Reconciling the Gross Debt vs. Net Debt Approach to Valuation

In addition to the previous models of valuation we have covered, firm valuation can also be estimated using the debt type associated with the business – gross or net.

Like all financial models, where assumptions are inherent within their foundation in order to produce results and estimations, gross and net debt make their own assumptions regarding how the cash in a firm is funded.

In other words, how a company gets its funding matters because its cost varies based on the type of funding.

How are businesses funded?

For example, traditionally the cheapest way to fund a business is through its own cash flow generated from earnings. If a company produces more than it consumes, then it’s self-sustaining and can finance itself.

If it’s funded through debt, this involves paying creditors interest and their principal back at the end of the period.

If it’s funded through equity, this involves selling ownership in a business. This means less earnings would eventually accrue to existing shareholders.

And there are various types of hybrid securities, such as warrants, convertible bonds, and preferred stock, that have characteristics of multiple categories.

The makeup of how a company is funded is typically called its capital structure.

What’s the difference between the gross debt and net debt approach to valuation?

In the gross debt framework, cash is funded using the same mix of debt and equity as the operating assets of the firm (i.e., assets that produce revenue).

In the net debt model, cash is funded with risk-free debt only, with operating assets funded with the remaining debt and equity.

These assumptions are reflected in the cost of debt (interest rate at which a firm could borrow at) figure used in the cost of capital calculation.

How does the cost of debt differ between the gross debt and net debt approaches?

The cost of debt is lower in the gross debt framework given it uses the same debt that is associated with the operating assets of the company.

It is higher in the net debt framework, where no cash is funded by the debt and equity comprising the firm’s operating assets.

In other words, when all cash is funded by risk-free debt (e.g., long-term treasury bonds), the rest of the firm has no cash available and hence that debt will carry a larger risk.

How does the gross debt vs. net debt valuation model work?

There are spreadsheets you can use. The Damodaran model is popular.

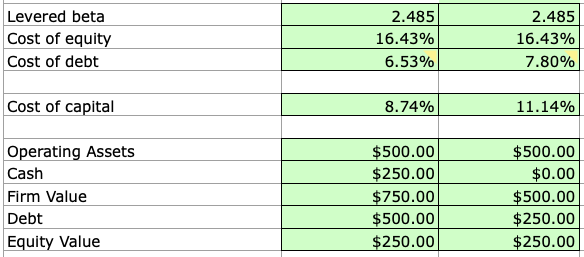

In this model we are looking to find how these nine outputs vary based on the gross versus net debt valuation methods:

- Levered beta

- Cost of equity

- Cost of debt

- Cost of capital

- Operating assets

- Cash

- Firm value

- Debt

- Equity value

Levered beta

A levered beta is the beta of a firm carrying leverage (i.e., debt). (The extent of a firm’s leverage is often determined by its debt-to-equity (D / (D + E)) ratio.)

An unlevered beta would be the beta of a firm not carrying any debt.

Cost of equity

The cost of equity is the return that a firm expects to compensate shareholders for investing money in the company.

Cost of debt

The cost of debt is the interest rate at which a company can expect to borrow.

Cost of capital

The cost of capital is the rate of return required to make an individual invest in the company.

It is often measured by the weighted averaged cost of capital (WACC) as used in the FCFF valuation framework.

Operating assets

Operating assets are essentially the assets needed to generate revenue and continue the operations of a business.

Cash can also be considered an operating asset.

Debt vs. equity value

Debt is money owed, while equity value is the amount of money contributed to the owners of a company (i.e., shareholders) plus the net value of any retained earnings.

Retained earnings references the net income of a company that is not distributed back to shareholders in the form of dividends.

Debt and equity value are inputs in the context of the gross debt framework, but outputs with respect to the net debt approach.

Cash

Cash is considered both an input and output, as well. There is both initial cash holdings (input) and cash derived from cash earnings divided by the risk-free rate (output).

