Best Brokers With TipRanks 2026

Looking for the best broker that uses TipRanks? We’ve handpicked the top regulated providers and tested each one, assessing the integration with TipRanks, the quality of insights provided, and the overall trading experience.

List Of Best Brokers With TipRanks For 2026

Based on our latest evaluations, these are the top brokers for TipRanks in February 2026:

- IG is the best TipRanks broker. IG provides one of the smoothest TipRanks experiences based on our tests, with analyst ‘Top Stocks’ and ‘Smart Scores’ available from within the trading interface – no extra clicks, no delays.

- Interactive Brokers combines TipRanks with its advanced research environment, enabling short-term traders to cross-reference analyst forecasts, news sentiment, and Smart Scores.

Which Top TipRanks Broker Scored Highest In Our Hands-On Tests?

We tested each top TipRanks broker across five core areas – here’s how they performed:

| Broker | TipRanks Integration | Ease of Use | Data Freshness | Customizability | Short-Term Trading Value | Average Score |

|---|---|---|---|---|---|---|

| IG | / 5 | / 5 | / 5 | / 5 | / 5 | / 5 |

| Interactive Brokers | / 5 | / 5 | / 5 | / 5 | / 5 | / 5 |

Top TipRanks Brokers Compared On Key Metrics

Here’s how the top TipRanks brokers compare on our favorite features and access during testing:

| Broker | Best Features | TipRanks Access |

|---|---|---|

| IG | Smart Scores & Analyst Consensus | Trading interface |

| Interactive Brokers | Forecasts & Smart Scores | Advanced research platform |

What Other Research Tools Do The Best TipRanks Brokers Offer?

The top brokers don’t stop at analyst data from TipRanks – some also offer other third-party research tools:

| Broker | Autochartist | Trading Central | Signal Services |

|---|---|---|---|

| IG | ✓ | ✓ | ✓ |

| Interactive Brokers | ✗ | ✓ |

What Do You Need To Get Started With The Best TipRanks Brokers?

Opening an account with the top TipRanks brokers is simple based on our experience – here’s what you’ll need:

| Broker | Min Deposit | Min Trade | Payment Methods | Instant Deposits |

|---|---|---|---|---|

| IG | $0 | 0.01 Lots | PayPal, Wire Transfer, Mastercard, Credit Card, Visa, Debit Card, PayNow | ✓ |

| Interactive Brokers | $0 | $100 | Cheque, ACH Transfer, Wire Transfer, Automated Customer Account Transfer Service, TransferWise, Debit Card | ✗ |

Are The Best TipRanks Brokers Good For Active Traders?

Discover how the top providers maximize the value you can get from TipRanks for active traders:

| Broker | Fast Execution | Auto Trading | API Access | VPS | Leverage |

|---|---|---|---|---|---|

| IG | ✓ | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✓ | ✓ | 1:30 (Retail), 1:250 (Pro) |

| Interactive Brokers | ✓ | Capitalise.ai, TWS API | ✗ | ✗ | 1:50 |

Are The Best TipRanks Brokers Good For Mobile Traders?

Mobile support is crucial if you want to access to TipRanks on the move. Here’s what each leading broker offers:

| Broker | iOS App | Android App | Smartwatch Support |

|---|---|---|---|

| IG | / 5 | / 5 | ✓ |

| Interactive Brokers | / 5 | / 5 | ✓ |

How Safe Are The Top Brokers With TipRanks?

Safety is key when choosing a broker that uses TipRanks – here’s how the top providers protect your funds:

| Broker | Trust Score | Regulator | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| IG | / 5 | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA | ✓ | ✓ |

| Interactive Brokers | / 5 | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | ✓ | ✓ |

How Do The Best TipRanks Brokers Compare On Costs?

