Bitfinex Review 2026

See the Top 3 Alternatives in your location.

Pros

- Despite a steep learning curve, the Bitfinex trading platform delivers for experienced traders, featuring a comprehensive charting package with 12 timeframes, plus margin trading and various order types.

- Bitfinex is well-suited to algo traders, facilitating automated trading through its Honey terminal and API integration, enabling traders to program trading strategies efficiently.

- Bitfinex boasts excellent liquidity across its crypto trading pairs, reducing the likelihood of slippage and ensuring efficient order execution, particularly for large volume trades, making it reliable for frequent traders.

Cons

- Testing reveals inadequate support, especially for active traders, with response times of 12 hours via email and a frustrating user experience with no live chat integrated into the trading platform.

- Despite enhancing its security measures with two-factor authentication, Bitfinex still hasn’t escaped its dogged history of major security breaches and regulatory fines.

- Like many crypto exchanges, Bitfinex operates in a regulatory grey area, which may pose risks for traders, especially compared to trusted crypto trading platforms like eToro.

Bitfinex Review

This Bitfinex review evaluates the trading environment following direct tests and comparisons with suitable alternatives from our 500-strong directory of crypto exchanges and online brokers.

Regulation & Trust

Bitfinex emerged as a pioneer among crypto exchanges, however recent regulatory issues have taken away some of its shine.

Having experienced a significant security breach in August 2016, where 119,756 Bitcoin (BTC) valued at approximately $72 million at the time were stolen, Bitfinex has faced various regulatory fines, including those from the Commodity Futures Trading Commission (CFTC), as reported by JD Supra.

More recently, it’s encountered serious allegations from the New York Attorney General’s Office, accusing the exchange of misleading investors regarding its Tether stablecoin. It has also been accused of engaging in cryptocurrency market manipulation.

In addition to its trading services, Bitfinex facilitates peer-to-peer (P2P) financing, operating offshore in the British Virgin Islands.

Nevertheless, like many crypto exchanges, Bitfinex operates as an unregulated entity. This implies that it functions without oversight or supervision from any governmental authority and may not adhere to the same standards and safeguards required of regulated entities.

| Bitfinex | Gemini | eToro | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | NYDFS, MAS, FCA | FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF | |

| Proof of Reserves | Yes | Yes | No |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

Live Accounts

Bitfinex offers several account types to cater to the diverse needs of traders:

- Individual accounts are suitable for retail traders

- Corporate accounts are designed for businesses

- Institutional accounts are tailored for professional traders and institutional investors

While Bitfinex doesn’t offer distinct account types for retail traders, it does provide multiple verification levels aligned with KYC, AML, and CTF regulations, impacting platform activity.

These verification tiers ranged from Basic Access to Full. Basic Access affords view-only account privileges, while Basic Plus enables exchange and OTC trading, crypto transfers, and Tether token withdrawals.

Intermediate verification encompasses all investment, lending, and borrowing activities, with most deposit and withdrawal methods accessible, barring international bank transfers.

Upon achieving Full verification, I gained access to all deposit and withdrawal methods, as well as full trading, lending, and borrowing capabilities.

The processing time for Intermediate and Full verification typically took 2-3 working days.

Bitfinex also provides a non-expiring demo account for paper trading, offering a risk-free environment that allows you to practice buying, selling, and developing strategies in simulated live markets.

Deposits & Withdrawals

There are three primary wallets:

- Exchange Wallet for currency exchanges

- Margin Wallet for leveraged trading

- Funding Wallet for providing margin financing

You just need to remember that funds are allocated appropriately before executing orders or offers.

Additionally, Bitfinex offers two supplementary wallets:

- Derivatives Wallet for derivatives trading

- Capital Raise Wallet for trading tokenized securities on Bitfinex Securities

However, using these wallets may involve specific requirements or limitations based on your verification levels and jurisdiction.

