by changing your business model every week. You’d never know what works and what doesn’t.

Trading is no different. Without an edge, there’s nothing to lean on when the inevitable losing streaks come. Professionals know what they’re looking for and why it works. The rest are just winging it.

Overtrading: Too many trades, high fees, decision fatigue

Another common pitfall is overtrading. The logic is seductive: the more trades you make, the more chances you have to win.

But in reality, trading too much is one of the fastest ways to bleed an account dry.

Every trade comes with costs: commissions, spreads, slippage. Even small fees add up quickly when you’re entering and exiting constantly.

Worse, overtrading leads to decision fatigue. The more choices you force yourself to make in a short time, the lower the quality of each decision becomes. Tired, stressed traders make sloppy trades.

Often, overtrading is driven by boredom or the need for excitement. Sitting on your hands and waiting for the right setup feels passive.

Clicking buttons feels active, like you’re “doing something.”

But the best traders understand that doing nothing is often the smartest move. They’re patient, waiting for high-probability opportunities instead of forcing trades just to stay busy.

Unrealistic expectations: Believing it’s a quick path to wealth

Finally, many traders fail simply because they come into the game with the wrong expectations.

Social media has stories of people turning a few thousand dollars into millions. Trading gurus advertise courses with promises of financial freedom in six months.

They think making 10% gains per month consistently is realistic.

It’s no wonder beginners expect to get rich fast.

The reality couldn’t be further from that. Trading successfully is slow, boring, and methodical.

It takes years of practice, thousands of hours, and countless mistakes.

Even then, the rewards are modest compared to the hype. The successful 4% don’t make millions quickly. They grind out consistent returns, protect their capital, and grow gradually.

When beginners expect fast riches, they over-risk, ignore discipline, and spiral into destructive cycles.

The disappointment from unmet expectations often pushes them to quit entirely.

Starting with the mindset of learning slowly and aiming for small, consistent progress provides a chance.

What Successful Traders Do Differently

They treat it like a business: Systems, processes, record-keeping

They approach trading with the same seriousness as running a company.

That means they have written systems for when to enter, when to exit, and how to size their trades. Systematic traders write it into algorithms.

They track what they do in detailed journals, reviewing what worked and what didn’t. (Trading journals don’t literally have to be paper, but whatever your preferred medium/tool.)

Think of it like running a restaurant. You wouldn’t guess when to order ingredients or change recipes every day. You’d follow a process and iterate from there.

Trading is heavily about executing a repeatable system with consistency.

Risk management above all: Never risking more than a small % per trade

Ask any professional trader what keeps them in the game, and they’ll likely give a similar answer: risk management.

The successful 4% obsess over protecting their downside. They never risk more than a tiny percentage of their account on a single trade or security.

This approach keeps losses survivable. A string of bad trades won’t wipe them out because they’ve capped their exposure.

They think less about how much they can make on one trade and more about how much they can lose without jeopardizing their long-term survival – keeping the upside without the unacceptable downside.

In a business where the unexpected happens daily, that mindset is the difference between longevity and blowing up.

Patience and discipline: Waiting for high-probability setups

The best traders know the hardest skill in trading isn’t pulling the trigger; it’s waiting.

Markets constantly tempt you with noise, but successful traders develop the discipline to only take trades that fit their plan and offer high probability of success.

They don’t feel the need to trade every hour of the day. Instead, they sit on the sidelines until conditions align.

This patience separates them from the majority who overtrade out of boredom or the fear of missing out. Paradoxically, by trading less, they often make more.

Always learning

The 4% don’t assume they’ve “figured it out.” Markets evolve, strategies stop working, and new software/tools emerge.

Instead of clinging to old habits, successful traders keep learning. They review every trade, study their mistakes, and adapt.

They read widely and sometimes even learn from losing traders, because failures often reveal what not to do.

This humility keeps them sharp. It’s not about perfection, but about continuous improvement.

Mindset mastery: Controlling emotions, sticking to the plan, avoiding FOMO

At the core, trading success is psychological. Fear, greed, and ego are constant enemies.

The 4% know this and build systems to keep emotions in check. They don’t chase after sudden spikes because they “feel” like something is happening. They don’t double down to prove themselves right.

Instead, they rely on their plan, not their gut. They understand that losing trades are inevitable and don’t take them personally.

This detachment allows them to stay calm during volatility while many panic. In short, they master themselves before they master the markets.

Eventually extending their time horizons

Even traders who start out purely in intraday moves often evolve. Over time, they begin to extend their time horizons – even if they still consider themselves day traders.

They still trade actively, but they start to see their portfolio or their process as a structured whole, not just a random series of isolated bets.

Instead of treating each trade like its own independent roll of the dice, they think in terms of portfolio construction, risk distribution, and long-term positioning.

They might use active trading to generate income, but they’ll also build core holdings, hedge intelligently, and diversify across strategies (ideally uncorrelated).

This structure shifts them from short-term speculators to long-term capital allocators. It’s a subtle but powerful change that cements their survival and growth in the markets.

Lessons for the Aspiring Trader

You can’t beat the market without an edge: Random trades = random results

If there’s one truth every trader eventually confronts, it’s this: without an edge, you’re just rolling dice.

An edge doesn’t mean predicting the market; it means having a repeatable method that gives you a slightly better chance of winning than losing over the long haul.

It’s hard to have consistent success skipping this step.

They enter trades based on a hunch, a tip from social media, or something they read.

Sometimes it works, sometimes it doesn’t. The results look random because they are random.

Think about it like professional poker. The pros don’t win every hand. Even against an amateur that barely knows how to play, their odds aren’t that much better than around 50% on the level of an individual hand.

