IronFX Review 2026

See the Top 3 Alternatives in your location.

Awards

- Best Online Trading Platform (2019)

- Best Broker of the Year (2019)

- Most Trustworthy Forex Broker Global (2019)

- Best Online Trading & Financial Services Company (2020)

- Best Online Forex Trading Platform (2021)

- International Online Currency Trading Platform of the Year (2021)

- Most Outstanding Online Trading Partners Program (2022)

Pros

- Fixed and floating spread accounts are available, making IronFX a good choice for both beginners and experienced traders

- The IronFX Academy delivers some excellent educational tools for beginners through to advanced traders

- IronFX is an established firm and is regulated by several reputable bodies, including the CySEC, FCA and FSCA

Cons

- Compared to the leading brokers, IronFX offers a relatively small selection of share CFDs

- It’s a shame that the broker doesn’t offer any additional software such as MT5 or TradingView to give experienced traders more choice

- Commissions start from $13.50 per lot in the zero-spread accounts, nearly double the industry average

IronFX Review

IronFX is an online, multi-asset broker best known for forex trading. Once registered, users can access the popular MetaTrader 4 (MT4) trading platform, flexible leverage and ultra-low spreads starting from 0.0 pips. This review will fully report IronFX’s offering, including exclusive deposit bonuses, demo accounts and fast deposit and withdrawal methods.

Company Details

IronFX was set up in 2010 by a team of finance and software experts. Today, the company employs more than 450 people and has created a solid reputation as a trusted and reliable broker. Its 200+ instruments and multiple platforms are accessible in 180+ countries with 50,000+ retail traders worldwide.

The company’s past and present sponsorships with global brands, such as the Korean diving team and sailing athlete Marilena Makri, have set it apart from other brokers.

The brokerage operates through four entities:

- Notesco Financial Services Ltd – regulated by the CySEC

- Notesco UK Limited – regulated by the FCA

- Notesco (SA) Pty Ltd – regulated by the FSCA

- Notesco Limited – registered in BMA / Bermuda

Trading Platform

IronFX uses the MetaTrader 4 trading platform. The software is considered one of the best in the industry, especially for forex trading. It is geared towards beginners and intermediates, promising easy-to-use features and straightforward portfolio management.

Traders can use the free MT4 download to install the platform on desktop devices, including Mac. Alternatively, you can trade directly through MetaTrader’s WebTrader.

Armed with account login details, you will get straightforward order execution, with instant execution and pending orders available. MT4 promises advanced charts with nine timeframes, over 30 built-in technical indicators, real-time news, plus automated trading capabilities. The MT4 platform can also be upgraded through MetaTrader’s Market and Signals, where users can buy technical indicators, add-ons, and signals for copy trading.

While using IronFX, our traders also found a Personal Multi-Account Manager (PAMM) system, which lets clients manage multiple MT4 accounts at the same time.

Note, the broker is planning to introduce MetaTrader 5 (MT5) to its platform offering, which will bring more advanced analysis tools and trading features for experienced traders.

Markets & Instruments

IronFX offers over 300+ CFD assets spanning:

- 80 forex pairs

- 30 commodities

- 30 indices

- 30 futures

- 150 stocks

On the downside, direct stock trading is not available. Also the broker does not offer trading on cryptos, ETFs, bonds or options.

IronFX operates through ECN, STP and market maker trading desks.

Spreads & Commissions

Traders can choose between floating/fixed spread Standard, Premium, and VIP accounts. Alternatively, the Live Zero Fixed Spread account comes with zero spreads, but traders will have to pay a commission.

Spreads also get more competitive as you move up the account tier structure, with the VIP account offering the best value for money. Overall, spreads and commission fees are competitive.

However, there are additional fees to be aware of. For example, IronFX charges a 3% account inactivity fee. Also, the broker charges a sizeable 3% of deposited funds when withdrawals are requested during periods of inactivity.

IronFX Leverage

IronFX offers flexible leverage up to 1:1000 (Bermuda), 1:500 (FSCA), and 1:30 (FCA & CySEC). This enables traders with a limited bankroll to take larger positions. A margin calculator is available on the website to see how much leverage you can access.

Note, leverage trading amplifies not only potential returns but also potential losses.

Mobile Apps

IronFX’s MetaTrader 4 trading platform is available via a mobile app for Android and iOS devices. The app can be downloaded from the respective app stores. Alternatively, the MT4 platform is available on mobile browsers.