Transferring funds between wallets is swift and straightforward using Bitfinex’s Quick Transfer feature or the Balances box on the Trading page.

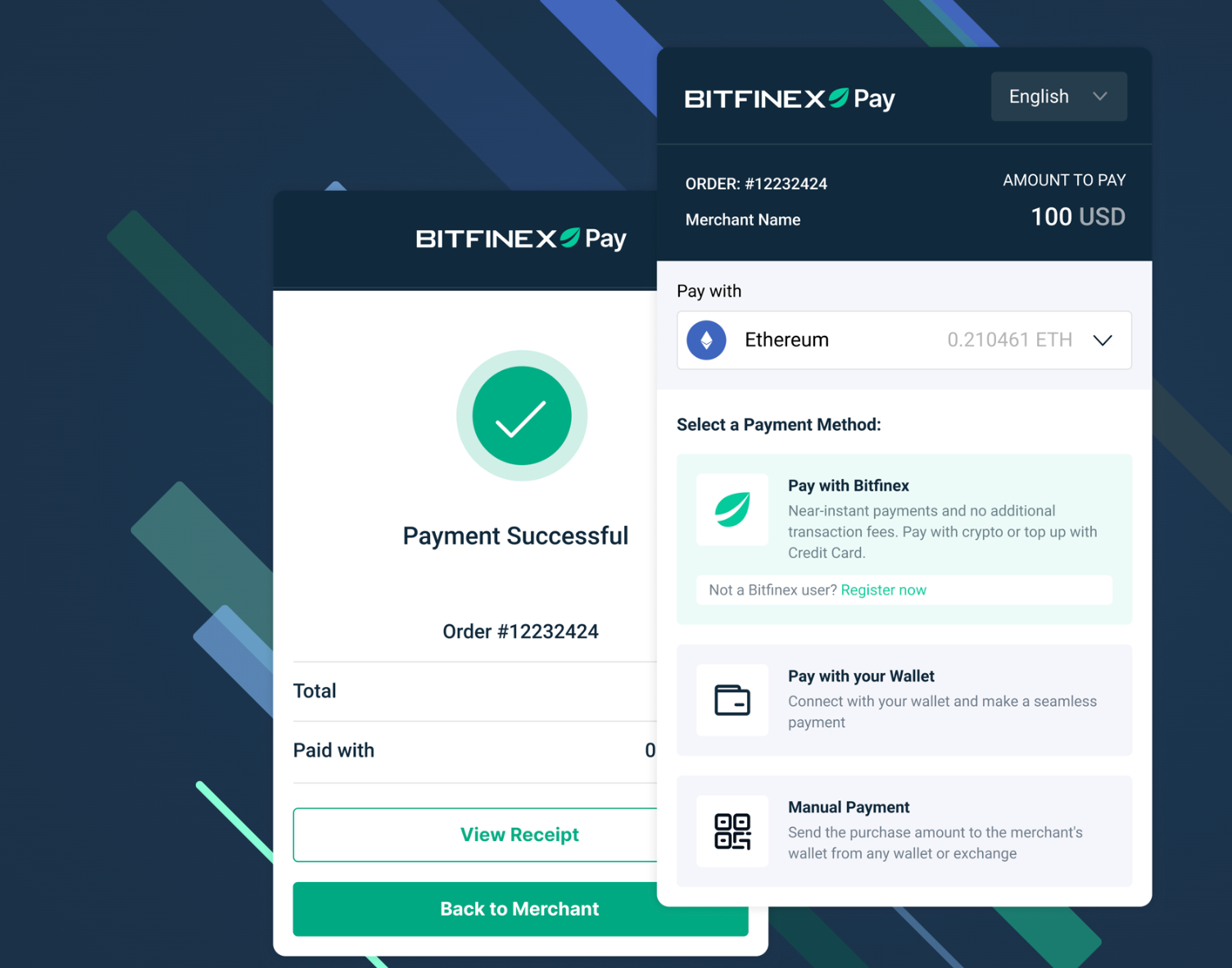

When purchasing cryptocurrencies, Bitfinex provides three options:

- Credit/debit card

- Exchange trading

- On-ramp services through happyCOINS

Each option varies in terms of available cryptocurrencies (new additions regularly), identity verification requirements, fees, and processing times. For example, credit/debit card purchases are typically instantaneous, while purchases through happyCOINS require a minimum of €50.

