Brokers With MYR Accounts

The Malaysian ringgit (MYR) is a relatively stable currency in Southeast Asia that provides Malaysians with a seamless trading experience through MYR-based accounts.

Malaysia’s trade in commodities like palm oil, rubber, and petroleum and strong export-oriented economy influence the MYR’s value.

Explore DayTrading.com’s pick of the best Malaysian ringgit brokers to find the optimal platform for your needs.

Best Brokers With MYR Accounts

After our hands-on assessments, these are the 3 top brokers supporting MYR accounts:

Here is a short summary of why we think each broker belongs in this top list:

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- JustMarkets - JustMarkets is a multi-asset broker with both CySEC-regulated and offshore branches. Offering ultra-low spreads, copy-trading services, 170+ tradeable instruments and MetaTrader support, JustMarkets has a lot to offer both beginner and experienced traders.

- FreshForex - FreshForex, operated by Riston Capital Ltd, was established in 2004 and provides forex and CFD trading access to clients in over 200 countries. The company positions itself as a convenient option for new traders, with low starting deposits and a focus on affordability and frequent bonus promotions.

Brokers With MYR Accounts Comparison

| Broker | MYR Account | Minimum Deposit | Markets | Regulator |

|---|---|---|---|---|

| Exness | ✔ | Varies based on the payment system | CFDs on Forex, Stocks, Indices, Commodities, Crypto | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| JustMarkets | ✔ | $1 | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures | CySEC, FSA |

| FreshForex | ✔ | $10 | CFDs, Forex, Stocks, Indices, Commodities, Crypto, ETFs | SVGFSA |

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

Cons

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

JustMarkets

"With some of the most affordable pricing in the game and access to the powerful MT4 and MT5 platforms, JustMarkets is a good choice for any investor."

Tobias Robinson, Reviewer

JustMarkets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures |

| Regulator | CySEC, FSA |

| Platforms | MT4, MT5 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:3000 |

| Account Currencies | USD, EUR, GBP, ZAR, MYR, IDR, AED, NGN, THB, VND, KWD, CNY |

Pros

- Low minimum deposit

- MetaTrader 4 integration

- Fast order executions from 0.01 seconds

Cons

- Non-forex asset list is light with just 65 stocks plus a handful of indices and commodities

- Limited availability with clients not accepted from the US, UK, Japan, Germany and other countries

FreshForex

"FreshForex is an obvious fit for experienced day traders looking for very high leverage of 1:1000+, especially paired with the ECN account where spreads start from 0.0 and commissions at $1.90. "

Christian Harris, Reviewer

FreshForex Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, ETFs |

| Regulator | SVGFSA |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR, ZAR, MYR, NGN |

Pros

- Active traders benefit from access to the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, both of which offer advanced charting capabilities, technical indicators, and algorithmic trading features.

- FreshForex’s accessible minimum deposit, starting from just $10, lowers the barrier to entry for new traders and those with smaller budgets. This affordability, combined with demo accounts, encourages learning without significant financial risk.

- FreshForex has invested in its research tools to inform clients' trading decisions, with forex calculators, market forecasts and analytics, plus a VPS for serious day traders looking to run hands-off strategies.

Cons

- FreshForex relies solely on the MT4 and MT5 platforms and does not offer proprietary trading software or support for popular alternatives, such as cTrader and TradingView, that we're increasingly seeing other brokers integrate. This limits options for day traders who prefer more modern, user-friendly interfaces or enhanced charting and social trading features.

- FreshForex's customer support performed below-average during testing, with particularly hard to reach agents on live chat during market hours, posing challenges for day traders needing urgent support.

- Despite over 20 years in the industry, FreshForex still operates offshore in Saint Vincent and the Grenadines, resulting in limited external regulation that raises concerns about fund safety and increases the risk of unethical behavior by the broker.

How Did We Choose The Best Brokers?

