Nash Equilibrium – Influence in Trading and Investing

What Is a Nash Equilibrium?

A Nash equilibrium is a situation in which no player has an incentive to change his or her strategy.

In other words, each player is doing the best he or she can given the strategies of the other players.

Nash equilibria are important because they provide a way to predict how people will behave in situations where there is competition.

For example, if two companies are competing for customers, we can use Nash equilibrium to predict how they will set prices.

Nash equilibrium is named after John Nash, who first described it in a paper published in 1951 called “Non-cooperative Games”. Nash won the Nobel Prize in Economics in 1994 for his work on game theory.

A game may have one or more Nash equilibria or none at all.

In a Nash equilibrium, player wins because everyone gets the outcome they want.

How to Find Nash Equilibria

There are a few different ways to find Nash equilibria. One is to use a Nash equilibrium calculator for easy-to-model situations, which you can find online.

Another way is to solve the equations that describe the Nash equilibrium. These equations are often called Nash equations.

To find a Nash equilibrium, you need to know the strategies of all the players in the game. Once you have this information, you can plug it into the Nash equations and solve for the equilibrium points.

Understanding Nash Equilibrium

The Nash equilibrium is considered one of the most important concepts of game theory, as it helps to explain mathematically and logically what each participant in a game wants and how to predict their behavior.

The Nash equilibrium is a situation where no player has an incentive to deviate from their current strategy, because doing so would only make them worse off.

In other words, each player is doing the best they can given the strategies of the other players. This is why Nash equilibria are also sometimes called “stable equilibria” or “perfectly balanced games”.

One of the key ideas behind Nash equilibrium is that it can be used to predict how people will behave in situations where there is competition.

Its widespread popularity is due to its widespread applicability, which can be used in markets, economics, and the social sciences.

Nash Equilibrium and Game Theory

Nash equilibrium is closely related to game theory, which is the study of how people make decisions in situations where their decisions depend on the decisions of others.

Game theory is often used to analyze contests like sports games or military battles. But it can also be used to analyze more everyday situations like auctions, evolution, or financial markets.

Nash equilibrium is a key concept in game theory and has important implications for how people behave in many different situations.

Nash Equilibrium vs. Dominant Strategy

It is important to note that Nash equilibrium is different from dominant strategy. A game can have a Nash equilibrium even if there is no dominant strategy.

A dominant strategy is when one particular strategy is always better than all the other strategies, regardless of what the other players are doing.

In contrast, Nash equilibrium occurs when each player’s best strategy is to play a certain strategy that optimizes your rewards based on whatever the other players are playing (and will have no reflexive effect on what they do).

So while dominant strategy provides a way to optimize your individual performance, Nash equilibrium shows how to predict the behavior of others in order to achieve the best possible outcome for yourself.

Nash Equilibrium and the Prisoner’s Dilemma

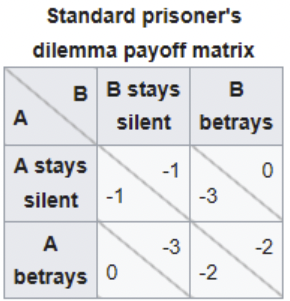

Nash equilibrium also has implications for the famous Prisoner’s Dilemma game, perhaps the most famous example in all of game theory.

In the Prisoner’s Dilemma, two criminals are arrested and questioned separately without being able to strategize with each other. Each criminal has the choice to confess or not confess.

If both criminals confess, then they will both be given a moderate prison sentence.

If only one criminal confesses, then that criminal will be given a short prison sentence (or none at all) and the other criminal will be given a long prison sentence.

If neither criminal confesses, then they will both be given a short prison sentence.

The Nash equilibrium in this game is for both criminals to confess, even though it will result in a moderate prison sentence. (It saves them from a longer one.)

This Nash equilibrium can have important implications for real-world situations like negotiations, treaties, and business contracts.

Applications of Nash Equilibrium

Nash equilibrium has many applications in different fields, such as economics, politics, and business.

In economics, Nash equilibrium is often used to model competition among firms.

In politics, Nash equilibrium can be used to analyze voting behavior and campaign strategies.

In business, Nash equilibrium can be used to understand pricing strategies and product positioning.

Nash equilibrium is also relevant in other fields such as psychology and neuroscience.

Psychologists use Nash equilibrium to study how people make decisions, while neuroscientists use it to study how the brain makes decisions.

Nash equilibrium is a powerful tool that can be used to understand and predict human behavior in many different settings.