Withdrawals can be made in both crypto and fiat currencies, with transaction fees for crypto withdrawals. Bitcoin withdrawals, for example, require a minimum wait time of 12 hours, though in my experience, it’s typically around 2 hours.

| Bitfinex | Gemini | eToro | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Mastercard, Payoneer, PayPal, Perfect Money, Simplex, Skrill, TransferWise, UnionPay, Visa, Volet, Western Union, Wire Transfer | ACH Transfer, Bitcoin Payments, Credit Card, Etana, Ethereum Payments, Mastercard, PayPal, Silvergate Bank Transfer, Visa, Wire Transfer | Bitcoin Payments, Debit Card, Ethereum Payments, iDeal, Klarna, Neteller, Przelewy24, Rapid Transfer, Skrill, Sofort, Swift, Trustly, Visa, Wire Transfer |

| Minimum Deposit | $0 | $0 | $100 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

Bitfinex provides access to over 180 digital currency pairs, with a surge of new tokens in 2024, encompassing a wide array of leading cryptocurrencies including Bitcoin, Ethereum, Tether, and Ripple.

This range provides more opportunities than alternatives like Gemini with around 120 pairs, but trails firms like OKX with its 500+ pairs.

Bitfinex is closely associated with the Tether stablecoin, which aims to maintain a value of $1. However, concerns over transparency regarding reserves may prompt caution when holding significant amounts of Tether in your account. While Tether claims full backing of the currency, ultimately, it’s up to you to decide whether to trust this assertion.

Traders enjoy the flexibility to trade crypto-only pairs as well as tokens paired with traditional currencies such as USD, GBP, EUR, and JPY, notable examples include BTC/USD, ETH/USD, and XRP/USD. Additionally, altcoins like Tron, Stellar, and NEOGAS are available for trading.

However, while Bitfinex provides leverage up to 1:10 for crypto margin trading, for higher leverage options like 1:100 or more, alternative exchanges like Binance are preferable.

Moreover, the exchange offers clients the opportunity to generate passive income from their cryptocurrency holdings through its staking and lending programs.

With staking, I deposited my chosen cryptocurrencies (currently supporting 10 coins) into my Bitfinex account. Bitfinex securely held the majority of staked tokens in cold storage and staked only a fraction of assets to minimize risks. In return, I received weekly interest payments, the amount of which varied depending on the asset.

Staking incurred no fees, and there was no requirement to lock in crypto for month-long periods, making it convenient if I decided to sell spontaneously.

| Bitfinex | Gemini | eToro | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | Cryptocurrencies | Cryptos | Stocks, ETFs, Options, Crypto |

| Margin Trading | Yes | No | Yes |

| Crypto Mining | No | No | No |

| Crypto Staking | Yes | Yes | Yes |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

While Bitfinex’s fees slightly surpass those of Binance, they still align with industry standards. However, it’s important to distinguish crypto exchange fees from those of traditional brokers.

In crypto exchanges like Bitfinex, fees hinge on the trade’s nature. Buyers typically face higher fees as they’re perceived to remove liquidity from the market, while sellers, contributing liquidity, encounter lower fees. Notably, no trading fees apply to large orders processed through the OTC desk.

Still, my experience with Bitfinex unveiled a somewhat intricate fee setup influenced by factors such as my 30-day trading volume and holdings of Bitfinex’s proprietary cryptocurrency, LEO. Thankfully, their fee calculator eased the process.

