Wealth Way Review 2024

Pros

- Low minimum deposit

- Demo account

- Copy trading

Cons

- No regulatory oversight

- No MT4 integration

Wealth Way Review

Wealth Way is a global forex and CFD broker. It offers multi-asset trading on the MetaTrader 5 (MT5) platform spanning forex, stocks, commodities, and cryptocurrencies. The broker also offers beginner-friendly educational content, a VPS, and multiple account types with different fee structures.

This Wealth Way review will look at the advantages and disadvantages of opening a live account, from minimum deposit requirements and demo account features to the firm’s regulatory status, spreads, trading apps, and more.

Key Takeaways

- Wealth Way offers a good range of trading tools, including MT5, Autochartist, copy trading and a VPS

- Low spreads and trading fees are available with the best accounts but a high deposit ($10,000+) is required

- Joining bonuses are available in some countries but turnover terms and conditions are steep

- The company is not regulated by a reputable financial watchdog

Company History & Overview

Wealth Way is a financial services firm, founded in 2017 by a team of professional traders. The vision of the company is to make the financial markets “accessible to everyone and serve all clients with greater transparency”.

The brokerage has its headquarters in London, UK though the company is registered offshore in Saint Vincent and the Grenadines. Wealth Way is currently unregulated.

Both STP and ECN pricing models are offered to suit different trading strategies and styles. Spreads start from 0.0 pips and up to 1:500 leverage is available, alongside 24/7 support and a personal account manager.

Trading Platform

Clients can trade on MetaTrader 5 (MT5). There are desktop download options for Windows, Mac, and Linux devices. Alternatively, MT5 can be used directly through major web browsers such as Safari and Firefox.

Although there is no choice of trading platforms, MT5 is a renowned multi-asset terminal that provides all the advanced analysis tools and custom charting views needed for successful trading. MetaTrader 5 is essentially a more powerful version of its predecessor, MT4, and is recognized for its stability and sophisticated trading features.

Whilst the platform does not offer a sleek design, the functionality is excellent. It is home to automated trading features, an integrated economic calendar, and an embedded community chat. Traders can also make use of 21 timeframe views, 38 in-built technical indicators, and 44 analytical objects.

Additionally, day traders can connect to the MetaTrader marketplace to purchase Expert Advisors (EAs), scripts, and technical indicators. Other features include a multi-threaded strategy tester, Market Depth pricing, one-click trading, and six pending order types vs four on MT4.

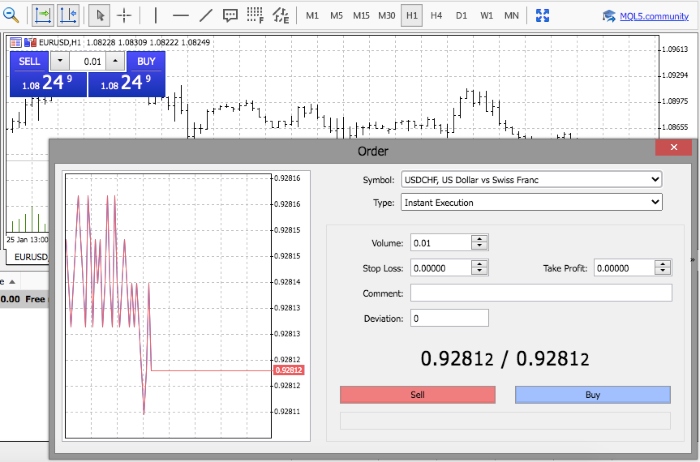

How To Place A Trade

There are several ways to initiate a new order on the Wealth Way MT5 platform:

- Click ‘F9’ to activate one-click trading

- Select ‘Tools’ in the menu and then ‘New Order’

- Double-click on the asset you want to trade in the ‘Market Watch’ widget

Day traders can then input the following details in the order screen:

- Symbol

- Volume

- Order type

- Comment (optional)

- Stop Loss or Take Profit

Once you have completed all the trade details, select ‘Buy’ or ‘Sell’ to open the position.

Users can manually close trades at any time. Alternatively, applying take profit or stop loss parameters will automatically close positions when the specified levels are triggered.

Markets & Instruments

Clients of Wealth Way have access to a good range of tradable instruments:

- Precious Metals – Trade three precious metal CFDs; gold, silver and platinum

- Indices – Speculate on 16 global stock indices such as the NASDAQ 100, Dow Jones 30, and FTSE 100

- Shares – Trade thousands of company stock CFDs on the NYSE, NASDAQ, and ASX exchanges

- Forex – Trade 60+ major, minor, and exotic currency pairs such as the EUR/GBP, USD/JPY, GBP/HKD, and AUD/CAD

- Cryptocurrencies – Invest in 7 popular digital and fiat currency pairs such as BTC/USD and ETH/EUR

- Commodities – Trade 6 soft commodities plus 3 spot energies and 2 energy futures

Fees

Wealth Way offers a choice of pricing models which is an advantage over many alternatives. The result is that traders can find a spread and/or commission structure that complements their trading strategy.

