3 Canadian Gold Stocks Poised to Ride 2025’s Bullion Boom

Gold’s explosive run in 2025 has turned Canada’s stock market into one of the purest, and most volatile, ways to play the metal. We’ve examined the country’s gold landscape and highlighted three Canadian equities – Agnico Eagle Mines, Wheaton Precious Metals and Centerra Gold – that potentially offer an enticing combination of valuation, growth and risk profile.

Key Takeaways

- Gold’s 2025 rally has turned Canada into a high-beta play on gold, with producers now accounting for around 12% of the S&P/TSX Composite Index’s more than 200 stocks by market value.

- We’ve dug into gold exposure in Canada’s stock market, from majors, mid-tiers, juniors and royalty/streaming firms, narrowing in on three stocks that show combinations of projected earnings growth of 114%–218% for 2025 and varied risk profiles:

- Agnico Eagle Mines is highlighted as a quality large-cap producer, with ~3.5m oz of gold in 2024, Q3 2025 AISC of US$1,373/oz, a roughly 67% jump in adjusted EBITDA to US$2.1bn, forecast 114% earnings growth in 2025, and a dividend record stretching back to the early 1980s.

- Wheaton Precious Metals offers a capital-light streaming model, diversified across 23 producing mines and multiple metals; 83% of attributable production (Jan–Sep 2025) came from the lowest half of industry cost curves, with production up 22%, adjusted earnings up 84%, a targeted ~40% production uplift by 2028, and a premium 2025e P/E of ~36.9x.

- Centerra Gold stands out as a contrarian value play, with consensus pointing to ~218% earnings growth in 2025, a forward P/E of ~5.3x, and a ~2% prospective yield; despite Q3 2025 production falling 13% to 81,773 oz and AISC rising 27% to US$1,652/oz, the group has zero debt and is working to extend Mount Milligan’s mine life to 2045.

This article is for information only and reflects the analyst’s view. It is not investment advice or a recommendation to buy or sell any security. Do your own research and consider speaking to a regulated financial adviser. Past performance is not a reliable guide to future results, and investments can go down as well as up.

A Resource Giant at the Heart of the Global Gold Trade

Canada’s a country rich in natural resources. With significant reserves of oil, potash, uranium, timber and other raw materials, the North American nation’s enormous commodity wealth is reflected in the make-up of its stock market.

Gold shares are especially well represented on the S&P/TSX Composite Index, Canada’s chief stock market index. Consisting of more than 200 different stocks, the benchmark represents roughly three-quarters of the entire market capitalization of the Toronto Stock Exchange (TSX).