See which best brokers for TipRanks keep trading costs low, so you can act on insights without losing profits:

| Broker | Cost Rating | Crypto Spread | FTSE CFD | GBP/USD CFD | Oil CFD | Stock CFD |

|---|---|---|---|---|---|---|

| IG | / 5 | Variable | 1.0 | 0.9 | 2.8 | 0.02 |

| Interactive Brokers | / 5 | 0.12%-0.18% | 0.005% (£1 Min) | 0.08-0.20 bps x trade value | 0.25-0.85 | 0.003 |

IG

Why We Chose IG

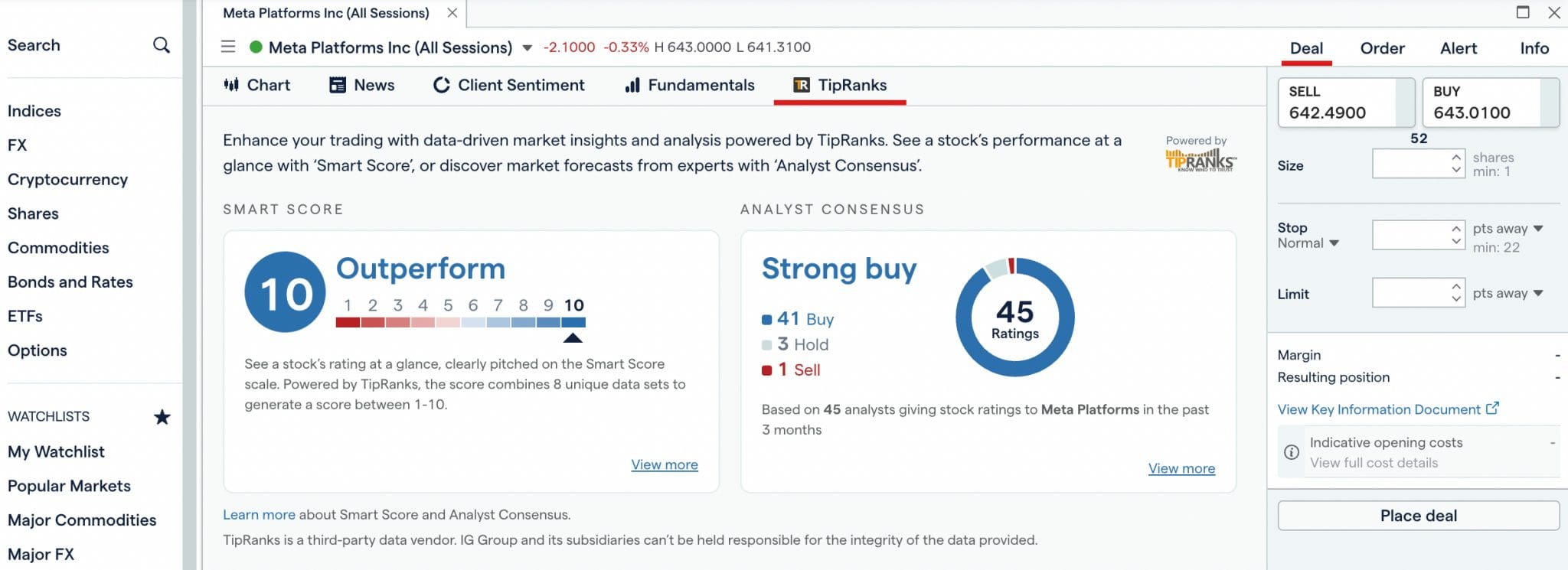

We picked IG for its reliable TipRanks integration that’s accessible by selecting ‘TipRanks’ under ‘My Workspace’.

I recommend clicking ‘Add To My Workspace’ – during testing I found this moveable widget the easiest way to analyze equities in charts alongside findings from TipRanks.

Pros And Cons Of Using TipRanks With IG

- TipRanks is integrated well with IG’s interface, with no issues finding or using its features during testing.

- You can access the top stocks by analyst pick and Smart Scores, or delve into analyst consensus by selecting ‘TipRanks’ for individual equities.

- Stocks are helpfully broken down by sectors in the broad view, with most under ‘Technology’ in our experience.

- There’s no explanation of ‘Smart Scores’ in the terminal which may leave beginners unsure how to best use the data.

