Cashu Brokers 2026

Cashu is one of the leading online payment providers in the Middle East and North Africa (MENA). Investors can fund forex and CFD trading accounts with Cashu. Our review covers the deposit and withdrawal process, associated fees, security, and other considerations for traders. We also list the best brokers that accept Cashu payments in 2026.

Best Cashu Brokers

Our evaluations have shown that these are the top 3 brokers accepting Cashu deposits:

Here is a summary of why we recommend these brokers in February 2026:

- RoboForex - RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

- Axiory - Founded in 2011, Axiory is a regulated forex and CFD broker offering tight spreads and highly leveraged trading on industry-leading platforms: MT4, MT5 and cTrader. The broker has won multiple global awards and is regulated by the FSC in Belize and the FSC in Mauritius.

- Errante - Errante is a Cyprus-based and regulated forex and CFD broker with leveraged trading on multiple assets, tiered accounts including a zero-spread option, and copy trading support. The broker offers leveraged trading up to 1:30 under its CySEC-regulated branch and 1:500 from an offshore branch, and supports the MetaTrader 4 and MetaTrader 5 platforms. Errante's asset list is relatively limited but it does offer fast execution and low latency, and it is a trustworthy brand.

Compare The Best Cashu Brokers

| Broker | Minimum Deposit | Instruments | Platforms | Leverage |

|---|---|---|---|---|

| RoboForex | $10 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures | R StocksTrader, MT4, MT5, TradingView | 1:2000 |

| Axiory | $10 | Forex, CFD indices, commodities | MyAxiory App, MT4, MT5, cTrader, AutoChartist, Quantower | 1:1000 |

| Errante | $50 | CFDs, Stocks, Indices, Forex, Metals, Energies, Cryptos | MT4, MT5 | 1:500 |

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

Pros

- The broker offers two commission-free withdrawals each month in the Free Funds Withdrawal program, helping day traders to minimize transaction costs.

- The broker offers leverage up to 1:2000 for certain account types, which is among the highest in the industry. This high leverage allows day traders to maximize their trading potential, albeit with a corresponding increase in risk.

- RoboForex secured the 'Best Forex Broker 2025' title in DayTrading.com's Awards after broadening their FX offering, cutting spreads and opening up services in various countries.

Cons

- RoboForex provides a variety of account types, which, while offering flexibility, can be overwhelming for newer traders trying to choose the most suitable option for their trading style. Alternatives, notably eToro, provide a smoother entry into online trading with one retail account.

- Despite 15+ years in the industry and registering with the Financial Commission, RoboForex is authorized by one ‘Red-Tier’ regulator – the IFSC in Belize, lowering the level of regulatory protections for traders.

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

Axiory

"Axiory remains a top choice for beginners with its low deposit, unlimited demo account and high-quality education. Experienced day traders will also appreciate the advanced capabilities of the cTrader platform, although the range of 150+ instruments may be too restricting."

William Berg, Reviewer

Axiory Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFD indices, commodities |

| Regulator | IFSC Belize |

| Platforms | MyAxiory App, MT4, MT5, cTrader, AutoChartist, Quantower |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR |

Pros

- Axiory offers free, multiple demo accounts in any of the 3 platforms with no expiry, so clients can continuously test their day trading strategies risk-free

- Spreads are decent based on tests, coming in at 0.3 pips for EUR/USD, which is in line with some of the best low-cost forex brokers

- A good range of accounts are available with just a $10 minimum deposit required and Islamic swap-free versions

Cons

- It’s a shame that copy trading services are not offered for beginners or strategy providers

- Although regulated in Belize and South Africa, Axiory doesn’t hold any top-tier licenses in Europe, the US or the Asia-Pacific region

- Only USD and EUR are accepted as account base currencies, so many clients may have to pay conversion fees

Errante

"We recommend Errante for users seeking multi-asset trading on the MT4 and MT5 platforms. The copy trading platform and straightforward sign-up process will also suit newer traders."

William Berg, Reviewer

Errante Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Stocks, Indices, Forex, Metals, Energies, Cryptos |

| Regulator | CySEC, FSA |

| Platforms | MT4, MT5 |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR |

Pros

- Reputable and trustworthy multi-asset broker

- Supports cTrader, MT4 and MT5 platforms

- Good range of cryptocurrencies including Bitcoin

Cons

- High deposits to unlock advanced account tiers with more favorable trading terms

- Small selection of shares

- MT4 not available to EU traders

How Did We Choose The Best Cashu Brokers?

To uncover the top Cashu brokers, we:

- Searched our database of 500 online platforms, identifying all those that support Cashu payments

- Ensured that they accept Cashu deposits and withdrawals for day trading

- Ranked them by their overall score, drawing on 100+ data points and insights from our team

Cashu Overview

Cashu was established by Maktoob.com in 2002 and was the first online payment service in the MENA region. Since then, it has grown to become the largest payments provider in the area with offices in Dubai, Egypt, and Jordan. The firm has 75,000 vendors and 7,000 online merchants across Levant countries such as Libya, Lebanon, and Iraq. Customers can top up their accounts via vendors, online payments, or gift cards.

