Best Litecoin Brokers & Exchanges 2026

Litecoin brokers and exchanges enable you to trade one of the top cryptos by market capitalization. We’ve listed the best Litecoin brokers and exchanges and share our tips for finding the right platform for your needs.

Top 6 Litecoin Brokers & Exchanges In 2026

After reviewing 140 platforms, we’ve selected the 6 best options for secure Litecoin trading :

-

1

Interactive Brokers

Interactive Brokers -

2

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

3

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

4

FOREX.com

FOREX.com -

5

CEX.IO

CEX.IO -

6

xChief

xChief

Why Are These Brokers the Best for Trading Litecoin?

Here’s a quick summary of what makes these brokers stand out for Litecoin traders:

- Interactive Brokers is the top Litecoin broker in 2026 - IBKR lets you purchase and hold Bitcoin, Bitcoin Cash, Ethereum, and Litecoin at competitive commission rates and without needing a crypto wallet. Additionally, there is a range of other diverse assets to explore, such as crypto indices like the NYSE Bitcoin Index, as well as futures contracts like the BAKKT Bitcoin Futures.

- eToro USA - eToro US offers 24 tradeable cryptoassets, with just a 1% buying/selling fee added to the spread. Additionally, there are 80 different coins available through the broker’s proprietary wallet service. You can also practice your crypto strategies easily by switching between live and demo mode. Crypto asset investing is highly volatile and unregulated. No consumer protection. Tax on profits may apply.

- OANDA US - Cryptocurrency trading is offered via Paxos, a separate entity from Oanda. You can speculate on the world’s biggest cryptos by market cap. Commissions are lower than many peers starting at 0.25%. Through the broker’s partnership with Paxos, clients can spot trade cryptocurrencies on the itBit exchange through the OANDA native platform.

- FOREX.com - You can trade a small range of 8+ cryptos against USD, EUR, GBP and AUD with tight spreads and no virtual wallet required. Algo traders can also utilize Expert Advisors (EAs) to automate their crypto trades.

- CEX.IO - CEX.IO offers hundreds of popular cryptocurrencies including big names like Bitcoin, Ethereum and Litecoin. The trading platform is well-designed with sophisticated charting and analysis tools, including 50+ in-built indicators. Traders can also reduce their monthly volumes through the tiered pricing structure.

- xChief - xChief’s range of 5 cryptocurrencies paired with USD is smaller than most competitors. In addition, the average BTCUSD spread of 30 pips is not the cheapest. That said, the broker does offer some useful crypto trading guides for beginners.

Compare the Best Litecoin Brokers and Exchanges by Key Features

Compare leading Litecoin trading platforms across essential criteria for active traders:

| Broker | Litecoin Margin Trading | Payment Methods | Regulators |

|---|---|---|---|

| Interactive Brokers | ✔ | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| eToro USA | ✔ | ACH Transfer, Debit Card, PayPal, Wire Transfer | SEC, FINRA |

| OANDA US | ✔ | ACH Transfer, Debit Card, Mastercard, Visa, Wire Transfer | NFA, CFTC |

| FOREX.com | ✔ | ACH Transfer, Credit Card, Debit Card, Mastercard, Neteller, PayNow, Skrill, Visa, Wire Transfer | NFA, CFTC |

| CEX.IO | ✔ | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Google Pay, Mastercard, Neteller, PayPal, Skrill, Swift, Visa, Wire Transfer | GFSC |

| xChief | ✔ | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, FasaPay, Neteller, Perfect Money, Skrill, UnionPay, Volet, WebMoney, Wire Transfer | ASIC |

How Safe Are The Top Litecoin Trading Platforms?