Typically, transactions involving cryptocurrencies, stablecoins, and fiat currencies incur a maker fee of 0.10%, and a taker fee of 0.20%. For derivative transactions, the maker fee drops to 0.02%, with the taker fee at 0.065%. These fees replace the traditional broker’s standard commission.

Maintaining a minimum of $5,000 worth of LEO coins garners a 25% discount on taker fees for cryptocurrency and stablecoin trades, along with a 10% discount on fiat trades. Additionally, balances exceeding $10,000 in LEO tokens unlock further percentage discounts, personalized to account balance.

Borrowing funds on Bitfinex incurs a maker fee twice – upon loan initiation and repayment. Interest rates and lending fees vary based on the involved asset or coin.

| Bitfinex | Gemini | eToro | |

|---|---|---|---|

| Fees & Costs Rating | |||

| Crypto Spread | Taker (0.2% to 0.055%) and maker (0.1% to 0.0%) | Transaction fee from $0.99 | BTC 1% |

| Inactivity Fee | $5 | $10 | |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

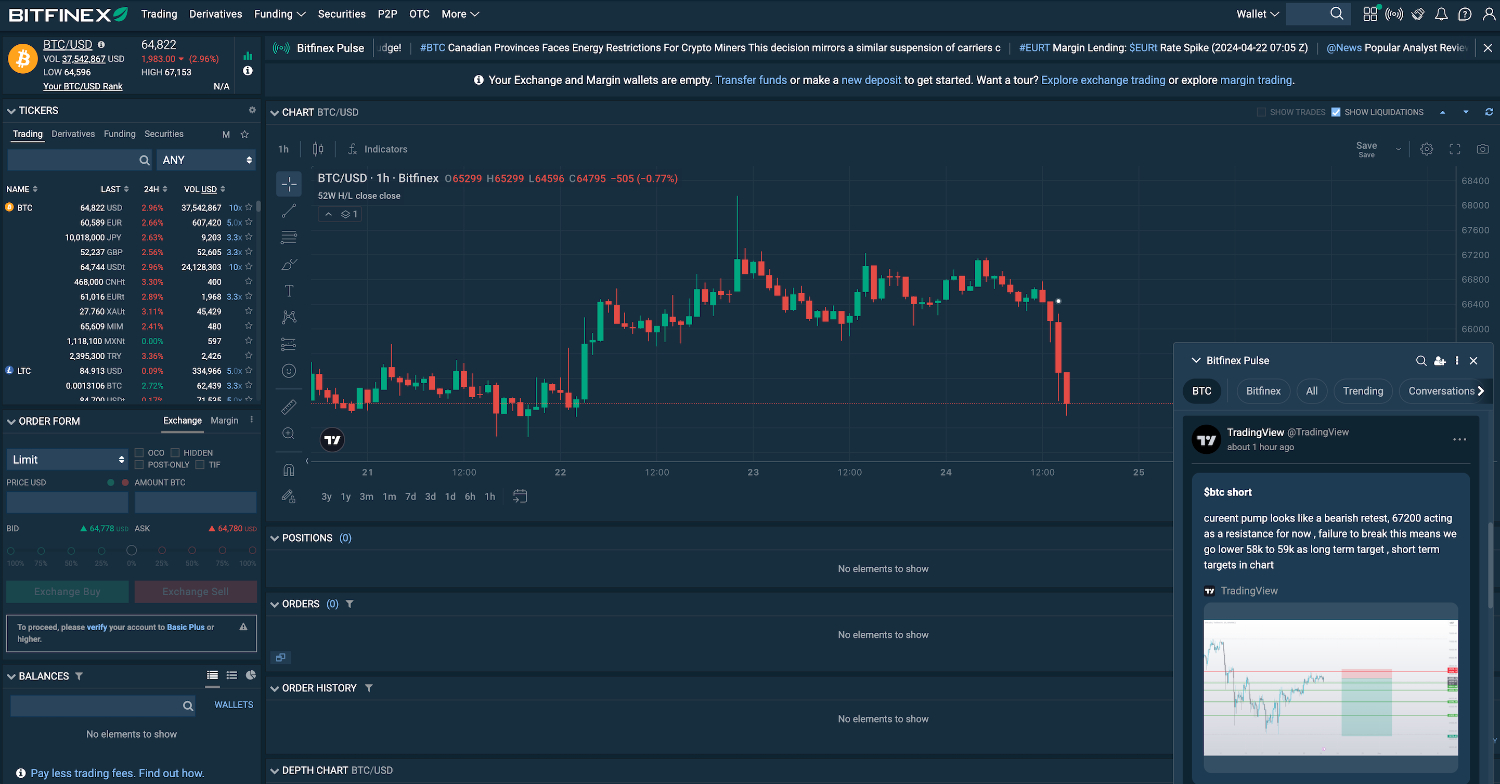

The proprietary web platform provides essential tools for technical analysis – ideal for day trading. However, for those new to cryptocurrency trading, the experience might initially seem daunting compared to platforms like eToro or Kraken.

Bitfinex’s platform impresses with an array of advanced features, including drawing tools, order book data, a rolling news bar, and high liquidity to minimize slippage.

During testing, I utilized 12 timeframes ranging from one minute to one month, diverse chart types such as line and candlesticks, and an array of indicators like moving averages and stochastic oscillators.

Additionally, Bitfinex caters to various trading strategies with multiple order types including limit, stop, and trailing stop orders.

Bitfinex Honey also proves to be a valuable tool, allowing you to execute numerous algorithmic orders directly from web browsers, streamlining the trading process.

Moreover, the Bitfinex Terminal facilitated strategy backtesting using historical market data, offering invaluable insights. Through APIs, clients can integrate with platforms like 3Commas and QuantConnect to deploy bots to help enhance their trading capabilities.

Comparing Bitfinex to leading exchanges like Binance and Kraken, each platform has its own strengths: Kraken’s platform is often favored by less experienced traders, while Binance boasts a broader range of assets with added complexities.