Mobile users benefit from total trade management without having to sacrifice functionality. The mobile offering also comes with the IronFX Research app which gives users an overview of the financial markets and major news events.

Payment Methods

IronFX customers can choose from a good range of deposit and withdrawal methods.

Accepted base currencies include USD, EUR, GBP, AUD, JPY, BTC, PLN, and CZK.

Deposits

- Local transfer solutions – Maximum deposit varies based on country and solution

- Bank wire transfer – Maximum deposit varies among banks

- Credit & debit cards – Maximum deposit $50,000

- Skrill – Maximum deposit $50,000

- Neteller – Maximum deposit $50,000

- FasaPay – Maximum deposit $5,000

- China Union – Maximum deposit CNY 360,000

- IronFX Card – Maximum PLN $99,000

- Perfect Money – Maximum deposit $50,000

- Digital Assets – No Maximum

There are no deposit fees (coverage for wire transfer charges for deposits over 10k USD).

Payments typically take up to 24 hours, though wire transfers may take up to five business days. The minimum deposit is 100 USD.

Withdrawals

Generally, no fees apply to deposits or withdrawals. Withdrawal options include:

- Credit & debit cards

- China Union Pay

- Bank Transfer

- Perfect Money

- Digital Assets

- IronFX Card

- Fasapay

- Nether

- Skrill

How To Make A Withdrawal

The withdrawal process is straightforward. From the client portal, navigate to “Transactions”, select ‘withdraw’ and follow the instructions.

Withdrawal times vary depending on the banking provider but range from the same day to 10 days. The minimum withdrawal via bank wire is $100. Withdrawals below $300 will have a fee of $55 per transaction.

For any withdrawal problems, contact customer support on one of the channels described further below.

Demo Accounts

IronFX offers demo accounts so traders can test the platform and practice strategies. There are two demo accounts available:

- Demo Floating Spread

- Demo STP/ECN Absolute Zero

Each demo account imitates real trading conditions, the only difference is virtual money is used.

Bonuses & Promotions

Traders have an excellent of welcome bonuses when they sign up for an account at IronFX:

- 100% unlimited Sharing Bonus – minimum $200 deposit

- 40% Power Bonus up to $4,000 – minimum $500 deposit

- 20% Iron Bonus up to $2,000 – minimum $100 deposit

Note, bonuses cannot be withdrawn. Offers also vary depending on the country you’re signing up from. Finally, check any minimum deposit bonus terms and conditions when you register for an account as they are subject to change.

Additional Features

TradeCopier

The broker launched TradeCopier with which traders can either register as Strategy Providers, get copied and earn a performance fee or as Strategy Followers, where they can copy top-performing strategies and get rewarded.

The copy trading tool is excellent for beginners looking to learn from seasoned traders while experienced investors can generate an additional revenue stream. New users can get started with TradeCopier in four easy steps.

Research & Education

IronFX recently strengthened its educational tools by introducing the Academy. Home to a breadth of content presented in courses, webinars, videos, podcasts and eBooks, it offers a complete trading experience for traders of all levels.

IronFX also offers an economic calendar while a VPS is available for $30 per month or with a minimum deposit of $5,000.

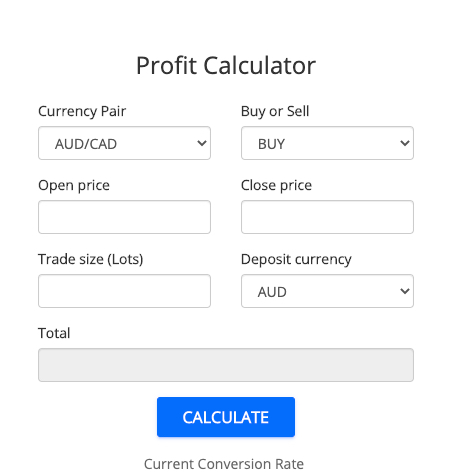

Finally, investors benefit from the latest features from Trading Central via the Client Portal as well as from trading widgets including a currency converter, a pip, margin and profit calculator.

IronFX Account Types

Multiple trading accounts are available at IronFX.

Live floating/live fixed account types:

- Standard – Floating spreads start from 1.6 pips, fixed spreads to 2, leverage up to 1:1000

- Premium – Floating spreads start from 1.4 pips, fixed spreads to 1.8, leverage up to 1:1000

- VIP – Floating spreads start from 1.2 pips, fixed spreads to 1.6, leverage up to 1:1000

- Live Zero Fixed Spread – Fixed spreads to 0 + commission, leverage up to 1:500

Islamic trading accounts are also available.