Cash as an output goes into calculating firm value and equity value in the gross debt approach.

In the net debt approach, cash is subtracted from debt at the beginning of the process.

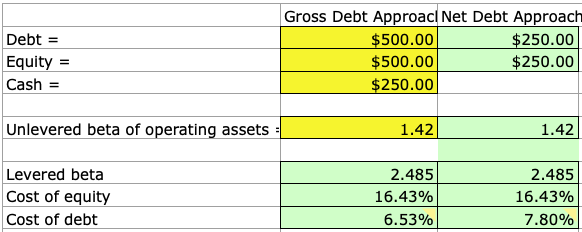

These can be assessed in our model by using the following inputs:

- Debt (gross debt framework only)

- Equity (gross debt framework only)

- Cash

- Unlevered beta of operating assets

- Operating earnings

- Cash earnings

- Tax rate

- Risk-free rate

- Risk premium

- Cost of debt for the firm

In the net debt framework, debt is equal to:

In the net debt framework, debt is equal to:

Gross debt – Cash (starting amount)

For net debt, equity is equal to:

Operating assets + Cash – Gross debt

Calculating Output Values from Input Values

Financial models are used to obtain outputs from mathematical relationships involving the inputs and/or other outputs.

We will go through each case individually:

Levered beta

Involves using the beta of the firm in a leveraged state and using the tax rate, debt, and equity to obtain what the beta of the firm would be in an unlevered, or non-debt, state.

Levered beta = Unlevered beta * (1 + (1 – Tax rate) * Debt/Equity)

Cost of equity

Determined from CAPM using the risk-free rate, levered beta, and market risk premium.

The levered beta is used as that appropriately reflects the true beta of the firm, as practically all firms will have some form of debt associated with them.

Cost of equity = Risk-free rate + ß * Market risk premium

Cost of debt

Here we calculate the interest rate associated with the firm’s debt, or a measure of the riskiness associated with it.

The cost of debt was also an input but was not adjusted for assumptions made about the firm’s cash holdings in the gross debt and net debt framework.

“Debt” within the equations is considered to be gross debt unless otherwise noted.

Cost of gross debt = [Debt * Cost of debt (before adjustments) – Cash * (Debt / (Debt + Equity)) * Risk-free rate / (Debt – Cash * (Debt / (Debt + Equity))]

Cost of net debt = (Debt * Cost of debt (before adjustments) – Cash * Risk-free rate) / Net Debt

The difference between the calculations is that the gross debt reading has to take into account the debt-to-equity ratio (D / (D+E)) as a measure of the company’s leverage.

Namely, of a firm’s debt and equity, the percentage of it that is comprised of debt.

Cost of capital

The cost of capital is fairly easy to compute for a debt and equity only firm.

We multiply the cost of equity by the percentage of equity comprising our capital structure (as a decimal) and add that to the cost of debt multiplied by (1 – Tax rate) by the percentage of debt comprising our capital structure.

If we had more components it would flow similarly.

Operating assets

Equal to operating earnings divided by cost of capital.

Cash

As an output, cash is equal to cash earnings divided by the risk-free capital rate.

Firm value

Equal to the sum of our operating assets and cash. This intuitively makes sense, as a firm is worth its assets that help drive revenue generation added to whatever cash is on hand.

This would be similar to calculating net worth, or the sum of an individual’s assets under their ownership plus whatever cash holdings they have.

Debt

Same as it is as an input, with net debt being calculated by taking gross debt and deducting current cash holdings.

Equity value

Equal to:

Equity value = Operating assets + Cash – Debt

How Inputs Affect Outputs

This section will be primarily dedicated to how changes in inputs affect firm value, which is often of central importance when conducting business-related financial models.

With the directional change of firm value we can derive the associated change with another variable, such as equity value.

Equity value is firm value minus debt.

Consequently, if firm value increases, equity value will as well, unless we are manipulating debt.

