Maslowian Portfolio Theory

Maslowian Portfolio Theory is a conceptual framework in finance that integrates psychological elements into investment strategy.

It’s inspired by Abraham Maslow’s hierarchy of needs, a psychological theory that categorizes human needs into a pyramid, from basic survival needs like food, water, and shelter to self-actualization (achieving your aspirations).

Key Takeaways – Maslowian Portfolio Theory

- Hierarchy of Needs

- Maslowian Portfolio Theory adapts Abraham Maslow’s hierarchy of needs to portfolio construction.

- Suggests investors have layers of financial needs corresponding to the hierarchy levels.

- Safety and security needs take precedence, followed by higher-order financial goals.

- Layered Portfolio Construction

- The theory advocates for constructing portfolios in a layered manner, each layer dedicated to a specific need or level of risk.

- The bottom layers focus on protection and meeting basic needs, while higher layers aim for growth and self-actualization goals.

- Behavioral Insight

- Maslowian Portfolio Theory emphasizes the behavioral aspects of investors – acknowledging that psychological and emotional factors significantly influence investment decisions.

- Seeks to create more personalized and psychologically satisfying investment strategies rather than necessarily mathematically optimal ones.

Core Concept of Maslowian Portfolio Theory

At its core, Maslowian Portfolio Theory suggests that investors have a hierarchy of financial needs, which influences their investment decisions.

Just as Maslow’s pyramid has layers like physiological needs and safety before reaching self-actualization, this theory posits that investors first seek to fulfill basic financial security before pursuing higher-risk investments.

They want their portfolios to eventually be able to provide for the basics before considering what it can do beyond that.

Application in Investment Strategies

In practical terms, Maslowian Portfolio Theory advises creating a portfolio in layers.

The bottom layer focuses on low-risk, income-generating assets to ensure basic financial needs are met.

This includes having cash (a safety buffer), lower-risk bonds, then building up from there.

As these needs are secured, investors can progressively take on more risk, aiming for higher returns with the upper layers of their portfolio.

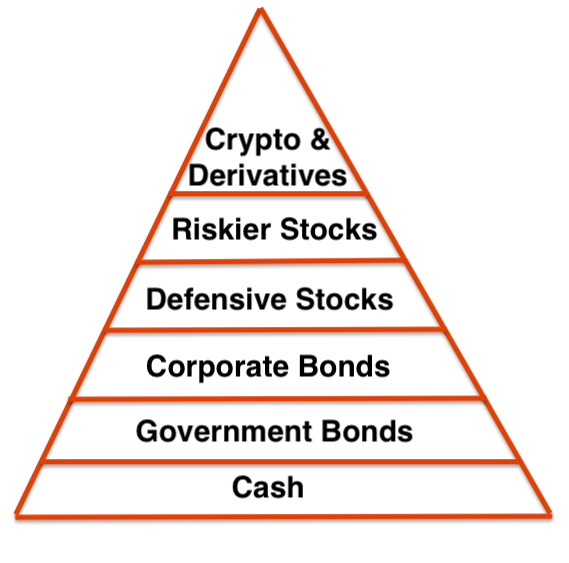

Below we have a stylized example of what a Maslow’s pyramid for investing might look like in terms of a risk hierarchy:

In a way, it’s similar to Exter’s Pyramid.

Components of Maslowian Portfolio Theory

Layered Portfolio Construction

The theory encourages a multi-layered portfolio structure.

Each layer corresponds to different levels of risk and return, aligned with the investor’s financial needs and stages in life.

The lower layers are more conservative, while the upper layers are more aggressive.

Behavioral Insights in Investment

Maslowian Portfolio Theory integrates behavioral finance insights.

It recognizes that investors are not always rational and their investment decisions are often influenced by psychological factors, including their personal hierarchy of needs.

Adaptability to Investor Life Stages

The theory is dynamic, changing as an investor’s life circumstances evolve.

For instance, a standard strategy is that a young investor might have a portfolio heavily weighted toward growth and high-risk assets, while an older investor might focus more on income and preservation of capital.

Related: Intertemporal Portfolio Choice

Evaluating Maslowian Portfolio Theory

Advantages

- Personalized Approach: It offers a more personalized investment strategy that considers individual financial goals and psychological predispositions.

- Risk Management: By structuring investments in layers, it inherently incorporates risk management, as basic needs are prioritized and secured.

Limitations

- Subjectivity in Needs Assessment: The theory relies heavily on the subjective assessment of an investor’s needs. These can vary widely and be difficult to quantify.

- Potential for Over-conservatism: The focus on securing basic needs first could lead some investors to be overly conservative, potentially missing out on beneficial investment opportunities. A portfolio that’s more appropriately balanced will generally lead to a better return-to-risk ratio.

Comparative Analysis

Maslowian Portfolio Theory contrasts with traditional portfolio theories like Modern Portfolio Theory (MPT), which focus primarily on optimizing risk and return without considering individual psychological factors or life stages.

Conclusion

Maslowian Portfolio Theory intertwines psychological factors with financial goals.

Its layered portfolio construction provides a method for addressing both security and growth needs.

While it offers a more personalized investment framework, its subjective nature and potential for over-conservatism are points of consideration for traders/investors and financial advisors.

The theory reminds us that finance isn’t just about numbers, but also about the people behind the investments and what makes them most comfortable.