Junk Bonds

Junk bonds are bonds with a credit rating of “BB” or lower. Junk bonds are also known as high-yield bonds because the higher risk associated with them typically means they carry a higher yield than other, safer investments.

Junk bonds are usually issued by companies that are in need of money and can’t access conventional financing sources such as bank loans.

Investors who buy junk bonds take on additional risks since these bonds have a greater chance of defaulting on their payments than investment-grade bonds do.

As a trader or investor, you must weigh the potential returns against the increased risk when deciding whether to invest in junk bonds. It is important to research the issuer of any bond before purchasing it, along with its creditworthiness and financial stability.

Additionally, diversification is also important. Investing in a variety of junk bonds can help to spread out the risk and increase the chances of receiving positive returns on your investment.

Overall, investing in junk bonds requires a great deal of research and knowledge about the bond issuer before deciding whether it is an appropriate investment for you.

Junk Bonds – Key Takeaways

- With the potential for higher yields and more generous terms, junk bonds may be a good option for some investors who are looking for higher yields than what conventional investments typically offer.

- However, because of their high-risk nature, junk bonds are generally not a large portion of any investor’s portfolio when they’re looking to have prudent balance.

- It is important to do your due diligence or consult with a financial professional before embarking on this strategy as risks can vary greatly depending on individual circumstances.

Junk Bonds Interest Rates (Junk Bonds Yield)

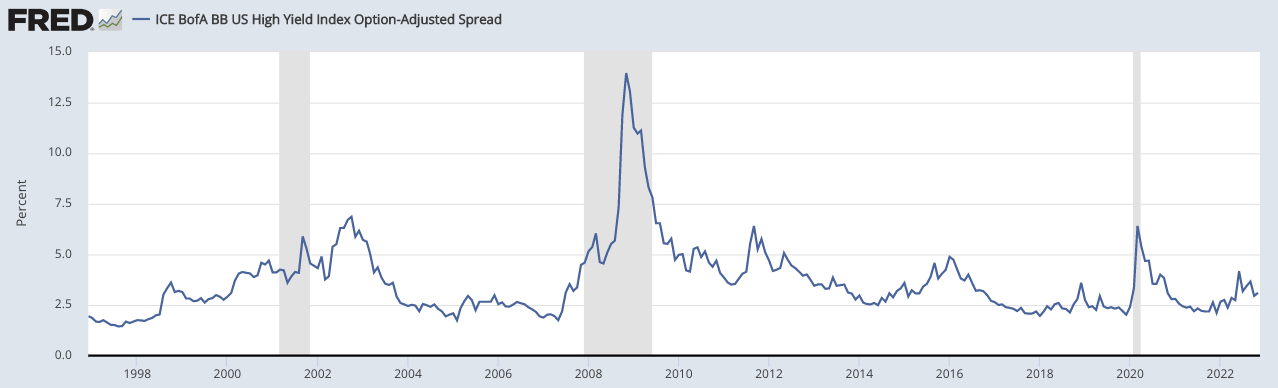

Junk bonds trade at what’s called a “spread” above risk-free bonds (such as US Treasuries) to compensate traders and investors for taking on credit risk.

The graph below shows the spread of BB junk bonds over equal-duration safe bonds.

ICE BofA BB US High Yield Index Option-Adjusted Spread (BAMLH0A1HYBB)

The yield expressed as a percentage of the bond’s face value is determined by this spread.

The yields of junk bonds tend to move inversely with interest rates – meaning when interest rates go down, the price of existing junk bonds goes up and their yields come down. In contrast, when interest rates increase, the prices of existing junk bonds drop and their yields rise.

When evaluating the potential profitability from investing in junk bonds, investors should take into account both current spreads (yields) and the potential for changes due to fluctuating interest rates and the prospects of the company itself.

Ultimately, there are risks associated with investing in any type of bond, including junk bonds. As an investor, it’s important to understand these risks before committing funds to any investment vehicle.

Junk Bonds and Corporate Raiders

In the 1980s, corporate raiders such as Carl Icahn and T. Boone Pickens made a name for themselves by buying large stakes in companies they felt were undervalued.

The raiders would buy up large amounts of a company’s equity and then use that to control its board of directors and put pressure on the management of the company.

To thwart these hostile takeover practices, sometimes companies will increase debt levels (often by issuing bonds, which are rated junk) to make the company less attractive to corporate raiders. Other tactics include poison pills and golden parachutes.

Bonds are senior to equity in corporate capital structure, meaning debtholders receive first priority.

How to Buy Junk Bonds

Traders and investors can buy junk bonds via individual securities or ETFs.

Individual junk bonds can be purchased from a broker-dealer and various online trading platforms. ETFs are tradeable on any exchange and provide easy diversification for investors.

It is important to understand the risks associated with investing in these types of bonds before buying them. This includes researching the issuer’s creditworthiness and financial stability, as well as understanding how changes in interest rates may affect their value.