STP/ECN trading account types:

- No Commission – Spreads start from 1.7 pips, leverage up to 1:200

- Zero Spread – Spreads start from 0 pips + commission, leverage up to 1:200

- Absolute Zero – Spreads start from 0 pips, leverage up to 1:200

The primary difference between live floating/live fixed trading accounts and the ECN/STP model is market execution. Real accounts use instant execution with re-quotes, whereas STP/ECN accounts use market execution, so no re-quotes are involved.

IronFX also offers the Cent account with which clients can start with fewer funds and smaller lot sizes. In addition, an institutional account is available.

An account manager is available with all of IronFX’s trading accounts. When we used IronFX, our experts also found that scalping, hedging, intraday trading and swing trading are all accepted.

Regulation & Licensing

IronFX is regulated by multiple financial agencies through its various trading entities:

- Notesco Financial Services Limited – regulated by the Cyprus Securities and Exchange Commission (CySEC), license number 125/10

- Notesco (SA) Pty Ltd – regulated by the Financial Sector Conduct Authority (FSCA), license number 45276

- Notesco UK Limited – regulated by the Financial Conduct Authority (FCA), license number 585561

- Notesco Limited – authorized in Bermuda, registration number 51491

Our team were also pleased to see that the broker offers negative balance protection, meaning traders cannot lose more than their account balance.

Trading Hours

IronFX trading hours run around the clock. Users can trade from 00:00 Monday through to 24:00 on Friday. The IronFX sever time runs on GMT+2, + DST

Note that while users may be able to trade 24 hours a day, spreads are less competitive during periods of low liquidity.

Customer Support

The IronFX customer support team is available 24/5 in over 20 different languages:

- Email address – support@IronFX.eu (Cyprus/EU), support@IronFX.com (Bermuda, South Africa), support@ironfx.co.uk (UK)

- Telephone contact numbers – +357 25027212 (Cyprus/EU), +27 11 0176600 (South Africa), +44 (0) 207 416 6670 (UK)

- Live chat – Chat support is accessible from the bottom right of the broker’s website

- FAQs – Available in the ‘Contact Us’ section, the FAQs can answer queries on any number of topics, from payment questions to instructions on how to close an account

To keep up with the latest IronFX news, you can also find the broker on social media:

Security & Safety

IronFX uses standard security features to keep clients’ personal information secure, including website encryption. The MT4 trading platform uses MetaTrader’s one-time password.

Security could be bolstered through the use of dual-factor platform authentication.

IronFX Verdict

IronFX is a good broker for novices up to intermediates. They offer the reliable MT4 trading platform, a range of products, plus competitive spreads and leverage levels. The choice of account types will also suit varying trading styles and capital needs.

Disclaimer: The offerings in this review primarily relate to Notesco Ltd , which is registered in Bermuda with registration number 51491.

FAQ

Is IronFX A Good Broker?

IronFX is a strong all-round broker with a reliable platform, low fees, high leverage, and a selection of welcome bonuses. Traders can also get started with a $100 minimum deposit while the ironfx.com group has good reviews from other users online.

Does IronFX Offer Negative Balance Protection?

Yes – IronFX does offer negative balance protection to all users. This ensures traders do not lose more than their initial deposit.

Can I Cancel An Instant Order Request At IronFX?

If the server has already received and processed the order, it may not be possible to cancel an instant order request. If this is the case, you will receive a pop-up to warn you that your order may not be cancelled.

Can I Use MetaTrader 5 At IronFX?

The MetaTrader 5 platform is not currently available at IronFX. Instead, customers have access to the MetaTrader 4 platform. With that said, the brokerage does have plans to introduce MT5 in the future.

Can I Use Expert Advisors At IronFX?

Expert Advisors (EAs) are supported on the MetaTrader 4 platform, so automated trading is possible.

Does IronFX Offer Sign-Up Bonuses?

Welcome bonuses are available at IronFX when you register for a new account. However, they do change over time and vary between countries, so check the current offers available when you sign up.