Our selection process to find the top MYR trading platforms was meticulous:

- Our comprehensive analysis leveraged our database covering hundreds of brokers and trading platforms.

- We eliminated platforms that did not meet our criteria for supporting MYR-denominated trading accounts.

- We assigned a numerical rank to each platform based on an evaluation of over 100 quantitative metrics and qualitative assessments derived from our rigorous testing.

What Is An MYR Account?

An MYR account is a trading account denominated in Malaysian ringgit.

This account type offers several advantages, including avoiding foreign exchange conversion fees, mitigating exchange rate risk, and more efficient investing in domestic Malaysian assets, such as equities and initial public offerings (IPOs).

The convenience and benefits of an MYR account make it highly advantageous if you actively trade in Malaysia’s financial markets.

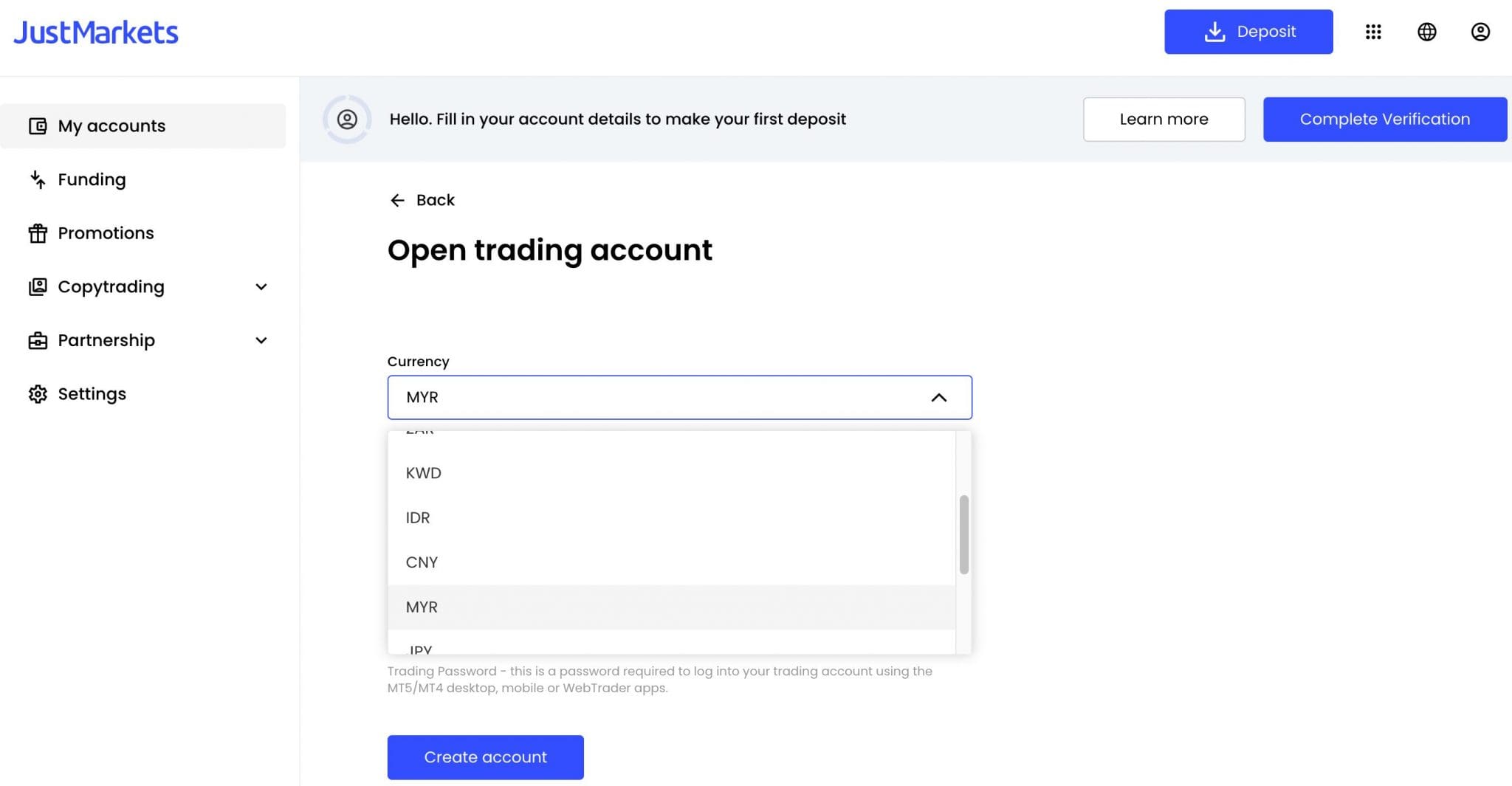

It’s a breeze to set up a MYR trading account once you’ve completed identify and address verification.Below is a snapshot of my account at JustMarkets, where you can see I simply had to select ‘MYR’ from the ‘Currency’ dropdown menu.

Do I Need An MYR Trading Account?

A MYR trading account isn’t for everyone, but it could be suitable depending on your circumstances:

- As a resident of Malaysia, an MYR trading account can simplify your tax reporting process. You can streamline your accounting tasks by avoiding the need to track foreign exchange gains or losses, alongside standard trading transactions.

- A MYR account can allow for seamless trading of Malaysian equities on the Bursa Malaysia, government bonds, and financial instruments, facilitating investment in Malaysia’s growing economy. Investment offerings vary between brokers.

- You can reduce the potential impact of foreign exchange fluctuations on your trading profits, especially when trading Malaysian assets or converting to other currencies. The MYR has experienced significant volatility in recent years, notably when Malaysia had a wide interest rate gap with the US.

How Can I Check If A Broker Offers An Account In Malaysian Ringgits?

Follow these three steps, which we took to check that each of our recommended brokers supports a Malaysian ringgit account:

- To find the available currencies for the trading account, look for the ‘Account Options’ section on the provider’s website or app.

