MogaFX Review 2024

Pros

- I appreciated the wide range of pro-level account types with varying trading conditions and base currencies to suit different requirements

- It’s reassuring to see that the Australian branch is regulated by the ASIC, a top-tier financial regulator with strict brokerage rules

- I was impressed by the range of additional tools available, including Autochartist, TradingView tools and the proprietary copy trading feature, MOGA Trade Plus+

Cons

- I think it’s disappointing that the demo account is only available for 30 days which trails behind the industry-average time limit of 60 days

- I’m a little hesitant that most traders will be registering under the offshore entity, which means they won’t receive the same fund protection measures as those registering with the ASIC-regulated entity

- I found spreads at MogaFX are highly uncompetitive unless you can deposit at least $10000 for the raw spread account. Otherwise, I think you’re better off considering other brokers

MogaFX Review

MogaFX is a regulated forex and CFD broker. The brand offers 50+ instruments on the MetaTrader 4 and MetaTrader 5 platforms, alongside access to third-party tools including TradingView and Autochartist. This review will cover MogaFX’s fee structure, how to register for a live account, sign-up bonuses, deposit and withdrawal methods, and more. Find out what our experts made of MogaFX.

Key Takeaways

- MogaFX offers an excellent suite of tools including copy trading

- The Australian trading entity is regulated by the ASIC

- A narrow range of instruments is available with no stocks

- The $10,000 minimum deposit is high which may deter beginners

Company History & Overview

MogaFX was established in 2018, with head offices in Sydney, Australia, and Saint Vincent and the Grenadines. The broker offers multi-asset trading across forex, CFDs, and commodities, with competitive trading conditions and 24/5 customer support. The vision of the brand is to meet all client needs through operational transparency, reliance, and top-quality service.

MogaFX operates globally via three entities:

- Moga International Group LLC – Regulated by Saint Vincent and the Grenadines Financial Services Authority (SVGFSA)

- Moga International Group Limited – Regulated by the Australian Securities & Investments Commission (ASIC)

- Moga International Group Pty Ltd – Registered in New Zealand

Trading Platforms

MogaFX offers two industry-leading platforms; MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both terminals are suitable for day traders and are offered by hundreds of brokers across the world. They are available to download to desktop devices or can be used through a web browser.

MT4 and MT5 support multi-asset trading, with powerful yet easy-to-use features. Having said that, MT5 is more suited to experienced traders given its advanced capabilities and in-depth analysis features. These include additional charting timeframes, order types, and more advanced strategy backtesting.

MetaTrader 4

- 9 timeframes

- 30+ in-built technical indicators

- Fast execution via one-click trading

- Extensive historical data and real-time pricing

- 24 analytical objects including shapes, arrows, and Fibonacci tools

- Automated trading through APIs and advanced stop-out levels

MetaTrader 5

- 21-time frames

- 38+ in-built technical indicators

- Detailed trading history statements

- News alerts and economic headlines

- Real-time price updates and market information

- 44 analytical objects including geometric shapes, arrows, and Elliott Wave tools

How To Place A Trade

- Open the MT4 or MT5 platform

- Under ‘Tools’ in the main menu select ‘New Order’. The order window should pop-out

- Choose the asset you want to trade by clicking on the corresponding symbol in the drop-down list

- Depending on when you want to enter the market, select ‘Pending Order’ or ‘Instant Execution’

- Enter the volume you want to trade in lots

- Add any risk management parameters such as a stop loss or take profit

- Confirm the trade using the ‘Buy’ or ‘Sell’ buttons

Assets & Markets

MogaFX offers 50+ instruments across three asset classes. This is significantly fewer than most brokers and means limited opportunities to build a diverse portfolio. Direct stock trading also isn’t available.

Supported assets:

- Two commodities; gold and silver (spot)

- 38 forex pairs including majors and minors such as GBP/USD, EUR/USD, and GBP/JPY

- 17 CFDs on stocks, indices, and cryptocurrencies including the S&P 500 index, Bitcoin, and WTI Crude Oil

Spreads & Fees

MogaFX is a low-fee broker with zero charges for signing up, depositing or withdrawing.

Trading fees vary depending on the registered account. The ECN and Raw-Spread accounts offer the tightest spreads from 0 pips, though an $8 commission applies, which is higher than many alternatives. Additionally, traders should be aware of the high minimum deposit requirements of these accounts at $50,000 and $10,000, respectively. The Standard account offers spreads from 2.5 pips whereas the VIP and M1 accounts offer spreads from 1.5 pips.