Litecoin traders need trusted platforms - see how these firms safeguard your funds:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Interactive Brokers | ✘ | ✔ | ✔ | |

| eToro USA | ✘ | ✘ | ✔ | |

| OANDA US | ✘ | ✘ | ✘ | |

| FOREX.com | ✘ | ✔ | ✔ | |

| CEX.IO | ✘ | ✔ | ✔ | |

| xChief | ✘ | ✘ | ✔ |

Mobile Litecoin Trading Ratings

Trade LTC on the go? See how these brokers stack up when it comes to mobile app performance:

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| eToro USA | iOS & Android | ✘ | ||

| OANDA US | iOS & Android | ✘ | ||

| FOREX.com | iOS & Android | ✘ | ||

| CEX.IO | iOS & Android | ✘ | ||

| xChief | iOS & Android | ✘ |

Are The Top Litecoin Brokers Good for Beginners?

New to Litecoin trading? See which of these platforms offer simple setups, educational tools, and beginner-friendly features:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| eToro USA | ✔ | $100 | $10 | ||

| OANDA US | ✔ | $0 | 0.01 Lots | ||

| FOREX.com | ✔ | $100 | 0.01 Lots | ||

| CEX.IO | ✘ | $20 | $1 | ||

| xChief | ✔ | $10 | 0.01 Lots |

Are The Top Litecoin Brokers Suitable for Advanced Traders?

Active and experienced Litecoin traders need strong tools - see which of our top brokers best support seasoned traders:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | ✔ | ✘ | 1:50 | ✔ | ✔ |

| eToro USA | ✘ | ✘ | ✘ | ✘ | - | ✔ | ✔ |

| OANDA US | Expert Advisors (EAs) on MetaTrader | ✘ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| FOREX.com | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| CEX.IO | API | ✘ | ✘ | ✘ | - | ✘ | ✘ |

| xChief | Expert Advisors (EAs) on MetaTrader | ✘ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

Detailed Ratings: The Best Litecoin Providers

Check our expert ratings to see how each top Litecoin broker scores in key categories:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| eToro USA | |||||||||

| OANDA US | |||||||||

| FOREX.com | |||||||||

| CEX.IO | |||||||||

| xChief |

How Popular Are The Best Litecoin Brokers And Exchanges?

Platform popularity can reflect trust - see which Litecoin providers have the largest client bases:

| Broker | Popularity |

|---|---|

| CEX.IO | |

| Interactive Brokers | |

| eToro USA | |

| xChief | |

| FOREX.com |

Why Choose Interactive Brokers for Litecoin Trading?

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Coins | BTC, LTC, ETH, XRP |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | 0.12%-0.18% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- IBKR is one of the most respected and trusted brokerages and is regulated by top-tier authorities, so you can have confidence in the integrity and security of your trading account.

- There's a vast library of free or paid third-party research subscriptions catering to all types of traders, plus you can enjoy commission reimbursements from IBKR if you subscribe to Toggle AI.

- While primarily geared towards experienced traders, IBKR has made moves to broaden its appeal in recent years, reducing its minimum deposit from $10,000 to $0.

Cons

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

Why Choose eToro USA for Litecoin Trading?

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Coins | BTC, ETH, BCH, DASH, LTC, ETC, MIOTA, XLM, EOS, NEO, ZEC, XTZ, MKR, COMP, LINK, UNI, YFI, DOGE, AAVE, ALGO, MANA, ENJ, BAT, MATIC, FLR, SHIBxM |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | BTC 0.75% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Regulator | SEC, FINRA |

| Account Currencies | USD |

Pros

- eToro USA Securities is a trustworthy, SEC-regulated broker that is a member of FINRA and SIPC

- Investors can access Smart Portfolios for a more hands-off approach, covering a range of sectors and markets such as renewable energy and artificial intelligence

- The low minimum deposit and straightforward account opening process means beginners can get started quickly

Cons

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

- Average fees may cut into the profit margins of day traders

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

Why Choose OANDA US for Litecoin Trading?

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Coins | BTC, ETH, LTC, BCH, PAXG, LINK, UNI, AAVE |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | $100 |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Regulator | NFA, CFTC |

| Account Currencies | USD, EUR, GBP, AUD, JPY, CHF, HKD, SGD |

Pros

- The broker offers a transparent pricing structure with no hidden charges

- Day traders can enjoy fast and reliable order execution

- The proprietary OANDA web platform continues to deliver a highly competitive charting environment, including 65+ technical indicators powered by TradingView

Cons

- It's a shame that customer support is not available on weekends

- There's only a small range of payment methods available, with no e-wallets supported

- The range of day trading markets is limited to forex and cryptos only

Why Choose FOREX.com for Litecoin Trading?