Finally, it is also important to make sure that the return you are getting compensates you adequately for taking on additional risk.

After all, higher yields generally come with higher risks, so it is up to the investor to decide if those risks are worth taking on when deciding whether or not to invest in high-yield bonds.

Junk Bonds ETF

The two most popular junk bond ETFs include:

HYG

The iShares iBoxx $ High Yield Corporate Bond ETF is an exchange-traded fund that invests in US dollar-denominated, high yield corporate bonds.

JNK

The SPDR Bloomberg Barclays High Yield Bond ETF is an ETF that invests in high yield corporate bonds issued by US and international companies.

Both are considered to be low cost options for investors who want to gain exposure to junk bonds without taking on too much risk.

Traders and investors should read the prospectus and other relevant information before investing in any ETF, however, as the investments are subject to market risks.

Junk Bonds Advantages and Disadvantages

Advantages:

- High yields compared to other bonds

- Potential for capital appreciation

- Lower levels of risk than many stocks

- Can be used as part of a diversified portfolio

Disadvantages:

- May be subject to sudden price swings due to market volatility

- Credit ratings may change and the issuer could default on interest payments or principal payment

- Losses could exceed the original investment amount

Overall, junk bonds offer investors the potential for higher returns but come with increased risks.

It is important to understand these risks before investing in any type of bond, especially one that is considered junk.

Additionally, investors should make sure they are getting compensated adequately for taking on additional risk by comparing current yields to other investment vehicles.

Junk Bonds vs. Stocks

All assets compete with each other, so no asset is inherently better than another.

Junk bonds, which are debt instruments issued by companies with lower credit ratings, can offer higher yields than stocks.

However, they also carry risk because of the higher probability of default and other factors.

Investors must understand the risks associated with junk bonds and make an informed decision about their suitability for a particular portfolio.

Overall, it depends on individual investor goals and objectives when determining if investing in junk bonds is preferable to stocks.

It may be beneficial for investors to consult with a financial advisor or other experienced investment professionals to determine whether junk bonds are better suited for their investment needs than stocks and other investment types.

In addition, there are certain advantages that both stocks and junk bonds have over each other.

Stocks generally provide more potential upside as companies increase in value, while junk bonds can offer investors a steady income stream due to their higher interest payments.

Ultimately, the decision between stocks and junk bonds is a personal one that must be made on an individual basis. Investors should consider their own unique financial situation and goals when determining which asset class is best for them.

The key takeaway is that there are risks associated with investing in both stocks and junk bonds; however, different types of investments have different strengths and weaknesses that should be taken into account before making any decisions.

Different types of assets also come with different levels of risk and reward – it’s important to do your research before committing to either asset.

FAQs – Junk Bonds

Is buying junk bonds a good idea?

When done with caution and research, investing in junk bonds can be a viable option for investors looking to diversify their portfolios and earn higher yields than what other types of investments typically offer.

Overall, it is important to do extensive research before investing in any type of bond.

Understanding the risks associated with such investments, as well as the potential rewards that come along with them, is key to making informed decisions when it comes to adding these instruments to your portfolio.

Discussing these investments with a financial advisor or an expert investor may also help you make sounder decisions about which bonds are right for your unique circumstances.

What is purpose of junk bonds?

Junk bonds are used by companies to raise capital in order to finance their operations.

They come with higher yields due to the risk associated with them, and investors who choose to buy junk bonds may be compensated for taking on additional risk if the bond performs well.

In addition, some investors use junk bonds as part of a diversified portfolio since they offer higher yields than other types of investments.

However, it is important to understand the risks associated with these instruments before committing any money to them.

What is a good yield for junk bonds?

The yield on a junk bond depends on several factors including the issuer’s credit rating, market conditions, and investor demand.

Generally speaking, yields on junk bonds typically range from 5-10 percent, with higher yields corresponding to higher risks.

It is important for investors to compare current yields against other investments before deciding if the additional risk associated with a junk bond is worth taking on.

Additionally, it is important to keep in mind that past performance does not guarantee future results and that no investment is without risk.

Are junk bonds profitable?

Yes, junk bonds can be profitable if you are sufficiently compensated for the credit risk.

On a mark-to-market basis, changes in interest rates and credit risk will influence the profitability of an investment.

Conclusion – Junk Bonds

Overall, junk bonds can offer an attractive opportunity for investors who are comfortable with taking on additional risk in exchange for higher yields.

However, it is important to conduct thorough research into the issuer and its creditworthiness before investing.

Diversification is also recommended in order to help spread out the potential risks associated with these investments.

Additionally, investors should also keep a close watch on interest rates as this could affect the performance of their investments over time.

All things considered, provided that you have done your due diligence and understand the risks involved, junk bonds can be a viable option for those looking to diversify their portfolios and potentially increase their returns.