- TipRanks data is limited compared to front-runner IC Markets with fewer charts and no insights like ‘Crowd Wisdom’ and ‘News Sentiment’.

- IG is missing a trick by not showing where insights from TipRanks experts align or diverge from the findings of its own analysts.

Interactive Brokers

Why We Chose Interactive Brokers

We included Interactive Brokers for its powerful, research-focused environment, where TipRanks data can be cross-referenced with institutional-grade analytics.

Though its integration scored lower than some of our top providers, advanced traders may still benefit from the broader research ecosystem it provides, especially when combining TipRanks with news and sentiment insights.

Pros And Cons Of Using TipRanks With Interactive Brokers

- Combines TipRanks data with broader sentiment tools, newsfeeds, and analytics.

- Smart Scores, news sentiment, and analyst trends can be compared side-by-side.

- TipRanks is buried under menus and not easy to add to the existing workspace.

- Data can be slow to load and doesn’t always update in real-time.

How Did DayTrading.com Choose The Best Brokers With TipRanks?

We took a methodical, proprietary approach to rank the top brokers for TipRanks:

First, we went digging online to find brokers that integrate with TipRanks in some way, only considering those authorized by at least one ‘green tier’ regulator in DayTrading.com’s Regulation & Trust Rating.

Why? We recommend using well-regulated brokers when working with TipRanks data to safeguard your capital from unfair trading practices.

Next, we created five categories, specific to TipRanks to score each broker from 1 to 5 (higher being better):

- Level of integration: How deeply is TipRanks integrated into the broker’s platform? Does the broker display TipRanks data within stock pages or dashboards? A higher score reflects seamless, in-platform access to TipRanks insights.

- Ease of use: How simple is it to find and interpret TipRanks data through the broker? Is it intuitive and accessible with minimal clicks or clutter? Higher scores went to brokers with clean interfaces and a good user experience.

- Data Freshness & Frequency: How often is TipRanks data updated on the broker’s platform? Are analyst ratings, insider moves, and sentiment data shown in real-time or with a lag? A higher score reflects fast syncing, critical for short-term traders.

- Customizability & Filtering: How much control does the trader have over what TipRanks data they see? Can users filter by analyst rank, sentiment score, or stock type (e.g. market cap, sector)? Higher scores reward brokers that let traders tailor the insights to suit their strategy.

- Value for Short-Term Trading: Does the TipRanks integration actually add actionable value for active traders? Are there tools or layouts that help identify short-term setups (e.g. intraday breakouts)? A high score indicates TipRanks isn’t just window dressing – it genuinely helps traders execute better.

Finally, we averaged these scores to assign brokers an overall rating for their use of TipRanks, and then ranked providers by this rating.

What Is TipRanks?

TipRanks is a financial research platform that aggregates analyst ratings, insider trading data, hedge fund moves, and financial news sentiment.

While it’s commonly associated with long-term trading, TipRanks can be an invaluable tool for short-term and day traders — especially when used with the right broker.

Not all brokerages offer the same level of access to TipRanks insights. Some offer direct integration or embedded analyst ratings, while others require toggling between platforms and widgets.

We’ve reviewed and tested providers to see how well they pair with TipRanks, both in terms of data visibility and ease of use.

How To Use TipRanks For Short-Term Trading

These are the five TipRanks features that can directly support short-term trading decisions – with examples of how to potentially use each:

1. Real-Time Analyst Ratings

TipRanks can alert you when top-ranked analysts update their ratings or price targets. These changes can spark price reactions – especially on mid-cap or lesser-covered stocks.

Example: An upgrade from a 5-star analyst on a small-cap biotech stock at the US market open may cause an intraday spike. A trader monitoring this might enter a position early, riding the momentum for a quick breakout trade.

2. Insider Trading Tracker

Executives buying or selling their own shares – particularly in clusters – often precede short-term price moves. TipRanks highlights these trades, including the role of the insider and the size of the position.

Example: You spot a CEO and CFO both buying shares just before earnings. That bullish signal, paired with technical support on the chart, may justify a pre-earnings long trade with a tight stop.