When we used MogaFX’s ECN account, we traded with average spreads of 0.3 pips +$8 commission on the GBP/USD. This asset was also available with a 1.8 pip spread on the VIP account and 2.8 pips on the Standard account.

Importantly, the Standard account trading conditions are not particularly competitive, and with all other profiles requiring a minimum deposit of at least $10,000, many beginners will be better off with an alternative broker.

Leverage

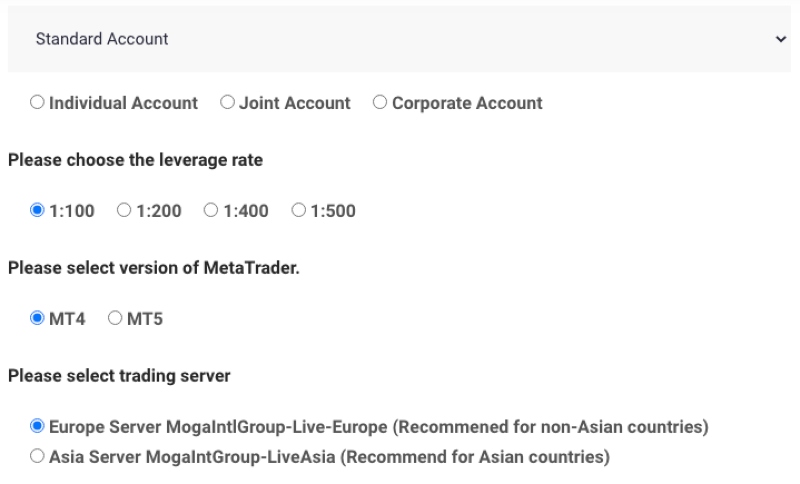

MogaFX offers leverage up to 1:500, which is in line with most offshore brokers. With that said, retail investors trading under the ASIC entity will only be able to trade with leverage up to 1:30.

Make sure you have a risk management strategy when trading with high leverage.

Mobile App

MogaFX does not offer a proprietary trading app. However, the broker does provide clients with access to MT4 and MT5, which can be downloaded to Android devices.

The MetaTrader apps offer the same trading experience as their desktop counterparts with customizable charts, a suite of indicators and drawing tools, plus one-click trading. Clients can also set up mobile price alerts so they don’t miss out on market opportunities.

Payment Methods

Deposits

MogaFX offers a good range of payment methods with low to zero fees and fast processing:

- FasaPay – No fee, instant processing

- Korea Online Banking – No fee, instant processing

- Vietnam Online Banking – No fee, instant processing

- Malaysia Online Banking – No fee, instant processing

- Indonesia Online Banking – No fee, instant processing

- Philippines Online Banking – 3.5% fee, instant processing

- Perfect Money – No fee, up to one working day processing time

- Bitcoin (via Coinpayments) – 0.5% fee, up to 30-minute processing

- Skrill – Fees vary on deposit bank and surcharge list, instant processing

- Neteller – Fees vary on deposit bank and surcharge list, instant processing

- Bank Wire Transfer – No fee, average of one to three working days processing

Withdrawals

MogaFX offers the same payment methods for withdrawals. The majority of withdrawal requests are processed within 24 hours, however, the time for the funds to be processed back to the original payment method does vary:

- FasaPay – No fee, three to five working days processing time

- Perfect Money – No fee, three to five working day processing time

- Bank Wire Transfer – $40 fee, three to five working days processing time

- Korea Online Banking – No fee, three to five working days processing time

- Vietnam Online Banking – No fee, three to five working days processing time

- Malaysia Online Banking – No fee, three to five working days processing time

- Indonesia Online Banking – No fee, three to five working days processing time

- Philippines Online Banking – 2% fee, three to five working days processing time

- Bitcoin (via Coinpayments) – $10 fee + and cryptocurrency transaction fee, three to five working days processing time

Account Types

The broker offers five live accounts. All profiles come with a minimum trade size of 0.01 lots and a maximum leverage of 1:500. The broker accepts four base currencies; USD, AUD, EUR, and GBP.