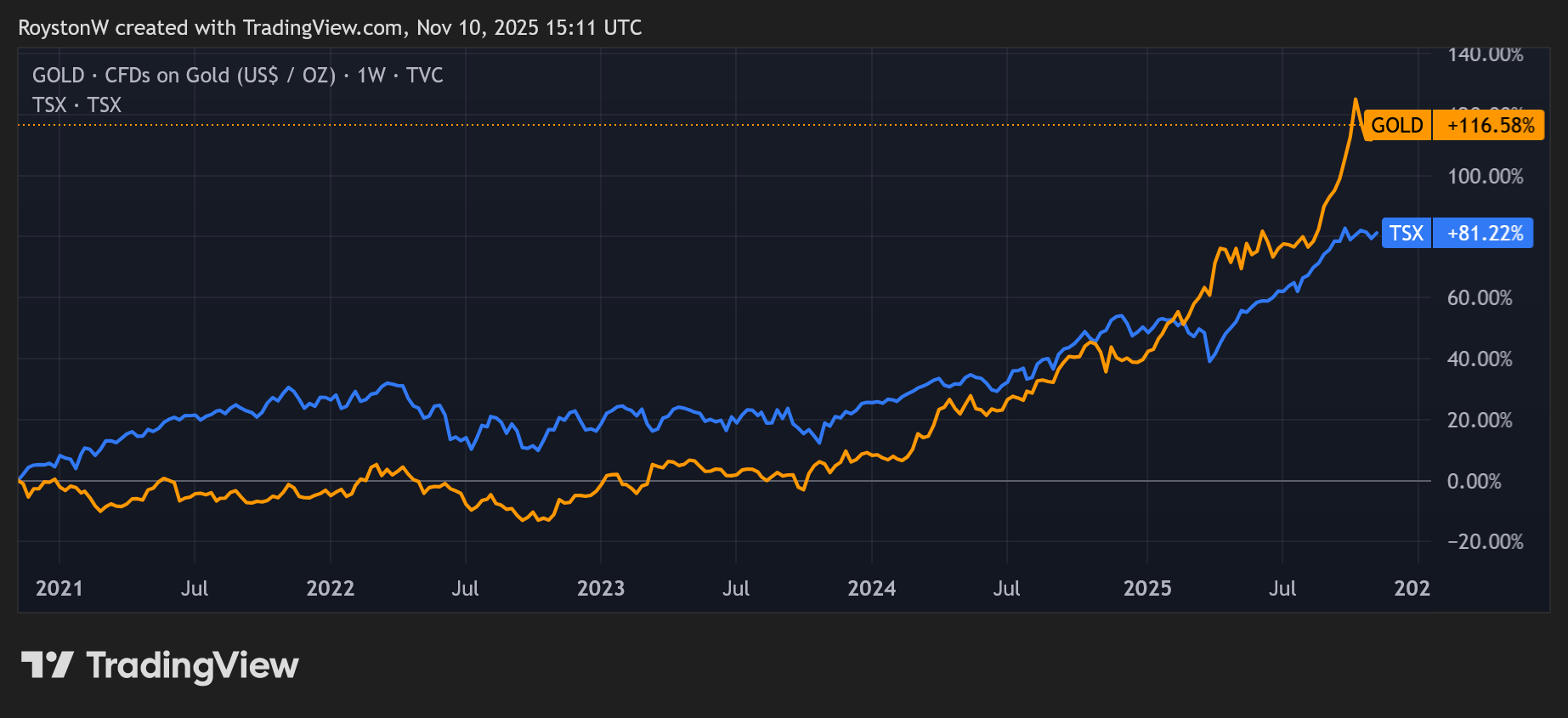

Thanks to gold’s stunning price run in 2025, yellow metal producers now represent roughly 12% of the entire S&P/TSX. As a result, the performance of Canada’s stock market is closely aligned with price movements of the precious metal.

A Spectrum Of Gold Shares

It’s perhaps no surprise that Canada is home to more gold mining stocks than anywhere else on the planet. Local listings include world class operators such as Agnico Eagle Mines and Barrick Gold, which (after US-listed Newmont Mining) are the world’s second and third largest gold producers by market cap respectively.

Investors can tap Canada’s stock market for major companies, mid-tier producers and junior miners that are still in the exploration stage. But that’s not all – stock pickers can also put their cash in gold royalty or streaming companies.

These companies don’t themselves operate gold mines. Instead, they provide mining companies with finance in exchange for a portion of future production. This can come in two forms:

- A streaming agreement gives the financing company the right to purchase a fixed percentage of the miner’s gold at a predetermined price, which is typically extremely low.

- A royalty agreement allows the firm stumping up the cash a percentage of revenue or production from a mine/mines.

Wheaton Precious Metals and Franco-Nevada are Canada’s most prominent names who operate using this model.

By investing in Canada’s gold miners, investors can also often obtain exposure to other precious metals along with some base metals.

Silver often comes from the same ore bodies as gold, meaning many producers also dig up vast quantities of the grey metal. Some also produce base metals copper, zinc, lead and molybdenum as a by-product of mining for gold.