3. News Sentiment Filter

TipRanks scans financial headlines and assigns a bullish or bearish sentiment score. This helps identify stocks gaining traction in the media, which can foreshadow volume spikes or algorithm-driven volatility.

Example: A mid-cap energy stock hits the “bullish” list after positive regulatory news coverage. A day trader might catch this sentiment shift early, enter on a breakout, and ride the volume for a short-term gain.

4. Top Stocks Lists

TipRanks curates ranked lists like “Top Stocks”. Traders can filter these by sector or market cap to build a focused watchlist.

Example: You filter the “Top Stocks” list to only include tech stocks with high hedge fund interest. One has earnings tomorrow and an ascending triangle forming – a potential candidate for a short-term breakout trade.

5. Smart Scores

This proprietary TipRanks score combines multiple signals – including analyst views, sentiment, fundamentals, and momentum – to give a stock a 1–10 rating. While not a trading signal alone, it can be used for market scans.

Example: A stock with a Smart Score of 9, heavy insider buying, and a recent analyst upgrade becomes a strong candidate for momentum trading, especially if it’s nearing a key technical breakout level.

Pros And Cons Of TipRanks For Active Traders

Pros

- Centralized Intelligence: Combines analyst, insider, hedge fund, and sentiment data in an easy-to-use dashboard – saving you time switching between tools.

- Real-Time Signals: Daily updates on analyst actions, insider trades, and media sentiment can create a stream of potential trading opportunities.

- Custom Filters: Tailor lists by market cap, sector, sentiment score, or hedge fund activity – perfect for building tight, morning prep lists.

- Hedge Fund Tracker: Shows which stocks institutions are buying or dumping – a useful overlay for contrarian or momentum strategies.

Cons

- Geared Toward Investors First: Some features are designed for long-term holders, so active traders need to extract what’s relevant.

- No Direct Execution or Charting: TipRanks is a research tool only. You’ll need an online broker to act on your ideas.

- Overload Risk: With so much data available, it’s easy to chase noise – we know we’ve dug through it. Traders should apply strict criteria to avoid distractions.

- Pricing: Some of the best features (like full insider breakdowns and hedge fund details) are sometimes locked behind a paywall or not available at every broker in our experience.

Bottom Line

TipRanks isn’t a trading platform. It’s a powerful market intelligence layer when paired with the right broker.

We’ve tested it across multiple providers and found that the quality of integration can vary: some brokers embed TipRanks data directly into their platforms, while others require switching between screens or widgets.

If you’re an active trader looking to spot early momentum, identify high-sentiment setups, or track institutional activity, TipRanks can be a valuable tool – but your broker choice matters.

To get started, check out our handpicked list of the best brokers with TipRanks support, based on usability, access to ratings, and how well they work in the heat of a trade.

FAQs

Is TipRanks Worth It?

Yes, but only if you use it right. For short-term and active traders, TipRanks can be a solid edge if you focus on analyst rating changes, insider activity, and news sentiment filters.

You could use it for pre-market prep to flag stocks with fresh upgrades or media buzz – catching early momentum before it hits major scanners.

It’s not a trading platform, but as a research layer to spot information-driven volatility, it can be a valuable tool.

How Accurate Is TipRanks?

TipRanks doesn’t predict the market – it tracks meaningful data and signals. Its accuracy comes from aggregating data from verified sources: industry analysts, corporate insiders, hedge fund filings, and news feeds.

For day traders, the value lies not in precision forecasts but in timely access to sentiment shifts. For instance, if several top analysts raise their targets on a mid-cap tech stock before earnings, TipRanks might help spotlight that trend.

Still, there’s no guarantee that data and insights from TipRanks are fully accurate. Risk management is required.

Is TipRanks Legit?

Yes, TipRanks is a legitimate fintech company, headquartered in Tel Aviv, Israel. It sources its analyst rankings and insider data from public filings and financial market experts.

It won’t tell you when to enter or exit, but it can help highlight where some institutional eyes are focused.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com