| Bitfinex | Gemini | eToro | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | Web Platform, Quantower | ActiveTrader, AlgoTrader, TradingView | eToro Web, CopyTrader, TradingCentral |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

Bitfinex Pulse is an excellent resource for staying informed about the crypto market. This social investing platform delivers news and analysis directly to your device, covering a wide range of topics from NFT games to price predictions for various cryptocurrencies like XRP.

Moreover, Bitfinex Alpha provides insightful articles with market analysis and commentary. Navigating through the platform’s blog, I discovered educational content aimed at expanding users’ knowledge base, alongside tutorial videos and articles guiding traders on effectively utilizing the platform.

| Bitfinex | Gemini | eToro | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

Bitfinex’s educational resources are a valuable aid, especially for beginner crypto traders. These resources encompass tutorials, articles, and guides covering a wide array of topics, including cryptocurrency basics, trading strategies, market analysis, risk management, and platform navigation.

One particularly beneficial learning tool I’ve really enjoyed is Bitfinex’s active YouTube channel, which delves into intriguing topics such as Bitcoin halving events.

That said, I’ve noted that while the content is informative, there isn’t much hand-holding, and most of it may prove challenging for novice traders to grasp fully.

| Bitfinex | Gemini | eToro | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

Similar to many cryptocurrency exchanges we’ve tested, Bitfinex operates on a self-service model for account management.

Assistance primarily comes from the exchange’s FAQ and help sections, offering a wealth of information covering various subjects, from beginner’s guidance to trading and lending insights, API documentation, account management, verification procedures, and deposit/withdrawal processes.

For additional support, email communication through a support ticket system is available, albeit without phone support. Based on my experience, I typically receive an email reply within up to 12 hours, which is relatively slow.

I’ve also encountered some inconvenience having to leave the trading platform and navigate to the exchange’s main website for live chat support for more urgent issues – not ideal if you’re day trading crypto.