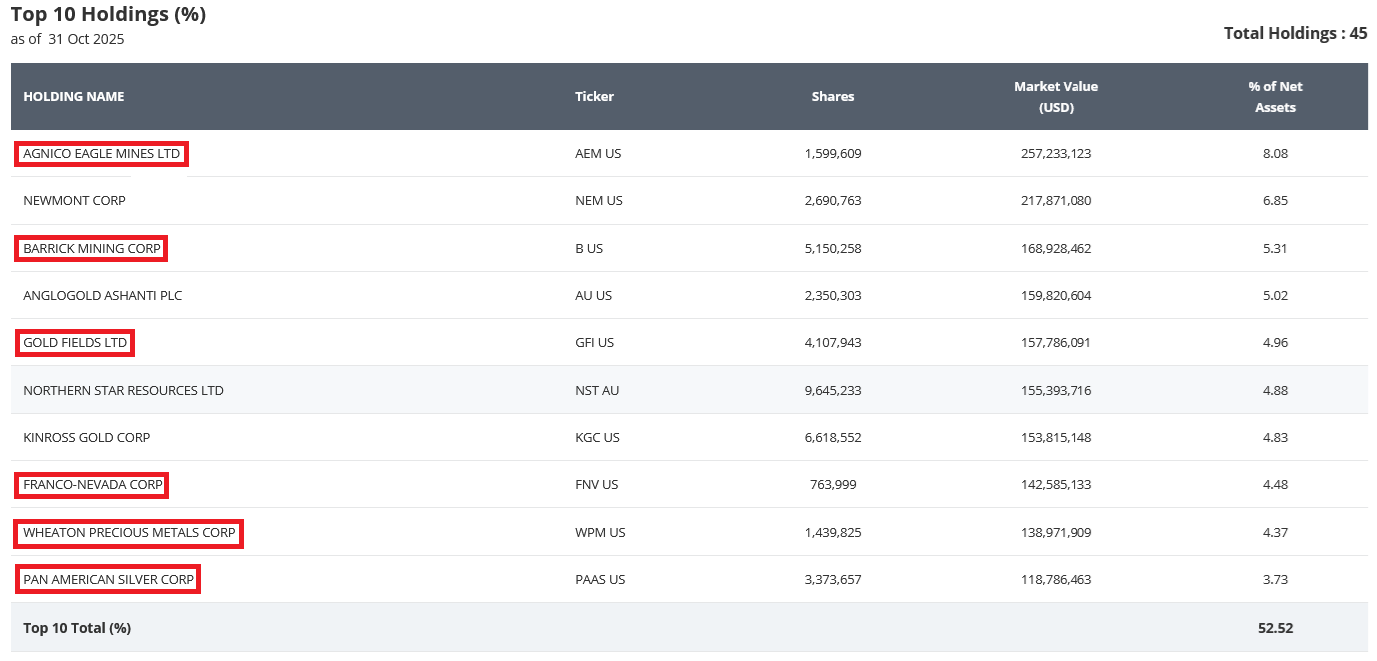

The abundance of gold stocks means that Canadian companies are often well represented in exchange-traded funds (ETFs) that track gold miner indices.

The VanEck Gold Miners ETF – which follows the MarketVector Global Gold Miners Index – holds shares in 45 different producers and has a distinctly Canadian flavor. Just under half (46%) of the fund is tied up in the country’s gold and silver producers.

There’s also a small pool of ETFs investors can choose from that focus solely on Canadian gold miners.

The BetaPro Canadian Gold Miners 2x Daily Bull ETF, for instance, provides leveraged exposure to the Solactive Canadian Gold Miners Index. This benchmark tracks the performance of 31 Canada-based mining companies.

Gold vs Gold Stocks

Investors have a multitude of ways to capitalize on a rising gold price. Purchasing physical gold in the form of bars or coins remains a popular route for many. Individuals can also purchase an ETF that closely tracks movements in the bullion price.

Purchasing gold stocks like those described above can deliver healthy returns during gold markets. This is because of the leverage factor – increasing gold prices drive up revenue while costs remain relatively unchanged. As a result, profits can rise extremely sharply during gold bull markets.

This, in turn, tends to result in share prices increasing faster than the gold price itself. It also means investors can be rewarded in other ways thanks to the profits boom, such as through dividend income.

Be mindful, though, that the leverage benefit can provide limited upside (if any at all) for those who decide to hedge their production.This strategy locks in a future price that miners can sell their gold, meaning the company can lose out when metal prices increase.

Naturally, the potential for greater rewards by buying gold stocks over gold itself also carries a higher degree of risk. When gold prices fall, the leverage phenomenon has an opposite effect and can substantially amplify a trader’s losses.

Furthermore, the highly complex nature of mining itself creates notable dangers for investors. Surprise production stoppages, disappointing exploration results, mine development setbacks, soaring costs and political headwinds can all weigh on profits (and by extension share prices), even when metal prices are stable or on the rise.