The key differences between the account types:

- Standard – Minimum deposit of $1,000 and spreads from 2.5 pips

- VIP – Minimum deposit of $10,000 and spreads from 1.5 pips

- ECN – Minimum deposit of $50,000 and spreads from 0 pips

- Raw Spread – Minimum deposit of $10,000 and spreads from 0 pips

- M1 – Minimum deposit of $10,000 and spreads from 1.5 pips

How To Open A MogaFX Account

New clients must complete a four-stage sign-up process:

- Provide personal contact information

- Initiate user information set-up

- Submit personal tax information and country of residency

- Supply financial information

Once you have completed the final step of the MogaFX sign-up process, you can log in and start trading.

MogaFX also offers a comprehensive account opening guide in the education section of its website.

Demo Account

The broker offers an MT4 and MT5 demo account so prospective clients can practice their strategy risk-free and test the services MogaFX offers. The demo account comes with $100,000 in virtual funds and is available for 30 days.

To access the practice profile, you will need to provide some basic personal information, including your name, email, nationality, and mobile number.

Deals & Promotions

The brokerage offers the MOGA Point Reward Mall bonus scheme. The program allows retail investors to earn “Moga Points” (MP) which can be redeemed for USD.

There are several different ways to earn Moga Points:

- Every $1000 deposit earns 10 MP

- Every $10,000 deposit earns 150 MP (100 MP + 50 MP bonus)

- Making a post or a comment on blogs, forums, or Moga social media accounts earns 2 MP

- Sharing any Moga official content on your personal social media platforms such as Instagram, Twitter, and Facebook earns 1 MP

MPs can be exchanged for USD equivalent bonus amounts or physical prizes such as electronics and luxury fashion items.

In addition to the MOGA Point Reward Mall, the broker offers special promotions and ways to earn bonuses throughout the year. The types of deals that the broker has previously offered include no-deposit bonuses and cashback schemes.

Check the broker’s website to see which seasonal offers are available and review the terms and conditions of promotions before signing up.

Regulation & Licensing

MogaFX operates through several entities:

- Moga International Group LLC – Licensed by St Vincent & The Grenadines Financial Services Authority (SVGFSA), license number 532LLC2020

- Moga International Group Pty Ltd – Licensed and regulated by the Australian Securities and Investments Commission (ASIC), license number 501156

- Moga International Group Limited – A registered company of New Zealand, license number 1002414

Traders registering with the entity based in Australia can expect a higher level of financial protection than those registered with Moga SV, which is based in St Vincent and the Grenadines. This includes access to compensation schemes and negative balance protection.

Additional Features

Education

While using MogaFX, our experts were impressed with the educational content available. The broker offers the ‘MogaFx Education Series’ consisting of 10 integrated YouTube videos established across three skill levels; elementary, intermediate, and advanced. Topics range from understanding the basics of forex trading and market opening hours to trading psychology and using the Elliot Wave theory.

Additionally, MogaFX hosts a comprehensive blog, economic calendar, glossary, and free guides for setting up an account and basic trading advice.

Autochartist

MogaFX provides complimentary access to Autochartist for traders depositing over $5,000. The tool provides reports that highlight trading opportunities, chart pattern recognition technology, and an integrated market scanner to assist decision-making, among other features.

Autochartist can be integrated directly into the MT4 and MT5 terminals for comprehensive market analysis.

TradingView

MogaFX hosts integrated TradingView charts which can be viewed at the instrument level. The solution offers market sentiment data and provides real-time analysis views. There is also a forex heatmap which provides a graphical representation of the strengths of popular currencies.

The third-party program is available to all customers with no sign-up requirements.

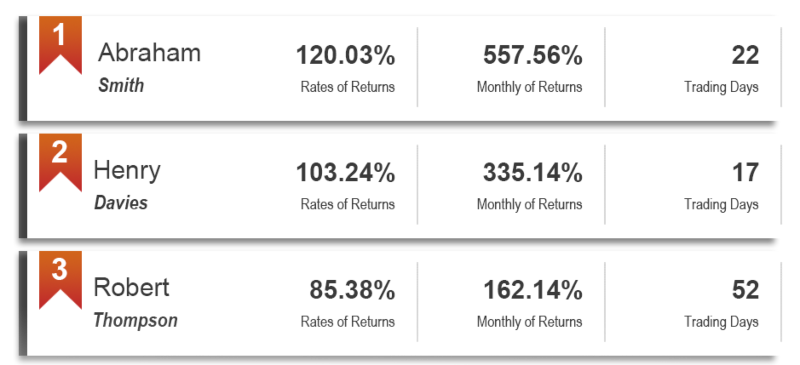

MOGA Trade Plus+

MogaFX also offers copy trading via the MOGA Trade Plus+ tool. Users can review the portfolio performance of master traders, including the number of active trading days, investment return history, and risk level.

