Livemarkets Review 2024

Livemarkets Review

Livemarkets is a multi-asset online broker offering more than 100,000 instruments on both a proprietary web trader and the MetaTrader 4 platforms. Access CFDs, spread betting and DMA investing opportunities in a vast range of securities and derivatives. Our Livemarkets review will cover account opening and login, ESMA leverage cap restrictions, payment methods, currency strength analysis and more.

Livemarkets Headlines

Livemarkets Limited is the UK affiliate of Trade Capital Markets Ltd (Trade.com). The group was founded in 2009 and now has over 10,000 live trading clients in more than 125 markets. Livemarkets UK holds regulation from the Financial Conduct Authority (FCA), following stringent compliance protocol. Customers benefit from using Trade.com’s established trading platform, market information and tools.

Trading Platform

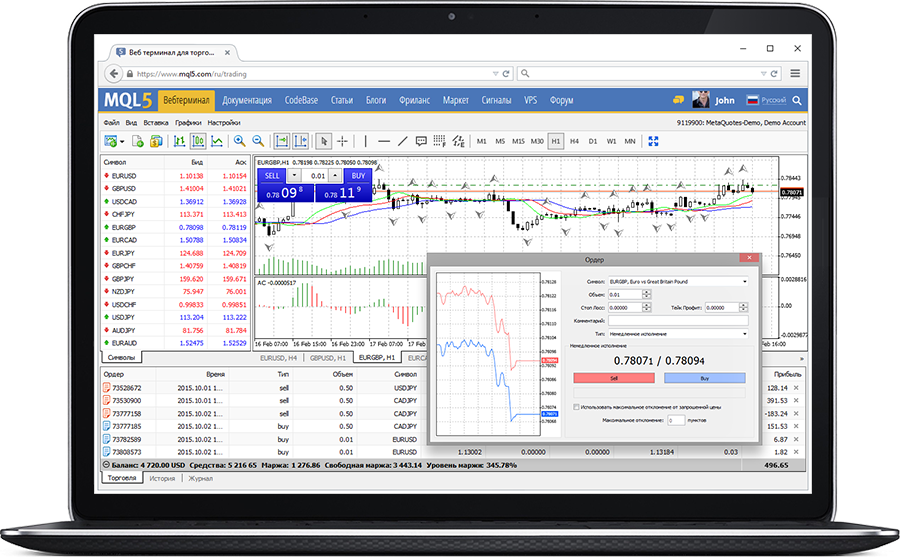

Livemarkets clients gain access to the Trade.com online trading platforms; WebTrader and MetaTrader 4 (MT4). Both platforms are compatible to use via all major web browsers or downloadable to desktop, mobile and tablet devices. Features of the platforms include:

Web Trader

- Live price alerts

- Live news streams

- Multi-chart displays

- Stop-loss notifications

- Customisable interface

- 24/5 responsive support

- One-click order execution

- Access to financial indicators

MetaTrader 4

- Historical data

- Live news streams

- Customisable charts

- 4 pending order types

- One-click order execution

- Automated trading via APIs

- 50+ built-in technical indicators

- User-friendly, multilingual interface

Markets

Livemarkets offers clients 100,000+ investment and trading asset opportunities. Trading instruments include:

CFDs & Spread Betting

Opportunity to speculate on price movements among various asset classes:

- Forex: Major, minor and exotic currency pairs

- Bonds: European and US bonds including Gilt10Y

- Shares: Leading global stocks, including Tesla and Facebook

- ETFs: Exposure to a broad range of ETF markets across various asset classes

- Indices: Indices on 38,000+ global corporate bonds and 1.4 million US municipal issues

- Commodities: A variety of commodities including precious metals and energies, such as DTN

DMA

Access advanced DMA trading tools to buy and share thousands of instruments in over 135 markets across 33 countries:

- Bonds: European and US bonds including Gilt10Y

- ETFs: Securities baskets from a range of markets and assets

- Shares: Leading global stocks from European and US markets

- Investment Funds: 11,000 mutual funds from 240+ fund families

- Options: Create options strategies using the risk/return portfolio and profitability lab

There are no cryptocurrency trading opportunities like Bitcoin (ticker BTC), available to Livemarkets clients under the UK affiliate. This is aligned with FCA regulation.