Investors can try to limit this risk by purchasing an ETF that holds a basket of mining stocks. This strategy spreads the danger and means that issues facing one or two stocks are smoothed out.

3 Top Canadian Gold Stocks

Now we’ve unpacked the background, let’s take a more detailed look at Canada’s gold mining sector. Here are three yellow metal producers that have grabbed my attention.

| Company | Type | P/E 2025e | EPS Growth 2025e | Key Point |

|---|---|---|---|---|

| Agnico Eagle Mines | Large-cap gold producer | 20.8x | ~114% | Low AISC, long dividend track record |

| Wheaton Precious Metals | Precious metals streamer | 36.9x | ~137% | Capital-light model, diversified streams |

| Centerra Gold | Mid-cap producer | 5.3x | ~218% | Net cash balance sheet, contrarian value play |

Figures/estimates from the time of analysis. Subject to change over time.

Agnico-Eagle Mines

With a market cap of CAD$118.4 billion, Agnico-Eagle Mines is by far Canada’s largest listed mining company. It’s also one of the biggest producers of gold on the planet.

In 2024 the business produced almost 3.5 million ounces of the yellow metal, along with 2.5 million ounces of silver. While 85% of its gold production comes from Canada, it also has working mines and exploration projects in Mexico, Australia and Finland.

These are pretty safe jurisdictions in which to look for and produce metal. They help spread out Agnico Eagle’s exposure to regional risks such as changing labor laws, evolving environmental regulations, and adverse weather that could impact production.

Agnico-Eagle has a strong operating record, and in the third quarter of 2025 output was 866,936 ounces, up fractionally year on year. And it managed to do this with some of the lowest all-in sustaining costs (AISC) in the business.

These stood at $1,373 per ounce in the quarter, creating enormous margins as the gold price ballooned. As a consequence, adjusted earnings before tax, interest, depreciation and amortization (EBITDA) jumped 167% to USD$2.1 billion.

City brokers reckon Agnico-Eagle’s earnings will rise 114% year on year in 2025. This leaves the company trading on a forward price-to-earnings (P/E) ratio of 20.8 times.

It is also expected to pay another cash dividend in 2025, a record stretching back to the early 1980s. Dividends are another potential benefit of holding gold stocks over physical metal or bullion-tracking ETFs, assets which provide nothing in the way of passive income.

Of the 20 brokers with ratings on Agnico-Eagle, 16 have put a ‘buy’ or ‘outperform’ rating on it. Three have placed a ‘hold’ rating. One considers Agnico-Eagle shares a ‘sell.’

Wheaton Precious Metals

As mentioned, Wheaton Precious Metals doesn’t dig for the yellow metal itself. Instead, it operates a streaming model, which protects it from operational headaches like declining ore grades and rocketing costs.

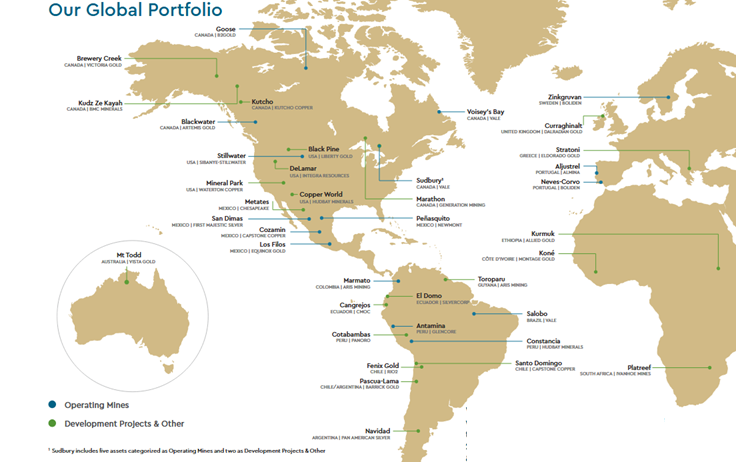

Excluding itself from the mining process has other perks, like more predictable margins, lower capital expenditure requirements, and higher leverage to metal prices. It also means the business has greater diversification, as its revenues streams can come from a plethora of mines and producers.