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Coins | BTC, BCH, ETH, LTC, XRP |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | BTC 1.4%, ETH 2% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Regulator | NFA, CFTC |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

Why Choose CEX.IO for Litecoin Trading?

"CEX.IO continues to serve a range of crypto investors looking to buy, sell, trade, hold and earn with low fees. The tiered pricing structure will appeal to active traders while rookie investors will enjoy the straightforward platform interface and excellent education."

Tobias Robinson, Reviewer

CEX.IO Quick Facts

| Coins | ZRX, 1INCH, AAVE, BTC, BCH, ADA, LINK, COMP, ATOM, DAI, DOGE, ETH, GUSD, ICP, LTC, LRC, MATIC, MKR, DOT, SHIB, SOL, XLM, SUSHI, SNX, USDT, XTZ, USDC, UNI, WBTC, ZIL |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | 0.15% maker & 0.25% taker (Standard) |

| Crypto Lending | Yes |

| Crypto Staking | Yes |

| Platforms | TradingView |

| Minimum Deposit | $20 |

| Regulator | GFSC |

| Account Currencies | USD, EUR, GBP |

Pros

- CEX.IO has remained a trusted crypto exchange since its launch, with 5+ million users

- CEX.IO continues to offer competitive pricing with 0.01% taker and 0% maker fees for high-volume traders

- There's a wide range of global payment methods available including PayPal

Cons

- A maintenance fee applies after 12 months of no activity

- Deposit and withdrawal fees are relatively high, including 0.3% + $25 for SWIFT withdrawals

- The Exchange Plus platform delivers a cluttered interface compared to competitor platforms

Why Choose xChief for Litecoin Trading?

"xChief continues to prove popular with investors looking to trade highly leveraged CFDs on the popular MetaTrader platforms. The broker's rebate scheme and investment accounts will particularly appeal to seasoned traders. However, the lack of top-tier regulatory oversight is a major drawback."

William Berg, Reviewer

xChief Quick Facts

| Coins | BTC, BCH, ETH, LTC, XRP |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Variable |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Regulator | ASIC |

| Account Currencies | USD, EUR, GBP, JPY, CHF |

Pros

- Traders can access a copy trading solution via the MetaQuotes Signals service

- xChief offers STP/ECN execution with low spreads from 0.0 pips and low commission rates starting from $2.50 per side

- The low minimum deposit of $10 will appeal to beginners, as well as the beginners’ guides in the Library

Cons

- The Classic+ and Cent accounts provide access to fewer instruments than the other account types, at 50+ and 35+, respectively

- The total range of 150+ assets is much lower than most competitors who typically offer hundreds

- xChief is an offshore broker with weak regulatory oversight from the VFSC, so traders will receive limited safeguards

How Did DayTrading.com Choose The Best Litecoin Trading Platforms?

In a comprehensive review spanning more than 200 data points across eight essential categories, we’ve evaluated and ranked the top platforms for buying, selling, and day trading Litecoin.

Our team of crypto-savvy traders, some of whom have actively traded Litecoin since its release in 2011, put each platform through hands-on testing to assess performance and to find the most trustworthy, secure, and user-friendly exchanges and brokers.

How To Choose A Litecoin Broker

Drawing on decades of combined expertise in the trading industry, we’ve outlined the essential features that set top-tier brokers for trading Litecoin apart:

Trust

Choose a reliable and reputable Litecoin broker to be assured your funds are as secure as possible.

We see this as the first priority for any trader for good reason – every week sees new stories emerge of traders losing millions to fraudulent brokers or investment scams.

But with cryptocurrencies like Litecoin, the lack of a strong regulatory framework makes the risk even starker – as seen in episodes from the collapse of FTX to the $1.5 billion lost in the 2025 ByBit hack.

Fortunately, Litecoin is one of the most established crypto tokens, so it’s available to trade with a number of regulated and trustworthy brokers.

