Sharpe Ratios by Asset Type & Conditions

The Sharpe ratio is a risk-adjusted return that looks at the return over cash relative to volatility.

It’s crude (e.g., treats upside and downside volatility the same, volatility = the sole measure of risk), but it’s widely used as a return-to-risk ratio.

It’s often looked at as a static figure when looking at asset classes as a whole.

But how does the Sharpe ratio vary by different market equilibrium conditions: bullish disequilibrium, equilibrium, and bearish disequilibrium?

How do different asset classes behave in these environments, and what does this mean for building a resilient portfolio?

Key Takeaways – Sharpe Ratios by Asset Type & Conditions

- Sharpe ratio measures return per unit of risk, helping compare assets across regimes.

- No asset dominates in all conditions: bullish, equilibrium, or bearish. They all react differently to macro influences.

- Equities excel in bullish markets but drag in downturns.

- Nominal and inflation-linked bonds perform well in stable or bullish phases but offer limited protection in deep bear markets.

- Balanced assets (e.g., risk parity/balanced beta) show the most consistent Sharpe ratios across conditions, softening losses in downturns.

- A “neutral” portfolio starts with balanced beta at its core, with equity and inflation-linked tilts for upside and protection.

Sharpe Ratios Across Conditions

When you look at how different assets perform across market regimes, the Sharpe ratio is one way to contextualize it.

It doesn’t just show raw returns, but adjusts for the risk (at least in terms of being defend by volatility) taken to earn those returns.

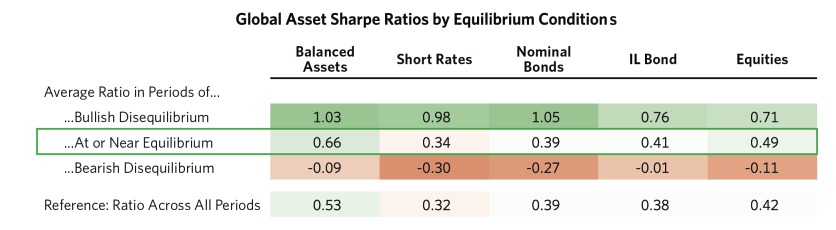

The table below (via Bridgewater Associates) highlights three distinct conditions (bullish disequilibrium, equilibrium, and bearish disequilibrium) and how balanced assets, bonds, equities, and short rates stack up.

The story changes depending on the state of the market.

First, let’s define what each of these means:

- Bullish disequilibrium – A setup where conditions are weak but policy is easy and risk premia are high. This creates outsized returns for assets.

- Equilibrium – A balanced state where growth and inflation sit near policymakers’ goals, policy is neutral, and assets earn roughly normal risk premia.

- Bearish disequilibrium – An environment where conditions are too hot, policy is tight, and risk premia are compressed. This generally leaves assets with poor returns.

Bullish Disequilibrium

This is the environment where optimism runs high and capital flows freely.

It’s like the “risk-on” party phase.

In these periods, Sharpe ratios are impressive across the board.

Nominal bonds top the list with a ratio of 1.05, while balanced assets are right behind at 1.03.

Even equities, which often carry the highest volatility (which can be punished by the Sharpe), deliver a healthy 0.71.

The big picture here is that in bullish disequilibrium, investors are rewarded generously for taking risk.

Almost everything you own seems to work, which makes diversification feel less important.

But the nuance is worth noting: balanced assets and nominal bonds also do well.

That suggests there’s value in holding diversified exposures even when times are good.

The party may feel like it’s driven by equities, but it’s the steady mix that quietly posts the strongest risk-adjusted returns.

At or Near Equilibrium

Now shift to calmer waters. In periods when the market is closer to balance (neither stretched with optimism nor gripped by fear), Sharpe ratios cool off.

Balanced assets once again take the top spot with 0.66, while the rest of the pack settles into a range between 0.34 and 0.49.

This is the kind of environment where patience pays. Returns aren’t the best anymore, but they’re steady, and risk is compensated in a more measured way.

A portfolio commonly just jogs along.

Importantly, diversification still shows its worth. While no single asset shoots the lights out, a blend provides consistent and respectable Sharpe ratios.

For long-term investors and risk-positive allocators, equilibrium periods reinforce why balanced approaches, like risk parity, make sense.

They might not grab headlines, but they quietly keep portfolios compounding at solid, risk-adjusted levels.

Bearish Disequilibrium

Here’s where the picture turns. In bearish disequilibrium, Sharpe ratios collapse.