Fees

Spreads offered by the broker vary depending on the account type opened. There is limited information on trading fees, although spreads on the Silver Account start from around 3 pips on major currency pairs, including EUR/USD and GBP/USD. Spreads are reduced for the higher account tier, though higher initial deposits are required.

The broker does charge swap rates for positions held overnight and a high inactivity fee is applied to accounts that are dormant for 90 days, charged at 10% of the account funds.

Leverage

As Livemarkets UK is regulated by the FCA, the broker complies with ESMA regulations, capping leverage at a maximum of 1:30 for certain instruments. This is legislation for authorised brokerages within Europe. Maximum leverage rates are:

- Equities: 1:5

- Commodities: 1:10

- Major Forex Pairs: 1:30

- Minor Forex Pairs & Indices: 1:20

Mobile Apps

Both trading platforms are available as mobile applications. MetaTrader 4 and the Livemarkets app are available for free download and compatible with iOS and Android (APK) devices. Access the full trading features of the desktop platforms, including analytical tools and customisable charts and graphs, while on the go.

Payment Methods

Deposits

Minimum deposit requirements vary by account type, the lowest deposit is $250 or equivalent on the standard account, which is relatively high for new traders vs other brokers. Prospective clients can utilise the demo account before opening a live account. Livemarkets does not charge a fee for any payment methods, although third-party charges may be applicable. Clients must login to the personal portal to complete deposits and withdrawals. Accepted payments include:

- Bank Wire Transfers

- Credit Cards & Debit Cards

- E-Wallets, including Skrill & Neteller

Processing times are not provided on the broker’s website, though credit/debit cards and e-wallet payments often provide instant funding.

Withdrawals

Withdrawals must be processed back to the original deposit method. Livemarkets does not charge a fee for withdrawals but minimum limits are applicable.

- Bank Wire Transfers: Minimum withdrawal of $100 or equivalent. Withdrawals less than $100 will incur a fee of $50

- Other Payment Methods: Minimum withdrawal amount of $20 or equivalent. Withdrawals less than $20 will incur a fee of $10

Demo Account

A free demo account is available via the Trade.com direct market access site. These accounts are a good way to practise trading, navigate platform features and test strategies risk-free. Traders can access up to £10,000 in virtual funds and experience real-time trading conditions and prices. The demo account is similar to the paper trading option offered by IG. A simple online registration form is required via the Livemarkets platform.

Deals & Promotions

Livemarkets does not offer any promotions or bonus deals to prospective and existing UK clients, including no deposit bonuses or sign-up offers. This is aligned with FCA and ESMA trading regulations restricting the ability of companies to offer financial incentives.

Regulation & Licensing

Livemarkets UK is authorised and regulated by the Financial Conduct Authority (FCA). This is a highly respected regulator in the international financial market. Under this authorisation, UK clients can be assured of segregated funds in top-tier banks, negative balance protection for retail traders and FSCS protection. Enhanced security is offered by the broker with additional coverage under the FSCS scheme is offered up to £1 million vs the standard compensation of £85,000. Traders can also access the Financial Ombudsman Service in the case of financial disputes.

Additional Features

Livemarkets posts a global economic calendar with worldwide events and the latest news. There are some enhanced trading tools available via the terminal interfaces including advanced charting, data analysis, custom watch lists, trading robots and customisable market indicators. These are suitable even for new investors to refine strategies, build strong market outlooks and gain additional insights. It is always worth monitoring external finance business sources outside of the Livemarkets environment.

There is no specific education platform, blog posts or training content to be accessed on the Livemarkets website, although exclusive webinar events are organised for registered clients. Topics include understanding prices and quotes, interpreting a historical events graph, utilising stop-loss strategies, outlooks on investing in major indices including NASDAQ, DAX, Dow Jones, Euronext, FTSE 100 and more. Keep an eye on the latest live forum release dates on the Livemarkets website.