Pros Of Trading With Cashu

Internationally Accepted

The payment system is accepted in multiple countries, including Dubai, Egypt, Libya, Lebanon, Iraq, Qatar, Jordan, and others in the Levant region. With that said, the payment service is not accepted in several major trading jurisdictions, including the UK.

Supported By Financial Services Companies

The company accepts both Mastercard and Visa cards for funding accounts online. The company also partnered with Mastercard to offer a prepaid virtual credit card and a Cashu Majd Joy Card which is connected to the Cashu e-wallet.

Instant Payments

Because it essentially operates as a digital wallet, most trading brokers process transactions from Cashu within minutes. This offers investors the advantage of faster deposits and withdrawals compared to cheques or bank wire transfers, which can take a few days to process.

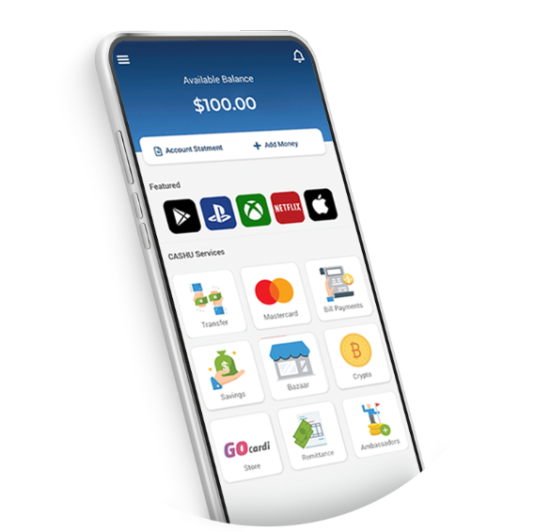

Mobile App

The e-wallet app is available to download for iOS and Android. Users can make payments and view transactions while on the go. The company’s gift cards can also be purchased via a separate app.

For mobile traders, the application allows clients to manage their funds and trading portfolio from portable devices.

Available With Other Businesses

Customers can use funds from the e-wallet to shop with a range of leading brands, including Amazon, eBay, Netflix, League of Legends, Skype, and many others. Details of all merchants accepting Cashu can be found on the company’s website.

Cryptocurrency Accepted

The Crypto Service within the mobile app gives investors the possibility to buy, hold and trade crypto. The spot rates for buying assets are set by the well-known exchange, Huobi.

Cons Of Trading With Cashu

Limited Support Options

The company does not offer a live chat service or a contact number for recharge queries, for example. However, consumers can contact customer service agents by clicking on the ‘New Ticket’ logo on the support page. The company also provides a comprehensive FAQ section. Still, support is limited compared to the likes of Skrill or Neteller.

Limited Broker Acceptance

Despite Cashu’s presence in most MENA countries, this has not transferred to the global broker market and the payment method is only accepted by select providers. This will be a real drawback for many investors.

Speed

Online payments with Mastercard and Visa are processed instantly. Payments via Cashu vendors are subject to individual processing times. Additionally, brokers may have their own processing times which can cause further delays. In general though, trading deposits are processed on the same day.

Security

The firm considers fraud and money laundering prevention essential to its business. This has resulted in heavy investment in risk and compliance technology to give its customers assurance of safety. Furthermore, the company’s partnership with Mastercard provides additional financial security. Clients may also need to submit an identification video for an extra layer of security.

How To Deposit Using Cashu

Consumers can deposit funds into their wallets by using local vendors in-store or topping up with a Mastercard or Visa card online.

To deposit at a broker like RoboForex, you’ll need to search for the Cashu payment option in the deposit section of your client area. Then enter the deposit amount and follow the instructions to complete the transaction.

Note the company charges 3.5% + foreign exchange bank rate for credit card funding. Customers can also top-up accounts with the payment provider’s gift cards or vouchers that are available online.

Fees

Cashu is transparent with the consumer fees that apply. These include a $1 wallet maintenance fee, a $1.50 local transfer fee, plus 3% in crypto buying/selling fees. Further details can be found on the company’s payments page.

Note that these fees relate to Cashu only and additional fees may be charged by brokers. Traders should check the broker’s charges before making a payment.

Is Cashu Good For Day Trading?

Cashu’s prominence in the MENA online payment sector and its commitment to anti-fraud and money laundering make it a strong option for local traders. The payment provider is accepted by major brands in other sectors but currently, there are a limited number of trading brokers that accept Cashu. This lack of integration and support is worth bearing in mind before making deposits.

FAQ

How Does Cashu Work With My Trading Account?

Cashu is a legitimate digital wallet that is used to make deposits to trading brokers. The company accepts Mastercard and Visa for online payments and deposits, which adds an extra layer of security and trust.

Are My Trading Funds Safe With Cashu?

The payment system uses secure encryption technology to protect transfers and client data. With that said, there is always a risk when trading online, so make sure you open an account with a trusted trading platform.

Are There Any Hidden Fees When Depositing Via Cashu?

No, the firm is transparent about the fees it charges. However, this isn’t always the case with trading platforms so be sure to consult the broker’s fee policy before signing up.