- Pepperstone is one of our most trusted Litecoin brokers year after year as it continues to comply with the stringent industry standards that have earned it licences from numerous green-tier regulators, a slew of DayTrading.com awards and the custom of more than 500,000 traders.

Pricing

Choose a Litecoin broker with low fees to avoid watching your profits evaporate as you make numerous short-term trades in a day.

We’ve found while reviewing dozens of crypto brokers that they usually charge fees through a spread – that’s the difference between the price you buy and sell the token at – rather than commissions.

Note that Litecoin, like most cryptocurrencies, is subject to frequent price swings, and the spread is likely to grow larger when markets are more volatile.

That’s why we test Litecoin trades to try and identify the average spread.

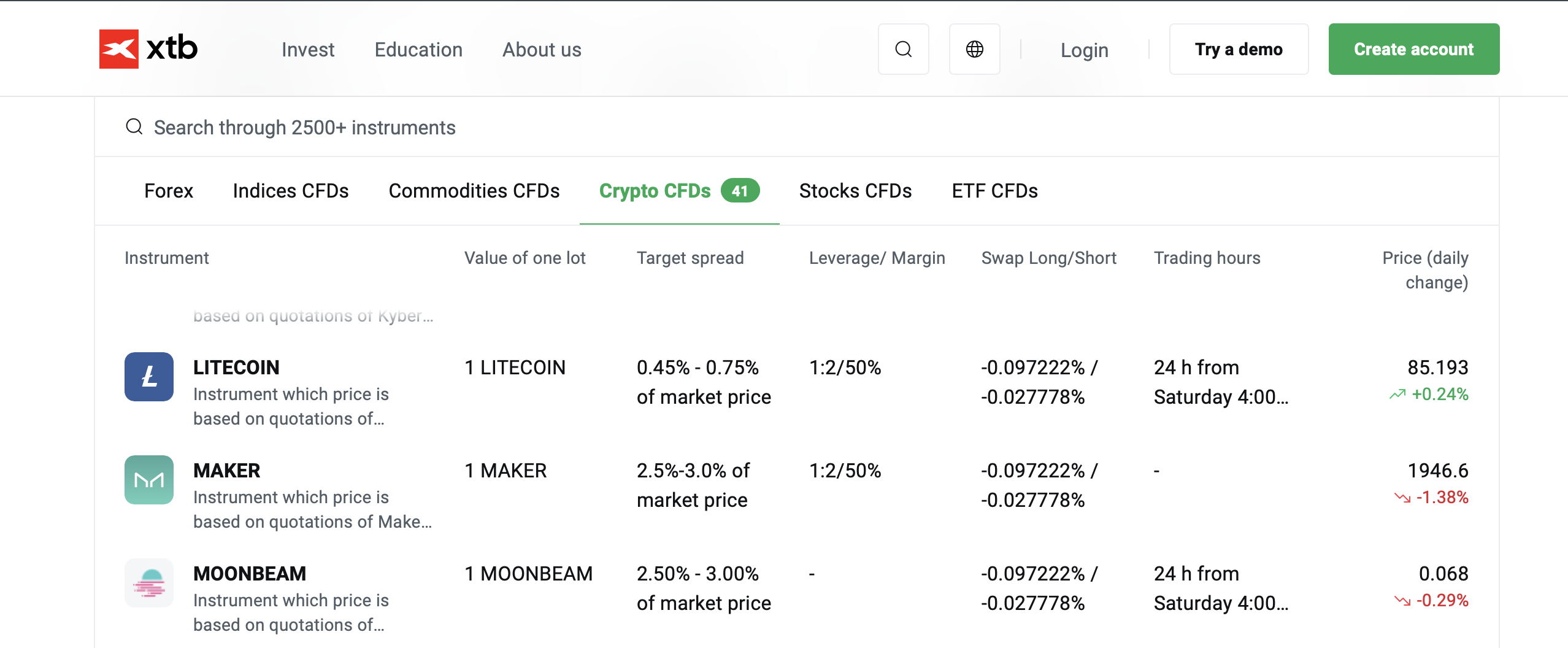

- XTB consistently impresses our experts because it’s one of the most transparent brokers when it comes to Litecoin and other cryptocurrencies. All XTB assets’ prices are listed in real time on its website, together with target spreads and swap rates; for LTC, these are tight at less than 1% of market price and no commission.