Copy trading is popular among beginners with limited market knowledge or those looking for a convenient way to increase revenue prospects without having to spend hours reviewing market movements.

Retail investors can get started with a minimum deposit of $500. On the downside, this is a higher entry point than many alternatives.

Trading Hours

MogaFX’s opening hours vary depending on the financial instrument that you are trading. Generally, all forex, commodities, and CFDs can be traded from 22:00 (GMT) on Sunday until 22:00 (GMT) on Friday.

CFD positions that are open after 22:00 are adjusted for interest changes daily.

Customer Service

MogaFX customer support is available 24/5. This includes via telephone, email, and live chat.

- Telephone – +61291890220

- Contact Email – service@mogafxglobal.com

- Address – First Floor, First St. Vincent Bank Ltd Building, James Street, Kingstown, St. Vincent and the Grenadines

The broker’s live chat service is run by LiveAgent and requires traders to submit their name and email address to get started. When we tested the service, a human customer service agent responded to queries relatively quickly.

Security & Safety

Despite some regulatory oversight and negative balance protection, the level of security compared to other brands is relatively low, which may raise scam concerns. Our traders were not offered the option to add two-factor authentication (2FA) at login or one-time passwords (OTP) for withdrawal requests.

Fortunately, security on the MetaTrader platforms is reliable with all trading data encrypted.

MogaFX Verdict

MogaFX offers a good selection of trading tools, from MT4 and MT5 to Autocharist, TradingView and a beginner-friendly copy trading tool. There is also a decent range of fast and fee-free deposit methods.

On the downside, traders will need to make a large deposit to access competitive spreads and trading fees. Also, users will receive limited recourse options if they register with the global entity, based in Saint Vincent and the Grenadines.

FAQs

Is MogaFX Legit?

Yes, MogaFX is a legitimate broker-dealer offering 50+ instruments on the MT4 and MT5 platforms. The company is regulated by the ASIC and is registered in New Zealand. The broker also follows anti-money laundering protocols and offers negative balance protection. On the downside, there are some negative user reviews and the global entity operates with limited regulatory oversight.

Does MogaFX Offer A Mobile App?

MogaFX does not offer its own trading app. Despite this, MetaTrader 4 and MetaTrader 5 are available to download on Android devices. They offer the full suite of trading features and functions, meaning clients can execute and manage positions while on the go.

Is The Minimum Deposit At MogaFX Low?

No, the MogaFX Standard account offers the lowest minimum deposit of $1,000. All other live profiles have a minimum requirement of $10,000. As a result, the broker is not the best fit for novice traders.

Does MogaFX Offer Reliable Customer Support?

Customer support at MogaFX is adequate. It includes a live chat service alongside a telephone helpline and email support. The customer service team is available 24/5. Our traders received responses to queries within a couple of minutes upon testing.

Is MogaFX Regulated?

MogaFX is regulated by Saint Vincent and the Grenadines Financial Services Authority (SVGFSA) and the Australian Securities and Investments Commission (ASIC), alongside registration in New Zealand. However, the majority of international retail traders will be registered under the global entity based in St Vincent and the Grenadines where customer safeguarding measures are limited.

Top 3 Alternatives to MogaFX

Compare MogaFX with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- DNA Markets – DNA Markets is a forex and CFD broker established in 2020. The broker operates two entities in Australia and the offshore jurisdiction, St Vincent and the Grenadines. Traders can access 800+ markets, with a Standard account for beginners and a Raw account for experienced traders. The reliable MetaTrader 4 and MetaTrader 5 platforms are available, alongside Signal Start.

MogaFX Comparison Table

| MogaFX | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| Rating | 2.5 | 4.4 | 4.3 | 3.5 |

| Markets | CFDs, Forex, Indices, Commodities, Cryptos | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Indices, Commodities, Stocks, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $1000 | $0 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | ASIC, SVGFSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | ASIC |

| Bonus | MOGA Point Rewards | – | – | – |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5, TradingView, AutoChartist | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:500 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:500 |

| Payment Methods | 6 | 6 | 6 | 10 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

DNA Markets Review |

Compare Trading Instruments

Compare the markets and instruments offered by MogaFX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| MogaFX | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | Yes |

MogaFX vs Other Brokers

Compare MogaFX with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of MogaFX yet, will you be the first to help fellow traders decide if they should trade with MogaFX or not?