Wheaton – which has a market cap of CAD$65.1 billion – sources its revenues from 23 working mines spread across the globe. While focused on gold-producing assets, it also has exposure to silver, platinum, palladium and copper.

What I like about Wheaton is its focus on ultra-low-cost assets which in turn boosts margins. Some 83% of its attributable production came from assets in the lowest half of their respective cost curves between January and September 2025.

Production also rose 22% year on year, to 173,415 gold equivalent ounces. Combined with the soaring gold price, adjusted net earnings increased 84% to USD$281,054.

The Vancouver-based business currently has 24 development projects on its books to boost long-term earnings. By 2028, it hopes to drive group production 40% higher from 2024’s levels.

In the meantime, City analysts think Wheaton’s earnings per share will soar 137% in 2025. This leaves it trading on a forward P/E multiple of 36.9 times.

Be mindful that this sort of high valuation could leave the company especially vulnerable to a price correction if gold prices drop.

At the time of my research, 16 City analysts have ratings on Wheaton shares. 13 have a ‘buy’ or ‘outperform’ classification on the gold company. Two consider it to be a ‘hold’, while one has attributed an ‘underperform’ rating.

Centerra Gold

From a value perspective, Centerra Gold is one of the standout names among Canada’s gold miners. City analysts think earnings will surge 218% in 2025, leaving the digger trading on a forward P/E ratio of 5.3 times.

A prospective dividend yield of 2% provides an added sweetener.

Though headquartered in Toronto, Centerra – which has a market cap of CAD$3.4 billion – owns assets in Canada, the US and Turkey. These include the Mount Milligan project in British Columbia, from where is produces gold and copper, and the Öksüt yellow metal complex in Turkey.

Centerra’s has endured operational issues in 2025, causing its share price to underperform the broader gold sector. Most notably, it’s experienced lower grades at Mount Milligan that pushed group production 13% lower in quarter three of 2025, to 81,773 ounces.

Fewer sold ounces and higher capital expenditure also pushed AISC on a by-product basis to US$1,652 per ounce. This was up 27% year on year.

Operational issues at Mount Milligan remain a threat in the near term. However, I feel this could be baked into the cheapness of Centerra’s share price today.

On balance, I believe Centerra could be an attractive long-term pick, underpinned by its portfolio of attractive growth projects (like Kemess, also in British Columbia), and work at Mount Milligan to increase the mine life to 2045. With zero debt, Centerra has a strong balance sheet with which to achieve its growth objectives.

Of the 12 analysts with ratings on Centerra shares, half have slapped a ‘buy’ or ‘outperform’ rating on the company. Two have attached a ‘sell’ or ‘underperform’ rating, while four consider it to be a ‘hold.’

This article is for information and educational purposes only and reflects the author’s personal opinion at the time of writing. It does not constitute investment advice, a personal recommendation, or an offer to buy or sell any security. Readers should do their own research and, where appropriate, seek advice from a regulated financial adviser. Past performance is not a guide to future returns, and the value of investments can fall as well as rise.

Article Sources

- S&P/TSX Composite Index – S&P Global

- VanEck Gold Miners UCITS ETF – VanEck Securities

- BetaPro Canadian Gold Miners 2x Daily Bull ETF – BetaPro

- The Goldwatcher: Demystifying Gold Investing – John Katz, Frank Holmes

- Guide To Investing: The Definitive Companion To Investment And The Financial Markets – Financial Times, Glen Arnold

- Largest Canadian Companies By Market Capitalization – CompaniesMarketCap

- Agnico-Eagle Reports Third-Quarter 2025 Results – Agnico-Eagle Mines

- 2024 Annual Report – Agnico-Eagle Mines

- Agnico-Eagle Mines - MarketScreener

- Guidebook 2025/2026 – Wheaton Precious Metals

- Wheaton Precious Metals Announces Record Revenue, Earnings and Cash Flow for the First Nine Months of 2025 – Wheaton Precious Metals

- 2024 Annual Report – Wheaton Precious Metals

- Wheaton Precious Metals – Market Screener

- Centerra Gold Reports Third Quarter 2025 Results – Centerra Gold

- 2024 Annual Report – Centerra Gold

- Centerra Gold - MarketScreener

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com