Charting Platforms

Choose a broker that lets you access professional-grade platforms and tools to help you analyze charts, test strategies, and plan your Litecoin (LTC) trades with confidence.

Many Litecoin brkers support MetaTrader 4 (MT4) and MetaTrader 5 (MT5) — both widely used platforms known for their reliability and packed with built-in indicators, customizable charting options, and support for automated trading.

We’ve also been impressed by modern platforms like TradingView, which combine real-time data, social trading ideas, and advanced charting in one sleek interface.

- FOREX.com remains a stellar choice for its charting platform options, which include MT4 and MT5 – with the largest number of MetaTrader servers in the world – as well as TradingView and a proprietary WebTrader platform. These excellent platforms are augmented by extra tools including Trading Central for analysis and mobile apps for trading on the go.

Extra Tools

Day trading cryptocurrencies like Litecoin is fast-paced and volatile, so you should find a broker with tools that will help you research and plan your trades.

We have found that it’s usually quickest and most intuitive to use research tools that are integrated in the platform you use to make trades, as they allow you to plan trades without opening numerous new tabs.

That’s why we highly rate brokers with powerful third-party integrations that support backtesting, algorithmic trading, and crypto-specific news feeds.

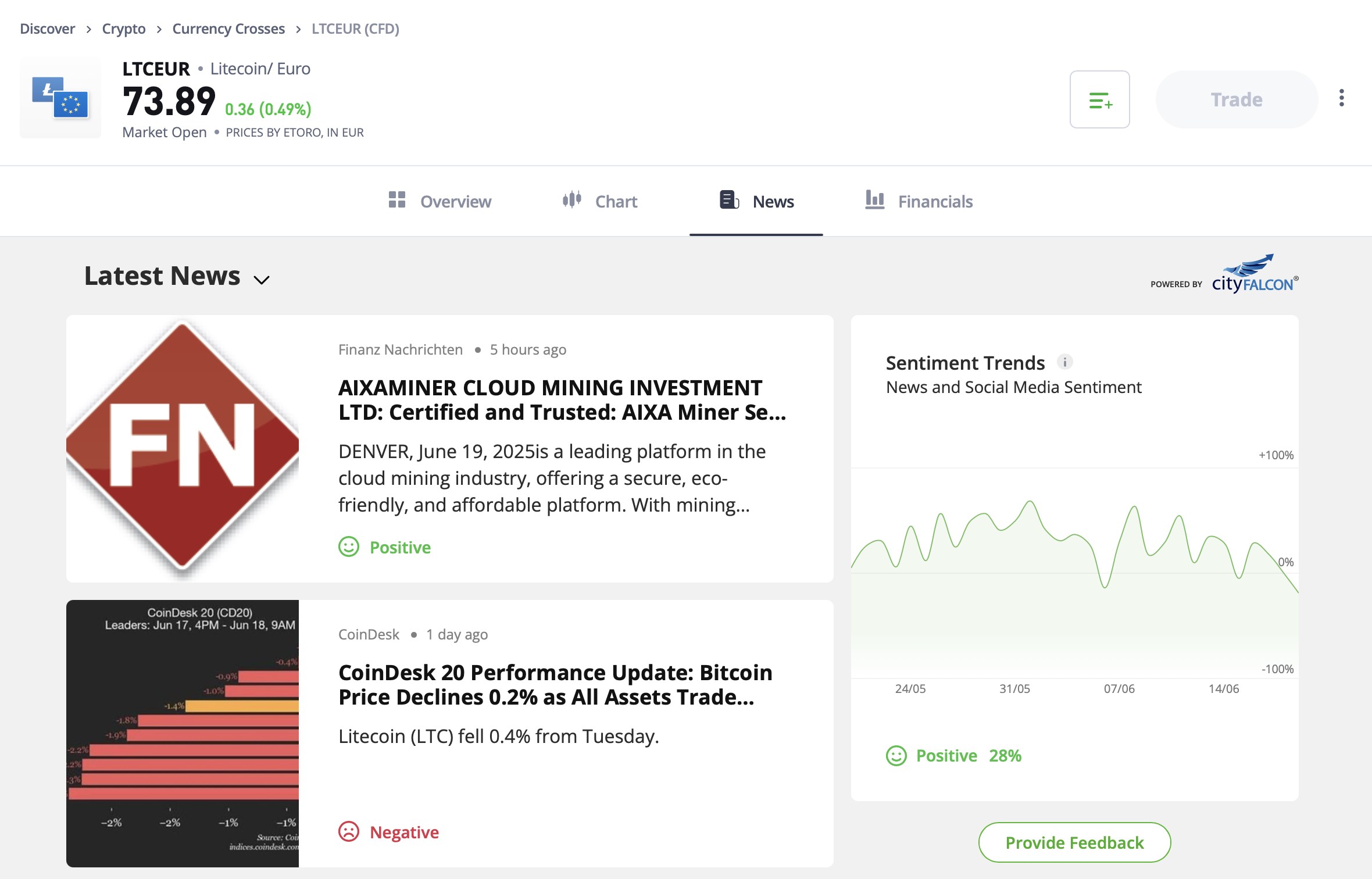

Trading Central, for instance, provides actionable analytics for crypto markets, and brokers that integrate TipRanks bring their clients the latest Litecoin news and expert analysis.

Extra tools can make all the difference when you’re trading a volatile asset like Litecoin, so you should consider these carefully when choosing a broker.For example, access to high-quality data feeds and technical analysis resources can help traders catch profitable entry and exit points in their short-term trades, and this might be worth a small increase in fees.

- Over decades of combined experience trading, our experts have found eToro‘s selection of additional tools some of the best of any broker, particularly for newer traders. Since these are integrated directly into the trading platform, everything you need to research Litecoin trades is a click away.

Customer Support