Best Alternatives to IronFX

Compare IronFX with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

IronFX Comparison Table

| IronFX | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Rating | 3.8 | 4.3 | 3.6 |

| Markets | Forex, Indices, Shares, Futures, Commodities, Metals (all CFDs) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | $1 (Binaries), 0.01 Lots (Forex/CFD) |

| Regulators | CySEC, FCA, FSCA, BMA / Bermuda | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Bonus | Traders can choose between: 100% unlimited Sharing Bonus – minimum $200 deposit. 40% Power Bonus up to $4,000 – minimum $500 deposit. 20% Iron Bonus up to $2,000 – minimum $100 deposit. | – | 100% Anniversary Bonus |

| Platforms | MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Leverage | 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) | 1:50 | 1:200 |

| Payment Methods | 9 | 6 | 10 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by IronFX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| IronFX | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | Yes | No | Yes |

| Silver | Yes | No | Yes |

| Corn | Yes | No | No |

| Crypto | No | Yes | Yes |

| Futures | Yes | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | Yes |

| Bonds | No | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | Yes |

IronFX vs Other Brokers

Compare IronFX with any other broker by selecting the other broker below.

The most popular IronFX comparisons:

Customer Reviews

4.4 / 5This average customer rating is based on 21 IronFX customer reviews submitted by our visitors.

If you have traded with IronFX we would really like to know about your experience - please submit your own review. Thank you.

Trading according to the market analysis has really helped me increase my profit, for sure IronFX is really the main deal!! The support team is not the greatest tho.

The trading platform has been very convenient and easy to navigate. I also love how cost-effective this platform is, the broker has beginners in mind.

Guys I don’t know if you have seen the new feature on their platform, the VIP trading room… I am not even sure that this is a new feature, but I recently discovered it and explored it.

I see here the same guys that are giving the webinars, giving trading advice and you can get in touch with them.

I am hooked on the webinars that IronFx provides regularly and have a high opinion about the professionalism of the lecturers. I was happy to see them in this room and have them some sort of mentors in the analysis discussions this boosted my confidence and improved my technical analysis skills.

And what is even better is that access to the VIP trading room is easy. If you have at least $250 on your trading account, you can access the bronze package, which I use, and join analysis discussions that are always going on. Plus, this is an excellent tool for exploring other markets than the one you are focused on.

I only recently started to reap the benefits of trading activity. Before that, I didn’t have enough theoretical base and practical skills. In this regard, it’s tough to constrain from paying homage to the ironfx broker. Due to its academic courses, both introductory ones and more profound, I managed to uplift my trading skills. Consequently, I started to increase my balance but not to drain it 😉

That was a tough path for me, i guess i experienced a full spectrum of emotions xD

But now everything is okay. Broker’s trading infrastructure helps me to continue this journey and I WILL!

tempting trading conditions

However, my attention to IronFx was captivated by its outstanding reputation with traders.

The trading conditions of ironfx have been great. I like that I can select from a lot of accounts at absolutely any point, giving me the full range functionality of the platform. If I decide to use a different strategy that would be best with a different set of trading conditions, trade execution, spread and leverage, I can simply create an account that fits my demands. I like that flexibility afforded me.

It seems to me that this broker is good in many of its features.

Some things are not suitable for me, but I have specific requirements, so I don’t consider it a problem.

Overall this broker is a great provider of trading. Just a few days ago I closed excellent buy order on EURUSD currency pair. It was perfect trade order. And technical analysis figure worked out completely.

my take on ironfx is basically this that you can literally create of your trading framework on their platform without struggling. the framework includes which assets you wanna trade, how you wanna trade them, at what cost you’d like to trade them, its all good basically. they give you a lot freedom of choice and you can have ECN spreads which is practically zero. nice

Here is my opinion about trading conditions of this broker and how they correspond to my trading.

Company provides quite favorable spreads. In addition, leverage for trading currency pairs is quite large. And thirdly, broker provides a wide range of financial instruments, including currency pairs.

All this together makes trading on company’s platform profitable and efficient.

I trade currency pairs. At the same time, I trade major, minor and even exotics.

With such leverage I can use small part of the margin.

And thanks to tight spreads, my trading is always efficient.

My opinion is that this broker is perfect for forex trading.

I have been trying to salvage some of my money ,the so called adivice lose £1000 don’t ask me how and ironFX won’t say. So I am trying to withdraw the £300 that’s left but can’t.

To withdraw you have to close all trades easy. So you go to the withdrawal page peer withdraw processing ok.when you go back to trading platform it’s started trading by its self and you can’t stop. So now your withdrawal will be denied as your trading.This just goes on and on. To put bluntly you have done your money and when you complain you get a call no it can’t be stopped but if you deposit some you may get a profit.