Short rates sink to -0.30, equities slip to -0.11, and even a balanced asset allocation, which usually cushion blows, post a negative -0.09.

The one sliver of resilience comes from inflation-linked bonds, nearly flat at -0.01, meaning they almost don’t underperform cash at all.

That doesn’t make them exciting, but it does suggest a defensive role when the rest of the landscape is painted red.

Still, the overall message is clear: when fear dominates and liquidity dries up, returns compress. Even the best-diversified portfolios struggle to generate positive risk-adjusted returns.

For traders/investors, the lesson is that diversifying won’t completely shield you in a true bearish disequilibrium.

In those moments, risk management matters more. Holding balanced assets doesn’t eliminate drawdowns, but it does soften them relative to concentrated bets like equities.

Summary

Looking across regimes, balanced assets stand out as the most consistent performer. They lead in equilibrium, rival the best in bullish conditions, and weather bearish periods with smaller losses than the rest.

That consistency is why strategies like risk parity have become so central in institutional portfolios.

They’re not about maximizing the benefits of one environment, but about smoothing returns across many and extracting risk premiums in a more efficient way.

In the end, the Sharpe ratio story is less about predicting which regime comes next and more about preparing for all of them.

Markets swing between optimism, balance, and fear.

Portfolios built on balanced exposures are the ones most likely to endure the ride.

The Idea Behind a Balanced Allocation (Risk Parity / Balanced Beta)

When people talk about “balanced assets” in this context, they’re usually pointing to a risk parity or balanced beta approach.

Unlike a traditional portfolio that allocates capital (e.g., 60 percent stocks and 40 percent bonds), balanced assets are built around risk contribution.

Each asset in the mix is weighted so that its risk impact, not its dollar weight, drives the portfolio.

The result is a blend where bonds, equities, and other assets all have a more equal say in shaping outcomes.

For example, nominal + inflation-linked bonds might be weighted higher than stocks in a portfolio by dollar weight in order to balance out their risk contribution.

Consistency Across Market Conditions

What jumps out in the table is how balanced assets quietly deliver across very different regimes.

They’re not always the absolute top performer, but they consistently land near it:

- At or Near Equilibrium – Sharpe ratio of 0.66, the strongest of all categories.

- Bullish Disequilibrium – Sharpe ratio of 1.03, right alongside nominal bonds at the top.

- Bearish Disequilibrium – Sharpe ratio of -0.09, still negative, but less painful than equities (-0.11) or short rates (-0.30).

This pattern highlights the advantage of risk parity: it doesn’t bet everything on one driver of returns.

Instead, it balances exposures to both growth-sensitive assets (like equities) and defensive assets (like bonds).

Why Balanced Beta Matters

Markets are unpredictable, and no one knows which regime comes next.

A portfolio tilted too heavily toward a single asset class will shine in one environment and struggle in another.

Balanced beta smooths that ride. It gives up some upside in raging bull markets but pays you back by softening the blows in downturns.

That’s why many institutions lean on balanced or risk parity allocations as a core strategy. They’re not chasing the hottest return in any single year and don’t care for the big ups and downs.

Instead, they’re looking for something more durable: steady, risk-adjusted performance across the full cycle.

Portfolio Construction Lessons

The first thing the Sharpe ratio table makes clear is that no single asset dominates across all conditions.

Markets swing between optimism, balance, and fear, and each environment favors different exposures.

Building a resilient portfolio means respecting that reality and diversifying across regimes.

Stocks

Equities are the clearest example of this. In bullish disequilibria, they do well, with a Sharpe ratio of 0.71.

But when the cycle flips to bearish, they quickly turn negative (-0.11).

Equities carry high beta to growth, which makes them strong in good times but painful in downturns. A portfolio built around them alone will feel that volatility.

Bonds

Bonds, both nominal and inflation-linked, perform a bit differently.

They shine in bullish and stable times, with Sharpe ratios hovering between 0.39 and 1.05, depending on the regime.

But they don’t provide as much of a cushion in bearish disequilibria as investors often hope.

Nominal bonds fall to -0.27, and inflation-linked bonds barely break even at -0.01. They help, but they’re not a silver bullet.

Short Rates

Short rates stand out as consistently weak, which should be expected.

With Sharpe ratios ranging from 0.98 in bullish disequilibrium down to -0.30 in bearish periods, their profile is volatile and heavily regime-dependent.