Crypto markets like Litecoin are open 24/7, so you should look for a broker with customer service assistants available as long as possible.

Our most highly rated Litecoin brokers for customer support have assistants available 24 hours per day on weekdays.

We also look for brokers that have various avenues to seek help, including:

- Phone lines, ideally in several different countries/regions to serve international clients.

- Live chat with fast response times from professional and knowledgeable assistants and not chatbots.

- Email is often the best avenue for more complex enquiries.

- Other channels such as a useful FAQ section, social media channels and forums.

- CMC Markets‘ customer support still stands out among the best in the industry, with multilingual, localized support available via phone and email 24/5 and lead times of under 2 hours during our tests.

Account Options

You should find a Litecoin broker that supports your preferred payment methods to avoid added charges or slow deposit and withdrawal times.

Good Litecoin brokers often support free account funding through bank transfer and card transactions as well as several digital methods.

We’ve also found that an increasing number of brokers is adopting crypto deposits – often the method of choice for those who actively trade tokens like Litecoin.

- FXCC remains one of the most flexible brokers on the market for account funding, with options to fund your account with card or wire transfer, to use e-wallets Neteller and Skrill, or to use cryptocurrencies including BTC, ETH and USDT.

Bottom Line

The best Litecoin brokers and exchanges create a user-friendly trading environment for retail investors, with low fees and fast payments.

And with a growing number of scams online, it’s important to read reviews and choose a trusted platform. Head to our table of top Litecoin brokers to get started today.

FAQ

What Is Litecoin’s Ticker Symbol On A Broker’s Platform?

You can find Litecoin under the ticker symbol LTC. Most brokers and exchanges include Litecoin in their list of top 20 cryptos by trading volume.

Should I Use A Regulated Litecoin Broker?

Many countries are still working to introduce regulations to govern the trading of cryptocurrencies like Litecoin. With that said, some Litecoin brokers are regulated by reputable agencies, such as the Cyprus Securities & Exchange Commission (CySEC).

Where possible, we recommend opening an account with a licensed provider as it provides protections for retail traders.