We will go through each individually:

Debt

An increase in debt will increase firm value. An increased debt load on the firm will decrease the cost of capital. Given we are deriving our firm value based off the cost of capital (FCFF DCF model), and the model generally follows the form:

Value = ∑ (Cash flow in time period, t) / (1 + r)^t

With r being our discount rate, the lower the discount rate, the lower the denominator value and therefore the higher the estimated firm value.

Equity

As recently mentioned, the higher the equity value, the higher the firm value.

Cash

Referencing back to this equation:

Cost of gross debt = [Debt * Cost of debt (before adjustments) – Cash * (Debt / (Debt + Equity)) * Risk-free rate / (Debt – Cash * (Debt / (Debt + Equity))]

If we increase starting cash levels, we increase the cost of debt.

If we increase the cost of debt, we increase the cost of capital (i.e., the discount rate) given equity becomes riskier and therefore lower firm value.

Unlevered beta of operating expenses

A higher beta will always drop firm value in the calculations, as it denotes a firm that will provide increasingly volatile, unpredictable returns the higher it gets.

Operating earnings

Higher operating earnings directly increases the value of operating assets (i.e., operating earnings divided by cost of capital).

So this will increase firm value.

Cash earnings

Here we are not referencing starting cash levels or cash on hand but rather earnings that our cash has generated (from interest or investment returns).

This directly increases the cash value of our firm (i.e., cash earnings divided by the risk-free rate) and increases firm value.

Tax rate

This is a tough one to answer due to the fact that any given tax rate will dictate the optimal debt ratio of a firm.

If its debt ratio is not line with the given tax rate, the firm can increase or decrease in value accordingly.

Some firms will be better off with more debt as the benefits will outweigh the disadvantages.

Some firms will be worse off as less debt will not provide an adequate means of financing operations or investments.

Firms are advised to take on some level of debt to increase their financial flexibility but not so much to outweigh any concomitant increase in default or bankruptcy risk.

Risk-free rate

A higher risk-free will decrease firm value.

A higher governmental bond rate will increase the cost of equity, which will increase the cost of capital directly, and therefore the present value of future cash flows will be discounted at a lower value.

Market risk premium

Market risk premium is also a part of the cost of equity calculation.

A higher market risk premium increases the cost of equity and cost of capital directly and will decrease firm value.

Cost of debt (before adjustments for debt type)

A higher cost of debt suggests that the firm would need to pay more interest on any debt acquired at the current point in time.

This will directly increase the cost of capital and decrease firm value.

Conclusion

The gross versus net debt frameworks provide fundamentally different approaches on which to perform valuation.

Gross debt references all debts outstanding in a firm, while net debt is the difference between gross debt and the cash balance of the firm.

Gross debt is the more common means of valuing a firm. In this case, cash is added to operating expenses at the end to arrive at firm value.

In a net debt framework, operating expenses alone is taken to be the firm value, given cash is subtracted from debt from the outset (rather than added at the end).

When firms traditionally have large cash balances, it may be more common to use the net debt approach.

But when doing it this way, one must be conscientious to use net debt for subsequent use of debt in the model.

Hence when valuing firms using one or the other, it is essential to stay consistent throughout.

If we use a net debt ratio for one calculation, we must use it throughout the model.

One issue with net debt valuations is that they tend to be inaccurate when valuing riskier firms.

Cash and debt are assumed to be equal in risk when comparing gross versus net debt due to the fact that they are weighted the exact same.

However, the debt in a lower credit rated firm will be much riskier than the cash availability in the firm.

Netting out cash can provide an underrated view of the firm’s default risk.

Of course, a firm with a riskier debt profile and at greater risk of default will inherently be of lower value, although this won’t be reflected when using net debt ratios.

As a result, use of net debt for lower rated firms will overstate their values.

The analyst, accordingly, must use his or her own discretion in each individual case.