- Ensure that ‘MYR’ is listed as a supported base currency for your trading account.

- Open a trading account and choose ‘MYR’ as your base currency.

Pros & Cons Of MYR Trading Accounts

Pros

- With an MYR base account, you avoid frequent currency conversions between MYR and other currencies, which can reduce transaction costs and foreign exchange risks.

- An MYR base account may provide direct access to Malaysian equities, bonds, and other financial instruments, making it easier to trade within the Malaysian market without needing additional currency exchange, though this depends on the markets offered by your broker.

- Suppose you are exposed to MYR assets or businesses in Malaysia. In that case, an MYR base account acts as a natural hedge against currency risk, stabilizing your investments in the face of exchange rate volatility.

Cons

- An MYR base account is most suitable for trading in Malaysian markets and assets denominated in MYR, which could limit access to international stocks, bonds, or financial products that trade in other currencies like USD, EUR, or GBP. If you plan to diversify globally, this could be restrictive.

- Imagine you want to invest in non-MYR-denominated assets. In that case, you’ll need to convert MYR to other currencies, which can expose you to foreign exchange risk and conversion costs, especially when the MYR is volatile.

- The MYR can be more volatile than major currencies like USD and EUR due to its exposure to global commodity prices and economic shifts in emerging markets. If the currency fluctuates significantly, particularly during periods of economic instability, this can impact the value of your trading account.

FAQ

Which Is The Best Broker With An MYR Account?

Our team of experts has thoroughly evaluated the top trading platforms that offer MYR accounts. Use our curated list to find the perfect fit for your day trading needs.

How Much Does It Cost To Open A Trading Account Based In Malaysian Ringgits?

Our analysis shows many brokers require a minimum deposit of up to USD 250 (approximately MYR 1,085) to start trading with MYR.

However, there are exceptional cases. Exness, for instance, offers a more affordable starting point with no minimum deposit requirement, making it a suitable option for beginners or those with small account balances.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com