Example of Nash Equilibrium

Consider the following example of Nash equilibrium.

Suppose there are two firms, Firm A and Firm B, selling identical products.

Both firms must decide how much to charge for their product. If one firm charges a higher price than the other, then it will lose all its customers to the other firm.

So both firms would like to charge the same price. But if they both charge the same price, then they will each only make a small profit.

If one firm decides to charge a lower price than the other, then it will make more profits in the short run. But in the long run, the other firm will also lower its price and they will both be worse off.

This is an example of Nash equilibrium, where neither firm has an incentive to deviate from the current price they both charge.

Nash Equilibrium and Auctions

Nash equilibrium also has important implications for auctions.

English auction Nash equilibrium

The most famous example is the English auction, which is used to sell things like art and antiques.

In an English auction, the auctioneer starts with a low price and then raises it until there is only one bidder left. The last bidder pays the highest price and wins the auction.

The Nash equilibrium in this case is for all the bidders to drop out of the auction as soon as the price gets too high for them.

This Nash equilibrium is sometimes called the “Winner’s Curse” because the winner is the one who pays the most and may have overpaid.

The Nash equilibrium in an auction can have important implications for how the auction is conducted and how much money is raised.

Sealed-bid auction Nash equilibrium

Consider a sealed-bid auction where two bidders are trying to win an item. Each bidder has to decide how much to bid, without knowing how much the other bidder is willing to pay.

The Nash equilibrium in this game is for both bidders to bid their true value for the item.

But if one bidder bids below their true value and the other bidder bids above their true value, then the bidder who bid above their true value will have a higher chance of winning (if both are sophisticated they would have an approximate understanding of the item’s true value).

Nash Equilibrium and Market Prices

Nash equilibrium can also be used to understand market prices.

Consider a market where there are two types of buyers, those who want to buy low (e.g., value investors) and those who want to buy high (e.g., momentum traders).

If the price is too low, then only the buyers who want to buy low will purchase the item. If the price is too high, then only the buyers who want to buy high will purchase the item.

The Nash equilibrium in this market is for the price to be such that both types of buyers are willing to purchase the item.

This Nash equilibrium is sometimes called the “Law of One Price” because it says that the price should be such that both types of buyers are willing to pay the same price.

The Nash equilibrium in a market can have important implications for how prices are set and how the market functions.

Nash Equilibrium and Nash Bargaining

Nash equilibrium is also relevant to bargaining situations.

In a Nash bargaining situation, two parties are trying to reach an agreement on something. Each party has their own preferences and they must decide how much they are willing to give up in order to reach an agreement.

The Nash equilibrium in these simple situations is for both parties to give up half of what they want.

This Nash equilibrium is sometimes called the “50-50 split” because it says that both parties should be willing to give up half of what they want in order to reach an agreement.

This is no different from the concept of two kids bargaining over the final cookie available. The Nash equilibrium in this situation is to divide it evenly so both can have equal amounts.

The Nash equilibrium in a bargaining situation can have important implications for how agreements are reached and how disputes are resolved.

Nash Equilibrium and Conflict Resolution

Nash equilibrium is also relevant to conflict resolution.

In a conflict, two parties are trying to achieve their own objectives while preventing the other party from achieving its objectives. Each party has its own preferences and must decide how much it is willing to give up in order to reach an agreement.

The Nash equilibrium in this situation is for both parties to give up half of what they want.

Nash Equilibrium and International Trade

In international trade, countries have certain production or resource advantages over others and they can use their comparative strengths to trade what they have for what they need.

For example, Saudi Arabia has a lot of oil, but needs to import a lot of machinery, equipment, base metals, vegetables, and so on.

Countries like China, Japan, India, UAE, and South Korea, on the other hand, have many of these things, but need to import a lot of oil.

So, Saudi Arabia and other countries can trade oil for machinery and other goods. This is an example of Nash equilibrium in action.

In this situation, both countries are better off than if they had not traded with each other.

And neither country has an incentive to change their strategy, given the strategy of the other country.

Nash Equilibrium and Evolution

Nash equilibrium also has implications for evolution.

Consider a population of animals that can either be black or white. The environment favors black animals, so animals that are black will tend to have more offspring than animals that are white.

As a result, the population will become mostly black. But then the environment might change and start favoring white animals. Now white animals will have more offspring than black animals.

This process will continue back and forth, with the population oscillating between being mostly black and mostly white.

This Nash equilibrium is sometimes called the “Red Queen Effect” because of the need to adapt faster just to survive.