Account Types

Livemarkets clients have access to four live trading account options; Silver, Gold, Platinum and Exclusive. These are hosted via the Trade Capital Markets Ltd terminal. Minimum deposit requirements start from $250 or equivalent on the Silver account. Spreads and trading conditions become more competitive as you move up account tiers.

- Silver: minimum deposit $250

- Gold: minimum deposit $10,000

- Platinum: minimum deposit $50,000

- Exclusive: minimum deposit $100,000

Account registration can be completed online to open a live account in a matter of minutes. You may be required to provide identification verification documents such as proof of residency under the know-your-customer (KYC) compliance.

Benefits

- FCA regulation

- Wide range of instruments

- Range of payment methods

- Demo account with virtual funds

- Mobile application trading terminals

- Spread betting, CFDs and DMA trading

- Industry recognised MT4 and proprietary terminal

- 24/5 customer support including telephone number

- Excess FSCS protection up to £1 million compensation

Drawbacks

- No live chat option

- 10% account funds inactivity fee

- Limited information on the broker’s website

- No established education and training platform

- Less competitive spreads for lower-tier accounts

- High fees if minimum withdrawal limits aren’t met

Trading Hours

Livemarkets follows standard office hours and offers 24-hour trading hours Monday-Friday. However, these timings may vary by instrument. Price feed and tracker tools are available outside of active hours.

Contact Details

Livemarkets offers the following customer support contact options:

- Email: info@livemarkets.com

- Telephone: +44(0)2031502385

- Address: Livemarkets Limited, 12th Floor, 30 Crown Place, London, EC2A 4EB

It was disappointing to see no live chat option.

Safety & Security

Clients can feel assured that Livemarkets provides a safe trading environment. The member area is password protected and all personal data between client terminals and the platform service is encrypted. The MT4 trading terminal offers secure login features, industry-standard data privacy and integrates dual-factor authentication. This, coupled with the rigorous regulation and additional insurance provide competitive retail trader security standards.

Livemarkets Verdict

Livemarkets is a UK broker with an impressive range of trading instruments, both securities and derivatives, on the established MT4 or proprietary Livemarkets WebTrader terminals. The broker is regulated by the FCA, offers 24/5 customer support and £1 million FSCS insurance. However, the lack of educational content, high additional fees, non-competitive spreads and mid-range minimum deposit may mean that some beginner or less active traders could be better off elsewhere.

FAQs

Is Livemarkets Regulated?

Yes, Livemarkets is regulated by the Financial Conduct Authority (FCA) under firm reference number 738538. Global affiliates also hold recognised licencing in South Africa by the Financial Sector Conduct Authority and in Europe from the Cyprus Securities and Exchange Commission (CySEC).

What Instruments Can I Trade With Livemarkets?

Livemarkets offers investment opportunities in over 100,000 instruments, including stocks and shares, forex pairs, index options, commodities like gold and more. Clients can also access global markets like the US, Australia, Asia and India.

What Are The Minimum Deposit Requirements To Trade With Livemarkets?

Livemarkets’ minimum deposit requirement is $250 or equivalent under the lowest tier account; Silver. Higher-level account types have higher minimum deposits.

Who Is Livemarkets Broker Owned By?

Livemarkets is the UK affiliate of Trade Capital Markets Ltd (Trade.com). Livemarkets UK now holds regulation from the Financial Conduct Authority, following stringent compliance protocol.

What Trading Platforms Does Livemarkets Offer?

Livemarkets offers two trading platforms; MetaTrader 4 and proprietary Web Trader terminal. Both platforms are available for free download to desktop devices, can be accessed via all major web browsers and have mobile app compatibility.

Top 3 Alternatives to Livemarkets

Compare Livemarkets with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Livemarkets Comparison Table

| Livemarkets | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 1 | 4.4 | 4.3 | 4 |

| Markets | CFDs, Forex, Stocks, ETFs, Options | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $250 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA, CySEC, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 7 | 6 | 6 | 10 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Livemarkets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Livemarkets | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | Yes | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | Yes | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Livemarkets vs Other Brokers

Compare Livemarkets with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Livemarkets yet, will you be the first to help fellow traders decide if they should trade with Livemarkets or not?