- Mini Account – Floating spreads from 1.4 pips, no commission fees

- Standard Account – Floating spreads from 1.6 pips, no commission fees

- ECN Account – Floating spreads from 0 pips, $10 commission per round lot turn

- Premium Account – Floating spreads from 0 pips, $5 commission per round lot turn

- VIP Account – Floating spreads from 0 pips, $2 commission per round lot turn

The broker also offers fractional pip pricing. This provides 5-digit pricing quotes vs the standard 4 digits. Essentially, traders benefit from more accurate quotes from liquidity providers and the smallest price movements.

When it comes to non-trading fees, there is a $5 charge for dormant accounts after 90 days of inactivity. This is pretty standard vs competitors.

Positions held after 10 PM (GMT) will also be liable for overnight rollover fees (not applicable to the swap-free account).

Wealth Way Leverage

As an unregulated brokerage, Wealth Way can provide highly leveraged trading opportunities. Day traders can access leverage up to 1:500. However, this is not as high as GoFX or SuperForex which offer leverage up to 1:3000.

Importantly, trading with leverage can amplify profits but also losses. Apply risk management parameters if trading on margin.

Users can also amend leverage levels by selecting the ‘Change Leverage’ tab in the ‘My Account’ section of the client dashboard. Changes are reflected instantly.

All accounts have a 100% margin call and a 30% stop-out level.

Mobile App

MetaTrader 5 can be downloaded as a mobile-compatible app. Users can access the full suite of trading features and functionality but in a terminal designed for smaller screens. This includes custom charts and graphs, live price quotes, and account management settings. Day traders can also set price alerts, position notifications, and view news streams.

Note, the MT5 app is currently unavailable for iOS users due to Apple App store restrictions.

On the downside, Wealth Way does not offer a proprietary mobile application.

Payment Methods

Deposits

Wealth Way has a low minimum deposit of just $10 or equivalent currency, which will attract beginners. All currencies are accepted – the broker will covert funds into the relevant account denomination at the interbank conversion rate.

Our experts also found that Wealth Way does not charge a fee for deposits, though for bank wire transfers a minimum payment of $2000 is required.

Accepted payment methods:

- Credit/debit card

- Bank wire transfer

- E-wallets such as Skrill and Neteller

All deposits are instant except for bank wire transfers which can take up to five working days.

How To Make A Deposit

- Log in to the Wealth Way client dashboard

- Select ‘Deposits’ from the side menu and then ‘Add Money’

- Choose the account to add funds to from the dropdown menu

- Enter the amount to deposit (note the $10 minimum)

- Click ‘Make Payment’

- Follow the on-screen instructions

- Select ‘Add Funds’

A useful transaction status report is available under ‘Deposits’ and then ‘Transaction’ in the client portal.

Withdrawals

Traders must withdraw funds back to the original payment method. Withdrawals are processed in EUR, GBP, and USD only so a currency conversion fee may apply. There is also a minimum withdrawal amount of $10 or equivalent currency.

Wealth Way processes all requests within 24 hours, though the time taken for funds to be received back to an account will vary by method. International bank wire transfers, for example, can take up to five working days.

Similar to deposits, the broker does not charge any commission fees, though third-party charges may apply.

When we used Wealth Way, we were disappointed to see that Mini Account holders can only request two withdrawals per month. Standard Account users, on the other hand, can request an unlimited number of withdrawals.

Demo Account

A free demo account is available to Wealth Way customers. The broker provides a risk-free practice profile on the MT5 platform, with unlimited virtual funds and no expiry date.

The demo account is a good environment for both experienced and beginner investors to test strategies, view spreads, and explore the broker’s trading tools.

How To Open A Demo Account

- From the Wealth Way homepage, select ‘Accounts’ from the top menu

- Click on the ‘Demo Account’ icon in green

- Complete the basic registration details including email and phone

- Select ‘Open Demo Account’

Alternatively, new users can register for a Wealth Way account and open a demo profile from the client portal.

Wealth Way Bonuses & Promotions

Wealth Way offers several welcome deals and deposit bonuses, including on Chinese New Year and Easter. Access to individual bonuses will vary between jurisdictions.

However, while using Wealth Way FX, we found that promotional terms and conditions are tough. For example, a 50% growth value (of the bonus amount) must be achieved before a withdrawal is permitted. A trader’s account must also have been active for at least three months.