The Nash equilibrium in evolution can have important implications for how populations change over time.

Nash Equilibrium and Day Trading

Nash equilibrium can also be applied to financial markets.

For example, consider a stock market where there are two types of traders: day traders and long-term investors.

Day traders buy and sell stocks very quickly, trying to make small profits on each trade.

Long-term investors buy stocks and hold them for a long time, hoping to make a large profit when they eventually sell (or receive a lot of cash distributions from the company, such as dividends).

If all the day traders sold their stocks, then the prices would fall and the long-term investors would have a mark-to-market loss.

But long-term investors might find the market to be at a discount and consider buying, instead of selling like more short-term focused traders, which might include a lot of retail traders, momentum traders, and others.

So, the stock market is an example of where there is no Nash equilibrium for all market participants.

The volatility of the stock market tends to be higher relative to changes in discounted earnings over time.

Nash Equilibrium FAQs

What is Nash equilibrium in game theory?

Nash equilibrium is a key concept in game theory and has important implications for how people behave in many different situations.

Nash equilibrium is a situation where no player has an incentive to change their strategy, given the strategies of the other players.

The concept is used to model situations where people are trying to optimize their own outcomes, given the constraints of the situation.

Nash equilibrium can help us understand how people will behave in different situations and what the implications of their actions might be.

What are some applications of Nash equilibrium?

Nash equilibrium has many applications in different fields such as game theory, economics, finance, and evolution.

In game theory, Nash equilibrium is often used to analyze competitive situations in which each player is trying to maximize his or her own gain.

For example, in the game of chicken, both players may be tempted to swerve at the last minute to avoid a collision.

However, if both players do this, then they will both lose. Therefore, the best strategy for both players is to stay on course, and this is a Nash equilibrium.

What is Nash equilibrium in evolution?

The Nash equilibrium in evolution can have important implications for how populations change over time.

The Nash equilibrium in evolution is a situation where the population changes based on changes in its environments that reward different qualities.

What is Nash equilibrium in financial markets?

The Nash equilibrium in financial markets can have important implications for how prices change over time.

Nash equilibrium is a situation where no trader has an incentive to change their strategy, given the strategies of the other traders.

What is an example of Nash equilibrium?

One example of Nash equilibrium is the Prisoner’s Dilemma game.

In this game, two criminals are arrested and interrogated separately.

Each criminal has the choice to confess or not confess. If both criminals confess, then they will both be given a medium-length prison sentence.

If only one criminal confesses, then that criminal will be given a short prison sentence (or no prison sentence, depending on how the game is illustrated) and the other criminal will be given a long prison sentence.

If neither criminal confesses, then they will both be given a short prison sentence.

The Nash equilibrium in this game is for both criminals to confess, even though it is not in their best interests to do so.

How might traders and investors think of the Nash equilibrium?

In complex games like trading and investing, there is generally no Nash equilibrium for large markets with many different types of buyers and sellers with different sizes and motivations.

But in general, the Nash equilibrium is used to model situations where people are trying to optimize their own outcomes, given the nature of the situation.

Nash equilibrium can help us understand how people will behave in different situations and what the implications of their actions might be.

In financial markets, Nash equilibrium is often thought of as a situation where prices are “correct” or “efficient”.

That is, Nash equilibrium is a situation where no trader has an incentive to trade, given the current prices of assets.

However, it’s important to remember that Nash equilibrium is just a model. And like all models, it has its limitations. In particular, Nash equilibrium doesn’t always accurately predict how people will actually behave in real-world situations.

Nevertheless, the Nash equilibrium is a useful tool for understanding how people might behave in complex situations like financial markets. And understanding Nash equilibrium can help traders and investors make better decisions about when to trade and when to hold or not trade.

Summary – Nash Equilibrium

Nash equilibrium in financial markets is a situation where no trader has an incentive to change their strategy, given the strategies of the other traders.

Nash equilibrium is often thought of as a situation where prices are efficient when it comes to markets or economics.

However, it’s important to remember that Nash equilibrium is just a model and it has its limitations.

In particular, Nash equilibrium doesn’t always accurately predict how people will actually behave in real-world situations and act in rational ways. There’s the old phrase that “the market can stay irrational longer than you can stay solvent.”

Nevertheless, the Nash equilibrium is a useful tool for understanding how people might behave in complex situations like financial markets, bargaining, negotiations, and other cases.

And understanding Nash equilibrium can help traders and investors make better decisions about when to trade and when to hold or not trade.