Balanced Assets

The strongest takeaway is the performance of balanced assets. Whether the market is roaring, steady, or sliding, balanced assets land near the top of the pack.

They post 1.03 in bullish disequilibria, 0.66 at equilibrium, and -0.09 in bearish stretches.

That consistency validates the risk parity approach, where portfolios are built around balanced risk contributions rather than capital weights.

For long-term investors – and even more strategic traders – the lesson is to try to think about how to build around balance. Then, if wanted, layer in tilts for growth or inflation.

It’s diversification across regimes, not just across assets, that keeps portfolios well-prepared for anything that follows.

Practical Takeaways for Investors

The main takeaway is that portfolios built for balance tend to hold up best across shifting market regimes.

Core Allocation

Start with a balanced beta or risk parity foundation.

This core allocation is so your risk isn’t concentrated in one place, giving you steady Sharpe ratios whether the market is bullish, stable, or bearish.

Satellite Tilts

From there, for more tactical traders/allocators, overweight equities as a satellite tilt to capture upside during bullish disequilibria, when growth assets tend to shine.

Pair that with inflation-linked bonds as a counterweight, giving your portfolio one potential solution (not the only answer) if inflation unexpectedly flares up.

Dynamic Overlays

If you have the ability to identify regime shifts (e.g., moving from equilibrium into a bullish disequilibrium), then consider overweighting assets with the strongest Sharpe ratios in that regime.

It adds a tactical edge without abandoning your balanced foundation.

Resilience First

Above all, focus on resilience. Balanced asset allocations won’t generally eliminate losses in downturns, but they smooth the ride.

Over the long run, that steadiness compounds into more reliable performance than swinging between extremes.

Portfolio Construction Example

Let’s take the lessons from the Sharpe ratios and turn them into an actual portfolio. The foundation will be in a balanced allocation.

Because it spreads risk more evenly across equities, bonds, and other exposures, it cushions volatility and avoids being overly dependent on any one driver of returns.

You’d commonly add 30-40% equities. This allocation gives you the upside in bullish disequilibria, when growth-sensitive assets tend to dominate performance.

The trade-off is clear: equities will hurt in bearish conditions, but their long-term return potential makes them a valuable tilt.

Next, include 20-30% each in nominal and inflation-linked bonds.

They won’t always be the star performer, but they add a different environmental exposure, with nominal doing better when inflation comes in below expectation and inflation-linked doing better when inflation is above expectation. Nominal bonds do best in an environment when growth and inflation run below expectation.

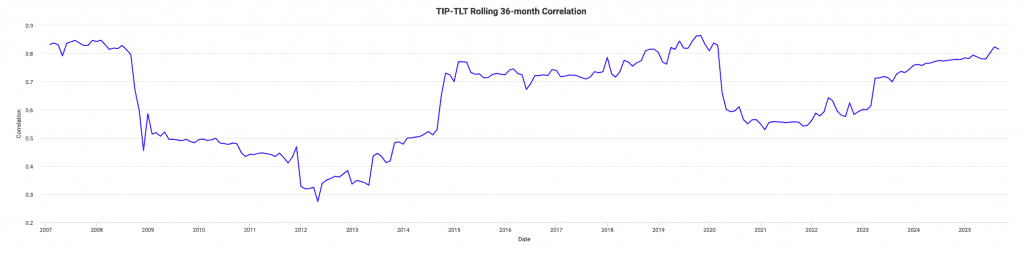

They both have exposure to interest rates, which means they’ll generally have a tighter correlation, ranging from +0.30 to +0.85 over a rolling 36-month timeframe.

The inflation protection of ILBs can be especially useful when other assets are struggling to keep up with rising price levels.

The caveat is that they’re vulnerable if yields rise or inflation accelerates (yes, inflation-linked varieties too), so they should remain a modest slice.

The last part is a 10-20% allocation to commodities, which provide a different type of exposure to both equities and bonds.

More tactical traders can change the weights within the context of these ranges.

This will give a portfolio that behaves like balanced beta at its core but layers in tactical tilts for growth, inflation, and other factors or variables of interest.

It’s diversified and positioned to adapt across regimes rather than chase one.

Conclusion

Balanced assets prove their worth by delivering consistency across regimes, while equities, bonds, and short rates each shine only in specific conditions.

Balance is a great default.

Focusing on balance rather than chasing extremes, traders/investors can better smooth returns, limit drawdowns, reduce the length of their underwater periods, and stay prepared no matter what part of the cycle they’re in.