Regulation

Wealth Way FX is the official trading name of Wealthway Corporation. The brokerage is registered in Saint Vincent and the Grenadines with the SVGFSA, license number 26349. However, when our experts reviewed the registered company list, no records were found for the company name or associated license number. As a result, the broker may be operating without regulatory oversight, which is a red flag.

Wealth Way also doesn’t offer negative balance protection, meaning traders can lose more than their deposit. This is a real drawback vs popular alternatives like AvaTrade.

Account Types

Wealth Way offers several account options with varying pricing models and trading conditions. Having said that, retail traders, particularly beginners, will be limited by the high minimum deposit requirements.

All profiles offer access to 1:500 leverage, the full range of trading instruments, and three base currencies (GBP, EUR, and USD). An Islamic swap-free version of each account type is also available.

Tailor-Made Account

- STP execution

- Commission-free

- 5-lot maximum trade size

- 0.01 lot minimum trade size

- Floating spreads from 1.4 pips

- Maximum 30 open orders at a time

- Account holders are permitted to choose a minimum deposit (to be approved by Wealth Way)

Mini Account

- STP execution

- Commission-free

- 5-lot maximum trade size

- $10,000 minimum deposit

- 0.01 lot minimum trade size

- Floating spreads from 1.4 pips

- Maximum 30 open orders at a time

Standard Account

- STP execution

- Commission-free

- 20-lot maximum trade size

- $25,000 minimum deposit

- 0.01 lot minimum trade size

- Floating spreads from 1.6 pips

- Maximum 50 open orders at a time

ECN Account

- STP execution

- 50-lot maximum trade size

- $10,000 minimum deposit

- $10 commission per lot

- 0.01 lot minimum trade size

- Floating spreads from 0 pips

- Maximum 100 open orders at a time

Premium Account

- STP execution

- $5 commission per lot

- $100,000 minimum deposit

- 100-lot maximum trade size

- 0.01 lot minimum trade size

- Floating spreads from 0 pips

- Maximum 300 open orders at a time

A Fixed Price Mechanism (FPM) solution is available to Premium account holders or those with an account balance of $100,000+. This is designed to protect investors against significant price shifts – the broker provides a fixed value for the held equity in a portfolio.

VIP Account

- STP execution

- $2 commission per lot

- 200 lot maximum trade size

- 0.01 lot minimum trade size

- Floating spreads from 0 pips

- $1,000,000 minimum deposit

- Maximum 500 open orders at a time

How To Open A Wealth Way Account

The registration process is straightforward. Our experts were able to open a live trading account in a few minutes.

- Navigate to the broker using the ‘Visit’ button in this Wealth Way review

- Click on the ‘Create Account’ icon in the dropdown menu

- Enter basic personal details and click ‘Sign Up’

- Verify your registration via the email link

- Log in to the client dashboard

- Select ‘My Accounts’ from the side menu

- Select the leverage and account base currency and click ‘Open Account’

New clients must provide proof of address and residency before the full suite of trading services are available. This can be uploaded via the ‘Profile’ section in the client portal.

Additional Tools

VPS

A Virtual Private Server is available to Wealth Way users. Traders benefit from no server downtime so clients can run automated trading strategies 24/7.

The VPS program is available to all traders for a monthly $30 fee. Alternatively, users with an account balance of $5000+ get free access, provided at least 20 round lot turns are traded per month.

Autochartist

Wealth Way offers all clients access to Autochartist. The analysis tool provides in-depth, yet digestible market information to support retail investors. It is ideal for traders with limited time to study market movements and economic trends.

Market data can be filtered by instrument or asset class. Users can also set trading alerts to notify them of any significant price breaks or trend lines.

Copy Trading

All live accounts can be set to ‘Auto Trader’ mode, a copy trading service offered by Wealth Way. The tool is useful for beginners and those looking for a hands-off approach to online trading. Users can copy the trades or proven strategies of ‘professional traders’ in return for a small fee.

Education & Training

Wealth Way has plenty of educational resources and training plans designed for both beginners and experienced retail traders. There is a four-part online course that provides users with the insights and skills to become successful traders.

Additionally, Wealth Way clients can access keyword glossaries and the latest news articles to stay up to date with market trends. We were pleased to see this information is updated daily.