But they play in a way that stacks the odds in their favor. Over time, that small edge compounds.

In trading, the same principle applies.

You don’t need a system that wins every time; you need one that, over hundreds of trades – or over months in the markets – generates a positive expectancy. That’s the foundation of survival.

Related: Statistical Edge

Consistency > big wins: It’s about surviving long enough to let compounding work

When beginners imagine trading success, they often picture one big score: catching the perfect breakout, doubling an account in a week, finding the big stock, or landing the trade of a lifetime.

The truth is, that kind of thinking ruins more traders than it makes.

The professionals think differently. They know it’s not about home runs, but consistency.

They aim for small, repeatable profits while keeping losses small. The magic comes from compounding. If you can grow your account by even one percent per month (or even half a percent per month) and do it reliably, the numbers can become a lot over years.

But you can’t compound if you’re constantly swinging for the fences and blowing up your account, or simply suffering terrible drawdowns.

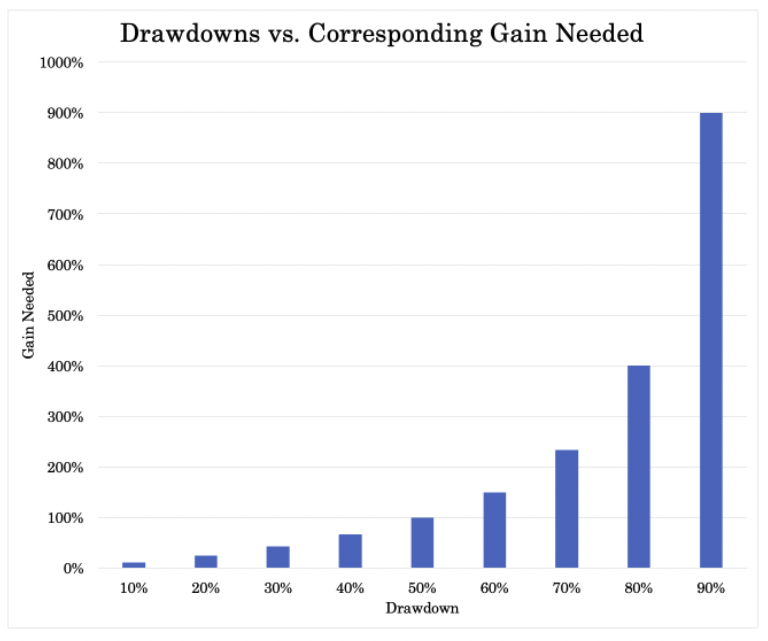

Losses aren’t made up for by corresponding gains, so it’s important to avoid drawdowns.

It gets worse the deeper the drawdown.

That’s why keeping drawdowns in the 10-20% range is reasonable for most traders.

Most of the 96% don’t make a living because they never hit a winning trade, but because they can’t string together disciplined performance long enough to stay in the game.

Start small, think long-term: Practice with small capital before scaling up

The temptation to go big is strong. You read about the 4% making real money and think the only way to catch up is to start with size.

But the best traders usually start small.

Small positions teach you the game without exposing you to bad losses. They give you room to experiment, to make mistakes, and to learn without burning out your capital.

Once you’ve proven you can trade consistently with a small account, scaling becomes easier. The skills transfer, but the stakes get higher.

It might take years to reach the point where trading becomes a serious source of income. And that’s okay.

Approaching it as a long-term craft, rather than a get-rich-quick scheme, puts you in the mindset of the 4%.

The goal isn’t to win big this month. It’s to still be here five years from now, smarter and stronger than you were at the start.

Compare results relative to a representative index

When thinking about trading results, it helps to compare them to a representative index.

You don’t have to reinvent the wheel. Broad markets already generate long-term returns without you lifting a finger.

That’s one of the great advantages of investing: you don’t necessarily have to put everything on your own shoulders. The market itself can make money for you without additional labor.

It’s about finding the best possible solution for the long haul. In my own trading, I’d love to eventually reach a point where I have the option to “fire” myself from the daily grind of trading and let a well-designed system do all the work.

I’m not there yet, but that’s the ultimate goal: to build something sustainable, where discipline and structure replace constant effort, and where the system can run itself and you have the freedom and option to be as involved or uninvolved as you want.

Know yourself: Trading isn’t for everyone; investing may be smarter

The final and maybe most overlooked lesson is self-awareness.

Trading looks glamorous online, but the reality is that it’s not always necessarily that fun.

You’re making decisions with real money on the line. Not everyone wants that.

Some people discover they hate doing it. Others find the constant uncertainty exhausting.

It might mean that trading might not be the right fit. And, as we just discussed, you don’t have to be a trader to build wealth.

For many, long-term investing (buying quality businesses, holding ETFs, dollar-cost averaging into index funds) can be a smarter, calmer path.

The 4% who succeed in trading aren’t necessarily more intelligent, but they are better suited to the temperament the job requires.

If you find yourself repeatedly breaking rules, taking wild risks, or losing sleep over trades (they call it the “sleep test”), it might be worth asking whether the stress is worth it.

Sometimes the wiser move isn’t to fight your own psychology, but to choose a wealth-building path that aligns with your own personality.

Conclusion

The reality is stark: 96% of day traders don’t make a living from it, and only 4% manage to make it work. That doesn’t mean trading is impossible; it means it’s brutally hard like any other competitive business.

The market isn’t a quick escape from a 9-to-5. It will take some time (and capital).

If you want to trade, it’s best to forget the fantasy of instant riches. Focus instead on building an edge, protecting your capital, and developing consistency.

Do that, and you give yourself a shot at joining the small minority who actually succeed.