To accommodate its diverse user base, the website offers support in five languages, including English, Spanish, and Mandarin.

There is also additional assistance through Bitfinex’s active presence on social media platforms like Twitter, Telegram, YouTube, Discord, and LinkedIn.

| Bitfinex | Gemini | eToro | |

|---|---|---|---|

| Customer Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

FAQ

Is Bitfinex A Good Broker For Day Trading?

Bitfinex offers a range of features suitable for day trading, including a powerful trading platform complete with advanced charting tools and deep liquidity.

However, traders should be aware of the platform’s history of security breaches and legal challenges, which may affect their decision to use it for day trading.

Is Bitfinex Legit Or A Scam?

Bitfinex is a legitimate cryptocurrency exchange with a long-standing presence in the industry.

While it has faced security challenges and controversies in the past, it continues to operate as a prominent platform for trading digital assets, offering advanced features and a wide range of cryptocurrencies.

Is Bitfinex A Regulated Broker?

Bitfinex is not regulated by any financial authority, as it operates in the cryptocurrency market, which generally lacks extensive regulatory oversight.

Traders should be aware of the risks associated with trading on unregulated platforms and conduct thorough research before engaging with Bitfinex or any similar exchange.

Is Bitfinex Suitable For Beginners?

Bitfinex is not the best choice for beginners due to its complex trading interface and advanced features, which can be overwhelming for those new to cryptocurrency trading.

Beginners might find platforms with simpler interfaces and more educational resources – such as eToro – more suitable for their needs.

Does Bitfinex Offer Low Fees?

Bitfinex’s fee structure is competitive, however fees vary based on factors like trading volume and token holdings.

While some fees may be lower compared to other exchanges, especially for active traders, prospective users should understand and calculate their specific costs before trading on the platform, making use of Bitfinex’s fee calculator.

Best Alternatives to Bitfinex

Compare Bitfinex with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Gemini – Gemini is a cryptocurrency exchange set up in 2014 by the Winklevoss brothers, known for their early involvement in Facebook. The exchange is among the world’s 20 largest and most popular. Gemini clients can trade and stake 110+ cryptocurrencies, with derivatives trading available in some jurisdictions, an advanced proprietary platform and additional features including an NFT marketplace.

Bitfinex Comparison Table

| Bitfinex | Interactive Brokers | Gemini | |

|---|---|---|---|

| Rating | 3.9 | 4.3 | 3.8 |

| Markets | Cryptocurrencies | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Cryptos |

| Demo Account | Yes | Yes | No |

| Minimum Deposit | $0 | $0 | $0 |

| Minimum Trade | $10 | $100 | 0.00001 BTC |

| Regulators | – | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NYDFS, MAS, FCA |

| Bonus | Referral Codes | – | – |

| Platforms | Web Platform, Quantower | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | ActiveTrader, AlgoTrader, TradingView |

| Leverage | – | 1:50 | – |

| Payment Methods | 16 | 6 | 10 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Gemini Review |

Compare Trading Instruments

Compare the markets and instruments offered by Bitfinex and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Bitfinex | Interactive Brokers | Gemini | |

|---|---|---|---|

| CFD | No | Yes | No |

| Forex | No | Yes | No |

| Stocks | No | Yes | No |

| Commodities | No | Yes | No |

| Oil | No | No | No |

| Gold | No | Yes | No |

| Copper | No | No | No |

| Silver | No | No | No |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

Bitfinex vs Other Brokers

Compare Bitfinex with any other broker by selecting the other broker below.

The most popular Bitfinex comparisons:

Article Sources

- Bitfinex Website

- Bitfinex Hack - Wikipedia

- Bitfinex CFTC Fine - JD Supra

- Bitfinex New York Illegal Activities - New York State Attorney General

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Customer Reviews

There are no customer reviews of Bitfinex yet, will you be the first to help fellow traders decide if they should trade with Bitfinex or not?