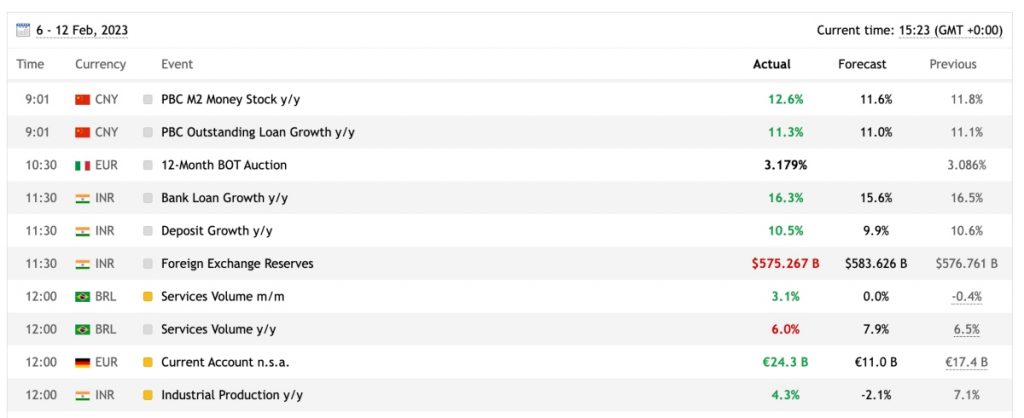

Traders can also access video tutorials on how to use the trading platform and client dashboard, as well as weekly webinars in some jurisdictions. In addition, a full economic calendar is available on the broker’s website.

Opening Hours

Wealth Way trading hours are between Sunday 22:05 and Friday 21:50 (GMT), though specific market opening times will vary. The US stock market, for example, can be traded between 14:30 and 21:00 (GMT) Monday to Friday.

All orders processed out-of-hours will be executed at the next available market price.

Customer Support

The broker’s customer service is basic, though a dedicated wealth manager is supposed to be available for clients 24/7.

It was disappointing to see that Wealth Way does not have a live chat service, a tool offered by many top brokers today. Instead, a WhatsApp chat function is available, though our traders could not connect to a customer service representative when they tested it.

- Telephone – +447717383818

- Email – operations@wealthwayfx.com

- WhatsApp – Green icon available on the bottom left of each webpage

- Online Contact Form – Available via the ‘Contact Us’ webpage or can be submitted in the client portal

- Registered Office Address – Suite 305, Griffith Corporate Centre, Kingstown, St. Vincent and the Grenadines

Security & Safety

The lack of credible regulatory oversight makes it difficult to confirm whether Wealth Way is a safe online broker. Fund security is also not guaranteed or covered by compensation schemes. Additionally, we were not offered the option to add two-factor authentication to the client dashboard.

With that said, the MetaTrader 5 platform uses reliable security features including transaction encryption and data privacy protocols.

Wealth Way Verdict

Wealth Way offers relatively competitive trading conditions, with a choice of account types and a good range of financial instruments. There are plenty of additional trading tools, free education, a demo account, plus high leverage.

On the downside, negative balance protection is not provided and the broker is not regulated by a trusted financial agency. In addition, the high minimum deposit with many of the account options means the best trading conditions are not within reach for many new traders.

FAQs

Are My Funds Safe With Wealth Way?

We cannot confirm that funds will be 100% safe with Wealth Way. The broker is unregulated and does not provide negative balance protection. As a result, we would recommend caution when making a deposit to Wealth Way FX.

Does Wealth Way Offer Low Trading Fees?

Wealth Way does offer competitive trading conditions through its multiple account options. However, traders will need to deposit upwards of $10,000 to benefit from ultra-tight spreads and low to zero commissions. This will put it out of reach for many beginners.

Is Wealth Way Regulated?

Wealth Way is not regulated by the St. Vincent & the Grenadines & Financial Services Authority (SVGFSA) despite claims online. Our experts checked the regulator’s approved entity list and the trading brokerage was not included. This means there may be limited fund protection measures or insurance schemes in place to protect retail investors.

Does Wealth Way Offer A Reliable Trading Platform?

Yes, Wealth Way clients can trade on the MetaTrader 5 platform and app. The terminal is trusted by millions of traders worldwide, with a wealth of analysis tools and customization features. MT5 is a good fit for both beginners and experienced traders.

Is Wealth Way A Good Or Bad Broker?

Wealth Way offers a decent breadth of asset classes, a choice of pricing models, copy trading, plus access to the MT5 platform. However, the lack of robust regulatory oversight and unresponsive customer support are major drawbacks. As a result, Wealth Way FX is not a top-rated trading broker.

Top 3 Alternatives to Wealth Way

Compare Wealth Way with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Wealth Way Comparison Table

| Wealth Way | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.3 | 4.4 | 4.3 | 4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Futures, Cryptos | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $10 | $0 | $0 | $1 |

| Minimum Trade | $10 | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | – | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT5, AutoChartist | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:500 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 6 | 6 | 6 | 10 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Wealth Way and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Wealth Way | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | Yes | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Wealth Way vs Other Brokers

Compare Wealth Way with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Wealth Way yet, will you be the first to help fellow traders decide if they should trade with Wealth Way or not?